| |

|

2023-09-30 |

2023-06-30 |

2023-03-31 |

2022-12-31 |

2022-09-30 |

2022-06-30 |

2022-03-31 |

2021-12-31 |

2021-09-30 |

2021-06-30 |

2021-03-31 |

2020-12-31 |

2020-09-30 |

2020-06-30 |

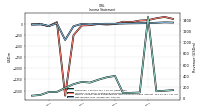

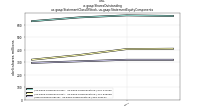

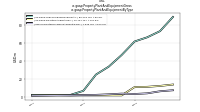

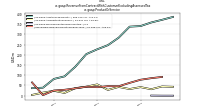

| Revenues |

|

429.65 | 416.94 | 390.99 | 395.51 | 370.99 | 327.25 | 275.98 | 288.52 | 247.88 | 179.26 | 108.22 | 106.01 | 54.04 | 40.50 |

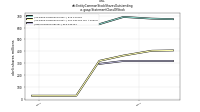

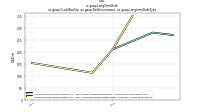

| Business Development Company Fees |

|

NA | 91.94 | 85.86 | 78.10 | 62.81 | 46.35 | 46.74 | 41.72 | 43.66 | 36.07 | 28.91 | 25.35 | 2.70 | 64.99 |

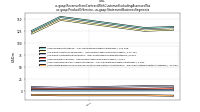

| Administrative Service |

|

43.64 | 45.11 | 31.66 | 42.02 | 32.61 | 42.92 | 28.34 | 55.28 | 44.12 | 37.12 | 13.51 | 23.93 | 14.90 | 3.66 |

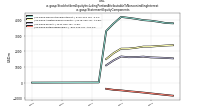

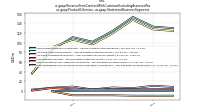

| Asset Management1 |

|

386.01 | 371.83 | 358.82 | 341.27 | 338.38 | 284.32 | 247.63 | 227.34 | 203.75 | 142.13 | 94.71 | 82.08 | 39.15 | 36.84 |

| Management Service Incentive |

|

0.00 | 0.00 | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| C L Os, Direct Lending Products |

