| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.70 | 0.70 | 0.70 | 0.55 | 0.55 | 0.55 | 0.55 | 0.55 | 0.55 | 0.55 | 0.47 | 0.47 | 0.47 | 0.47 | 0.47 | 0.41 | 0.41 | |

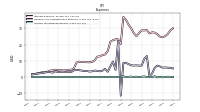

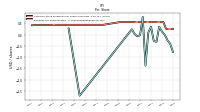

| Earnings Per Share Basic | -0.77 | -0.41 | -0.25 | -0.01 | 0.13 | 0.35 | -0.33 | -0.28 | 0.35 | 0.08 | -1.38 | 0.78 | -0.03 | -0.08 | 0.03 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -2.71 | NA | NA | 0.19 | 0.27 | 0.28 | 0.23 | 0.04 | 0.28 | 0.45 | 0.25 | 0.25 | 0.25 | 0.28 | 0.28 | 0.26 | 0.27 | 0.24 | |

| Earnings Per Share Diluted | -0.77 | -0.41 | -0.25 | -0.01 | 0.13 | 0.35 | -0.33 | -0.28 | 0.35 | 0.08 | -1.38 | 0.78 | -0.03 | -0.08 | 0.03 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -2.71 | NA | NA | NA | 0.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

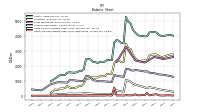

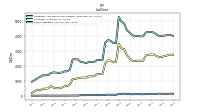

| Costs And Expenses | 124.48 | 123.78 | 116.84 | 109.48 | 100.72 | 111.69 | 118.52 | 134.09 | 126.14 | 113.97 | 162.66 | 131.04 | 118.99 | 122.28 | 118.14 | 119.75 | 135.96 | 150.17 | 140.44 | 147.94 | 76.68 | 110.41 | 86.79 | 102.42 | 104.51 | 53.41 | 53.05 | 51.24 | 48.91 | 49.30 | 46.56 | 46.74 | 45.75 | 46.35 | 45.06 | 45.42 | 46.14 | 47.73 | 43.05 | 42.58 | 41.38 | 40.31 | 38.03 | 37.05 | 38.88 | 37.89 | 34.26 | 33.38 | 35.64 | 31.08 | 27.93 | 24.63 | |

| General And Administrative Expense | 5.30 | 5.72 | 5.79 | 5.92 | 5.78 | 6.56 | 7.08 | 5.71 | 2.17 | 0.45 | 12.97 | 11.27 | 7.07 | 7.06 | 7.20 | 7.11 | 7.27 | 7.99 | 8.74 | 8.72 | -11.52 | 22.38 | 4.45 | 9.61 | 6.53 | 3.27 | 5.09 | 3.96 | 3.55 | 3.82 | 4.01 | 3.53 | 3.40 | 3.71 | 3.71 | 4.00 | 4.27 | 4.33 | 4.11 | 3.10 | 3.36 | 2.94 | 3.30 | 3.25 | 2.96 | 3.64 | 2.72 | 3.04 | 3.24 | 2.75 | 2.57 | 2.15 | |

| Interest Expense | 30.06 | 28.84 | 26.52 | 25.23 | 24.56 | 24.97 | 26.52 | 27.44 | 27.66 | 26.93 | 29.00 | 28.80 | 28.84 | 27.10 | 25.20 | 27.16 | 30.03 | 32.37 | 35.35 | 37.13 | 20.42 | 23.37 | 23.30 | 22.77 | 21.81 | 16.05 | 13.96 | 13.58 | 12.77 | 12.61 | 10.31 | 9.36 | 9.11 | 9.14 | 9.46 | 9.30 | 9.52 | 8.85 | 5.16 | 4.53 | 4.44 | 4.18 | 4.07 | 4.15 | 4.24 | 4.53 | 4.10 | 4.02 | 3.28 | 3.16 | 3.08 | 2.17 | |

