| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

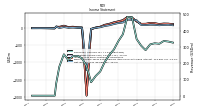

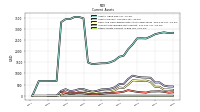

| Revenues | 322.63 | 315.68 | 280.29 | 308.38 | 349.04 | 482.96 | 484.65 | 377.84 | 336.38 | 283.58 | 250.73 | 207.66 | 149.24 | 121.07 | 82.84 | 181.37 | 229.71 | 244.80 | 242.96 | 218.67 | 254.66 | 178.56 | 76.89 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Operating Costs And Expenses | 184.54 | 167.54 | 158.96 | 181.45 | 151.13 | 171.21 | 156.39 | 141.97 | 134.37 | 112.09 | 121.53 | 107.77 | 106.57 | 99.13 | 108.77 | 2145.70 | 207.03 | 217.13 | 199.33 | 185.16 | 181.39 | 137.87 | 32.93 | 98.66 | 79.80 | NA | NA | NA | |

| General And Administrative Expense | 19.24 | 19.37 | 18.73 | 19.77 | 17.20 | 19.62 | 18.53 | 17.07 | 15.46 | 14.70 | 24.76 | 20.36 | 18.45 | 16.66 | 15.73 | 18.08 | 16.78 | 17.34 | 19.11 | 16.20 | 18.50 | 10.30 | 1.70 | 5.30 | 5.71 | NA | NA | NA | |

| Operating Income Loss | 138.09 | 148.13 | 121.33 | 126.93 | 197.91 | 311.75 | 328.26 | 235.87 | 202.01 | 171.49 | 129.19 | 99.90 | 42.66 | 21.94 | -25.93 | -1964.34 | 22.68 | 27.67 | 43.63 | 33.52 | 73.27 | 40.69 | 43.96 | -6.86 | -4.03 | -0.33 | -0.21 | -0.06 | |

| Interest Income Expense Net | -0.41 | 1.03 | -1.15 | 0.49 | -1.80 | -5.26 | -7.02 | -9.36 | -7.48 | -7.47 | -8.75 | -7.29 | -7.35 | -7.33 | -7.26 | -6.76 | -6.75 | -6.90 | -7.30 | -7.42 | -7.50 | -4.96 | 0.00 | 2.61 | 2.07 | 1.36 | 0.65 | 0.00 | |

| Interest Paid Net | 0.59 | 12.59 | 1.16 | 12.02 | 0.59 | 13.33 | 0.51 | 12.22 | 0.45 | 12.45 | 1.59 | 12.44 | 0.45 | 12.90 | 0.00 | 12.54 | 0.54 | 12.62 | 0.49 | 12.57 | 0.54 | 0.35 | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 4.10 | 4.20 | 4.10 | 3.80 | 3.40 | 3.50 | 3.50 | 2.90 | 2.60 | 2.90 | 3.50 | 2.70 | 1.10 | 2.90 | 3.10 | 2.90 | 2.70 | 2.80 | 3.10 | 2.40 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 31.55 | 31.21 | 24.85 | 19.61 | -58.70 | 19.36 | 27.88 | 18.10 | 2.42 | 3.63 | 2.40 | 0.40 | 0.00 | -0.34 | -3.18 | -75.83 | 2.31 | 3.53 | 5.14 | 3.77 | 7.92 | 3.54 | 0.77 | -0.89 | -0.41 | 0.36 | 0.16 | -0.02 | |

| Income Taxes Paid Net | 12.21 | 18.80 | NA | NA | 11.32 | 23.77 | 24.14 | 13.00 | 4.29 | -1.14 | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 113.86 | 117.48 | 104.60 | 106.68 | 254.76 | 286.96 | 299.90 | 208.62 | 192.15 | 159.91 | 116.17 | 91.49 | 42.01 | 13.70 | -29.39 | -1895.30 | 13.63 | 17.36 | 31.30 | 22.71 | 56.97 | 25.48 | 46.74 | 86.45 | 85.37 | NA | NA | NA | |

| Net Income Loss | 98.44 | 102.03 | 91.49 | 96.33 | 231.74 | 245.48 | 250.58 | 166.04 | 150.23 | 119.36 | 84.44 | 63.24 | 27.75 | 9.15 | -18.27 | -1227.01 | 8.12 | 10.55 | 18.51 | 13.03 | 32.39 | 6.71 | 46.74 | -3.36 | -1.54 | 0.67 | 0.29 | -0.04 | |

| Net Income Loss Available To Common Stockholders Basic | 97.31 | 100.86 | 90.45 | 95.34 | 229.58 | 243.18 | 248.21 | 164.62 | 149.15 | 118.42 | 83.80 | 63.03 | 27.75 | 9.15 | -18.27 | -1227.01 | 8.12 | 7.78 | 18.51 | NA | 32.92 | 6.18 | 46.74 | -3.36 | -1.54 | 0.67 | 0.29 | -0.04 | |

| Net Income Loss Available To Common Stockholders Diluted | 97.31 | 100.86 | 90.45 | 95.34 | 229.59 | 243.19 | 248.22 | 164.63 | 149.16 | 118.43 | 83.81 | 63.03 | 27.75 | 9.15 | -18.27 | -1227.01 | 8.12 | 7.78 | 18.51 | NA | NA | 6.18 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

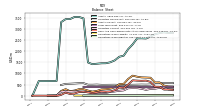

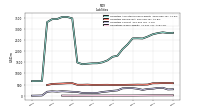

| Assets | 2756.22 | 2652.49 | 2566.72 | 2576.05 | 2572.59 | 2300.64 | 2086.79 | 1794.61 | 1746.74 | 1585.78 | 1498.35 | 1455.85 | 1453.42 | 1434.28 | 1413.08 | 1490.83 | 3466.41 | 3533.13 | 3531.13 | 3437.97 | 3433.52 | 3300.10 | NA | 658.81 | 656.55 | 652.75 | 652.65 | NA | |

| Liabilities And Stockholders Equity | 2756.22 | 2652.49 | 2566.72 | 2576.05 | 2572.59 | 2300.64 | 2086.79 | 1794.61 | 1746.74 | 1585.78 | 1498.35 | 1455.85 | 1453.42 | 1434.28 | 1413.08 | 1490.83 | 3466.41 | 3533.13 | 3531.13 | 3437.97 | 3433.52 | 3300.10 | NA | 658.81 | 656.55 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 591.27 | 805.75 | 814.84 | 820.35 | 850.75 | 898.96 | 750.48 | 530.25 | 518.79 | 376.75 | 312.86 | 289.22 | 281.53 | 214.86 | 182.50 | 229.25 | 293.22 | 292.25 | 230.50 | 203.25 | 292.36 | 211.71 | NA | 0.36 | 0.73 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 401.12 | 618.47 | 676.57 | 667.28 | 675.44 | 689.54 | 501.89 | 346.40 | 366.98 | 245.02 | 190.28 | 178.19 | 192.56 | 148.53 | 116.85 | 146.49 | 182.63 | 164.49 | 96.71 | 76.31 | 135.76 | 36.72 | 0.02 | 0.24 | 0.57 | NA | 1.78 | 0.33 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 401.12 | 618.47 | 676.57 | 667.28 | 675.44 | 689.54 | 501.89 | 346.40 | 366.98 | 245.02 | 190.28 | 178.19 | 192.56 | 148.53 | 116.85 | 146.49 | 182.63 | 164.49 | 96.71 | 76.31 | 135.76 | 36.72 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Accounts Receivable Net Current | 189.71 | 186.76 | 137.38 | 151.57 | 170.77 | 207.72 | 247.40 | 179.65 | 149.77 | 130.10 | 119.24 | 107.23 | 81.56 | 61.24 | 60.52 | 77.74 | 105.78 | 120.66 | 126.94 | 107.39 | 140.28 | 167.17 | NA | NA | NA | NA | NA | NA | |

| Other Assets Current | 0.43 | 0.51 | 0.88 | 1.33 | 1.05 | 0.61 | 1.15 | 1.69 | 1.43 | 1.57 | 2.09 | 2.81 | 3.60 | 4.61 | 4.49 | 4.15 | 4.51 | 5.05 | 5.66 | 6.69 | 4.06 | 2.03 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Assets Noncurrent | 18.73 | 41.37 | 16.23 | 20.59 | 20.38 | 20.74 | 10.19 | 8.85 | 8.16 | 8.86 | 8.97 | 6.13 | 6.98 | 8.07 | 4.55 | 3.78 | 4.46 | 4.77 | 5.30 | 2.04 | 0.00 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

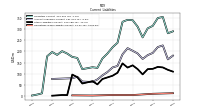

| Liabilities Current | 314.89 | 303.70 | 263.00 | 311.24 | 340.27 | 341.97 | 333.03 | 238.73 | 218.54 | 190.69 | 167.95 | 125.94 | 128.95 | 124.46 | 120.31 | 170.70 | 175.21 | 190.31 | 201.13 | 184.46 | 197.36 | 178.07 | NA | 11.58 | 5.96 | NA | NA | NA | |

| Accounts Payable Current | 193.21 | 183.34 | 166.23 | 190.81 | 202.85 | 214.61 | 186.84 | 134.65 | 127.91 | 107.46 | 92.13 | 74.12 | 62.63 | 63.48 | 64.53 | 86.15 | 79.43 | NA | NA | NA | 76.30 | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Current | 121.67 | 120.36 | 96.77 | 120.44 | 137.43 | 127.36 | 146.18 | 104.08 | 90.64 | 83.22 | 75.81 | 51.81 | 66.32 | 60.99 | 55.78 | 84.55 | 95.78 | 3.68 | 4.13 | 2.47 | 1.00 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Noncurrent | 558.66 | 501.63 | 493.86 | 497.73 | 492.12 | 488.96 | 485.21 | 483.51 | 482.95 | 489.58 | 487.74 | 485.90 | 485.05 | 497.64 | 490.44 | 491.24 | 562.67 | 558.87 | 545.85 | 536.94 | 528.21 | 479.02 | NA | NA | NA | NA | NA | NA | |

| Long Term Debt | 392.84 | 392.21 | 391.59 | 390.98 | 390.38 | 389.79 | 389.22 | 388.65 | 388.09 | 387.54 | 387.00 | 391.45 | 391.12 | 390.79 | 390.46 | 390.15 | 389.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 392.84 | 392.21 | 391.59 | 390.98 | 390.38 | 389.79 | 389.22 | 388.65 | 388.09 | 387.54 | 387.00 | 391.45 | 391.12 | 390.79 | 390.46 | 390.15 | 389.83 | 389.53 | 389.23 | 388.93 | 388.63 | 388.34 | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 191.00 | 182.98 | 175.37 | 167.71 | 164.14 | 198.68 | 170.28 | 174.78 | 228.49 | 210.88 | 219.10 | 234.20 | 291.26 | 279.55 | 275.28 | 285.70 | 952.48 | 1014.17 | 1044.57 | 1031.36 | 1031.19 | 991.96 | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 17.36 | 10.17 | 9.45 | 10.06 | 6.61 | 6.51 | 4.57 | 4.34 | 5.15 | 5.98 | 6.59 | 5.24 | 5.70 | 6.05 | 1.49 | 0.90 | 1.48 | 2.04 | 2.42 | 0.69 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 7.13 | NA | NA | NA | 4.85 | NA | NA | NA | 5.15 | NA | NA | NA | 5.70 | NA | NA | NA | 1.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1882.67 | 1847.16 | 1809.86 | 1767.08 | 1740.19 | 1469.71 | 1268.56 | 1072.37 | 1045.25 | 905.52 | 842.66 | 844.01 | 839.42 | 812.18 | 802.32 | 828.89 | 2728.53 | 2783.95 | 2784.15 | 2716.58 | 2707.95 | 2643.01 | 4.78 | NA | NA | NA | NA | NA | |

| Additional Paid In Capital | 1743.93 | 1738.67 | 1731.06 | 1720.49 | 1719.88 | 1637.28 | 1647.64 | 1649.11 | 1689.50 | 1665.81 | 1684.58 | 1731.23 | 1712.54 | 1709.04 | 1706.12 | 1704.00 | 1703.36 | 1704.65 | 1672.52 | 1636.65 | 1641.24 | 1647.90 | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 486.16 | 409.23 | 329.01 | 259.64 | 185.67 | -46.07 | -291.55 | -542.13 | -708.17 | -858.40 | -977.76 | -1062.21 | -1125.45 | -1153.19 | -1162.34 | -1144.07 | 82.94 | 74.82 | 67.04 | 48.53 | 35.51 | 3.12 | NA | -3.37 | -0.01 | NA | NA | NA | |

| Minority Interest | 191.00 | 182.98 | 175.37 | 167.71 | 164.14 | 198.68 | 170.28 | 174.78 | 228.49 | 210.88 | 219.10 | 234.20 | 291.26 | 279.55 | 275.28 | 285.70 | 952.48 | 1014.17 | 1044.57 | 1031.36 | 1031.19 | 991.96 | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 4.11 | 4.20 | 4.09 | 3.77 | 3.45 | 3.46 | 3.52 | 2.88 | 2.59 | 2.91 | 3.53 | 2.71 | NA | 2.93 | 3.06 | 2.88 | NA | 2.83 | 3.12 | 2.43 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 4.12 | 4.35 | 3.09 | 2.51 | 5.51 | 7.61 | 4.61 | 11.64 | 1.50 | 5.28 | 0.28 | 0.15 | NA | 0.10 | 0.21 | 0.28 | NA | 0.49 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

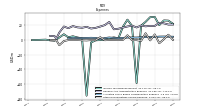

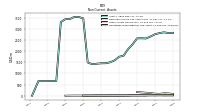

| Net Cash Provided By Used In Operating Activities | 246.88 | 187.31 | 201.77 | 219.82 | 268.00 | 410.68 | 379.13 | 238.87 | 260.54 | 221.90 | 187.88 | 118.15 | 79.12 | 65.16 | 30.96 | 134.88 | 159.01 | 179.22 | 192.83 | 116.56 | 214.79 | 87.30 | NA | -105.38 | 104.61 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -384.25 | -162.39 | -118.04 | -150.22 | -196.59 | -134.96 | -116.12 | -71.21 | -80.00 | -70.84 | -49.72 | -42.88 | -19.15 | -26.68 | -60.36 | -163.80 | -70.17 | -98.87 | -171.90 | -183.31 | -115.75 | -758.51 | NA | 237.73 | -237.73 | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -79.97 | -83.02 | -74.45 | -77.77 | -85.51 | -88.07 | -107.52 | -188.25 | -58.58 | -96.33 | -126.07 | -89.64 | -15.95 | -6.79 | -0.25 | -7.22 | -70.69 | -12.57 | -0.53 | 7.30 | 0.00 | 707.90 | NA | -132.96 | 133.12 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 246.88 | 187.31 | 201.77 | 219.82 | 268.00 | 410.68 | 379.13 | 238.87 | 260.54 | 221.90 | 187.88 | 118.15 | 79.12 | 65.16 | 30.96 | 134.88 | 159.01 | 179.22 | 192.83 | 116.56 | 214.79 | 87.30 | NA | -105.38 | 104.61 | NA | NA | NA | |

| Net Income Loss | 98.44 | 102.03 | 91.49 | 96.33 | 231.74 | 245.48 | 250.58 | 166.04 | 150.23 | 119.36 | 84.44 | 63.24 | 27.75 | 9.15 | -18.27 | -1227.01 | 8.12 | 10.55 | 18.51 | 13.03 | 32.39 | 6.71 | 46.74 | -3.36 | -1.54 | 0.67 | 0.29 | -0.04 | |

| Profit Loss | 113.86 | 117.48 | 104.60 | 106.68 | 254.76 | 286.96 | 299.90 | 208.62 | 192.15 | 159.91 | 116.17 | 91.49 | 42.01 | 13.70 | -29.39 | -1895.30 | 13.63 | 17.36 | 31.30 | 22.71 | 56.97 | 25.48 | 46.74 | 86.45 | 85.37 | NA | NA | NA | |

| Depreciation Depletion And Amortization | 95.92 | 81.16 | 77.01 | 70.70 | 63.82 | 68.97 | 57.25 | 53.11 | 53.42 | 47.99 | 43.33 | 42.94 | 45.08 | 44.73 | 50.87 | 142.67 | 137.63 | 143.89 | 126.10 | 115.95 | 110.41 | 67.48 | 23.16 | 63.35 | 51.36 | NA | NA | NA | |

| Increase Decrease In Other Operating Capital Net | 1.40 | 0.24 | -2.94 | -4.62 | 2.69 | 8.72 | 0.36 | 1.85 | 0.00 | -0.21 | -0.85 | -0.60 | -0.51 | 0.32 | 0.64 | 0.33 | 19.39 | 3.14 | 0.64 | 0.61 | 0.85 | -0.04 | NA | 0.46 | -0.04 | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 2.94 | 49.38 | -13.72 | -19.20 | -36.95 | -39.68 | 67.75 | 29.88 | 19.67 | 10.86 | 12.01 | 25.67 | 20.32 | 0.72 | -17.22 | -28.03 | -14.89 | -7.60 | 19.55 | -5.01 | -26.89 | 77.50 | NA | 10.79 | 35.48 | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 9.87 | 17.11 | -24.15 | -12.04 | -11.76 | 27.77 | 52.19 | 6.74 | 20.45 | 15.32 | 18.01 | 11.50 | -1.01 | -1.06 | -21.62 | 6.73 | -22.87 | 10.46 | 12.30 | -6.73 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | 27.14 | 11.95 | 20.86 | 15.40 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | -3.18 | -74.65 | 2.50 | 3.41 | 4.93 | 3.42 | 8.63 | 3.49 | 0.14 | 0.31 | -0.12 | NA | NA | NA | |

| Share Based Compensation | 4.11 | 4.20 | 4.09 | 3.77 | 3.45 | 3.46 | 3.52 | 2.88 | 2.59 | 2.91 | 3.53 | 2.71 | 1.16 | 2.93 | 3.06 | 2.88 | 2.71 | 2.83 | 3.12 | 2.43 | 1.85 | 0.00 | NA | 0.00 | 0.00 | NA | NA | NA | |

| Amortization Of Financing Costs | 1.08 | 1.07 | 1.06 | 1.04 | 1.04 | 1.03 | 0.97 | 2.81 | 1.14 | 1.13 | 1.11 | 0.91 | 0.92 | 0.91 | 0.90 | 0.90 | 0.90 | 0.89 | 0.88 | 0.87 | 0.89 | 0.57 | NA | 0.00 | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -384.25 | -162.39 | -118.04 | -150.22 | -196.59 | -134.96 | -116.12 | -71.21 | -80.00 | -70.84 | -49.72 | -42.88 | -19.15 | -26.68 | -60.36 | -163.80 | -70.17 | -98.87 | -171.90 | -183.31 | -115.75 | -758.51 | NA | 237.73 | -237.73 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -79.97 | -83.02 | -74.45 | -77.77 | -85.51 | -88.07 | -107.52 | -188.25 | -58.58 | -96.33 | -126.07 | -89.64 | -15.95 | -6.79 | -0.25 | -7.22 | -70.69 | -12.57 | -0.53 | 7.30 | 0.00 | 707.90 | NA | -132.96 | 133.12 | NA | NA | NA | |

| Payments Of Dividends Common Stock | 21.60 | 21.80 | 22.11 | 22.58 | 18.98 | 19.04 | 0.00 | 37.17 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-30 | 2018-06-30 | 2018-03-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

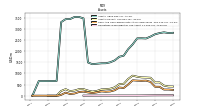

| Revenues | 322.63 | 315.68 | 280.29 | 308.38 | 349.04 | 482.96 | 484.65 | 377.84 | 336.38 | 283.58 | 250.73 | 207.66 | 149.24 | 121.07 | 82.84 | 181.37 | 229.71 | 244.80 | 242.96 | 218.67 | 254.66 | 178.56 | 76.89 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 43.73 | 45.02 | 36.30 | 41.49 | 44.29 | 65.60 | 66.51 | 58.59 | 55.67 | 45.62 | 30.04 | 26.49 | 19.49 | 10.49 | 8.88 | 10.50 | 19.20 | 15.72 | 15.86 | 19.64 | 26.99 | 21.15 | 4.75 | 13.39 | 9.78 | NA | NA | NA | ||

| 26.37 | 27.07 | 20.85 | 27.77 | 59.45 | 100.12 | 85.34 | 56.58 | 62.46 | 42.83 | 32.59 | 34.76 | 23.01 | 14.89 | 13.17 | 16.18 | 22.54 | 21.24 | 22.59 | 27.38 | 28.78 | 14.20 | 3.65 | 10.12 | 8.37 | NA | NA | NA | ||

| Oil And Condensate | 252.53 | 243.59 | 223.15 | 239.12 | 245.30 | 317.24 | 332.79 | 262.67 | 218.25 | 195.13 | 188.10 | 146.41 | 106.74 | 95.68 | 60.79 | 154.69 | 187.97 | 207.84 | 204.51 | 171.65 | 198.89 | 143.20 | 68.49 | 176.48 | 154.16 | NA | NA | NA |