|

NA | NA | 7.52 | 6.37 | 6.78 | 6.29 | NA | NA | NA | NA | NA | NA | NA | NA |

| Diversified Lending, Credit Strategies |

|

159.46 | 155.09 | NA | NA | 126.49 | 108.91 | NA | NA | NA | NA | NA | NA | NA | NA |

| Diversified Lending, Direct Lending Products |

|

NA | NA | 146.09 | 140.02 | 126.49 | 108.91 | 105.45 | 97.23 | 90.89 | 83.77 | 76.48 | 66.57 | 25.11 | 23.58 |

| First Lien Lending, Credit Strategies |

|

4.53 | 4.75 | NA | NA | 4.21 | 3.97 | NA | NA | NA | NA | NA | NA | NA | NA |

| First Lien Lending, Direct Lending Products |

|

NA | NA | 4.49 | 4.16 | 4.21 | 3.97 | 3.68 | 3.46 | 4.10 | 3.82 | 3.81 | 3.33 | 3.18 | 3.05 |

| G P Debt Financing, G P Capital Solutions Products |

|

NA | NA | 3.75 | 3.62 | 3.53 | 3.37 | 3.09 | 3.31 | 6.17 | 0.74 | NA | NA | NA | NA |

| G P Debt Financing, G P Strategic Capital Strategies |

|

4.61 | 3.63 | NA | NA | 3.53 | 3.37 | NA | NA | NA | NA | NA | NA | NA | NA |

| G P Minority Equity Investments, G P Capital Solutions Products |

|

NA | NA | 130.30 | 133.52 | 153.56 | 124.43 | 102.10 | 111.74 | 85.43 | 36.34 | NA | NA | NA | NA |

| G P Minority Stakes, G P Strategic Capital Strategies |

|

132.50 | 130.42 | NA | NA | 153.56 | 124.43 | NA | NA | NA | NA | NA | NA | NA | NA |

| Liquid Credit, Credit Strategies |

|

6.59 | 6.14 | NA | NA | 6.78 | 6.29 | NA | NA | NA | NA | NA | NA | NA | NA |

| Net Lease, Real Estate Products |

|

NA | NA | 25.96 | 22.73 | 21.07 | 19.22 | 17.16 | NA | NA | NA | NA | NA | NA | NA |

| Net Lease, Real Estate Strategies |

|

32.99 | 30.44 | NA | NA | 21.07 | 19.22 | NA | NA | NA | NA | NA | NA | NA | NA |

| Opportunistic Lending, Credit Strategies |

|

2.42 | 2.48 | NA | NA | 2.31 | 2.73 | NA | NA | NA | NA | NA | NA | NA | NA |

| Opportunistic Lending, Direct Lending Products |

|

NA | NA | 2.40 | 2.17 | 2.31 | 2.73 | 1.54 | 1.52 | 1.17 | 0.74 | 0.56 | 0.35 | 0.01 | NA |

| Professional Sports Minority Investments, G P Capital Solutions Products |

|

NA | NA | 0.40 | 0.32 | 0.28 | 0.51 | 0.50 | 0.32 | 0.16 | NA | NA | NA | NA | NA |

| Professional Sports Minority Stakes, G P Strategic Capital Strategies |

|

0.68 | 0.56 | NA | NA | 0.28 | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA |

| Strategic Revenue Share Purchase Consideration Amortization, G P Capital Solutions Products |

|

NA | NA | -9.77 | -9.77 | -9.77 | -8.92 | -8.92 | -8.92 | -0.97 | NA | NA | NA | NA | NA |

| Strategic Revenue Share Purchase Consideration Amortization, G P Strategic Capital Strategies |

|

-10.66 | -9.77 | NA | NA | -9.77 | -8.92 | NA | NA | NA | NA | NA | NA | NA | NA |

| Technology Lending, Credit Strategies |

|

52.89 | 48.10 | NA | NA | 29.91 | 23.80 | NA | NA | NA | NA | NA | NA | NA | NA |

| Technology Lending, Direct Lending Products |

|

NA | NA | 47.69 | 38.14 | 29.91 | 23.80 | 23.03 | 18.68 | 16.82 | 16.73 | 13.86 | 11.82 | 10.85 | 10.21 |

| Administrative Service, Credit Strategies |

|

31.25 | 32.83 | NA | NA | 25.67 | 35.65 | NA | NA | NA | NA | NA | NA | NA | NA |

| Administrative Service, Direct Lending Products |

|

NA | NA | 20.09 | 25.46 | 25.67 | 35.65 | 25.22 | 46.18 | 37.43 | 34.34 | 13.51 | 23.93 | 14.90 | 3.66 |

| Administrative Service, G P Capital Solutions Products |

|

NA | NA | 8.40 | 10.78 | 5.82 | 7.27 | 3.12 | 9.10 | 6.69 | 2.79 | NA | NA | NA | NA |

| Administrative Service, G P Strategic Capital Strategies |

|

8.85 | 9.20 | NA | NA | 5.82 | 7.27 | NA | NA | NA | NA | NA | NA | NA | NA |

| Administrative Service, Real Estate Products |

|

NA | NA | 3.16 | 5.78 | 1.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Administrative Service, Real Estate Strategies |

|

3.55 | 3.08 | NA | NA | 1.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

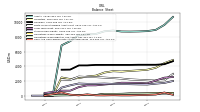

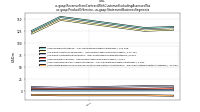

| Asset Management1, Credit Strategies |

|

225.89 | 216.54 | NA | NA | 169.70 | 145.71 | NA | NA | NA | NA | NA | NA | NA | NA |

| Asset Management1, Direct Lending Products |

|

NA | NA | 208.19 | 190.86 | 169.70 | 145.71 | 133.70 | 120.89 | 112.97 | 105.06 | 94.71 | 82.08 | 39.15 | 36.84 |

| Asset Management1, G P Capital Solutions Products |

|

NA | NA | 124.68 | 127.68 | 147.61 | 119.39 | 96.77 | 106.45 | 90.78 | 37.08 | NA | NA | NA | NA |

| Asset Management1, G P Strategic Capital Strategies |

|

127.14 | 124.84 | NA | NA | 147.61 | 119.39 | NA | NA | NA | NA | NA | NA | NA | NA |

| Asset Management1, Real Estate Products |

|

NA | NA | 25.96 | 22.73 | 21.07 | 19.22 | 17.16 | NA | NA | NA | NA | NA | NA | NA |

| Asset Management1, Real Estate Strategies |

|

32.99 | 30.44 | NA | NA | 21.07 | 19.22 | NA | NA | NA | NA | NA | NA | NA | NA |

| Management Service Incentive, Real Estate Products |

|

NA | NA | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Management Service Incentive, Real Estate Strategies |

|

0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

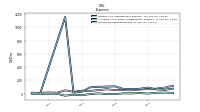

| Administrative Fees, Related Party |

|

15.80 | 14.40 | NA | NA | 14.30 | 14.20 | NA | NA | NA | NA | NA | NA | NA | NA |

| Dealer Manager Revenue, Related Party |

|

12.20 | 10.20 | NA | NA | 5.90 | 6.60 | NA | NA | NA | NA | NA | NA | NA | NA |

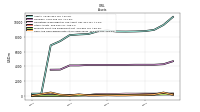

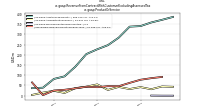

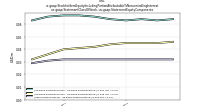

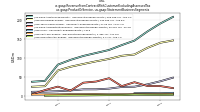

| Credit Strategies |

|

257.13 | 249.38 | NA | NA | 195.37 | 181.36 | NA | NA | NA | NA | NA | NA | NA | NA |

| Direct Lending Products |

|

NA | NA | 228.28 | 216.32 | 195.37 | 181.36 | 158.93 | 172.98 | 150.40 | 139.39 | 108.22 | 106.01 | 54.04 | 40.50 |

| G P Capital Solutions Products |

|

NA | NA | 133.09 | 138.46 | 153.43 | 126.66 | 99.89 | 115.54 | 97.47 | 39.87 | NA | NA | NA | NA |

| G P Strategic Capital Strategies |

|

135.98 | 134.04 | NA | NA | 153.43 | 126.66 | NA | NA | NA | NA | NA | NA | NA | NA |

| Real Estate Products |

|

NA | NA | 29.62 | 40.73 | 22.19 | 19.22 | 17.16 | NA | NA | NA | NA | NA | NA | NA |

| Real Estate Strategies |

|

36.54 | 33.52 | NA | NA | 22.19 | 19.22 | NA | NA | NA | NA | NA | NA | NA | NA |

| Revenue From Contract With Customer Excluding Assessed Tax |

|

429.65 | 416.94 | 390.99 | 395.51 | 370.99 | 327.25 | 275.98 | 288.52 | 247.88 | 179.26 | 108.22 | 106.01 | 54.04 | 40.50 |

| Business Development Company Fees |

|

NA | 91.94 | 85.86 | 78.10 | 62.81 | 46.35 | 46.74 | 41.72 | 43.66 | 36.07 | 28.91 | 25.35 | 2.70 | 64.99 |

| Administrative Service |

|

43.64 | 45.11 | 31.66 | 42.02 | 32.61 | 42.92 | 28.34 | 55.28 | 44.12 | 37.12 | 13.51 | 23.93 | 14.90 | 3.66 |

| Asset Management1 |

|

386.01 | 371.83 | 358.82 | 341.27 | 338.38 | 284.32 | 247.63 | 227.34 | 203.75 | 142.13 | 94.71 | 82.08 | 39.15 | 36.84 |

| Management Service Incentive |

|

0.00 | 0.00 | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| C L Os, Direct Lending Products |

|

NA | NA | 7.52 | 6.37 | 6.78 | 6.29 | NA | NA | NA | NA | NA | NA | NA | NA |

| Diversified Lending, Credit Strategies |

|

159.46 | 155.09 | NA | NA | 126.49 | 108.91 | NA | NA | NA | NA | NA | NA | NA | NA |

| Diversified Lending, Direct Lending Products |

|

NA | NA | 146.09 | 140.02 | 126.49 | 108.91 | 105.45 | 97.23 | 90.89 | 83.77 | 76.48 | 66.57 | 25.11 | 23.58 |

| First Lien Lending, Credit Strategies |

|

4.53 | 4.75 | NA | NA | 4.21 | 3.97 | NA | NA | NA | NA | NA | NA | NA | NA |

| First Lien Lending, Direct Lending Products |

|

NA | NA | 4.49 | 4.16 | 4.21 | 3.97 | 3.68 | 3.46 | 4.10 | 3.82 | 3.81 | 3.33 | 3.18 | 3.05 |

| G P Debt Financing, G P Capital Solutions Products |

|

NA | NA | 3.75 | 3.62 | 3.53 | 3.37 | 3.09 | 3.31 | 6.17 | 0.74 | NA | NA | NA | NA |

| G P Debt Financing, G P Strategic Capital Strategies |

|

4.61 | 3.63 | NA | NA | 3.53 | 3.37 | NA | NA | NA | NA | NA | NA | NA | NA |

| G P Minority Equity Investments, G P Capital Solutions Products |

|

NA | NA | 130.30 | 133.52 | 153.56 | 124.43 | 102.10 | 111.74 | 85.43 | 36.34 | NA | NA | NA | NA |

| G P Minority Stakes, G P Strategic Capital Strategies |

|

132.50 | 130.42 | NA | NA | 153.56 | 124.43 | NA | NA | NA | NA | NA | NA | NA | NA |

| Liquid Credit, Credit Strategies |

|

6.59 | 6.14 | NA | NA | 6.78 | 6.29 | NA | NA | NA | NA | NA | NA | NA | NA |

| Net Lease, Real Estate Products |

|

NA | NA | 25.96 | 22.73 | 21.07 | 19.22 | 17.16 | NA | NA | NA | NA | NA | NA | NA |

| Net Lease, Real Estate Strategies |

|

32.99 | 30.44 | NA | NA | 21.07 | 19.22 | NA | NA | NA | NA | NA | NA | NA | NA |

| Opportunistic Lending, Credit Strategies |

|

2.42 | 2.48 | NA | NA | 2.31 | 2.73 | NA | NA | NA | NA | NA | NA | NA | NA |

| Opportunistic Lending, Direct Lending Products |

|

NA | NA | 2.40 | 2.17 | 2.31 | 2.73 | 1.54 | 1.52 | 1.17 | 0.74 | 0.56 | 0.35 | 0.01 | NA |

| Professional Sports Minority Investments, G P Capital Solutions Products |

|

NA | NA | 0.40 | 0.32 | 0.28 | 0.51 | 0.50 | 0.32 | 0.16 | NA | NA | NA | NA | NA |

| Professional Sports Minority Stakes, G P Strategic Capital Strategies |

|

0.68 | 0.56 | NA | NA | 0.28 | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA |

| Strategic Revenue Share Purchase Consideration Amortization, G P Capital Solutions Products |

|

NA | NA | -9.77 | -9.77 | -9.77 | -8.92 | -8.92 | -8.92 | -0.97 | NA | NA | NA | NA | NA |

| Strategic Revenue Share Purchase Consideration Amortization, G P Strategic Capital Strategies |

|

-10.66 | -9.77 | NA | NA | -9.77 | -8.92 | NA | NA | NA | NA | NA | NA | NA | NA |

| Technology Lending, Credit Strategies |

|

52.89 | 48.10 | NA | NA | 29.91 | 23.80 | NA | NA | NA | NA | NA | NA | NA | NA |

| Technology Lending, Direct Lending Products |

|

NA | NA | 47.69 | 38.14 | 29.91 | 23.80 | 23.03 | 18.68 | 16.82 | 16.73 | 13.86 | 11.82 | 10.85 | 10.21 |

| Administrative Service, Credit Strategies |

|

31.25 | 32.83 | NA | NA | 25.67 | 35.65 | NA | NA | NA | NA | NA | NA | NA | NA |

| Administrative Service, Direct Lending Products |

|

NA | NA | 20.09 | 25.46 | 25.67 | 35.65 | 25.22 | 46.18 | 37.43 | 34.34 | 13.51 | 23.93 | 14.90 | 3.66 |

| Administrative Service, G P Capital Solutions Products |

|

NA | NA | 8.40 | 10.78 | 5.82 | 7.27 | 3.12 | 9.10 | 6.69 | 2.79 | NA | NA | NA | NA |

| Administrative Service, G P Strategic Capital Strategies |

|

8.85 | 9.20 | NA | NA | 5.82 | 7.27 | NA | NA | NA | NA | NA | NA | NA | NA |

| Administrative Service, Real Estate Products |

|

NA | NA | 3.16 | 5.78 | 1.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Administrative Service, Real Estate Strategies |

|

3.55 | 3.08 | NA | NA | 1.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Asset Management1, Credit Strategies |

|

225.89 | 216.54 | NA | NA | 169.70 | 145.71 | NA | NA | NA | NA | NA | NA | NA | NA |

| Asset Management1, Direct Lending Products |

|

NA | NA | 208.19 | 190.86 | 169.70 | 145.71 | 133.70 | 120.89 | 112.97 | 105.06 | 94.71 | 82.08 | 39.15 | 36.84 |

| Asset Management1, G P Capital Solutions Products |

|

NA | NA | 124.68 | 127.68 | 147.61 | 119.39 | 96.77 | 106.45 | 90.78 | 37.08 | NA | NA | NA | NA |

| Asset Management1, G P Strategic Capital Strategies |

|

127.14 | 124.84 | NA | NA | 147.61 | 119.39 | NA | NA | NA | NA | NA | NA | NA | NA |

| Asset Management1, Real Estate Products |

|

NA | NA | 25.96 | 22.73 | 21.07 | 19.22 | 17.16 | NA | NA | NA | NA | NA | NA | NA |

| Asset Management1, Real Estate Strategies |

|

32.99 | 30.44 | NA | NA | 21.07 | 19.22 | NA | NA | NA | NA | NA | NA | NA | NA |

| Management Service Incentive, Real Estate Products |

|

NA | NA | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Management Service Incentive, Real Estate Strategies |

|

0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Administrative Fees, Related Party |

|

15.80 | 14.40 | NA | NA | 14.30 | 14.20 | NA | NA | NA | NA | NA | NA | NA | NA |

| Dealer Manager Revenue, Related Party |

|

12.20 | 10.20 | NA | NA | 5.90 | 6.60 | NA | NA | NA | NA | NA | NA | NA | NA |

| Credit Strategies |

|

257.13 | 249.38 | NA | NA | 195.37 | 181.36 | NA | NA | NA | NA | NA | NA | NA | NA |

| Direct Lending Products |

|

NA | NA | 228.28 | 216.32 | 195.37 | 181.36 | 158.93 | 172.98 | 150.40 | 139.39 | 108.22 | 106.01 | 54.04 | 40.50 |

| G P Capital Solutions Products |

|

NA | NA | 133.09 | 138.46 | 153.43 | 126.66 | 99.89 | 115.54 | 97.47 | 39.87 | NA | NA | NA | NA |

| G P Strategic Capital Strategies |

|

135.98 | 134.04 | NA | NA | 153.43 | 126.66 | NA | NA | NA | NA | NA | NA | NA | NA |

| Real Estate Products |

|

NA | NA | 29.62 | 40.73 | 22.19 | 19.22 | 17.16 | NA | NA | NA | NA | NA | NA | NA |

| Real Estate Strategies |

|

36.54 | 33.52 | NA | NA | 22.19 | 19.22 | NA | NA | NA | NA | NA | NA | NA | NA |

| Counterparty Name Managed Product One, Related Party Promissory Note, Related Party |

|

4.40 | 4.40 | NA | NA | 0.70 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA |

| Counterparty Name Managed Product Two, Related Party Promissory Note, Related Party |

|

0.20 | 0.20 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA |