| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Earnings Per Share Basic | 0.87 | 0.95 | 0.86 | 1.06 | 0.42 | 0.51 | 0.67 | 0.61 | 0.51 | 0.61 | |

| Earnings Per Share Diluted | 0.87 | 0.94 | 0.85 | 1.06 | 0.41 | 0.50 | 0.67 | 0.60 | 0.50 | 0.60 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 10.46 | 12.98 | 13.41 | 10.07 | 10.87 | 9.55 | 8.50 | 8.30 | 23.53 | 17.05 | |

| Revenues | 10.45 | 12.98 | 13.41 | 10.06 | 10.87 | 9.93 | 8.49 | 8.57 | 23.53 | 17.05 | |

| Interest And Fee Income Loans And Leases | 126.56 | 117.74 | 111.95 | 105.12 | 95.97 | 63.88 | 51.74 | 44.09 | 53.53 | 52.77 | |

| Marketing And Advertising Expense | 1.00 | 1.04 | 1.09 | 0.87 | 1.50 | 0.98 | 0.67 | 0.67 | 0.70 | 0.99 | |

| Interest Expense | 45.20 | 38.33 | 31.29 | 18.64 | 8.89 | 3.28 | 2.82 | 2.86 | 8.32 | 8.25 | |

| Interest Income Expense Net | 89.50 | 87.78 | 89.78 | 94.89 | 95.07 | 69.09 | 56.02 | 46.66 | 50.35 | 51.17 | |

| Interest Paid Net | 47.78 | 32.64 | 28.65 | 15.35 | 9.01 | 3.31 | 4.01 | 2.27 | 8.09 | 6.54 | |

| Income Tax Expense Benefit | 5.78 | 9.33 | 8.37 | 10.08 | 2.95 | 3.99 | 4.36 | 3.60 | 3.23 | 3.37 | |

| Income Taxes Paid Net | 8.02 | 8.27 | 16.52 | 0.04 | 5.74 | 2.19 | 3.28 | 0.09 | 0.05 | -0.09 | |

| Net Income Loss | 33.12 | 36.09 | 32.56 | 40.28 | 16.72 | 15.84 | 20.36 | 18.35 | 15.82 | 18.92 | |

| Comprehensive Income Net Of Tax | 57.57 | 23.85 | 22.57 | 49.86 | 17.86 | -15.50 | 0.99 | -13.32 | 26.13 | 24.06 | |

| Net Income Loss Available To Common Stockholders Basic | 33.06 | 36.02 | 32.49 | 40.24 | 16.68 | 15.80 | 20.32 | 18.32 | 15.80 | 18.90 | |

| Interest Income Expense After Provision For Loan Loss | 84.93 | 86.65 | 88.08 | 93.99 | 73.20 | 56.41 | 53.51 | 46.98 | 44.19 | 49.63 | |

| Noninterest Expense | 62.09 | 60.60 | 60.98 | 58.29 | 67.66 | 53.94 | 45.55 | 44.08 | 48.67 | 44.39 | |

| Noninterest Income | 16.06 | 19.36 | 13.82 | 14.66 | 14.14 | 17.36 | 16.76 | 19.05 | 23.53 | 17.05 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

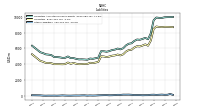

| Assets | 9951.06 | 9866.28 | 9871.96 | 9917.22 | 9573.24 | 7922.92 | 7168.00 | 7341.51 | 6028.33 | 5802.67 | |

| Liabilities | 8738.26 | 8702.70 | 8724.62 | 8783.50 | 8481.04 | 7003.49 | 6352.45 | 6521.30 | 5264.88 | 5087.66 | |

| Liabilities And Stockholders Equity | 9951.06 | 9866.28 | 9871.96 | 9917.22 | 9573.24 | 7922.92 | 7168.00 | 7341.51 | 6028.33 | 5802.67 | |

| Stockholders Equity | 1212.81 | 1163.59 | 1147.33 | 1133.73 | 1092.20 | 919.43 | 815.55 | 820.22 | 763.45 | 715.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 190.83 | 291.29 | 323.83 | 369.70 | 195.50 | 256.21 | 448.38 | 786.38 | 133.93 | 105.26 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 192.33 | 292.79 | 325.33 | 371.20 | 198.52 | 259.22 | 451.39 | 789.40 | 143.93 | 115.26 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

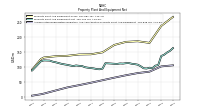

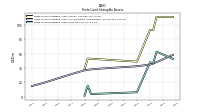

| Property Plant And Equipment Gross | 267.58 | NA | NA | NA | 237.28 | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 104.85 | NA | NA | NA | 101.17 | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 2.01 | 2.01 | 2.01 | 1.36 | 1.36 | 0.38 | 0.30 | 0.30 | 0.30 | 0.30 | |

| Property Plant And Equipment Net | 162.73 | 153.55 | 147.85 | 140.42 | 136.11 | 105.80 | 103.69 | 95.13 | 112.39 | 109.59 | |

| Goodwill | 306.04 | 306.04 | 306.04 | 279.13 | 279.13 | 167.88 | 115.03 | 115.03 | 115.03 | 115.03 | |

| Intangible Assets Net Excluding Goodwill | 66.03 | 68.28 | 74.91 | 58.62 | 59.89 | 30.84 | 14.57 | 13.51 | 10.49 | 12.98 | |

| Finite Lived Intangible Assets Net | 58.67 | 60.68 | 62.69 | 46.70 | 48.06 | NA | NA | NA | NA | NA | |

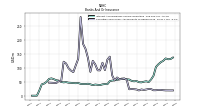

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 80.95 | 106.26 | 91.84 | 83.22 | 91.77 | 97.28 | 66.09 | 43.59 | NA | 2.23 | |

| Held To Maturity Securities Fair Value | 504.33 | 494.24 | 527.59 | 555.26 | 559.92 | 508.96 | 516.68 | 523.70 | 197.60 | 219.61 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.23 | NA | 0.03 | 0.56 | 0.16 | NA | 0.12 | 0.23 | 4.70 | 0.11 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 80.95 | 106.26 | 91.84 | 83.22 | 91.77 | 97.28 | 66.09 | 43.59 | NA | 2.23 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

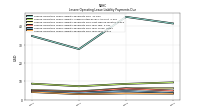

| Time Deposit Maturities Year One | 688.98 | NA | NA | NA | 469.82 | NA | NA | NA | NA | NA | |

| Deposits | 8190.39 | 8149.01 | 8120.86 | 7581.68 | 7872.63 | 6803.55 | 6194.40 | 6364.81 | 4741.86 | 4714.45 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 54.20 | 54.12 | 54.05 | 53.97 | 53.89 | 39.56 | 39.53 | 39.51 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

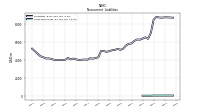

| Stockholders Equity | 1212.81 | 1163.59 | 1147.33 | 1133.73 | 1092.20 | 919.43 | 815.55 | 820.22 | 763.45 | 715.00 | |

| Additional Paid In Capital Common Stock | 1162.27 | 1160.71 | 1158.73 | 1160.44 | 1159.51 | 1079.56 | 1014.33 | 1014.33 | 1009.48 | 1012.97 | |

| Retained Earnings Accumulated Deficit | 433.13 | 410.24 | 384.09 | 361.44 | 330.72 | 323.45 | 314.62 | 301.22 | 168.98 | 120.88 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -76.40 | -100.85 | -88.61 | -78.63 | -88.20 | -89.34 | -58.00 | -38.63 | 12.37 | -6.14 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.86 | 1.72 | 2.22 | 1.43 | 1.72 | 1.49 | 1.70 | 1.15 | 1.22 | 0.38 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

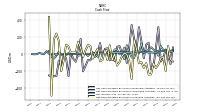

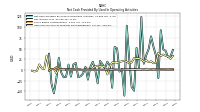

| Net Cash Provided By Used In Operating Activities | 44.62 | 48.12 | 92.99 | -18.80 | 33.54 | 53.89 | 78.44 | 48.76 | 26.24 | -3.62 | |

| Net Cash Provided By Used In Investing Activities | -198.66 | -29.94 | -51.55 | -123.89 | -163.44 | -109.99 | -238.35 | -240.35 | -81.64 | -94.93 | |

| Net Cash Provided By Used In Financing Activities | 53.57 | -50.72 | -87.32 | 315.37 | 69.20 | -136.07 | -178.10 | 130.77 | 79.14 | 94.25 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 44.62 | 48.12 | 92.99 | -18.80 | 33.54 | 53.89 | 78.44 | 48.76 | 26.24 | -3.62 | |

| Net Income Loss | 33.12 | 36.09 | 32.56 | 40.28 | 16.72 | 15.84 | 20.36 | 18.35 | 15.82 | 18.92 | |

| Share Based Compensation | 1.86 | 1.72 | 2.22 | 1.43 | 1.72 | 1.49 | 1.70 | 1.15 | 1.23 | 0.38 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -198.66 | -29.94 | -51.55 | -123.89 | -163.44 | -109.99 | -238.35 | -240.35 | -81.64 | -94.93 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 53.57 | -50.72 | -87.32 | 315.37 | 69.20 | -136.07 | -178.10 | 130.77 | 79.14 | 94.25 | |

| Payments Of Dividends | 10.26 | 9.88 | 9.97 | 9.53 | 9.44 | 6.96 | 6.95 | 7.09 | 6.26 | 5.41 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2020-03-31 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 10.45 | 12.98 | 13.41 | 10.06 | 10.87 | 9.93 | 8.49 | 8.57 | 23.53 | 17.05 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 10.46 | 12.98 | 13.41 | 10.07 | 10.87 | 9.55 | 8.50 | 8.30 | 23.53 | 17.05 | |

| Bank Servicing Charges And Other Fees | 4.27 | 6.82 | 6.61 | 4.93 | 5.33 | 4.87 | 3.96 | 4.18 | NA | NA | |

| Trust And Wealth Management Services | 1.28 | 1.17 | 0.50 | 0.51 | NA | NA | NA | NA | NA | NA | |

| Bank Servicing | 4.83 | 4.85 | 4.44 | 4.10 | 4.37 | 4.33 | 3.96 | 3.71 | 4.13 | 4.32 | |

| Credit And Debit Card | 4.92 | 4.99 | 5.09 | 4.64 | 4.95 | 4.68 | 4.54 | 4.12 | 3.51 | 3.43 |