| Interest Paid Net | 28.32 | 28.19 | 26.10 | 25.03 | 23.67 | 24.01 | 27.86 | 28.63 | 16.28 | 33.20 | 17.59 | 36.14 | 16.97 | 29.30 | 16.10 | 37.72 | 17.51 | 45.59 | 19.09 | 49.55 | -7.46 | 28.69 | 16.23 | 27.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | -17.21 | -18.73 | -11.34 | 0.42 | 7.11 | 18.01 | -15.41 | -12.03 | 17.68 | 4.43 | -66.24 | 38.69 | -1.13 | -3.57 | 1.79 | 11.15 | 65.98 | -3.59 | -64.76 | 34.74 | -21.07 | -9.81 | 8.78 | -3.12 | -18.72 | 1.06 | 3.27 | 4.84 | 4.75 | 3.00 | 7.57 | 7.62 | -4.74 | 6.62 | -197.05 | 7.95 | 8.24 | 7.01 | 14.23 | 12.76 | 12.46 | 11.92 | 14.79 | 16.13 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.01 | 0.10 | 0.21 | 0.03 | -0.16 | 0.09 | -0.19 | 0.53 | -0.10 | 0.03 | -0.12 | 0.43 | 0.16 | -0.05 | 0.23 | 0.04 | 0.27 | 0.16 | -0.13 | 0.48 | -0.01 | 0.01 | 0.08 | 0.03 | 0.04 | 0.02 | 0.03 | 0.02 | 0.04 | 0.01 | 0.04 | 0.01 | 0.04 | -0.01 | 0.03 | 0.03 | -0.01 | 0.01 | 0.10 | 0.02 | 0.08 | -0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.04 | 0.04 | 0.11 | -0.01 | 0.06 | 0.09 | |

| Income Taxes Paid | 0.10 | 0.04 | NA | NA | 0.07 | 0.00 | NA | NA | 0.01 | 0.01 | NA | NA | 0.28 | 1.10 | 0.00 | 0.00 | 0.00 | 0.03 | 0.45 | 0.01 | 0.02 | 0.01 | 0.04 | 0.00 | 0.02 | 0.02 | 0.08 | 0.00 | 0.02 | 0.02 | 0.03 | 0.04 | 0.00 | 0.07 | -0.05 | 0.13 | 0.00 | 0.04 | 0.04 | 0.04 | -0.00 | 0.04 | 0.04 | 0.08 | -0.05 | 0.08 | 0.06 | 0.02 | 0.03 | -0.01 | 0.02 | 0.01 | |

| Net Income Loss | -37.15 | -19.59 | -12.24 | -0.45 | 6.39 | 16.96 | -16.06 | -13.41 | 16.95 | 3.71 | -66.70 | 37.86 | -1.66 | -3.80 | 1.30 | 10.84 | 65.03 | -3.94 | -64.77 | 34.02 | -57.70 | -0.45 | 29.70 | 6.57 | -17.99 | 10.99 | 11.68 | 7.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | -37.22 | -19.64 | -12.30 | NA | 6.26 | 16.86 | -16.16 | -13.41 | 16.95 | 3.70 | NA | 37.74 | NA | -3.80 | 1.30 | 10.84 | 65.03 | -3.94 | -64.77 | 34.02 | -57.70 | -0.45 | 29.60 | 6.29 | -18.27 | 10.99 | 11.68 | 7.42 | 12.06 | 11.58 | 16.81 | 17.39 | -2.34 | 16.91 | -191.16 | -33.37 | 14.11 | 12.62 | 14.61 | 15.19 | 12.72 | 1.97 | 15.20 | 24.73 | 13.19 | 11.76 | 11.95 | 13.06 | 13.26 | 11.56 | 10.93 | 6.54 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

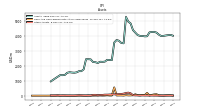

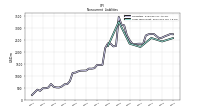

| Assets | 3989.67 | 4044.99 | 4027.57 | 4007.00 | 3979.98 | 3968.99 | 4062.66 | 4197.69 | 4241.68 | 4239.88 | 4211.21 | 3952.58 | 3946.44 | 3973.05 | 3977.66 | 4028.70 | 4193.14 | 4360.25 | 4804.32 | 4927.20 | 5238.58 | 3484.43 | 3507.77 | 3655.62 | 3703.57 | 3536.97 | 2365.11 | 2377.05 | 2385.07 | 2265.07 | 2251.21 | 2259.39 | 2174.54 | 2227.04 | 2237.57 | 2414.93 | 2427.61 | 2429.72 | 1751.61 | 1629.48 | 1632.45 | 1553.08 | 1527.20 | 1539.97 | 1562.13 | 1524.79 | 1382.82 | 1363.25 | 1368.58 | 1266.67 | 1162.73 | 951.29 | |

| Liabilities | 2733.99 | 2740.36 | 2691.61 | 2647.36 | 2593.64 | 2562.82 | 2647.21 | 2740.61 | 2744.97 | 2733.90 | 2682.66 | 2331.58 | 2337.04 | 2336.37 | 2311.23 | 2338.33 | 2487.38 | 2693.64 | 3107.84 | 3140.19 | 3459.61 | 2245.06 | 2226.12 | 2340.77 | 2353.03 | 2159.44 | 1456.43 | 1448.48 | 1450.06 | 1314.33 | 1294.00 | 1298.50 | 1217.88 | 1213.59 | 1210.33 | 1180.72 | 1130.17 | 1116.39 | 778.38 | 647.95 | 642.78 | 552.62 | 506.08 | 510.78 | 534.68 | 653.79 | 504.52 | 477.34 | 476.91 | 368.48 | 417.47 | 193.89 | |

| Liabilities And Stockholders Equity | 3989.67 | 4044.99 | 4027.57 | 4007.00 | 3979.98 | 3968.99 | 4062.66 | 4197.69 | 4241.68 | 4239.88 | 4211.21 | 3952.58 | 3946.44 | 3973.05 | 3977.66 | 4028.70 | 4193.14 | 4360.25 | 4804.32 | 4927.20 | 5238.58 | 3484.43 | 3507.77 | 3655.62 | 3703.57 | 3536.97 | 2365.11 | 2377.05 | 2385.07 | 2265.07 | 2251.21 | 2259.39 | 2174.54 | 2227.04 | 2237.57 | 2414.93 | 2427.61 | 2429.72 | 1751.61 | 1629.48 | 1632.45 | 1553.08 | 1527.20 | 1539.97 | 1562.13 | 1524.79 | 1382.82 | 1363.25 | 1368.58 | 1266.67 | 1162.73 | 951.29 | |

| Stockholders Equity | 1255.68 | 1304.63 | 1335.95 | 1359.64 | 1386.34 | 1406.16 | 1415.45 | 1457.08 | 1496.71 | 1505.98 | 1528.55 | 1621.00 | 1609.39 | 1636.67 | 1666.43 | 1690.37 | 1705.75 | 1666.61 | 1696.49 | 1787.00 | 1778.97 | 1239.36 | 1281.65 | 1294.36 | 1330.04 | 1377.53 | 908.68 | 928.57 | 935.00 | 950.74 | 957.21 | 960.90 | 956.65 | 1013.44 | 1027.24 | 1234.20 | 1297.45 | 1313.33 | 973.22 | 981.53 | 989.67 | 1000.46 | 1021.12 | 1029.19 | 1027.45 | 870.99 | 878.30 | 885.90 | 891.67 | 898.19 | NA | 757.40 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 12.31 | 24.36 | 25.21 | 23.34 | 12.25 | 14.01 | 26.01 | 97.66 | 83.03 | 54.88 | 18.67 | 184.46 | 42.05 | 45.03 | 24.48 | 29.66 | 93.74 | 29.00 | 21.10 | 20.15 | 35.35 | 9.64 | 18.70 | 17.38 | 16.57 | 551.71 | 12.91 | 12.81 | 29.94 | 13.75 | 9.02 | 15.70 | 8.79 | 11.31 | 7.05 | 9.54 | 13.79 | 4.93 | 5.04 | 2.98 | 7.66 | 2.70 | 3.12 | 3.59 | 5.25 | 3.17 | 1.39 | 9.28 | 3.27 | 5.72 | 1.08 | 2.44 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 26.71 | 39.63 | 25.82 | 23.34 | 12.25 | 15.53 | 27.75 | 99.06 | 84.52 | 56.02 | 20.08 | 201.47 | 56.85 | 57.64 | 30.10 | 34.01 | 100.70 | 33.03 | 24.68 | 24.62 | 38.94 | 12.00 | 21.14 | 22.15 | 19.68 | 552.22 | 13.25 | 13.51 | 30.47 | NA | NA | NA | 9.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 786.31 | 802.90 | 809.59 | 817.88 | 821.24 | 826.95 | 827.86 | 851.36 | 874.11 | 873.49 | 865.22 | 824.62 | 830.88 | 840.93 | 843.42 | 843.42 | 840.55 | 854.08 | 875.02 | 918.99 | 924.16 | 448.71 | 587.17 | 623.61 | 627.11 | 269.33 | 269.41 | 269.41 | 267.86 | 259.42 | 257.75 | 257.72 | 253.06 | 253.06 | 253.06 | 254.01 | 254.01 | 254.01 | 258.33 | 246.65 | 243.69 | 239.22 | 243.58 | 243.58 | 244.66 | 241.29 | 228.82 | 224.67 | 224.67 | 213.99 | 195.76 | 143.77 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amortization Of Intangible Assets | 21.47 | 22.75 | 23.97 | 24.61 | 26.25 | 27.77 | 31.61 | 34.08 | 36.35 | 34.17 | 32.73 | 41.58 | 40.78 | 40.68 | 43.27 | 42.46 | 40.87 | 51.65 | 51.62 | 53.84 | 16.94 | 25.20 | 25.45 | 26.79 | 30.58 | 8.38 | 8.54 | 8.67 | 7.05 | 7.11 | 7.13 | 7.71 | 6.85 | 7.15 | 7.28 | 7.34 | 7.42 | 7.59 | 6.68 | 6.02 | 5.83 | 5.36 | 5.21 | 5.20 | 5.16 | 5.08 | 4.64 | 4.64 | 4.96 | 3.51 | 2.48 | 1.91 | |

| Finite Lived Intangible Assets Net | 263.50 | 295.19 | 318.98 | 344.06 | 369.33 | 396.26 | 424.87 | 466.32 | 505.63 | 536.77 | 570.45 | 505.58 | 548.94 | 604.23 | 645.59 | 689.51 | 732.38 | 808.82 | 924.59 | 1000.96 | 1056.56 | 215.94 | 297.70 | 323.71 | 351.87 | 99.95 | 108.93 | 118.06 | 124.85 | 105.50 | 113.23 | 123.30 | 118.27 | 125.90 | 133.84 | 141.92 | 150.08 | 158.38 | 163.83 | 139.33 | 142.27 | 131.68 | 132.23 | 138.27 | 144.48 | 131.16 | 110.81 | 112.18 | 117.60 | 103.90 | 80.08 | 60.10 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Line Of Credit | 205.00 | 200.00 | 240.00 | 245.00 | 195.00 | 135.00 | 230.00 | NA | NA | NA | 385.00 | NA | NA | NA | 200.00 | 348.00 | 0.00 | 210.00 | 65.00 | 80.00 | 175.00 | 467.00 | 452.00 | 570.00 | 570.00 | 565.00 | 155.00 | 160.00 | 160.00 | 25.00 | NA | 311.00 | 117.00 | 114.00 | 59.00 | 55.00 | NA | 184.50 | 195.50 | 150.50 | 157.00 | 69.00 | 25.00 | 27.50 | 49.50 | 167.00 | 27.00 | NA | 345.50 | 282.50 | 338.00 | 118.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 2572.61 | NA | NA | NA | 2432.79 | NA | NA | NA | 2577.95 | NA | NA | NA | 2202.97 | NA | NA | NA | 2340.45 | NA | NA | NA | 3254.89 | NA | NA | NA | 2245.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Senior Notes | 2195.48 | 2193.58 | 2191.68 | 2189.78 | 2187.88 | 2185.97 | 2184.07 | 2481.90 | 2479.77 | 2477.73 | 2032.76 | 2035.30 | 2033.24 | 2031.20 | 1766.39 | 1619.53 | 2017.38 | 2015.10 | 2362.63 | 2360.06 | 2357.50 | 945.95 | 945.35 | 944.74 | 944.14 | 943.54 | 647.58 | 647.21 | 646.84 | 646.55 | 646.27 | 346.10 | 347.98 | 347.84 | 347.70 | 347.56 | 347.42 | 347.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

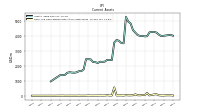

| Stockholders Equity | 1255.68 | 1304.63 | 1335.95 | 1359.64 | 1386.34 | 1406.16 | 1415.45 | 1457.08 | 1496.71 | 1505.98 | 1528.55 | 1621.00 | 1609.39 | 1636.67 | 1666.43 | 1690.37 | 1705.75 | 1666.61 | 1696.49 | 1787.00 | 1778.97 | 1239.36 | 1281.65 | 1294.36 | 1330.04 | 1377.53 | 908.68 | 928.57 | 935.00 | 950.74 | 957.21 | 960.90 | 956.65 | 1013.44 | 1027.24 | 1234.20 | 1297.45 | 1313.33 | 973.22 | 981.53 | 989.67 | 1000.46 | 1021.12 | 1029.19 | 1027.45 | 870.99 | 878.30 | 885.90 | 891.67 | 898.19 | NA | 757.40 | |

| Common Stock Value | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.99 | 0.99 | 0.99 | 0.99 | 0.99 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.71 | 0.70 | 0.70 | 0.70 | 0.55 | 0.55 | 0.55 | 0.55 | 0.55 | 0.55 | 0.55 | 0.47 | 0.47 | 0.47 | 0.47 | 0.47 | 0.41 | 0.41 | |

| Additional Paid In Capital Common Stock | 2621.49 | 2621.11 | 2620.69 | 2619.99 | 2619.53 | 2619.04 | 2618.64 | 2617.58 | 2617.17 | 2616.75 | 2616.45 | 2615.63 | 2615.30 | 2614.35 | 2613.87 | 2612.78 | 2612.43 | 2612.06 | 2611.57 | 2610.67 | 2609.80 | 1969.17 | 1968.49 | 1968.20 | 1968.22 | 1968.25 | 1473.94 | 1473.53 | 1473.53 | 1473.56 | 1472.75 | 1472.51 | 1472.48 | 1472.48 | 1472.27 | 1457.95 | 1457.63 | 1457.37 | 1106.45 | 1105.86 | 1105.68 | 1105.68 | 1104.80 | 1104.50 | 1103.98 | 937.28 | 936.60 | 936.38 | 935.44 | 935.46 | 777.17 | 776.91 | |

| Retained Earnings Accumulated Deficit | 100.17 | 137.32 | 156.92 | 169.16 | 169.61 | 163.22 | 146.25 | 162.31 | 175.72 | 158.77 | 155.06 | 221.75 | 183.90 | 185.56 | 189.36 | 188.06 | 177.22 | 112.19 | 116.13 | 180.90 | 146.88 | 204.58 | 205.03 | 174.59 | 108.14 | 126.41 | 115.42 | 103.74 | 96.33 | 84.26 | 72.69 | 55.87 | 38.49 | 40.83 | 23.91 | 215.08 | 248.45 | 234.33 | 221.71 | 207.10 | 191.91 | 179.19 | 177.22 | 162.02 | 137.29 | 124.10 | 112.35 | 100.39 | 87.33 | 74.08 | 62.52 | 41.34 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

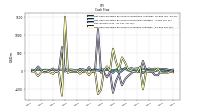

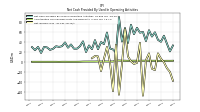

| Net Cash Provided By Used In Operating Activities | 32.59 | 20.91 | 36.33 | 51.90 | 39.93 | 43.77 | 58.65 | 50.27 | 62.81 | 41.31 | 59.43 | 57.94 | 67.53 | 54.91 | 73.59 | 37.60 | 67.19 | 40.35 | 89.05 | 18.74 | 24.75 | 26.67 | 58.23 | 35.27 | 39.32 | 25.21 | 43.20 | 25.32 | 32.58 | 19.65 | 40.81 | 31.21 | 26.30 | 26.20 | 34.61 | 28.25 | 38.68 | 31.16 | 29.82 | 31.07 | 26.05 | 23.85 | 28.84 | 29.65 | 17.85 | 29.89 | 23.26 | 29.31 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -37.88 | -26.98 | -66.14 | -63.82 | -53.80 | 66.29 | -8.33 | -8.78 | -7.29 | -35.23 | -514.36 | 113.90 | -41.09 | -22.83 | -1.16 | 42.09 | 238.05 | 370.89 | 18.55 | 250.33 | 611.76 | -7.03 | 122.91 | 11.02 | -523.89 | -643.75 | -7.11 | -11.46 | -120.31 | -8.57 | -5.41 | -80.87 | -0.81 | 1.07 | -10.24 | -56.62 | 1490.61 | -688.61 | -48.14 | -5.11 | -85.05 | -44.28 | -2.83 | 14.67 | -41.02 | -147.89 | -37.92 | -5.64 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -7.63 | 19.88 | 32.29 | 23.01 | 10.60 | -122.28 | -121.63 | -26.94 | -27.03 | 29.86 | 273.54 | -27.22 | -27.22 | -4.54 | -76.33 | -146.39 | -237.58 | -402.89 | -107.53 | -283.40 | -609.57 | -28.78 | -182.14 | -43.82 | -50.56 | 1157.34 | -35.99 | -30.98 | 103.92 | -6.35 | -42.08 | 56.57 | -28.02 | -23.02 | -26.85 | 24.12 | -22.91 | 657.34 | 20.38 | -30.64 | 63.97 | 20.01 | -26.48 | -45.98 | 25.25 | 119.77 | 6.78 | -17.67 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 32.59 | 20.91 | 36.33 | 51.90 | 39.93 | 43.77 | 58.65 | 50.27 | 62.81 | 41.31 | 59.43 | 57.94 | 67.53 | 54.91 | 73.59 | 37.60 | 67.19 | 40.35 | 89.05 | 18.74 | 24.75 | 26.67 | 58.23 | 35.27 | 39.32 | 25.21 | 43.20 | 25.32 | 32.58 | 19.65 | 40.81 | 31.21 | 26.30 | 26.20 | 34.61 | 28.25 | 38.68 | 31.16 | 29.82 | 31.07 | 26.05 | 23.85 | 28.84 | 29.65 | 17.85 | 29.89 | 23.26 | 29.31 | NA | NA | NA | NA | |

| Net Income Loss | -37.15 | -19.59 | -12.24 | -0.45 | 6.39 | 16.96 | -16.06 | -13.41 | 16.95 | 3.71 | -66.70 | 37.86 | -1.66 | -3.80 | 1.30 | 10.84 | 65.03 | -3.94 | -64.77 | 34.02 | -57.70 | -0.45 | 29.70 | 6.57 | -17.99 | 10.99 | 11.68 | 7.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -37.88 | -26.98 | -66.14 | -63.82 | -53.80 | 66.29 | -8.33 | -8.78 | -7.29 | -35.23 | -514.36 | 113.90 | -41.09 | -22.83 | -1.16 | 42.09 | 238.05 | 370.89 | 18.55 | 250.33 | 611.76 | -7.03 | 122.91 | 11.02 | -523.89 | -643.75 | -7.11 | -11.46 | -120.31 | -8.57 | -5.41 | -80.87 | -0.81 | 1.07 | -10.24 | -56.62 | 1490.61 | -688.61 | -48.14 | -5.11 | -85.05 | -44.28 | -2.83 | 14.67 | -41.02 | -147.89 | -37.92 | -5.64 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -7.63 | 19.88 | 32.29 | 23.01 | 10.60 | -122.28 | -121.63 | -26.94 | -27.03 | 29.86 | 273.54 | -27.22 | -27.22 | -4.54 | -76.33 | -146.39 | -237.58 | -402.89 | -107.53 | -283.40 | -609.57 | -28.78 | -182.14 | -43.82 | -50.56 | 1157.34 | -35.99 | -30.98 | 103.92 | -6.35 | -42.08 | 56.57 | -28.02 | -23.02 | -26.85 | 24.12 | -22.91 | 657.34 | 20.38 | -30.64 | 63.97 | 20.01 | -26.48 | -45.98 | 25.25 | 119.77 | 6.78 | -17.67 | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 12.19 | 12.15 | 12.14 | 26.71 | 26.71 | 26.65 | 26.63 | 26.63 | 26.63 | 26.58 | 26.57 | 26.57 | 26.57 | 26.52 | 26.51 | 26.51 | 26.51 | 26.46 | 26.45 | 26.45 | 42.66 | 42.64 | 42.63 | 42.63 | 42.63 | 41.36 | 30.61 | 30.61 | 30.61 | 30.59 | 30.59 | 30.58 | 30.59 | 30.57 | 30.26 | 30.25 | 30.25 | 23.54 | 23.54 | 23.53 | 23.53 | 23.51 | 23.50 | 23.50 | 23.50 | 19.78 | 19.78 | 19.76 | 19.76 | 17.01 | 17.01 | 16.61 | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.23 | 0.04 | 0.01 | 0.01 | 0.52 | NA | NA | 0.00 | 0.65 | NA | NA | 0.00 | 0.38 | 0.03 | 0.03 | 0.01 | 0.40 | 0.06 | 0.00 | 0.00 | 0.21 | 0.01 | 0.01 | 0.01 | 0.25 | 0.01 | 0.00 | 0.03 | 0.31 | NA | NA | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |