| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

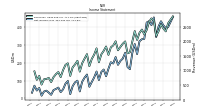

| Earnings Per Share Basic | 128.38 | 132.92 | 123.84 | 106.31 | 141.52 | 125.97 | 131.84 | 125.87 | 96.07 | 93.25 | 88.69 | 67.72 | 82.26 | 69.19 | 44.56 | 47.97 | 69.88 | 60.94 | 58.20 | 52.23 | 64.36 | 54.21 | 55.90 | 45.19 | 33.40 | 43.26 | 39.46 | 27.78 | 39.83 | 30.43 | 23.51 | 16.81 | 33.87 | 28.75 | 22.97 | 9.63 | 23.82 | 21.49 | 15.68 | 5.34 | 21.24 | 18.08 | 10.37 | 7.04 | 12.28 | 10.60 | 9.17 | 3.99 | 6.44 | 8.19 | 6.65 | 2.61 | 10.32 | 7.65 | 11.64 | |

| Earnings Per Share Diluted | 121.34 | 125.26 | 116.54 | 99.89 | 133.21 | 118.51 | 123.65 | 116.56 | 88.73 | 86.44 | 82.45 | 63.21 | 76.93 | 65.11 | 42.50 | 44.96 | 64.41 | 56.11 | 53.09 | 47.64 | 58.57 | 48.28 | 49.05 | 39.34 | 28.88 | 38.02 | 35.19 | 25.12 | 37.80 | 28.46 | 22.01 | 15.79 | 31.92 | 27.11 | 21.91 | 9.22 | 23.24 | 20.70 | 15.17 | 5.16 | 21.15 | 17.67 | 10.11 | 6.84 | 11.98 | 10.33 | 8.97 | 3.90 | 6.32 | 7.98 | 6.48 | 2.52 | 9.96 | 7.31 | 11.13 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 2432.57 | 2569.03 | 2338.33 | 2178.28 | 2712.18 | 2776.90 | 2658.94 | 2378.41 | 2230.34 | 2395.64 | 2283.60 | 2041.45 | 2344.01 | 1990.01 | 1620.37 | 1582.53 | 1990.19 | 1911.26 | 1800.19 | 1687.01 | 1994.55 | 1852.41 | 1787.31 | 1529.41 | 1816.34 | 1667.92 | 1544.49 | 1277.09 | 1752.77 | 1537.57 | 1388.18 | 1144.03 | 1555.28 | 1402.35 | 1243.63 | 957.75 | 1328.04 | 1203.17 | 1102.05 | 811.31 | 1242.15 | 1188.97 | 1009.89 | 770.26 | 943.74 | 870.64 | 769.78 | 600.49 | 741.29 | 707.48 | 695.88 | 514.50 | 811.00 | 676.17 | 964.50 | |

| Interest Paid Net | 13.92 | 0.50 | 13.92 | 0.86 | 14.03 | 0.85 | 20.11 | 12.52 | 14.21 | 12.60 | 14.26 | 12.61 | 11.85 | 12.36 | 0.42 | 12.17 | 0.41 | 11.99 | 0.14 | 11.91 | 0.11 | 11.91 | 0.17 | 11.98 | 0.14 | 11.82 | -0.24 | 11.54 | 0.02 | 11.33 | -1.27 | 10.84 | 0.23 | 12.09 | 0.18 | 12.04 | 0.21 | 12.09 | 0.14 | 12.03 | 0.20 | 12.07 | 0.21 | 12.39 | 0.34 | 0.12 | 0.27 | 0.32 | 0.42 | 0.52 | 0.54 | 0.51 | 0.65 | 0.63 | 3.94 | |

| Income Loss From Continuing Operations Before Income Taxes Domestic | 484.05 | 539.34 | 471.18 | 433.81 | 574.72 | 538.51 | 574.01 | 565.95 | 426.81 | 434.13 | 417.46 | 312.01 | 385.37 | 321.46 | 209.83 | 161.38 | 295.30 | 267.17 | 244.71 | 218.61 | 277.44 | 249.71 | 241.59 | 191.00 | 261.32 | 244.46 | 208.97 | 132.16 | 228.66 | 185.00 | 144.72 | 103.31 | 207.17 | 185.00 | 148.68 | 62.36 | 151.22 | 143.79 | 108.82 | 49.71 | 151.82 | 131.59 | 80.18 | 55.10 | 96.03 | 84.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 73.97 | 106.18 | 67.15 | 89.46 | 119.95 | 127.12 | 140.70 | 139.84 | 92.22 | 102.05 | 96.17 | 63.24 | 80.37 | 64.99 | 45.76 | -14.33 | 39.16 | 43.39 | 34.50 | 30.20 | 45.28 | 53.89 | 38.41 | 24.95 | 136.70 | 82.36 | 61.09 | 29.24 | 77.77 | 67.61 | 53.04 | 38.01 | 73.17 | 68.53 | 55.29 | 23.30 | 51.77 | 53.64 | 40.65 | 25.86 | 54.01 | 48.66 | 29.49 | 20.06 | 35.40 | 31.13 | 17.12 | 10.84 | 18.05 | 25.53 | 24.91 | 9.66 | 27.82 | 20.95 | 46.98 | |

| Income Taxes Paid Net | 94.55 | 50.02 | 257.19 | 5.42 | 125.94 | 112.15 | 289.19 | 2.54 | 99.53 | 117.29 | 169.93 | 2.63 | 76.86 | 74.47 | 9.30 | 2.44 | 44.80 | 37.63 | 69.17 | 2.32 | 55.40 | 39.49 | 82.94 | 3.33 | 90.28 | 70.58 | 92.29 | 7.08 | 70.87 | 58.04 | 73.56 | 16.52 | 70.83 | 71.06 | 38.32 | 14.46 | 60.07 | 58.64 | 34.47 | 28.66 | 58.02 | 42.26 | 9.70 | 3.24 | 23.55 | 21.01 | 15.42 | -0.38 | 27.03 | 8.70 | 3.40 | 10.63 | 23.25 | 7.71 | 1.02 | |

| Net Income Loss | 410.07 | 433.16 | 404.03 | 344.35 | 454.77 | 411.39 | 433.31 | 426.10 | 334.58 | 332.08 | 321.30 | 248.76 | 305.00 | 256.47 | 164.07 | 175.70 | 256.14 | 223.79 | 210.21 | 188.41 | 232.16 | 195.82 | 203.17 | 166.05 | 124.62 | 162.10 | 147.88 | 102.92 | 150.89 | 117.39 | 91.68 | 65.30 | 134.00 | 116.47 | 93.39 | 39.06 | 99.45 | 90.15 | 68.18 | 23.85 | 97.81 | 82.94 | 50.69 | 35.04 | 60.63 | 53.00 | 46.84 | 20.12 | 32.39 | 43.41 | 38.45 | 15.17 | 58.70 | 43.94 | 71.28 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

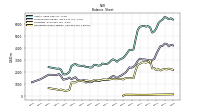

| Assets | 6601.76 | 6372.26 | 6266.77 | 6075.90 | 5660.97 | 5389.53 | 5287.70 | 5726.21 | 5834.48 | 5788.89 | 5854.44 | 5820.81 | 5777.14 | 5499.92 | 4730.02 | 3887.52 | 3809.82 | 3843.36 | 3603.24 | 3362.77 | 3165.93 | 3089.82 | 3009.39 | 2846.07 | 2989.28 | 3049.51 | 2918.09 | 2742.30 | 2643.94 | 2663.22 | 2698.42 | 2541.65 | 2515.13 | 2570.68 | 2596.24 | 2376.13 | 2351.34 | 2413.08 | 2382.06 | 2524.75 | 2486.15 | 2518.90 | 2531.17 | 2665.05 | 2604.84 | 2480.73 | 1990.96 | 1850.91 | 1779.48 | 1799.62 | 2175.68 | 2275.73 | 2260.06 | NA | NA | |

| Liabilities | 2237.03 | 2199.68 | 2113.51 | 2230.56 | 2154.12 | 2304.70 | 2296.03 | 3000.61 | 2832.10 | 2771.84 | 2812.15 | 2774.30 | 2674.07 | 2580.93 | 2117.61 | 1470.60 | 1468.57 | 1471.90 | 1483.80 | 1463.99 | 1357.37 | 1407.51 | 1401.82 | 1379.26 | 1383.79 | 1398.84 | 1382.31 | 1334.02 | 1339.50 | 1364.08 | 1340.82 | 1285.19 | 1275.97 | 1330.19 | 1321.35 | 1210.90 | 1227.08 | 1261.68 | 1282.85 | 1198.67 | 1224.80 | 1243.80 | 1210.89 | 1112.96 | 1124.37 | 1101.42 | 469.14 | 432.67 | 404.69 | 453.60 | 524.88 | 457.53 | 519.69 | NA | NA | |

| Liabilities And Stockholders Equity | 6601.76 | 6372.26 | 6266.77 | 6075.90 | 5660.97 | 5389.53 | 5287.70 | 5726.21 | 5834.48 | 5788.89 | 5854.44 | 5820.81 | 5777.14 | 5499.92 | 4730.02 | 3887.52 | 3809.82 | 3843.36 | 3603.24 | 3362.77 | 3165.93 | 3089.82 | 3009.39 | 2846.07 | 2989.28 | 3049.51 | 2918.09 | 2742.30 | 2643.94 | 2663.22 | 2698.42 | 2541.65 | 2515.13 | 2570.68 | 2596.24 | 2376.13 | 2351.34 | 2413.08 | 2382.06 | 2524.75 | 2486.15 | 2518.90 | 2531.17 | 2665.05 | 2604.84 | 2480.73 | 1990.96 | 1850.91 | 1779.48 | 1799.62 | 2175.68 | 2275.73 | 2260.06 | NA | NA | |

| Stockholders Equity | 4364.73 | 4172.58 | 4153.26 | 3845.35 | 3506.85 | 3084.84 | 2991.67 | 2725.60 | 3002.38 | 3017.05 | 3042.29 | 3046.51 | 3103.07 | 2918.99 | 2612.41 | 2416.92 | 2341.24 | 2371.46 | 2119.44 | 1898.78 | 1808.56 | 1682.32 | 1607.57 | 1466.81 | 1605.49 | 1650.68 | 1535.78 | 1408.28 | 1304.44 | 1299.14 | 1357.60 | 1256.46 | 1239.16 | 1240.49 | 1274.88 | 1165.24 | 1124.26 | 1151.39 | 1099.21 | 1326.08 | 1261.35 | 1275.09 | 1320.28 | 1552.09 | 1480.48 | 1379.31 | 1521.82 | 1418.24 | 1374.80 | 1346.02 | 1650.80 | 1818.20 | 1740.37 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

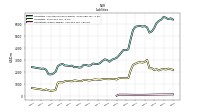

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 3215.44 | 2969.99 | 2758.06 | 2858.59 | 2574.52 | 1821.36 | 1563.96 | 2227.09 | 2636.98 | 2748.06 | 2664.83 | 2814.52 | 2809.78 | 2592.47 | 2028.00 | 1118.27 | 1160.80 | 1116.06 | 906.41 | 840.70 | 732.25 | 632.55 | 458.48 | 450.71 | 689.56 | 643.93 | 548.18 | 510.74 | 416.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 29.20 | 28.10 | 27.60 | 26.80 | 27.20 | 27.80 | 30.00 | 18.80 | 20.30 | 20.80 | 21.70 | 25.90 | 23.60 | 28.70 | 28.40 | 27.80 | 26.70 | 24.60 | 25.00 | 31.10 | 29.40 | 31.75 | 40.00 | 43.00 | 45.50 | 42.30 | 44.00 | 47.70 | 49.40 | 51.50 | 53.10 | 55.70 | 60.50 | 63.70 | 68.50 | 74.40 | 82.00 | 87.10 | 85.50 | 86.30 | 92.70 | 85.40 | 90.80 | 92.50 | 82.90 | NA | NA | NA | 89.50 | NA | NA | NA | 37.20 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

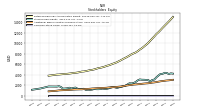

| Stockholders Equity | 4364.73 | 4172.58 | 4153.26 | 3845.35 | 3506.85 | 3084.84 | 2991.67 | 2725.60 | 3002.38 | 3017.05 | 3042.29 | 3046.51 | 3103.07 | 2918.99 | 2612.41 | 2416.92 | 2341.24 | 2371.46 | 2119.44 | 1898.78 | 1808.56 | 1682.32 | 1607.57 | 1466.81 | 1605.49 | 1650.68 | 1535.78 | 1408.28 | 1304.44 | 1299.14 | 1357.60 | 1256.46 | 1239.16 | 1240.49 | 1274.88 | 1165.24 | 1124.26 | 1151.39 | 1099.21 | 1326.08 | 1261.35 | 1275.09 | 1320.28 | 1552.09 | 1480.48 | 1379.31 | 1521.82 | 1418.24 | 1374.80 | 1346.02 | 1650.80 | 1818.20 | 1740.37 | NA | NA | |

| Additional Paid In Capital Common Stock | 2848.53 | 2801.03 | 2747.69 | 2676.64 | 2600.01 | 2538.81 | 2498.12 | 2416.66 | 2378.19 | 2349.00 | 2314.56 | 2272.01 | 2214.43 | 2188.21 | 2151.62 | 2127.32 | 2055.41 | 2020.18 | 1962.16 | 1899.10 | 1820.22 | 1762.32 | 1721.70 | 1678.10 | 1644.20 | 1626.11 | 1607.96 | 1570.27 | 1515.83 | 1499.77 | 1483.06 | 1467.00 | 1447.80 | 1420.21 | 1389.72 | 1370.76 | 1325.49 | 1299.53 | 1277.76 | 1259.41 | 1212.05 | 1208.65 | 1196.38 | 1184.96 | 1169.70 | 1134.31 | 1113.12 | 1074.21 | 1072.78 | 1054.23 | 1037.30 | 1014.02 | 951.23 | NA | NA | |

| Retained Earnings Accumulated Deficit | 13365.02 | 12954.95 | 12521.79 | 12117.77 | 11773.41 | 11318.65 | 10907.25 | 10473.94 | 10047.84 | 9713.26 | 9381.18 | 9059.88 | 8811.12 | 8506.12 | 8249.65 | 8085.57 | 7909.87 | 7653.73 | 7429.95 | 7219.74 | 7031.33 | 6799.18 | 6603.36 | 6400.19 | 6231.94 | 6107.32 | 5945.22 | 5797.34 | 5695.38 | 5544.48 | 5427.09 | 5335.42 | 5270.11 | 5136.11 | 5019.64 | 4926.24 | 4887.19 | 4787.74 | 4697.58 | 4629.41 | 4605.56 | 4507.75 | 4424.81 | 4374.12 | 4339.08 | 4278.45 | 4225.45 | 4178.61 | 4158.49 | 4126.10 | 4082.69 | 4044.25 | 4029.07 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 26.02 | 26.05 | 25.16 | 22.28 | 24.10 | 26.69 | 20.09 | 11.67 | 15.38 | 15.01 | 13.38 | 14.47 | 15.23 | 13.64 | 14.43 | 7.49 | 19.85 | 20.77 | 18.58 | 19.33 | 24.01 | 23.59 | 18.59 | 9.51 | 11.88 | 11.21 | 10.88 | 10.59 | 11.14 | 11.08 | 10.83 | 10.55 | 14.22 | 13.57 | 12.90 | 13.40 | 18.35 | 18.23 | 15.94 | 10.70 | 3.91 | 11.73 | 10.59 | 8.06 | 14.71 | 16.96 | 16.73 | 16.44 | 16.51 | 16.26 | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 495.71 | 658.08 | 28.68 | 315.52 | 817.20 | 605.70 | 137.88 | 309.33 | 260.10 | 461.27 | 192.76 | 328.26 | 345.93 | 208.67 | 302.23 | 68.44 | 357.10 | 206.82 | 74.76 | 227.85 | 231.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -1.29 | -15.79 | 182.06 | 178.68 | -12.42 | -78.09 | 85.93 | 106.06 | -18.45 | 90.84 | 6.04 | 20.64 | -16.19 | -9.03 | 140.99 | -19.29 | 51.86 | |

| Net Cash Provided By Used In Investing Activities | -6.75 | -6.90 | -7.54 | -2.92 | -6.79 | -3.01 | -13.31 | -4.32 | -6.19 | -5.36 | -3.23 | -3.39 | 8.17 | -4.29 | -4.55 | -3.26 | -5.96 | -4.52 | -0.92 | -1.88 | -1.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -12.16 | 0.01 | -15.92 | -1.85 | -2.70 | -14.01 | -17.34 | -2.95 | -2.02 | -0.29 | -1.50 | 1.06 | -64.97 | 3.54 | 23.71 | 148.85 | -52.89 | |

| Net Cash Provided By Used In Financing Activities | -243.51 | -439.25 | -121.68 | -28.53 | -57.24 | -345.29 | -787.70 | -714.90 | -364.98 | -372.67 | -339.23 | -320.13 | -136.79 | 360.10 | 612.05 | -107.72 | -306.39 | 7.36 | -8.13 | -117.53 | -129.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -312.16 | 28.85 | -114.08 | -141.06 | -294.19 | 26.32 | 6.37 | 382.18 | 38.58 | 3.82 | -20.87 | -454.98 | -208.74 | 32.04 | -26.79 | -164.60 | -250.38 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 495.71 | 658.08 | 28.68 | 315.52 | 817.20 | 605.70 | 137.88 | 309.33 | 260.10 | 461.27 | 192.76 | 328.26 | 345.93 | 208.67 | 302.23 | 68.44 | 357.10 | 206.82 | 74.76 | 227.85 | 231.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -1.29 | -15.79 | 182.06 | 178.68 | -12.42 | -78.09 | 85.93 | 106.06 | -18.45 | 90.84 | 6.04 | 20.64 | -16.19 | -9.03 | 140.99 | -19.29 | 51.86 | |

| Net Income Loss | 410.07 | 433.16 | 404.03 | 344.35 | 454.77 | 411.39 | 433.31 | 426.10 | 334.58 | 332.08 | 321.30 | 248.76 | 305.00 | 256.47 | 164.07 | 175.70 | 256.14 | 223.79 | 210.21 | 188.41 | 232.16 | 195.82 | 203.17 | 166.05 | 124.62 | 162.10 | 147.88 | 102.92 | 150.89 | 117.39 | 91.68 | 65.30 | 134.00 | 116.47 | 93.39 | 39.06 | 99.45 | 90.15 | 68.18 | 23.85 | 97.81 | 82.94 | 50.69 | 35.04 | 60.63 | 53.00 | 46.84 | 20.12 | 32.39 | 43.41 | 38.45 | 15.17 | 58.70 | 43.94 | 71.28 | |

| Depreciation Depletion And Amortization | 4.33 | 4.18 | 4.22 | 4.19 | 4.16 | 4.25 | 4.53 | 4.46 | 4.74 | 4.68 | 4.83 | 5.20 | 5.19 | 5.55 | 5.63 | 5.62 | 5.45 | 5.22 | 5.08 | 5.06 | 5.12 | 5.03 | 4.99 | 5.04 | 5.58 | 5.59 | 5.79 | 5.70 | 5.68 | 5.66 | 5.49 | 5.45 | 5.35 | 5.44 | 5.46 | 5.28 | 5.03 | 4.66 | 4.22 | 3.71 | 4.02 | 3.53 | 3.08 | 2.77 | 2.28 | 2.09 | 1.93 | 1.80 | 1.72 | 1.71 | 1.64 | 1.60 | 1.72 | 1.82 | 1.85 | |

| Increase Decrease In Inventories | -53.62 | -16.32 | 154.55 | 77.27 | -382.17 | -208.30 | 185.11 | 246.27 | 83.84 | -109.85 | 143.58 | 120.71 | -54.10 | 160.64 | 87.50 | 168.35 | -149.16 | 98.72 | 116.56 | 28.06 | -167.96 | -12.54 | 89.22 | 98.19 | -130.36 | 11.61 | 132.52 | 140.33 | -224.63 | 69.12 | -13.93 | 254.64 | -154.95 | 75.92 | 129.62 | 84.21 | -144.73 | 59.95 | 109.77 | 102.73 | -178.81 | -24.86 | 96.69 | 159.85 | -64.76 | -1.82 | 64.69 | 99.64 | -48.89 | 44.86 | 42.13 | 61.42 | -131.50 | 138.29 | -79.21 | |

| Share Based Compensation | 26.02 | 26.05 | 25.16 | 22.28 | 24.10 | 26.69 | 20.09 | 11.67 | 15.38 | 15.01 | 13.38 | 14.47 | 15.23 | 13.64 | 14.43 | 7.49 | 19.85 | 20.77 | 18.58 | 19.33 | 24.01 | 23.59 | 18.59 | 9.51 | 11.88 | 11.21 | 10.88 | 10.59 | 11.14 | 11.08 | 10.83 | 10.55 | 14.22 | 13.57 | 12.90 | 13.40 | 18.35 | 18.23 | 15.94 | 10.70 | 3.91 | 11.73 | 10.59 | 8.06 | 14.71 | 16.96 | 16.73 | 16.44 | 16.51 | 16.26 | 16.12 | 15.58 | 12.39 | 19.92 | 15.15 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -6.75 | -6.90 | -7.54 | -2.92 | -6.79 | -3.01 | -13.31 | -4.32 | -6.19 | -5.36 | -3.23 | -3.39 | 8.17 | -4.29 | -4.55 | -3.26 | -5.96 | -4.52 | -0.92 | -1.88 | -1.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -12.16 | 0.01 | -15.92 | -1.85 | -2.70 | -14.01 | -17.34 | -2.95 | -2.02 | -0.29 | -1.50 | 1.06 | -64.97 | 3.54 | 23.71 | 148.85 | -52.89 | |

| Payments To Acquire Property Plant And Equipment | 6.35 | 7.08 | 8.73 | 2.71 | 6.46 | 3.22 | 4.70 | 4.06 | 5.93 | 5.33 | 3.52 | 3.10 | 3.79 | 4.11 | 4.71 | 3.51 | 5.96 | 6.04 | 5.41 | 5.29 | 4.85 | 5.57 | 6.14 | 3.11 | 4.60 | 5.89 | 4.62 | 5.16 | 5.86 | 4.74 | 6.34 | 5.43 | 4.81 | 4.88 | 3.69 | 4.89 | 4.35 | 6.52 | 15.37 | 5.43 | 4.95 | 5.98 | 4.63 | 3.46 | 2.00 | 4.37 | 3.10 | 2.90 | 2.77 | 1.20 | 6.47 | 1.01 | 2.63 | 1.39 | 2.04 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -243.51 | -439.25 | -121.68 | -28.53 | -57.24 | -345.29 | -787.70 | -714.90 | -364.98 | -372.67 | -339.23 | -320.13 | -136.79 | 360.10 | 612.05 | -107.72 | -306.39 | 7.36 | -8.13 | -117.53 | -129.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -312.16 | 28.85 | -114.08 | -141.06 | -294.19 | 26.32 | 6.37 | 382.18 | 38.58 | 3.82 | -20.87 | -454.98 | -208.74 | 32.04 | -26.79 | -164.60 | -250.38 | |

| Payments For Repurchase Of Common Stock | 286.43 | 484.26 | 201.08 | 110.05 | 116.17 | 368.49 | 266.92 | 748.79 | 385.16 | 398.49 | 376.94 | 377.43 | 154.50 | 0.00 | 0.00 | 216.58 | 332.88 | 61.06 | 87.98 | 216.50 | 188.76 | 173.83 | 126.30 | 357.24 | 191.97 | 70.69 | 73.96 | 85.55 | 163.61 | 195.24 | 9.41 | 87.10 | 167.92 | 194.16 | 6.19 | 63.10 | 158.11 | 61.99 | 314.87 | 32.58 | 118.68 | 140.83 | NA | NA | 7.15 | NA | NA | NA | 22.67 | 365.74 | NA | NA | 39.79 | 201.21 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 2432.57 | 2569.03 | 2338.33 | 2178.28 | 2712.18 | 2776.90 | 2658.94 | 2378.41 | 2230.34 | 2395.64 | 2283.60 | 2041.45 | 2344.01 | 1990.01 | 1620.37 | 1582.53 | 1990.19 | 1911.26 | 1800.19 | 1687.01 | 1994.55 | 1852.41 | 1787.31 | 1529.41 | 1816.34 | 1667.92 | 1544.49 | 1277.09 | 1752.77 | 1537.57 | 1388.18 | 1144.03 | 1555.28 | 1402.35 | 1243.63 | 957.75 | 1328.04 | 1203.17 | 1102.05 | 811.31 | 1242.15 | 1188.97 | 1009.89 | 770.26 | 943.74 | 870.64 | 769.78 | 600.49 | 741.29 | 707.48 | 695.88 | 514.50 | 811.00 | 676.17 | 964.50 | |

| Home Building | 2387.09 | 2512.41 | 2283.77 | 2131.33 | 2668.04 | 2739.45 | 2610.06 | 2309.23 | 2176.81 | 2336.61 | 2224.56 | 1963.71 | 2263.67 | 1920.75 | 1588.76 | 1555.71 | 1946.86 | 1873.33 | 1757.45 | 1643.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Mortgage Banking | 45.48 | 56.62 | 54.56 | 46.94 | 44.15 | 37.45 | 48.88 | 69.18 | 53.53 | 59.02 | 59.04 | 77.73 | 80.34 | 69.26 | 31.61 | 26.82 | 43.34 | 37.93 | 42.75 | 43.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Mid Atlantic, Home Building | 1043.46 | 1146.56 | 1058.79 | 941.15 | 1133.81 | 1282.50 | 1208.31 | 1141.71 | 982.60 | 1082.71 | 1048.42 | 936.14 | 1105.17 | 949.47 | 839.85 | 774.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Mid East, Home Building | 440.71 | 468.73 | 411.68 | 402.40 | 594.83 | 569.99 | 521.04 | 461.40 | 485.37 | 503.23 | 478.18 | 424.95 | 499.02 | 404.99 | 299.95 | 320.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| North East, Home Building | 263.70 | 268.24 | 232.93 | 183.43 | 229.53 | 250.07 | 237.39 | 175.55 | 199.30 | 213.09 | 193.25 | 162.19 | 176.44 | 157.97 | 98.22 | 106.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| South East, Home Building | 639.23 | 628.89 | 580.37 | 604.36 | 709.87 | 636.88 | 643.32 | 530.56 | 509.53 | 537.59 | 504.72 | 440.43 | 483.04 | 408.31 | 350.74 | 354.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |