| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

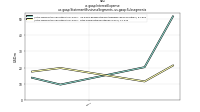

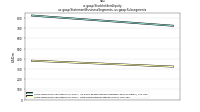

| Common Stock Value | 4.74 | 4.74 | 4.67 | 4.67 | 4.67 | 4.67 | 4.67 | 4.15 | 4.15 | 4.16 | 4.16 | 4.16 | 4.16 | 4.16 | 4.16 | |

| Weighted Average Number Of Diluted Shares Outstanding | NA | 476.80 | 466.80 | 484.43 | NA | 482.28 | 472.73 | 429491.38 | NA | 420.97 | 415.66 | 415.59 | 415.67 | 415.59 | 415.67 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 467.97 | 466.80 | 466.79 | NA | 466.58 | 456.31 | 414795.51 | NA | 415.74 | 415.66 | 415.59 | 415.52 | 415.52 | 415.46 | |

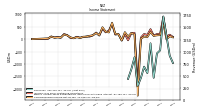

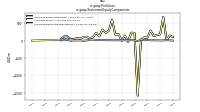

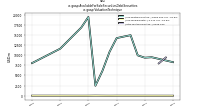

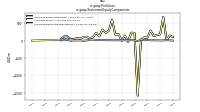

| Earnings Per Share Basic | 0.16 | 0.27 | -0.01 | 1.42 | 0.34 | 0.31 | 0.27 | 0.67 | 0.17 | 0.19 | -0.02 | -3.86 | 0.51 | 0.54 | -0.08 | |

| Earnings Per Share Diluted | 0.18 | 0.26 | -0.01 | 1.37 | 0.33 | 0.30 | 0.26 | 0.65 | 0.17 | 0.19 | -0.02 | -3.86 | 0.51 | 0.54 | -0.08 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

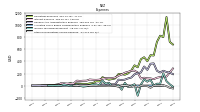

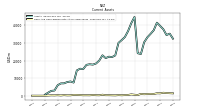

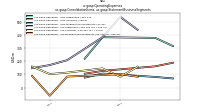

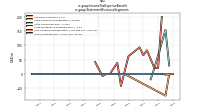

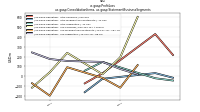

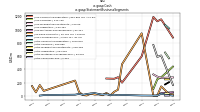

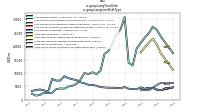

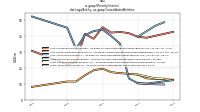

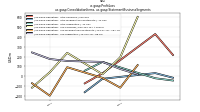

| Revenues | 762.40 | 912.84 | 1322.48 | 1729.20 | 1024.47 | 960.42 | 454.05 | 1170.72 | 552.66 | 685.02 | 451.76 | 286.83 | 880.05 | 627.92 | 431.53 | |

| Interest Income Operating | 365.54 | 273.38 | 211.65 | 225.41 | 217.55 | 190.63 | 253.68 | 253.74 | 234.12 | 233.85 | 232.20 | 402.37 | 463.09 | 448.13 | 416.05 | |

| Gain Loss On Investments | 521.11 | 968.34 | -234.04 | -147.12 | 10.50 | 11.11 | 200.38 | -265.57 | -62.72 | 89.09 | 102.78 | -566.28 | -251.86 | 2.21 | -26.64 | |

| Operating Expenses | 680.73 | 723.70 | 1136.74 | 802.88 | 826.38 | 723.86 | 497.93 | 503.57 | 403.62 | 469.57 | 436.54 | 302.92 | 335.80 | 250.56 | 201.86 | |

| General And Administrative Expense | 189.29 | 214.62 | 225.27 | 246.24 | 216.78 | 245.07 | 367.72 | 362.50 | 260.49 | 316.56 | 217.37 | 206.36 | 186.68 | 133.51 | 118.91 | |

| Interest Expense | 283.25 | 218.09 | 150.83 | 138.83 | 141.94 | 129.93 | 106.54 | 118.91 | 120.68 | 130.53 | 116.40 | 216.85 | 247.01 | 245.90 | 228.00 | |

| Interest Paid Net | 265.24 | 188.98 | 147.19 | 132.82 | 140.74 | 133.58 | 102.17 | 129.49 | 61.35 | 115.33 | 137.03 | 198.44 | 259.12 | 225.38 | 223.73 | |

| Allocated Share Based Compensation Expense | NA | NA | NA | 0.31 | 0.00 | 0.00 | 0.61 | 0.50 | 0.00 | 0.00 | 0.71 | 0.50 | 0.00 | 0.00 | 0.66 | |

| Income Tax Expense Benefit | -18.05 | 22.08 | 72.69 | 202.79 | 29.48 | 31.56 | -1.08 | 98.26 | 65.56 | 100.81 | 17.41 | -166.87 | 22.79 | -5.44 | -21.58 | |

| Income Taxes Paid | 2.25 | 0.12 | 1.60 | 0.04 | 2.77 | 6.24 | 14.36 | 0.13 | 3.52 | 0.01 | 0.01 | 0.08 | 0.27 | 0.01 | 1.11 | |

| Profit Loss | 105.83 | 154.19 | 33.33 | 689.93 | 187.84 | 170.68 | 145.73 | 301.34 | 101.52 | 103.92 | 44.13 | -1607.26 | 230.38 | 244.66 | -25.02 | |

| Comprehensive Income Net Of Tax | 71.07 | 115.17 | -12.85 | 638.80 | 162.70 | 152.62 | 130.44 | 284.27 | 82.23 | 99.27 | 15.73 | -2278.33 | 187.00 | 244.82 | 103.06 | |

| Net Income Loss Available To Common Stockholders Basic | 81.75 | 124.46 | -3.28 | 661.86 | 160.44 | 146.15 | 121.31 | 277.58 | 68.61 | 77.92 | -8.87 | -1602.32 | 211.78 | 224.58 | -31.94 | |

| Net Income Loss Available To Common Stockholders Diluted | 81.75 | 124.46 | -3.28 | 661.86 | 160.44 | 146.15 | 121.31 | 277.58 | 68.61 | 77.92 | -8.87 | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

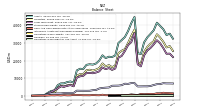

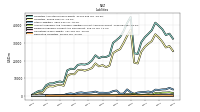

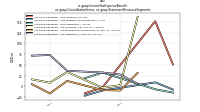

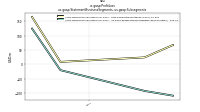

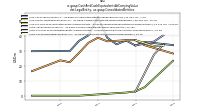

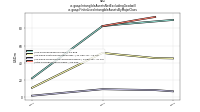

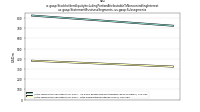

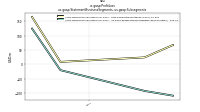

| Assets | 32479.34 | 35334.54 | 34553.85 | 37868.55 | 39742.19 | 41604.11 | 37250.40 | 35184.13 | 33252.11 | 30406.36 | 23752.15 | 24193.47 | 44863.45 | 41347.93 | 36792.38 | |

| Liabilities | 25469.27 | 28272.91 | 27490.85 | 30683.83 | 33072.81 | 34977.00 | 31084.25 | 29562.32 | 27822.43 | 24977.73 | 18363.18 | 18863.01 | 37627.19 | 34085.81 | 29991.54 | |

| Liabilities And Stockholders Equity | 32479.34 | 35334.54 | 34553.85 | 37868.55 | 39742.19 | 41604.11 | 37250.40 | 35184.13 | 33252.11 | 30406.36 | 23752.15 | 24193.47 | 44863.45 | 41347.93 | 36792.38 | |

| Stockholders Equity | 6943.00 | 6990.57 | 6993.83 | 7122.63 | 6604.03 | 6556.09 | 6072.05 | 5522.83 | 5321.02 | 5329.19 | 5292.29 | 5263.89 | 7157.71 | 7178.47 | 6717.97 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash | 1336.51 | 1420.01 | 1510.85 | 1671.18 | 1332.58 | 1366.68 | 956.24 | 1038.48 | 944.85 | 841.02 | 1013.21 | 360.45 | 528.74 | 738.22 | 406.04 | |

| Cash And Cash Equivalents At Carrying Value | 1336.51 | 1420.01 | 1510.85 | 1671.18 | 1332.58 | 1366.68 | 956.24 | 1038.48 | 944.85 | 841.02 | 1013.21 | 360.45 | 528.74 | 738.22 | 406.04 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1617.63 | 1949.58 | 1944.81 | 1966.21 | 1528.44 | 1561.42 | 1194.74 | 1174.52 | 1080.47 | 1021.58 | 1152.14 | 507.89 | 690.93 | 901.37 | 565.19 | |

| Available For Sale Securities Debt Securities | 8289.28 | 9437.01 | 7988.80 | 9509.93 | 9396.54 | 9973.80 | 14956.89 | 14606.16 | 14244.56 | 10830.07 | 6144.24 | 2479.60 | 19477.73 | 16853.91 | 12125.83 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Net | 37.88 | 33.80 | 44.80 | 51.82 | 56.62 | 59.61 | 31.17 | 31.49 | 27.49 | 27.28 | 23.42 | 23.27 | 18.02 | NA | NA | |

| Goodwill | 85.20 | 85.20 | 85.20 | 85.20 | 85.20 | 29.47 | 29.47 | 29.47 | 29.47 | 29.47 | 29.47 | 29.47 | 29.74 | 41.99 | 24.64 | |

| Intangible Assets Net Excluding Goodwill | 141.41 | 146.75 | 145.70 | 142.69 | 143.13 | 73.72 | 32.16 | 33.36 | 34.12 | 35.07 | 36.00 | 36.50 | 40.96 | 19.35 | 19.07 | |

| Finite Lived Intangible Assets Net | 118.17 | 115.81 | 114.97 | 105.85 | 119.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

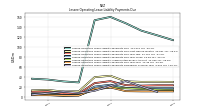

| Long Term Debt | 22010.63 | 23971.03 | 23890.34 | 27137.49 | 29823.49 | 31583.90 | 29168.73 | 27201.61 | 25769.37 | 22979.76 | 16676.44 | 17843.67 | 35650.84 | 30524.96 | 28783.31 | |

| Deferred Income Tax Liabilities Net | 711.86 | 738.21 | 716.15 | 642.04 | 440.69 | 407.58 | 100.11 | 93.15 | 7.86 | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 67.07 | 71.06 | 69.17 | 62.08 | 65.35 | 71.02 | 94.10 | 98.98 | 108.67 | 99.44 | 96.68 | 66.58 | 78.55 | 83.65 | 82.86 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

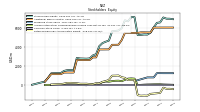

| Stockholders Equity | 6943.00 | 6990.57 | 6993.83 | 7122.63 | 6604.03 | 6556.09 | 6072.05 | 5522.83 | 5321.02 | 5329.19 | 5292.29 | 5263.89 | 7157.71 | 7178.47 | 6717.97 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 7010.07 | 7061.63 | 7063.00 | 7184.71 | 6669.38 | 6627.11 | 6166.15 | 5621.81 | 5429.68 | 5428.63 | 5388.97 | 5330.46 | 7236.26 | 7262.12 | 6800.83 | |

| Common Stock Value | 4.74 | 4.74 | 4.67 | 4.67 | 4.67 | 4.67 | 4.67 | 4.15 | 4.15 | 4.16 | 4.16 | 4.16 | 4.16 | 4.16 | 4.16 | |

| Additional Paid In Capital | 6062.02 | 6060.67 | 6060.74 | 6059.98 | 6059.67 | 6057.74 | 6059.19 | 5547.61 | 5547.11 | 5554.56 | 5554.56 | 5500.31 | 5498.23 | 5498.23 | 5498.23 | |

| Retained Earnings Accumulated Deficit | -418.66 | -381.84 | -387.87 | -267.88 | -813.04 | -856.80 | -886.30 | -914.30 | -1108.93 | -1094.59 | -1110.15 | -1059.71 | 549.73 | 545.71 | 528.89 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 37.65 | 48.34 | 57.62 | 67.19 | 90.25 | 87.99 | 81.51 | 72.39 | 65.70 | 52.07 | 30.73 | 6.13 | 682.15 | 706.93 | 686.69 | |

| Minority Interest | 67.07 | 71.06 | 69.17 | 62.08 | 65.35 | 71.02 | 94.10 | 98.98 | 108.67 | 99.44 | 96.68 | 66.58 | 78.55 | 83.65 | 82.86 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 5.66 | 5.42 | 7.09 | 8.88 | 10.58 | 11.00 | 14.94 | 19.08 | 9.96 | 8.91 | 10.33 | 12.61 | 15.76 | 13.95 | 13.99 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

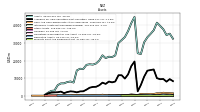

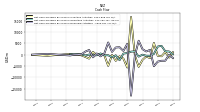

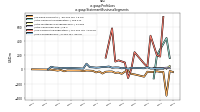

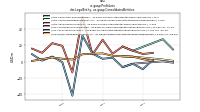

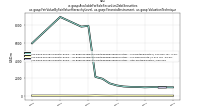

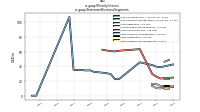

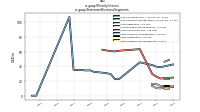

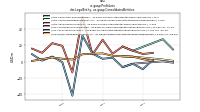

| Net Cash Provided By Used In Operating Activities | 142.15 | 1376.61 | 1465.15 | 3890.15 | 3570.37 | 320.09 | -511.23 | -495.36 | -29.93 | -880.45 | 1454.90 | 1311.42 | 693.81 | 466.82 | -2482.79 | |

| Net Cash Provided By Used In Investing Activities | 1052.83 | -1319.91 | 1201.65 | -736.32 | -500.79 | 5181.17 | -1575.64 | -798.48 | -2322.27 | -5395.52 | -297.60 | 16660.82 | -5697.58 | -1773.87 | -724.13 | |

| Net Cash Provided By Used In Financing Activities | -1526.92 | -51.94 | -2688.20 | -2716.06 | -3102.56 | -5134.58 | 2107.10 | 1387.88 | 2411.09 | 6145.40 | -513.05 | -18155.29 | 4793.34 | 1643.22 | 3263.07 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 142.15 | 1376.61 | 1465.15 | 3890.15 | 3570.37 | 320.09 | -511.23 | -495.36 | -29.93 | -880.45 | 1454.90 | 1311.42 | 693.81 | 466.82 | -2482.79 | |

| Profit Loss | 105.83 | 154.19 | 33.33 | 689.93 | 187.84 | 170.68 | 145.73 | 301.34 | 101.52 | 103.92 | 44.13 | -1607.26 | 230.38 | 244.66 | -25.02 | |

| Deferred Income Tax Expense Benefit | -26.35 | 22.08 | 74.11 | 201.32 | 31.67 | 27.33 | 6.96 | 85.23 | 57.30 | 99.37 | 25.28 | -166.92 | 20.13 | -6.65 | -21.60 | |

| Amortization Of Financing Costs | 5.60 | 4.44 | 2.72 | 6.92 | 3.28 | 2.51 | 3.78 | 4.60 | 10.38 | 6.36 | 4.86 | 1.14 | 1.03 | 1.06 | 1.06 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 1052.83 | -1319.91 | 1201.65 | -736.32 | -500.79 | 5181.17 | -1575.64 | -798.48 | -2322.27 | -5395.52 | -297.60 | 16660.82 | -5697.58 | -1773.87 | -724.13 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -1526.92 | -51.94 | -2688.20 | -2716.06 | -3102.56 | -5134.58 | 2107.10 | 1387.88 | 2411.09 | 6145.40 | -513.05 | -18155.29 | 4793.34 | 1643.22 | 3263.07 | |

| Payments Of Dividends Common Stock | NA | 139.15 | 161.60 | 116.69 | 116.64 | 93.32 | 82.96 | 82.95 | 62.36 | 41.57 | 20.78 | 207.76 | 207.76 | 207.76 | 207.72 | |

| Dividends | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 20.80 | NA | NA | 207.76 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

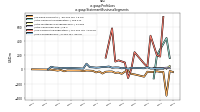

| Revenues | 762.40 | 912.84 | 1322.48 | 1729.20 | 1024.47 | 960.42 | 454.05 | 1170.72 | 552.66 | 685.02 | 451.76 | 286.83 | 880.05 | 627.92 | 431.53 | |

| Intersegment Elimination, Servicer And Origination | NA | NA | NA | -2.40 | -28.21 | -47.67 | NA | -11.50 | -13.70 | -25.03 | NA | NA | NA | NA | NA | |

| Intersegment Elimination, Servicer And Origination | NA | 0.00 | -0.10 | NA | NA | NA | -49.20 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, M S R Related Investments | NA | NA | NA | 201.77 | 10.65 | 38.04 | NA | 195.32 | -298.27 | 20.80 | NA | NA | NA | NA | NA | |

| Operating, Origination | NA | NA | NA | 461.99 | 635.30 | 559.14 | NA | 399.17 | 419.23 | 459.22 | NA | NA | NA | NA | NA | |

| Operating, Servicing | NA | NA | NA | 919.49 | 250.55 | 164.14 | NA | 383.79 | 153.78 | 64.01 | NA | NA | NA | NA | NA | |

| Operating, M S R Related Investments | NA | 56.81 | 107.79 | NA | NA | 38.83 | -105.15 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Origination | NA | 256.56 | 348.83 | NA | NA | 559.14 | 294.72 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Servicing | NA | 456.40 | 742.09 | NA | NA | 155.60 | 18.66 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Consumer Loan | NA | NA | NA | 18.93 | 20.74 | 22.71 | NA | 25.47 | 27.31 | 29.55 | NA | NA | 37.30 | 40.33 | 43.84 | |

| Mortgage Loans Receivable | NA | NA | NA | 34.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Servicer And Origination | NA | NA | NA | 1585.65 | 924.69 | 809.00 | NA | 966.77 | 288.47 | 569.06 | NA | NA | NA | NA | NA | |

| Consumer Loan | NA | 16.46 | 18.11 | NA | NA | 22.71 | 24.93 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Mortgage Loans Receivable | NA | 42.34 | 36.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Servicer And Origination | NA | 769.77 | 1198.81 | NA | NA | 801.25 | 257.47 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate | 3.70 | 5.39 | 5.25 | 6.44 | 6.90 | 14.44 | NA | NA | NA | NA | NA | NA | 0.03 | 0.00 | 0.00 | |

| Residential Securities And Loans, Residential Mortgage Loans | NA | NA | NA | 27.55 | 29.39 | 46.51 | NA | 49.47 | 40.12 | 33.91 | NA | NA | NA | NA | NA | |

| Residential Securities And Loans, Residential Mortgage Backed Securities | NA | NA | NA | 56.35 | 38.53 | 67.77 | NA | 103.25 | 63.82 | 61.03 | NA | NA | NA | NA | NA | |

| Residential Securities And Loans, Residential Mortgage Loans | NA | 1.98 | 8.98 | NA | NA | 46.51 | 50.12 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Residential Securities And Loans, Residential Mortgage Backed Securities | NA | 76.91 | 54.58 | NA | NA | 67.77 | 94.32 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Operating | 365.54 | 273.38 | 211.65 | 225.41 | 217.55 | 190.63 | 253.68 | 253.74 | 234.12 | 233.85 | 232.20 | 402.37 | 463.09 | 448.13 | 416.05 | |

| Operating, M S R Related Investments | NA | NA | NA | 15.70 | 13.19 | 11.38 | NA | 21.58 | 12.70 | 25.49 | NA | NA | NA | NA | NA | |

| Operating, Origination | NA | NA | NA | 55.37 | 79.09 | 54.85 | NA | 22.85 | 20.05 | 17.41 | NA | NA | NA | NA | NA | |

| Operating, Servicing | NA | NA | NA | 11.35 | 7.17 | -2.73 | NA | 4.87 | 0.62 | 2.39 | NA | NA | NA | NA | NA | |

| Operating, M S R Related Investments | NA | 15.40 | 11.34 | NA | NA | 11.38 | 3.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Origination | NA | 41.86 | 46.22 | NA | NA | 54.85 | 31.26 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Servicing | NA | 55.84 | 16.76 | NA | NA | -2.73 | 11.32 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Consumer Loan | NA | NA | NA | 18.93 | 20.74 | 22.71 | NA | 25.47 | 27.31 | 29.55 | NA | NA | 37.30 | 40.33 | 43.84 | |

| Mortgage Loans Receivable | NA | NA | NA | 34.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Servicer And Origination | NA | NA | NA | 82.43 | 99.45 | 63.51 | NA | 49.31 | 33.37 | 45.29 | NA | NA | -226.27 | 135.89 | 147.42 | |

| Consumer Loan | NA | 16.46 | 18.11 | NA | NA | 22.71 | 24.93 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Mortgage Loans Receivable | NA | 42.34 | 36.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Servicer And Origination | NA | 113.11 | 74.31 | NA | NA | 63.51 | 45.58 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate | 3.70 | 5.39 | 5.25 | 6.44 | 6.90 | 14.44 | NA | NA | NA | NA | NA | NA | 0.03 | 0.00 | 0.00 | |

| Residential Securities And Loans, Residential Mortgage Loans | NA | NA | NA | 26.99 | 32.55 | 37.49 | NA | 36.32 | 34.84 | 33.91 | NA | NA | NA | NA | NA | |

| Residential Securities And Loans, Residential Mortgage Backed Securities | NA | NA | NA | 56.35 | 53.69 | 52.49 | NA | 89.85 | 77.21 | 61.03 | NA | NA | NA | NA | NA | |

| Residential Securities And Loans, Residential Mortgage Loans | NA | 19.19 | 22.64 | NA | NA | 37.49 | 33.29 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Residential Securities And Loans, Residential Mortgage Backed Securities | NA | 76.91 | 54.58 | NA | NA | 52.49 | 97.96 | NA | NA | NA | NA | NA | NA | NA | NA |