| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

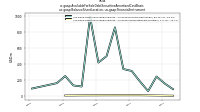

| Weighted Average Number Of Diluted Shares Outstanding | 164.38 | 162.75 | 161.32 | NA | 158.71 | 157.40 | 155.88 | NA | 153.76 | 151.36 | 131.78 | NA | 128.81 | 126.32 | 123.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 164.38 | 162.75 | 161.32 | NA | 158.71 | 157.40 | 155.88 | NA | 153.76 | 151.36 | 131.78 | NA | 128.81 | 126.32 | 123.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

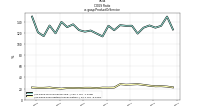

| Earnings Per Share Basic | -0.49 | -0.68 | -0.74 | -0.95 | -1.32 | -1.34 | -1.56 | -1.56 | -1.44 | -1.83 | -0.83 | -0.58 | -0.56 | -0.48 | -0.47 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.49 | -0.68 | -0.74 | -0.95 | -1.32 | -1.34 | -1.56 | -1.56 | -1.44 | -1.83 | -0.83 | -0.58 | -0.56 | -0.48 | -0.47 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

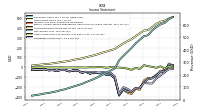

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

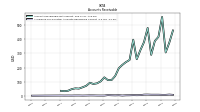

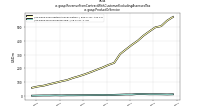

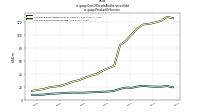

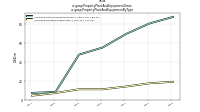

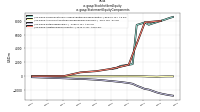

| Revenue From Contract With Customer Excluding Assessed Tax | 584.00 | 556.00 | 518.00 | 510.21 | 481.04 | 451.81 | 414.94 | 383.01 | 350.68 | 315.50 | 251.01 | 234.74 | 217.38 | 200.45 | 182.86 | 167.33 | 153.04 | 140.48 | 125.22 | 115.47 | 105.58 | 94.59 | 83.62 | 77.05 | 66.91 | 60.99 | 53.01 | 49.30 | 42.28 | 37.44 | 31.79 | |

| Revenues | 584.00 | 556.00 | 518.00 | 510.21 | 481.04 | 451.81 | 414.94 | 383.01 | 350.68 | 315.50 | 251.01 | 234.74 | 217.38 | 200.45 | 182.86 | 167.33 | 153.04 | 140.48 | 125.22 | 115.47 | 105.58 | 94.59 | 83.62 | 77.05 | 66.91 | 60.99 | 53.01 | 49.30 | 42.28 | 37.44 | 31.79 | |

| Gain Loss On Investments | NA | NA | NA | -0.87 | -0.09 | 0.58 | 1.38 | 1.94 | 0.39 | 2.38 | 2.90 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

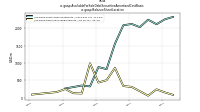

| Cost Of Goods And Services Sold | 145.00 | 149.00 | 142.00 | 139.49 | 137.65 | 137.69 | 131.16 | 119.50 | 109.67 | 101.11 | 66.12 | 61.14 | 56.91 | 51.15 | 48.49 | 44.68 | 40.82 | 38.78 | 35.09 | 31.39 | 29.70 | 28.23 | 24.11 | 22.49 | 21.12 | NA | NA | NA | NA | NA | NA | |

| Gross Profit | 439.00 | 407.00 | 376.00 | 370.72 | 343.39 | 314.11 | 283.78 | 263.51 | 241.01 | 214.39 | 184.88 | 173.60 | 160.47 | 149.30 | 134.37 | 122.64 | 112.21 | 101.70 | 90.13 | 84.08 | 75.88 | 66.36 | 59.51 | 55.26 | 47.12 | 41.31 | 35.54 | 33.13 | 28.18 | 23.66 | 19.41 | |

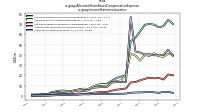

| Operating Expenses | 550.00 | 569.00 | 536.00 | 528.37 | 549.99 | 522.17 | 523.47 | 477.94 | 439.56 | 477.83 | 275.56 | 228.20 | 212.45 | 194.69 | 186.57 | 167.35 | 157.94 | 145.32 | 141.91 | 111.82 | 104.36 | 104.79 | 84.49 | 80.61 | 82.34 | 68.47 | 64.18 | 51.10 | 50.07 | 44.22 | 42.11 | |

| Research And Development Expense | 165.00 | 172.00 | 163.00 | 154.03 | 148.48 | 155.84 | 161.65 | 147.45 | 130.53 | 122.41 | 68.86 | 62.32 | 58.15 | 53.87 | 48.49 | 43.36 | 41.83 | 40.05 | 34.03 | 30.03 | 27.60 | 24.83 | 19.93 | 19.35 | 19.19 | 16.92 | 15.36 | 10.53 | 9.71 | 9.65 | 8.77 | |

| General And Administrative Expense | 111.00 | 119.00 | 110.00 | 86.45 | 111.52 | 101.69 | 109.34 | 108.91 | 105.15 | 157.08 | 60.18 | 50.71 | 44.48 | 42.50 | 34.03 | 31.35 | 28.89 | 26.89 | 25.77 | 19.24 | 19.85 | 20.95 | 15.07 | 14.67 | 13.55 | 11.95 | 11.64 | 9.09 | 7.92 | 6.14 | 6.95 | |

| Selling And Marketing Expense | 270.00 | 261.00 | 256.00 | 258.89 | 289.98 | 264.65 | 252.47 | 221.58 | 203.88 | 198.35 | 146.52 | 115.17 | 109.81 | 98.32 | 104.04 | 92.64 | 87.22 | 78.39 | 82.11 | 62.55 | 56.91 | 59.00 | 49.49 | 46.62 | 49.61 | 39.60 | 37.18 | 31.48 | 32.44 | 28.42 | 26.40 | |

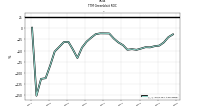

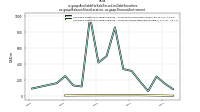

| Operating Income Loss | -111.00 | -162.00 | -160.00 | -157.65 | -206.60 | -208.06 | -239.69 | -214.43 | -198.56 | -263.44 | -90.68 | -54.60 | -51.98 | -45.39 | -52.20 | -44.70 | -45.73 | -43.62 | -51.78 | -27.73 | -28.48 | -38.43 | -24.98 | -25.35 | -35.23 | -27.16 | -28.63 | -17.97 | -21.89 | -20.56 | -22.70 | |

| Interest Expense | 2.00 | 2.00 | 3.00 | 2.41 | 2.81 | 2.92 | 2.87 | 23.41 | 23.14 | 22.87 | 22.76 | 22.60 | 22.37 | 16.93 | 10.76 | 10.65 | 7.83 | 4.30 | 4.24 | 4.18 | 4.12 | 4.06 | 2.72 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | NA | NA | NA | 2.49 | 0.67 | 2.16 | 0.68 | 2.16 | 0.68 | 2.16 | 0.71 | 2.19 | 0.72 | 0.06 | 0.78 | 0.00 | 0.43 | 0.00 | 0.43 | 0.00 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 18.00 | 42.00 | 31.00 | NA | NA | NA | NA | 0.00 | 0.00 | -0.04 | -0.14 | 0.00 | -0.09 | -2.17 | NA | 0.00 | -14.57 | 0.00 | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 172.00 | 185.00 | 166.00 | 165.31 | 170.99 | 171.18 | 169.52 | 157.87 | 155.78 | 187.71 | 64.11 | 56.41 | 53.65 | 48.39 | 37.73 | 36.93 | 35.73 | 31.27 | 22.68 | 22.42 | 21.54 | 18.22 | 14.13 | 14.57 | 14.41 | 11.98 | 8.91 | 5.26 | 4.84 | 3.66 | 3.37 | |

| Income Tax Expense Benefit | 7.00 | 7.00 | 4.00 | 4.20 | 3.73 | 4.22 | 1.86 | 5.50 | 0.67 | -7.46 | 0.01 | 0.77 | 0.21 | -0.43 | -0.40 | 0.87 | 0.35 | -1.48 | -1.20 | 1.87 | -0.70 | -1.00 | -0.20 | 0.18 | -0.94 | 0.20 | 0.20 | 0.16 | 0.10 | 0.10 | 0.08 | |

| Income Taxes Paid | NA | NA | NA | 2.56 | 2.14 | 2.40 | 0.90 | 0.57 | 0.91 | 1.10 | 0.54 | 0.36 | 0.23 | 0.18 | 0.21 | 0.28 | 0.19 | 0.51 | 0.14 | 0.12 | 0.40 | NA | NA | 0.08 | NA | NA | NA | -0.09 | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -4.00 | 6.00 | 13.00 | 23.05 | -14.88 | -5.04 | -24.14 | -12.41 | -3.97 | -1.24 | 0.22 | 2.82 | -2.95 | 1.78 | 2.85 | 0.76 | 1.79 | -1.20 | -0.14 | 0.60 | -0.44 | -0.30 | -0.57 | 0.46 | -0.14 | 0.17 | 0.07 | 0.02 | -0.11 | -0.10 | 0.08 | |

| Net Income Loss | -81.00 | -111.00 | -119.00 | -152.92 | -208.90 | -210.47 | -242.71 | -241.19 | -221.31 | -276.68 | -109.23 | -75.81 | -72.76 | -60.10 | -57.66 | -50.47 | -63.49 | -42.98 | -51.97 | -30.81 | -29.52 | -39.21 | -25.96 | -24.72 | -33.78 | -27.00 | -28.90 | -18.22 | -21.93 | -20.60 | -22.75 | |

| Comprehensive Income Net Of Tax | -85.00 | -105.00 | -106.00 | -129.86 | -223.78 | -215.51 | -266.85 | -253.60 | -225.28 | -277.92 | -109.01 | -72.99 | -75.71 | -58.32 | -54.81 | -49.72 | -61.71 | -44.18 | -52.10 | -30.21 | -29.95 | -39.51 | -26.53 | -24.22 | -33.92 | -26.83 | -28.83 | -18.20 | -22.04 | -20.70 | -22.67 |

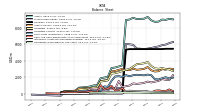

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

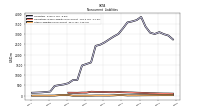

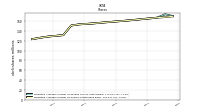

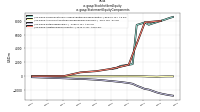

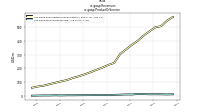

| Assets | 8740.00 | 8713.00 | 8900.00 | 9307.00 | 9093.74 | 9074.01 | 9045.68 | 9205.69 | 8996.97 | 8932.09 | 3430.45 | 3298.80 | 3170.28 | 3115.01 | 2037.01 | 1955.39 | 1870.78 | 1026.81 | 998.54 | 864.34 | 796.71 | 763.92 | 726.90 | 367.40 | 337.16 | 316.23 | 320.23 | 130.63 | NA | NA | NA | |

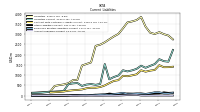

| Liabilities | 3010.00 | 3073.00 | 3366.00 | 3841.00 | 3686.12 | 3620.99 | 3572.99 | 3283.84 | 3012.42 | 2889.91 | 2747.67 | 2604.75 | 2489.63 | 2429.82 | 1623.91 | 1550.05 | 1472.38 | 776.09 | 759.10 | 611.96 | 552.21 | 518.77 | 477.29 | 203.80 | 180.70 | 163.36 | 154.31 | 146.29 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 8740.00 | 8713.00 | 8900.00 | 9307.00 | 9093.74 | 9074.01 | 9045.68 | 9205.69 | 8996.97 | 8932.09 | 3430.45 | 3298.80 | 3170.28 | 3115.01 | 2037.01 | 1955.39 | 1870.78 | 1026.81 | 998.54 | 864.34 | 796.71 | 763.92 | 726.90 | 367.40 | 337.16 | 316.23 | 320.23 | 130.63 | NA | NA | NA | |

| Stockholders Equity | 5730.00 | 5640.00 | 5534.00 | 5466.00 | 5407.61 | 5453.02 | 5472.69 | 5921.86 | 5984.56 | 6042.19 | 682.78 | 694.04 | 680.65 | 685.20 | 413.10 | 405.34 | 398.39 | 250.72 | 239.44 | 252.38 | 244.50 | 245.15 | 249.62 | 163.59 | 156.46 | 152.87 | 165.92 | -243.60 | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 2727.00 | 2686.00 | 2843.00 | 3229.00 | 3006.94 | 2945.50 | 2898.64 | 3040.63 | 2852.87 | 2877.16 | 3012.14 | 2878.57 | 2757.54 | 2706.93 | 1633.52 | 1599.72 | 1526.60 | 697.02 | 676.93 | 709.33 | 658.11 | 633.38 | 636.16 | 315.40 | 294.67 | 274.69 | 279.80 | 92.79 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 400.00 | 356.00 | 125.00 | 264.00 | 249.62 | 216.02 | 194.23 | 260.13 | 372.37 | 225.26 | 659.89 | 434.61 | 409.77 | 957.23 | 619.22 | 520.05 | 1039.63 | 206.75 | 208.11 | 298.39 | 195.90 | 192.88 | 211.76 | 127.95 | 137.57 | 126.46 | 221.73 | 23.28 | 20.13 | 28.84 | 39.71 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 408.00 | 368.00 | 134.00 | 271.00 | 259.01 | 225.59 | 204.49 | 272.66 | 387.07 | 239.96 | 673.44 | 448.63 | 423.70 | 971.14 | 634.29 | 531.95 | 1051.37 | 218.50 | 219.85 | 311.21 | 204.45 | 201.44 | 220.32 | 136.23 | 137.84 | 126.74 | 221.99 | 23.28 | 25.57 | 32.72 | 43.60 | |

| Short Term Investments | 1730.00 | 1750.00 | 2245.00 | 2316.00 | 2223.54 | 2260.96 | 2292.90 | 2241.66 | 2109.69 | 2243.64 | 2030.18 | 2121.58 | 2085.37 | 1557.28 | 827.56 | 882.98 | 326.63 | 350.71 | 339.38 | 265.37 | 350.11 | 343.37 | 335.29 | 101.77 | 86.04 | 86.75 | 2.50 | 14.39 | NA | NA | NA | |

| Accounts Receivable Net Current | 418.00 | 388.00 | 290.00 | 481.00 | 380.75 | 323.38 | 258.91 | 397.51 | 253.57 | 238.48 | 218.47 | 194.82 | 139.47 | 110.54 | 111.04 | 130.12 | 101.78 | 87.85 | 83.33 | 91.93 | 70.14 | 59.84 | 50.37 | 52.25 | 46.88 | 35.30 | 32.17 | 34.54 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 75.00 | 91.00 | 88.00 | 76.00 | 68.57 | 64.49 | 75.48 | 66.61 | 56.78 | 115.25 | 55.78 | 81.61 | 82.02 | 44.07 | 40.91 | 32.95 | 29.02 | 24.64 | 20.54 | 29.45 | 20.28 | 17.43 | 20.20 | 17.00 | 10.04 | 12.88 | 10.27 | 7.03 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | NA | NA | NA | 2377.06 | 2393.88 | 2350.86 | 2302.18 | 2218.78 | 2432.84 | 2420.97 | 2415.20 | 1330.77 | 882.98 | 1315.66 | 471.87 | 339.38 | 265.37 | 350.11 | 343.37 | 335.29 | 101.77 | 86.04 | 86.75 | 2.50 | 14.39 | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 107.00 | NA | NA | NA | 99.71 | NA | NA | NA | 85.05 | NA | NA | NA | 69.94 | NA | NA | NA | 62.56 | NA | NA | NA | 20.66 | NA | NA | NA | 15.13 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 48.00 | NA | NA | NA | 34.22 | NA | NA | NA | 22.27 | NA | NA | NA | 16.41 | NA | NA | NA | 9.64 | NA | NA | NA | 8.12 | NA | NA | NA | 4.11 | NA | NA | NA | |

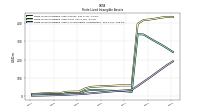

| Amortization Of Intangible Assets | NA | NA | NA | 23.80 | 23.30 | 23.20 | 22.70 | 22.40 | 22.40 | 21.30 | 2.90 | 2.90 | 2.70 | 2.80 | 2.80 | 2.90 | 2.60 | 3.00 | 2.10 | 1.70 | 1.80 | 1.20 | 1.20 | 0.80 | 0.80 | 0.70 | 0.70 | 0.50 | 0.50 | 0.40 | 0.30 | |

| Property Plant And Equipment Net | 50.00 | 49.00 | 54.00 | 59.00 | 60.88 | 66.96 | 66.42 | 65.49 | 60.75 | 61.86 | 62.52 | 62.78 | 62.41 | 63.41 | 61.91 | 53.53 | 51.73 | 51.86 | 52.19 | 52.92 | 44.25 | 40.67 | 19.18 | 12.54 | 13.12 | 13.30 | 13.18 | 11.03 | NA | NA | NA | |

| Goodwill | 5406.00 | 5406.00 | 5406.00 | 5400.00 | 5400.27 | 5400.27 | 5401.34 | 5401.34 | 5401.34 | 5338.12 | 48.02 | 48.02 | 48.02 | 48.02 | 48.02 | 48.02 | 47.96 | 47.96 | 47.96 | 18.09 | 18.10 | 18.09 | 6.30 | 6.28 | 6.30 | 6.30 | 6.28 | 2.60 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 197.00 | 211.00 | 227.00 | 241.00 | 261.82 | 281.47 | 298.82 | 316.97 | 336.35 | 337.79 | 24.19 | 27.01 | 28.95 | 30.03 | 31.03 | 32.53 | 33.83 | 34.71 | 28.02 | 13.90 | 14.99 | 16.01 | 11.86 | 11.76 | 11.46 | 11.05 | 9.84 | 9.15 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 241.00 | 261.82 | 281.47 | 298.82 | 316.97 | 336.35 | 337.79 | 24.19 | 27.01 | 28.95 | 30.03 | 31.03 | 32.53 | 33.83 | 34.71 | 28.02 | 13.90 | 14.99 | 16.01 | 11.86 | 11.76 | 11.46 | 11.05 | 9.84 | 9.15 | NA | NA | NA | |

| Other Assets Noncurrent | 49.00 | 51.00 | 48.00 | 46.00 | 43.46 | 46.55 | 47.23 | 42.29 | 45.48 | 41.01 | 28.02 | 24.26 | 24.36 | 22.28 | 20.48 | 18.50 | 18.45 | 18.99 | 16.70 | 15.29 | 13.53 | 12.48 | 12.34 | 10.43 | 2.46 | 1.66 | 1.67 | 4.98 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | NA | NA | NA | 2406.00 | 2405.62 | 2353.05 | 2301.37 | 2217.61 | 2430.86 | 2418.42 | 2410.43 | 1324.94 | 881.78 | 1315.06 | 471.50 | 339.20 | 265.40 | 350.35 | 343.62 | 335.61 | 101.97 | 86.11 | 86.77 | 2.50 | 14.38 | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

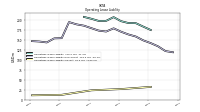

| Liabilities Current | 1543.00 | 1456.00 | 1362.00 | 1465.00 | 1309.45 | 1236.59 | 1185.28 | 1242.81 | 988.17 | 912.53 | 800.46 | 1545.61 | 573.94 | 533.58 | 570.39 | 546.96 | 478.39 | 620.67 | 601.91 | 564.19 | 244.79 | 218.14 | 202.93 | 190.76 | 170.96 | 152.80 | 143.06 | 135.63 | NA | NA | NA | |

| Accounts Payable Current | 11.00 | 13.00 | 10.00 | 12.00 | 49.12 | 43.71 | 33.75 | 20.20 | 11.55 | 9.41 | 9.54 | 8.56 | 5.11 | 4.73 | 8.02 | 3.84 | 4.92 | 3.49 | 4.35 | 17.21 | 12.09 | 12.58 | 11.83 | 9.57 | 12.88 | 9.85 | 15.91 | 11.90 | NA | NA | NA | |

| Accrued Income Taxes Current | NA | NA | NA | 5.00 | NA | NA | NA | 7.42 | NA | NA | NA | 2.46 | NA | NA | NA | 1.59 | NA | NA | NA | 1.20 | NA | NA | NA | 0.83 | NA | NA | NA | 0.83 | NA | NA | NA | |

| Accrued Liabilities Current | NA | NA | NA | 67.00 | NA | NA | NA | 48.30 | NA | NA | NA | 24.72 | NA | NA | NA | 22.53 | NA | NA | NA | 6.39 | NA | NA | NA | 3.39 | NA | NA | NA | 4.30 | NA | NA | NA | |

| Other Liabilities Current | 108.00 | 95.00 | 91.00 | 112.00 | 100.09 | 106.48 | 110.93 | 89.31 | 91.52 | 80.46 | 108.73 | 53.73 | 47.33 | 54.80 | 36.60 | 36.89 | 33.29 | 31.84 | 32.41 | 9.96 | 6.30 | 6.33 | 4.90 | 6.19 | 4.96 | 4.40 | 4.82 | 5.85 | NA | NA | NA | |

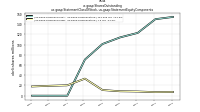

| Contract With Customer Liability Current | 1256.00 | 1225.00 | 1173.00 | 1242.00 | 1044.62 | 994.10 | 952.19 | 973.29 | 759.91 | 721.81 | 613.17 | 502.74 | 424.76 | 391.25 | 392.12 | 365.24 | 306.74 | 283.72 | 268.03 | 245.62 | 206.15 | 186.43 | 173.55 | 159.82 | NA | NA | NA | NA | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred Income Tax Liabilities Net | NA | NA | NA | 12.00 | NA | NA | NA | 9.42 | NA | NA | NA | 3.88 | NA | NA | NA | 1.56 | NA | NA | NA | 0.73 | NA | NA | NA | 0.17 | NA | NA | NA | 0.13 | NA | NA | NA | |

| Other Liabilities Noncurrent | 28.00 | 27.00 | 25.00 | 23.00 | 18.39 | 18.53 | 16.09 | 31.77 | 33.12 | 18.23 | 10.67 | 11.38 | 12.71 | 12.02 | 6.70 | 5.36 | 4.78 | 4.24 | 3.47 | 39.00 | 34.78 | 31.40 | 10.10 | 7.02 | 6.55 | 6.45 | 6.32 | 4.95 | NA | NA | NA | |

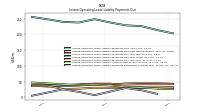

| Operating Lease Liability Noncurrent | 119.00 | 122.00 | 134.00 | 142.00 | 148.91 | 158.58 | 163.87 | 170.61 | 179.21 | 171.14 | 173.47 | 179.52 | 185.86 | 189.21 | 194.89 | 154.51 | 153.96 | 143.71 | 146.04 | 147.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

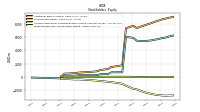

| Stockholders Equity | 5730.00 | 5640.00 | 5534.00 | 5466.00 | 5407.61 | 5453.02 | 5472.69 | 5921.86 | 5984.56 | 6042.19 | 682.78 | 694.04 | 680.65 | 685.20 | 413.10 | 405.34 | 398.39 | 250.72 | 239.44 | 252.38 | 244.50 | 245.15 | 249.62 | 163.59 | 156.46 | 152.87 | 165.92 | -243.60 | NA | NA | NA | |

| Additional Paid In Capital | 8534.00 | 8359.00 | 8148.00 | 7974.00 | 7785.75 | 7607.38 | 7411.55 | 7749.72 | 7558.82 | 7391.17 | 1753.84 | 1656.10 | 1569.71 | 1498.55 | 1168.13 | 1105.56 | 1048.90 | 839.52 | 784.07 | 744.90 | 706.81 | 677.50 | 642.46 | 565.65 | 534.30 | 496.80 | 483.02 | 44.47 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -2786.00 | -2705.00 | -2594.00 | -2475.00 | -2322.09 | -2113.20 | -1902.72 | -1815.87 | -1574.68 | -1353.37 | -1076.69 | -967.46 | -891.65 | -818.89 | -758.79 | -701.12 | -650.65 | -587.16 | -544.18 | -492.21 | -461.40 | -431.88 | -392.68 | -402.47 | -377.79 | -344.01 | -317.01 | -287.91 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -18.00 | -14.00 | -20.00 | -33.00 | -56.06 | -41.19 | -36.15 | -12.01 | 0.40 | 4.38 | 5.61 | 5.39 | 2.57 | 5.52 | 3.74 | 0.89 | 0.14 | -1.65 | -0.46 | -0.32 | -0.92 | -0.48 | -0.18 | 0.39 | -0.07 | 0.07 | -0.10 | -0.17 | NA | NA | NA |

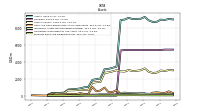

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

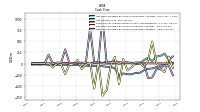

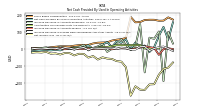

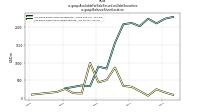

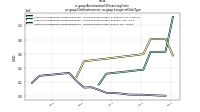

| Net Cash Provided By Used In Operating Activities | 156.00 | 53.00 | 129.00 | 76.24 | 9.98 | -19.05 | 18.83 | 13.53 | 37.12 | -2.61 | 56.08 | 34.91 | 43.43 | 10.93 | 38.70 | 24.84 | 10.64 | -1.13 | 21.26 | 10.10 | 6.44 | -5.34 | 3.97 | 0.15 | -9.47 | -6.24 | -9.69 | -6.70 | -8.53 | -11.84 | -15.04 | |

| Net Cash Provided By Used In Investing Activities | 20.00 | 495.00 | 59.00 | -82.78 | 21.49 | 19.63 | -88.34 | -156.71 | 101.46 | -463.47 | 151.91 | -37.26 | -595.62 | -722.87 | 50.60 | -562.94 | 22.89 | -22.38 | -125.61 | 80.90 | -10.54 | -28.73 | -238.94 | -18.24 | -1.16 | -88.52 | 8.22 | 4.40 | 0.71 | 1.01 | 0.84 | |

| Net Cash Provided By Used In Financing Activities | -133.00 | -315.00 | -326.00 | 14.44 | 5.63 | 22.55 | 5.38 | 30.62 | 9.21 | 33.05 | 16.18 | 25.14 | 5.21 | 1047.08 | 14.17 | 18.65 | 798.40 | 23.07 | 13.26 | 15.41 | 7.47 | 15.44 | 319.44 | 16.04 | 21.81 | -0.56 | 200.11 | -0.01 | 0.75 | 0.05 | -0.34 |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 156.00 | 53.00 | 129.00 | 76.24 | 9.98 | -19.05 | 18.83 | 13.53 | 37.12 | -2.61 | 56.08 | 34.91 | 43.43 | 10.93 | 38.70 | 24.84 | 10.64 | -1.13 | 21.26 | 10.10 | 6.44 | -5.34 | 3.97 | 0.15 | -9.47 | -6.24 | -9.69 | -6.70 | -8.53 | -11.84 | -15.04 | |

| Net Income Loss | -81.00 | -111.00 | -119.00 | -152.92 | -208.90 | -210.47 | -242.71 | -241.19 | -221.31 | -276.68 | -109.23 | -75.81 | -72.76 | -60.10 | -57.66 | -50.47 | -63.49 | -42.98 | -51.97 | -30.81 | -29.52 | -39.21 | -25.96 | -24.72 | -33.78 | -27.00 | -28.90 | -18.22 | -21.93 | -20.60 | -22.75 | |

| Increase Decrease In Accounts Receivable | 31.00 | 99.00 | -191.00 | 101.97 | 59.05 | 65.23 | -139.25 | 145.26 | 14.76 | -7.95 | 22.75 | 55.83 | 29.17 | -0.38 | -18.25 | 28.12 | 13.85 | 4.84 | -9.30 | 22.14 | 10.30 | 8.96 | -1.72 | 5.58 | 11.43 | 3.55 | -2.24 | 8.39 | 4.30 | 2.40 | -3.09 | |

| Increase Decrease In Accounts Payable | -2.00 | 3.00 | -2.00 | -35.79 | 5.16 | 9.46 | 15.18 | 6.96 | 1.85 | -3.67 | 1.63 | 2.70 | 0.57 | -3.13 | 3.94 | -0.27 | 0.59 | -0.27 | 1.64 | -0.68 | -1.20 | 0.22 | 2.34 | -2.75 | 5.07 | -2.60 | 3.78 | -0.92 | 0.80 | -2.03 | 3.68 | |

| Share Based Compensation | 172.00 | 185.00 | 166.00 | 165.31 | 170.99 | 171.18 | 169.52 | 157.87 | 155.78 | 187.71 | 64.11 | 56.41 | 53.67 | 48.38 | 37.73 | 36.93 | 35.73 | 31.27 | 22.68 | 22.42 | 21.54 | 18.22 | 14.13 | 14.57 | 14.41 | 11.98 | 8.91 | 5.26 | 4.84 | 3.66 | 3.37 | |

| Amortization Of Financing Costs | 1.00 | 1.00 | 1.00 | NA | 2.00 | 1.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

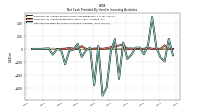

| Net Cash Provided By Used In Investing Activities | 20.00 | 495.00 | 59.00 | -82.78 | 21.49 | 19.63 | -88.34 | -156.71 | 101.46 | -463.47 | 151.91 | -37.26 | -595.62 | -722.87 | 50.60 | -562.94 | 22.89 | -22.38 | -125.61 | 80.90 | -10.54 | -28.73 | -238.94 | -18.24 | -1.16 | -88.52 | 8.22 | 4.40 | 0.71 | 1.01 | 0.84 | |

| Payments To Acquire Property Plant And Equipment | 3.00 | NA | NA | 2.62 | 1.88 | 2.17 | 5.33 | 6.51 | 1.77 | 0.78 | 3.26 | 1.79 | 0.63 | 2.74 | 7.93 | 5.46 | 0.06 | 2.21 | 7.71 | 5.56 | 4.46 | 5.31 | 4.48 | 0.98 | 0.41 | 2.71 | 2.45 | 1.61 | 1.62 | 2.10 | 0.93 |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -133.00 | -315.00 | -326.00 | 14.44 | 5.63 | 22.55 | 5.38 | 30.62 | 9.21 | 33.05 | 16.18 | 25.14 | 5.21 | 1047.08 | 14.17 | 18.65 | 798.40 | 23.07 | 13.26 | 15.41 | 7.47 | 15.44 | 319.44 | 16.04 | 21.81 | -0.56 | 200.11 | -0.01 | 0.75 | 0.05 | -0.34 |

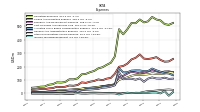

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | 2017-01-31 | 2016-10-31 | 2016-07-31 | 2016-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

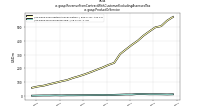

| Revenues | 584.00 | 556.00 | 518.00 | 510.21 | 481.04 | 451.81 | 414.94 | 383.01 | 350.68 | 315.50 | 251.01 | 234.74 | 217.38 | 200.45 | 182.86 | 167.33 | 153.04 | 140.48 | 125.22 | 115.47 | 105.58 | 94.59 | 83.62 | 77.05 | 66.91 | 60.99 | 53.01 | 49.30 | 42.28 | 37.44 | 31.79 | |

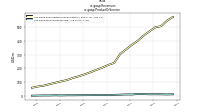

| Subscription And Circulation | 569.00 | 542.00 | 503.00 | 494.82 | 465.86 | 435.38 | 397.94 | 369.33 | 336.70 | 303.12 | 240.06 | 225.40 | 206.74 | 190.69 | 173.78 | 158.51 | 144.52 | 132.49 | 117.16 | 108.46 | 97.70 | 87.85 | 76.84 | 70.96 | 61.86 | NA | NA | NA | NA | NA | NA | |

| Technology Service | 15.00 | 14.00 | 15.00 | 15.39 | 15.19 | 16.42 | 17.00 | 13.69 | 13.98 | 12.38 | 10.95 | 9.34 | 10.64 | 9.76 | 9.08 | 8.81 | 8.52 | 7.99 | 8.06 | 7.01 | 7.88 | 6.73 | 6.78 | 6.09 | 5.05 | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 584.00 | 556.00 | 518.00 | 510.21 | 481.04 | 451.81 | 414.94 | 383.01 | 350.68 | 315.50 | 251.01 | 234.74 | 217.38 | 200.45 | 182.86 | 167.33 | 153.04 | 140.48 | 125.22 | 115.47 | 105.58 | 94.59 | 83.62 | 77.05 | 66.91 | 60.99 | 53.01 | 49.30 | 42.28 | 37.44 | 31.79 | |

| Subscription And Circulation | 569.00 | 542.00 | 503.00 | 494.82 | 465.86 | 435.38 | 397.94 | 369.33 | 336.70 | 303.12 | 240.06 | 225.40 | 206.74 | 190.69 | 173.78 | 158.51 | 144.52 | 132.49 | 117.16 | 108.46 | 97.70 | 87.85 | 76.84 | 70.96 | 61.86 | NA | NA | NA | NA | NA | NA | |

| Technology Service | 15.00 | 14.00 | 15.00 | 15.39 | 15.19 | 16.42 | 17.00 | 13.69 | 13.98 | 12.38 | 10.95 | 9.34 | 10.64 | 9.76 | 9.08 | 8.81 | 8.52 | 7.99 | 8.06 | 7.01 | 7.88 | 6.73 | 6.78 | 6.09 | 5.05 | NA | NA | NA | NA | NA | NA |