| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Earnings Per Share Basic | -0.31 | -0.40 | -0.41 | -0.01 | -0.56 | -0.48 | -0.44 | -0.41 | -0.45 | -0.56 | -0.53 | -0.46 | -0.70 | -0.50 | -0.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.31 | -0.40 | -0.41 | -0.01 | -0.56 | -0.48 | -0.44 | -0.41 | -0.45 | -0.56 | -0.53 | -0.46 | -0.70 | -0.50 | -0.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

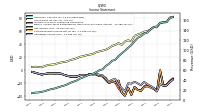

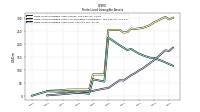

| Revenue From Contract With Customer Excluding Assessed Tax | 162.12 | 154.97 | 154.53 | 153.01 | 146.54 | 144.75 | 140.31 | 134.07 | 131.89 | 126.74 | 123.57 | 116.52 | 108.99 | 103.80 | 97.58 | 92.38 | 86.84 | 79.70 | 77.65 | 71.30 | 67.18 | 60.54 | 58.57 | 54.81 | 51.70 | 50.12 | 47.62 | 44.53 | 42.16 | 38.30 | 36.01 | 33.76 | 30.41 | 28.02 | 26.28 | 24.16 | 22.15 | 20.99 | 19.16 | 16.83 | 15.67 | 14.32 | 14.04 | 12.83 | |

| Revenues | 162.12 | 154.97 | 154.53 | 153.01 | 146.54 | 144.75 | 140.31 | 134.07 | 131.89 | 126.74 | 123.57 | 116.52 | 108.99 | 103.80 | 97.58 | 92.38 | 86.84 | 79.70 | 77.65 | 71.30 | 67.18 | 60.54 | 58.57 | 54.81 | 51.70 | 50.12 | 47.62 | 44.53 | 42.16 | 38.30 | 36.01 | 33.76 | 30.41 | 28.02 | 26.28 | 24.16 | 22.15 | 20.99 | 19.16 | 16.83 | 15.67 | 14.32 | 14.04 | 12.83 | |

| Cost Of Revenue | 80.72 | 80.83 | 80.70 | 79.71 | 80.34 | 77.89 | 77.42 | 73.67 | 72.41 | 69.73 | 68.23 | 63.32 | 64.48 | 57.37 | 53.20 | 53.11 | 44.80 | 40.45 | 40.05 | 37.18 | 35.44 | 30.14 | 29.30 | 26.98 | 26.57 | 25.81 | 24.33 | 22.77 | 21.15 | 19.60 | 18.87 | 17.81 | 16.58 | 15.13 | 14.14 | 13.27 | 12.87 | 12.14 | 10.83 | 10.21 | 10.88 | 9.17 | 8.41 | 7.81 | |

| Gross Profit | 81.39 | 74.13 | 73.83 | 73.30 | 66.20 | 66.86 | 62.89 | 60.40 | 59.48 | 57.01 | 55.34 | 53.20 | 44.51 | 46.44 | 44.38 | 39.27 | 42.04 | 39.26 | 37.59 | 34.11 | 31.74 | 30.40 | 29.27 | 27.83 | 25.13 | 24.30 | 23.30 | 21.76 | 21.01 | 18.71 | 17.14 | 15.95 | 13.82 | 12.88 | 12.15 | 10.88 | 9.28 | 8.85 | 8.33 | 6.62 | 4.79 | 5.16 | 5.64 | 5.03 | |

| Operating Expenses | 99.41 | 97.31 | 97.50 | 94.50 | 98.69 | 93.95 | 86.67 | 81.80 | 77.05 | 79.98 | 75.28 | 70.71 | 64.99 | 66.28 | 76.69 | 66.48 | 63.90 | 52.65 | 51.95 | 51.26 | 44.44 | 37.67 | 35.95 | 33.04 | 31.46 | 30.23 | 31.01 | 28.70 | 28.35 | 28.03 | 26.75 | 25.38 | 22.15 | 19.83 | 17.13 | 15.47 | 13.94 | 13.37 | 12.88 | 11.96 | 11.11 | 10.15 | 9.21 | 7.26 | |

| Research And Development Expense | 34.27 | 34.54 | 34.10 | 34.42 | 34.04 | 33.10 | 31.83 | 31.13 | 29.96 | 30.76 | 29.43 | 26.80 | 25.21 | 23.57 | 23.64 | 24.96 | 19.88 | 19.62 | 19.12 | 17.66 | 15.52 | 12.90 | 11.76 | 11.16 | 10.67 | 10.09 | 9.92 | 9.65 | 8.51 | 8.22 | 7.83 | 7.90 | 6.61 | 5.98 | 4.80 | 4.15 | 3.41 | 3.15 | 2.79 | 2.74 | 2.75 | 2.26 | 2.15 | 1.87 | |

| General And Administrative Expense | 30.28 | 28.08 | 27.13 | 24.69 | 23.70 | 22.61 | 23.29 | 20.57 | 20.02 | 20.35 | 18.70 | 18.83 | 17.06 | 17.56 | 17.20 | 19.11 | 15.38 | 13.42 | 14.08 | 13.86 | 12.66 | 11.24 | 10.80 | 10.30 | 9.86 | 9.60 | 9.27 | 8.45 | 8.48 | 8.62 | 7.44 | 7.42 | 6.55 | 5.96 | 5.34 | 5.12 | 4.64 | 4.57 | 4.06 | 3.72 | 3.42 | 3.21 | 2.78 | 2.33 | |

| Selling And Marketing Expense | 26.55 | 26.12 | 28.70 | 28.14 | 28.50 | 27.97 | 26.48 | 25.27 | 22.50 | 22.66 | 20.59 | 19.82 | 17.73 | 18.40 | 16.31 | 19.88 | 16.58 | 15.70 | 15.87 | 15.80 | 13.58 | 11.47 | 12.11 | 10.97 | 10.29 | 9.90 | 11.10 | 9.88 | 9.49 | 8.98 | 9.61 | 8.21 | 7.16 | 6.66 | 6.99 | 6.19 | 5.89 | 5.64 | 6.03 | 5.51 | 4.93 | 4.60 | 4.14 | 3.06 | |

| Operating Income Loss | -18.02 | -23.17 | -23.67 | -21.20 | -32.49 | -27.09 | -23.78 | -21.40 | -17.57 | -22.97 | -19.94 | -17.51 | -20.48 | -19.85 | -32.31 | -27.20 | -21.86 | -13.39 | -14.35 | -17.14 | -12.69 | -7.27 | -6.67 | -5.21 | -6.33 | -5.93 | -7.71 | -6.94 | -7.34 | -9.32 | -9.62 | -9.44 | -8.32 | -6.95 | -4.98 | -4.58 | -4.66 | -4.53 | -4.55 | -5.34 | -6.32 | -5.00 | -3.58 | -2.23 | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | 0.00 | 19.87 | NA | NA | NA | NA | 0.00 | 0.00 | -1.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 19.37 | 21.11 | 20.62 | 18.09 | 16.86 | 16.76 | 17.52 | 14.02 | 13.54 | 14.07 | 13.63 | 13.10 | 12.32 | 11.60 | 10.78 | 14.54 | 10.84 | 10.07 | 9.57 | 8.90 | 8.62 | 7.50 | 7.00 | 6.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 2.06 | 1.01 | 0.48 | 0.02 | 0.73 | 0.47 | 0.34 | 1.36 | 0.73 | 0.60 | 0.18 | 0.14 | 0.80 | 0.12 | 0.07 | 0.44 | -12.18 | -0.03 | -0.24 | -0.04 | -3.18 | -0.29 | -0.15 | -0.19 | -0.67 | 0.00 | 0.22 | 0.14 | 0.10 | 0.10 | 0.00 | 0.23 | 0.10 | 0.08 | 0.01 | 0.03 | 0.02 | 0.02 | 0.01 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | |

| Net Income Loss | -18.08 | -23.17 | -23.62 | -0.52 | -32.41 | -27.79 | -25.22 | -23.56 | -25.38 | -31.58 | -30.13 | -25.66 | -37.82 | -26.72 | -38.97 | -34.11 | -15.67 | -18.57 | -17.33 | -19.31 | -11.86 | -8.86 | -8.63 | -6.05 | -5.52 | -5.78 | -7.82 | -7.04 | -7.51 | -9.48 | -9.71 | -9.65 | -8.42 | -7.02 | -4.98 | -4.64 | -4.76 | -4.62 | -4.68 | -5.57 | -6.50 | -5.18 | -3.71 | -2.49 | |

| Comprehensive Income Net Of Tax | -17.20 | -23.21 | -23.62 | 0.50 | -31.78 | -28.83 | -26.49 | -24.72 | -25.61 | -31.43 | -30.18 | -25.63 | -37.81 | -26.71 | -38.86 | -34.28 | -15.79 | -18.59 | -17.26 | -19.19 | -11.82 | -8.78 | -8.62 | -6.07 | -5.59 | -5.77 | -7.85 | -7.04 | -7.55 | -9.50 | -9.69 | -9.56 | NA | -6.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

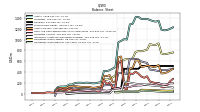

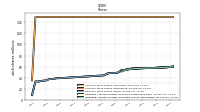

| Assets | 1201.42 | 1179.25 | 1172.69 | 1184.39 | 1349.73 | 1333.40 | 1343.70 | 1364.10 | 1385.05 | 1379.65 | 1383.60 | 1420.50 | 1416.70 | 1293.51 | 1281.58 | 1002.50 | 1009.43 | 977.68 | 951.78 | 490.41 | 463.72 | 435.10 | 418.76 | 421.85 | 212.81 | 205.47 | 193.40 | 191.59 | 200.98 | 205.28 | 200.25 | 203.59 | 204.47 | 198.72 | 169.69 | 171.04 | 136.81 | 133.30 | 133.52 | 125.54 | 61.11 | NA | NA | NA | |

| Liabilities | 752.95 | 738.22 | 731.28 | 745.29 | 930.70 | 903.05 | 902.76 | 917.92 | 814.75 | 797.92 | 786.10 | 787.53 | 773.34 | 656.25 | 634.09 | 641.59 | 630.02 | 595.84 | 565.92 | 338.01 | 304.82 | 275.11 | 260.46 | 267.00 | 106.19 | 102.83 | 93.05 | 91.21 | 100.75 | 102.79 | 93.39 | 91.82 | 86.49 | 75.33 | 63.41 | 61.82 | 57.87 | 52.03 | 48.76 | 50.96 | 55.37 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1201.42 | 1179.25 | 1172.69 | 1184.39 | 1349.73 | 1333.40 | 1343.70 | 1364.10 | 1385.05 | 1379.65 | 1383.60 | 1420.50 | 1416.70 | 1293.51 | 1281.58 | 1002.50 | 1009.43 | 977.68 | 951.78 | 490.41 | 463.72 | 435.10 | 418.76 | 421.85 | 212.81 | 205.47 | 193.40 | 191.59 | 200.98 | 205.28 | 200.25 | 203.59 | 204.47 | 198.72 | 169.69 | 171.04 | 136.81 | 133.30 | 133.52 | 125.54 | 61.11 | NA | NA | NA | |

| Stockholders Equity | 448.48 | 441.03 | 441.41 | 439.10 | 419.02 | 430.35 | 440.94 | 446.19 | 570.30 | 581.73 | 597.50 | 632.97 | 643.36 | 637.26 | 647.49 | 360.91 | 379.41 | 381.84 | 385.86 | 152.39 | 158.90 | 159.99 | 158.31 | 154.85 | 106.62 | 102.64 | 100.35 | 100.38 | 100.23 | 102.50 | 106.85 | 111.77 | 117.97 | 123.38 | 106.29 | 109.22 | 78.94 | 81.27 | 84.77 | 74.58 | -36.32 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 427.96 | 396.69 | 379.20 | 375.12 | 531.08 | 499.29 | 496.21 | 511.59 | 522.45 | 504.08 | 495.36 | 616.94 | 616.22 | 480.59 | 464.54 | 178.81 | 186.34 | 688.83 | 669.87 | 209.18 | 218.31 | 342.79 | 327.38 | 330.49 | 131.09 | 125.64 | 112.24 | 109.64 | 125.67 | 127.41 | 124.08 | 128.44 | 133.22 | 141.06 | 135.68 | 137.16 | 104.52 | 106.38 | 107.53 | 99.34 | 33.87 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 229.66 | 155.99 | 118.23 | 121.26 | 199.60 | 192.57 | 211.13 | 225.54 | 322.85 | 294.77 | 317.95 | 370.70 | 407.70 | 365.20 | 376.26 | 83.08 | 100.09 | 601.16 | 582.89 | 110.54 | 108.34 | 211.78 | 176.74 | 255.41 | 57.96 | 40.14 | 34.47 | 42.76 | 54.87 | 51.62 | 52.53 | 55.26 | 67.05 | 75.17 | 69.37 | 94.17 | 67.98 | 72.34 | 94.91 | 86.67 | 18.68 | 21.17 | 25.55 | 23.71 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 233.63 | 158.06 | 120.53 | 123.53 | 201.90 | 195.31 | 214.09 | 228.52 | 325.82 | 297.74 | 320.93 | 374.18 | 411.19 | 368.67 | 379.72 | 86.53 | 103.56 | 603.31 | 585.05 | 112.36 | 110.16 | 214.09 | 179.05 | 257.73 | 60.28 | 43.05 | 37.39 | 44.07 | 56.19 | NA | NA | NA | 68.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Marketable Securities Current | 94.35 | 134.79 | 161.78 | 150.48 | 233.75 | 203.12 | 188.22 | 188.14 | 104.88 | 99.81 | 93.34 | 157.86 | 131.35 | 30.91 | 12.69 | 29.75 | 32.33 | 35.70 | 34.81 | 53.97 | 68.98 | 86.24 | 101.97 | 38.70 | 41.69 | 48.72 | 44.19 | 39.41 | 42.25 | 40.71 | 43.11 | 49.74 | 43.57 | 44.72 | 49.15 | 25.52 | 20.96 | 18.03 | NA | NA | 0.00 | NA | NA | NA | |

| Accounts Receivable Net Current | 42.90 | 44.45 | 38.67 | 39.81 | 46.73 | 52.60 | 46.06 | 36.60 | 46.98 | 53.50 | 38.69 | 36.06 | 36.43 | 42.12 | 33.59 | 26.58 | 22.44 | 24.35 | 26.59 | 19.55 | 19.67 | 23.12 | 27.00 | 16.90 | 13.20 | 15.77 | 15.01 | 8.45 | 12.24 | 16.25 | 10.58 | 8.73 | 9.01 | 8.99 | 6.99 | 7.22 | 5.01 | 6.50 | 5.47 | 5.74 | 9.06 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 11.62 | 14.63 | 11.95 | 15.47 | 10.83 | 13.50 | 13.74 | 22.93 | 10.53 | 21.06 | 9.44 | 16.98 | 8.86 | 9.00 | 8.86 | 9.31 | 6.35 | 6.11 | 5.53 | 6.46 | 3.98 | 4.79 | 4.69 | 4.70 | 3.12 | 5.09 | 4.07 | 6.02 | 3.21 | 5.33 | 6.86 | 5.15 | 3.06 | 2.41 | 2.61 | 3.28 | 2.69 | 2.32 | 1.97 | 1.77 | 1.08 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 94.23 | 134.71 | 161.55 | 150.25 | 233.53 | 202.89 | 188.00 | 188.14 | 104.88 | 99.81 | 93.34 | 157.86 | 131.35 | 30.91 | NA | NA | NA | 35.70 | 34.81 | 53.97 | 68.98 | 86.24 | 101.97 | NA | 41.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 118.23 | NA | NA | NA | 117.34 | NA | NA | NA | 110.25 | NA | NA | NA | 84.39 | NA | NA | NA | 73.86 | NA | NA | NA | 66.50 | NA | NA | NA | 58.38 | NA | NA | NA | 42.69 | NA | NA | NA | 38.11 | NA | NA | NA | 26.31 | NA | NA | NA | 19.45 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 77.05 | NA | NA | NA | 60.65 | NA | NA | NA | 43.64 | NA | NA | NA | 34.83 | NA | NA | NA | 34.61 | NA | NA | NA | 31.51 | NA | NA | NA | 23.84 | NA | NA | NA | 15.21 | NA | NA | NA | 13.67 | NA | NA | NA | 7.79 | NA | NA | NA | 4.62 | NA | NA | NA | |

| Amortization Of Intangible Assets | 4.90 | 5.25 | 5.25 | 5.26 | 4.98 | 4.42 | 4.42 | 4.42 | 4.44 | 4.48 | 4.56 | 4.42 | 4.44 | 4.46 | 4.49 | 4.49 | 3.31 | 0.91 | 0.91 | 1.22 | 0.86 | 0.25 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.35 | 0.23 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 41.18 | 44.81 | 48.46 | 53.01 | 56.70 | 59.13 | 62.57 | 63.34 | 66.61 | 66.92 | 65.45 | 61.58 | 49.56 | 51.59 | 50.30 | 48.68 | 39.25 | 39.92 | 39.73 | 40.72 | 34.99 | 35.13 | 36.73 | 36.59 | 34.54 | 32.14 | 31.57 | 31.70 | 27.48 | 28.99 | 27.80 | 27.49 | 24.44 | 21.43 | 18.72 | 19.00 | 18.52 | 14.25 | 14.03 | 14.29 | 14.83 | NA | NA | NA | |

| Goodwill | 512.87 | 512.87 | 512.87 | 512.87 | 512.87 | 512.87 | 512.87 | 512.87 | 512.87 | 512.87 | 512.87 | 462.27 | 462.27 | 462.27 | 462.27 | 462.27 | 462.02 | 107.86 | 107.86 | 107.86 | 107.91 | 12.88 | 12.90 | 12.90 | 12.90 | 12.90 | 12.90 | 12.88 | 12.90 | 12.90 | 12.90 | 12.90 | 12.88 | 8.78 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 121.57 | 128.35 | 134.69 | 139.97 | 145.68 | 146.20 | 150.90 | 156.31 | 162.46 | 170.96 | 179.80 | 175.93 | 184.86 | 194.34 | 203.99 | 214.00 | 223.86 | 54.17 | 57.21 | 60.25 | 63.30 | 7.72 | 9.08 | 10.56 | 12.03 | 13.51 | 14.72 | 15.91 | 15.21 | 15.63 | 16.05 | 16.59 | 17.19 | 11.27 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 121.57 | 128.35 | 134.69 | 139.97 | 145.68 | 146.20 | 150.90 | 156.31 | 162.46 | 170.96 | 179.80 | 175.93 | 184.86 | 194.34 | 203.99 | 214.00 | 223.86 | 54.17 | 57.21 | 60.25 | 63.30 | 7.72 | 9.08 | 10.56 | 12.03 | 13.51 | 14.72 | 15.91 | 15.21 | NA | NA | NA | 17.19 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 2.61 | 3.44 | 1.99 | 2.09 | 2.26 | 1.93 | 1.97 | 2.04 | 2.31 | 2.08 | 2.25 | 2.38 | 2.43 | 2.83 | 2.16 | 1.32 | 2.32 | 3.50 | 3.53 | 2.71 | 2.23 | 1.75 | 1.17 | 1.09 | 1.01 | 0.50 | 0.51 | 0.50 | 0.53 | 0.64 | 0.54 | 0.61 | 0.55 | 0.96 | 1.19 | 1.14 | 1.23 | 0.81 | 0.74 | 0.75 | 2.49 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 94.52 | 135.52 | 162.79 | 151.31 | 235.62 | 205.48 | 189.84 | 189.44 | 105.10 | 99.82 | 93.35 | 157.85 | 131.36 | 30.86 | NA | NA | NA | 35.56 | 34.71 | 53.97 | 69.09 | 86.32 | 102.14 | NA | 41.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

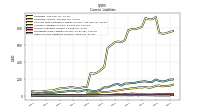

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

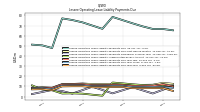

| Liabilities Current | 191.56 | 176.09 | 168.90 | 176.90 | 192.04 | 166.23 | 160.29 | 171.85 | 168.36 | 163.94 | 153.03 | 153.40 | 145.83 | 145.06 | 119.84 | 140.53 | 132.97 | 116.18 | 99.68 | 100.42 | 73.68 | 60.95 | 54.59 | 61.80 | 68.07 | 64.25 | 51.96 | 51.62 | 59.21 | 60.48 | 52.42 | 48.66 | 45.69 | 39.27 | 32.53 | 35.48 | 32.89 | 28.21 | 23.51 | 24.22 | 29.19 | NA | NA | NA | |

| Accounts Payable Current | 19.35 | 15.11 | 14.14 | 13.91 | 10.05 | 11.66 | 12.85 | 13.42 | 10.60 | 5.40 | 11.36 | 14.26 | 7.89 | 15.41 | 7.03 | 12.82 | 10.97 | 8.61 | 8.36 | 10.25 | 9.17 | 7.88 | 6.64 | 6.38 | 7.62 | 6.35 | 5.31 | 5.77 | 4.23 | 5.08 | 5.51 | 4.87 | 3.45 | 3.66 | 3.53 | 3.44 | 1.99 | 2.64 | 1.94 | 4.50 | 4.08 | NA | NA | NA | |

| Other Accrued Liabilities Current | 4.53 | NA | NA | NA | 5.18 | NA | NA | NA | 8.05 | NA | NA | NA | 7.82 | NA | NA | NA | 6.23 | NA | NA | NA | 3.69 | NA | NA | NA | 1.70 | NA | NA | NA | 1.72 | NA | NA | NA | 2.68 | NA | NA | NA | 2.29 | NA | NA | NA | 1.83 | NA | NA | NA | |

| Accrued Liabilities Current | 16.47 | 17.61 | 15.92 | 20.03 | 20.75 | 15.14 | 14.70 | 15.53 | 18.34 | 17.62 | 24.81 | 26.95 | 22.44 | 21.15 | 15.59 | 19.13 | 16.34 | 12.36 | 10.15 | 11.43 | 9.33 | 7.61 | 7.69 | 10.85 | 10.56 | 5.90 | 5.86 | 9.58 | 8.82 | 9.07 | 10.75 | 10.15 | 11.32 | 6.79 | 6.87 | 10.34 | 9.27 | 7.09 | 6.70 | 5.86 | 11.66 | NA | NA | NA | |

| Contract With Customer Liability Current | 118.72 | 115.78 | 111.47 | 122.06 | 117.47 | 101.06 | 95.82 | 103.32 | 98.69 | 100.12 | 89.16 | 88.90 | 81.94 | 77.87 | 68.17 | 64.19 | 57.85 | 52.05 | 46.02 | 45.25 | 42.53 | 34.80 | 33.16 | NA | 38.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

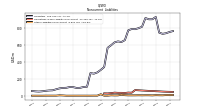

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Liabilities Noncurrent | 7.98 | 7.34 | 4.53 | 5.17 | 6.19 | 3.57 | 5.02 | 5.05 | 4.25 | 5.03 | 4.15 | 3.88 | 4.10 | 5.76 | 11.57 | 3.67 | 3.24 | 4.64 | 0.50 | 0.48 | 17.20 | 0.59 | 0.82 | 0.36 | 0.44 | 0.58 | 0.59 | 0.47 | 0.36 | 0.29 | 0.22 | 2.71 | 4.25 | 0.69 | 0.72 | 0.71 | 0.68 | 0.01 | 0.01 | 0.07 | 0.10 | NA | NA | NA | |

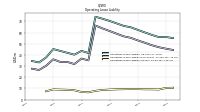

| Operating Lease Liability Noncurrent | 45.59 | 46.89 | 48.70 | 50.93 | 52.99 | 55.29 | 56.65 | 59.01 | 61.37 | 63.70 | 66.28 | 35.12 | 36.74 | 31.84 | 33.71 | 33.72 | 36.08 | 30.31 | 26.53 | 27.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

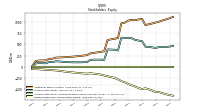

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 448.48 | 441.03 | 441.41 | 439.10 | 419.02 | 430.35 | 440.94 | 446.19 | 570.30 | 581.73 | 597.50 | 632.97 | 643.36 | 637.26 | 647.49 | 360.91 | 379.41 | 381.84 | 385.86 | 152.39 | 158.90 | 159.99 | 158.31 | 154.85 | 106.62 | 102.64 | 100.35 | 100.38 | 100.23 | 102.50 | 106.85 | 111.77 | 117.97 | 123.38 | 106.29 | 109.22 | 78.94 | 81.27 | 84.77 | 74.58 | -36.32 | NA | NA | NA | |

| Additional Paid In Capital | 1075.28 | 1050.63 | 1027.80 | 1001.87 | 982.30 | 961.84 | 943.61 | 922.37 | 1064.36 | 1050.18 | 1034.52 | 1039.82 | 1024.58 | 980.66 | 964.18 | 638.74 | 622.69 | 609.33 | 594.76 | 344.03 | 331.36 | 320.63 | 310.16 | 298.09 | 259.73 | 249.89 | 241.84 | 233.88 | 226.49 | 221.04 | 215.83 | 210.91 | 207.54 | 204.45 | 180.35 | 178.26 | 143.34 | 140.89 | 139.74 | 124.88 | 6.67 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -625.69 | -607.62 | -584.45 | -560.83 | -560.31 | -527.90 | -500.11 | -474.89 | -493.93 | -468.55 | -436.97 | -406.84 | -381.19 | -343.37 | -316.65 | -277.68 | -243.30 | -227.63 | -209.06 | -191.73 | -172.42 | -160.56 | -151.70 | -143.07 | -152.11 | -146.59 | -140.81 | -132.99 | -125.78 | -118.27 | -108.79 | -99.08 | -89.43 | -81.01 | -73.99 | -69.01 | -64.37 | -59.61 | -54.98 | -50.30 | -44.73 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1.11 | -1.99 | -1.95 | -1.95 | -2.97 | -3.60 | -2.57 | -1.30 | -0.14 | 0.09 | -0.06 | -0.01 | -0.03 | -0.04 | -0.05 | -0.16 | 0.01 | 0.14 | 0.16 | 0.09 | -0.04 | -0.08 | -0.16 | -0.16 | -0.14 | -0.07 | -0.08 | -0.06 | -0.05 | -0.01 | 0.00 | -0.01 | -0.10 | -0.03 | -0.05 | -0.01 | -0.01 | -0.02 | NA | NA | 0.00 | NA | NA | NA |

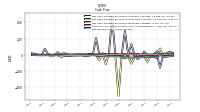

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

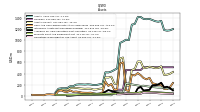

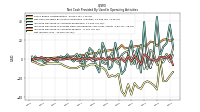

| Net Cash Provided By Used In Operating Activities | 36.58 | 16.75 | 13.07 | 3.89 | 44.80 | 6.15 | -9.77 | -4.62 | 39.31 | -14.39 | 11.49 | -5.48 | 19.09 | 5.24 | -11.41 | -15.80 | 1.90 | 17.35 | -7.79 | -10.89 | 8.46 | 17.42 | -14.18 | -7.10 | 8.13 | 11.60 | 0.41 | -10.67 | 4.78 | 1.00 | -2.58 | 0.19 | 5.02 | 0.05 | 2.98 | -2.64 | -1.03 | -0.14 | 0.38 | -4.50 | -1.31 | -1.40 | 2.83 | -1.63 | |

| Net Cash Provided By Used In Investing Activities | 34.60 | 20.81 | -20.13 | 77.99 | -40.03 | -25.39 | -7.33 | -92.81 | -11.30 | -10.05 | -10.28 | -33.50 | -108.22 | -20.32 | 6.81 | -2.43 | -503.88 | -2.42 | 13.38 | 9.66 | -114.42 | 14.77 | -68.99 | -2.65 | 6.57 | -8.59 | -11.48 | -4.44 | -3.30 | -3.39 | 0.68 | -10.51 | -11.78 | -16.09 | -25.46 | -5.09 | -4.13 | -20.13 | -0.64 | -1.83 | -1.08 | -2.59 | -4.93 | -2.71 | |

| Net Cash Provided By Used In Financing Activities | 4.08 | 0.39 | 3.84 | -160.32 | 2.63 | 0.45 | 2.67 | 0.13 | 0.07 | 1.26 | -54.46 | 1.97 | 131.65 | 4.04 | 297.80 | 1.19 | 2.24 | 3.33 | 467.10 | 3.43 | 2.03 | 2.85 | 4.50 | 207.20 | 3.12 | 2.66 | 2.79 | 2.99 | 1.76 | 1.49 | -0.84 | -1.47 | -1.36 | 21.85 | -2.32 | 33.92 | 0.80 | -2.29 | 8.49 | 74.33 | -0.11 | -0.39 | 3.93 | 18.95 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 36.58 | 16.75 | 13.07 | 3.89 | 44.80 | 6.15 | -9.77 | -4.62 | 39.31 | -14.39 | 11.49 | -5.48 | 19.09 | 5.24 | -11.41 | -15.80 | 1.90 | 17.35 | -7.79 | -10.89 | 8.46 | 17.42 | -14.18 | -7.10 | 8.13 | 11.60 | 0.41 | -10.67 | 4.78 | 1.00 | -2.58 | 0.19 | 5.02 | 0.05 | 2.98 | -2.64 | -1.03 | -0.14 | 0.38 | -4.50 | -1.31 | -1.40 | 2.83 | -1.63 | |

| Net Income Loss | -18.08 | -23.17 | -23.62 | -0.52 | -32.41 | -27.79 | -25.22 | -23.56 | -25.38 | -31.58 | -30.13 | -25.66 | -37.82 | -26.72 | -38.97 | -34.11 | -15.67 | -18.57 | -17.33 | -19.31 | -11.86 | -8.86 | -8.63 | -6.05 | -5.52 | -5.78 | -7.82 | -7.04 | -7.51 | -9.48 | -9.71 | -9.65 | -8.42 | -7.02 | -4.98 | -4.64 | -4.76 | -4.62 | -4.68 | -5.57 | -6.50 | -5.18 | -3.71 | -2.49 | |

| Depreciation Depletion And Amortization | 17.94 | 18.29 | 17.93 | 17.54 | 16.42 | 15.29 | 15.03 | 14.92 | 14.25 | 14.08 | 13.59 | 12.91 | 12.87 | 12.93 | 13.03 | 13.02 | 10.73 | 5.93 | 5.97 | 5.82 | 5.36 | 3.69 | 3.87 | 3.88 | 3.90 | 3.82 | 3.70 | 3.52 | 3.26 | 3.06 | 2.94 | 2.93 | 2.42 | 1.87 | 1.35 | 1.20 | 0.96 | 1.09 | 1.03 | 1.00 | 0.90 | 0.81 | 0.62 | 0.64 | |

| Increase Decrease In Accounts Receivable | -1.49 | 5.58 | -1.27 | -6.92 | -5.90 | 6.34 | 9.74 | -10.46 | -6.58 | 14.84 | 2.17 | -0.36 | -5.70 | 8.57 | 7.16 | 4.54 | -5.19 | -2.21 | 7.08 | -0.04 | -5.35 | -3.80 | 10.11 | 3.72 | -2.57 | 0.72 | 6.61 | -3.80 | -4.02 | 5.66 | 1.86 | -0.25 | -0.10 | 1.45 | -0.26 | 2.23 | -1.48 | 1.04 | -0.23 | -3.31 | 2.21 | 0.64 | 0.76 | -0.35 | |

| Increase Decrease In Accounts Payable | 4.24 | 0.85 | 2.05 | 2.22 | -2.17 | -0.42 | -1.20 | 3.25 | 4.92 | -5.96 | -0.32 | 3.11 | -2.23 | 3.40 | -3.19 | -0.28 | 1.20 | 0.12 | -1.63 | 1.44 | -0.91 | 1.47 | 0.23 | -1.05 | 1.50 | 0.67 | -0.10 | 1.29 | -0.94 | 0.39 | -0.23 | 1.20 | 0.24 | -0.38 | 0.57 | 0.92 | -0.41 | 0.61 | -2.07 | 1.04 | 1.56 | 0.65 | 0.28 | -1.16 | |

| Share Based Compensation | 19.37 | 21.11 | 20.62 | 18.09 | 13.95 | 17.78 | 18.57 | 14.86 | 14.11 | 14.40 | 13.93 | 13.46 | 12.61 | 12.01 | 11.20 | 14.87 | 11.13 | 10.34 | 9.89 | 9.15 | 8.95 | 7.50 | 7.00 | 6.09 | 6.31 | 5.41 | 5.02 | 4.20 | 3.82 | 3.36 | 2.86 | 2.60 | 2.49 | 1.91 | 1.64 | 1.32 | 1.48 | 1.10 | 1.07 | 0.92 | 0.48 | 0.41 | 0.38 | 0.33 | |

| Amortization Of Financing Costs | 0.50 | 0.49 | 0.49 | 0.62 | 0.68 | 0.68 | 0.69 | 0.68 | 0.49 | 0.51 | 0.54 | 0.51 | 0.55 | 0.48 | 0.49 | 0.46 | 0.46 | 0.46 | 0.29 | 0.25 | 0.24 | 0.24 | 0.22 | 0.12 | 0.00 | 0.00 | 0.00 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 34.60 | 20.81 | -20.13 | 77.99 | -40.03 | -25.39 | -7.33 | -92.81 | -11.30 | -10.05 | -10.28 | -33.50 | -108.22 | -20.32 | 6.81 | -2.43 | -503.88 | -2.42 | 13.38 | 9.66 | -114.42 | 14.77 | -68.99 | -2.65 | 6.57 | -8.59 | -11.48 | -4.44 | -3.30 | -3.39 | 0.68 | -10.51 | -11.78 | -16.09 | -25.46 | -5.09 | -4.13 | -20.13 | -0.64 | -1.83 | -1.08 | -2.59 | -4.93 | -2.71 | |

| Payments To Acquire Property Plant And Equipment | 1.10 | 1.27 | 2.26 | 1.03 | 2.21 | 3.84 | 1.23 | 3.87 | 3.69 | 1.68 | 8.27 | 6.11 | 7.18 | 1.76 | 10.13 | 4.64 | 1.37 | 1.63 | 5.32 | 5.54 | 1.11 | 1.02 | 5.76 | 5.40 | 0.94 | 3.75 | 2.26 | 5.36 | 0.80 | 4.81 | 5.16 | 3.59 | 3.56 | 1.25 | 1.89 | 0.44 | 1.22 | 1.35 | 0.64 | 1.83 | 1.08 | 2.59 | 4.93 | 2.54 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 4.08 | 0.39 | 3.84 | -160.32 | 2.63 | 0.45 | 2.67 | 0.13 | 0.07 | 1.26 | -54.46 | 1.97 | 131.65 | 4.04 | 297.80 | 1.19 | 2.24 | 3.33 | 467.10 | 3.43 | 2.03 | 2.85 | 4.50 | 207.20 | 3.12 | 2.66 | 2.79 | 2.99 | 1.76 | 1.49 | -0.84 | -1.47 | -1.36 | 21.85 | -2.32 | 33.92 | 0.80 | -2.29 | 8.49 | 74.33 | -0.11 | -0.39 | 3.93 | 18.95 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

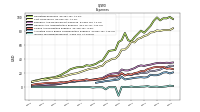

| Revenues | 162.12 | 154.97 | 154.53 | 153.01 | 146.54 | 144.75 | 140.31 | 134.07 | 131.89 | 126.74 | 123.57 | 116.52 | 108.99 | 103.80 | 97.58 | 92.38 | 86.84 | 79.70 | 77.65 | 71.30 | 67.18 | 60.54 | 58.57 | 54.81 | 51.70 | 50.12 | 47.62 | 44.53 | 42.16 | 38.30 | 36.01 | 33.76 | 30.41 | 28.02 | 26.28 | 24.16 | 22.15 | 20.99 | 19.16 | 16.83 | 15.67 | 14.32 | 14.04 | 12.83 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 162.12 | 154.97 | 154.53 | 153.01 | 146.54 | 144.75 | 140.31 | 134.07 | 131.89 | 126.74 | 123.57 | 116.52 | 108.99 | 103.80 | 97.58 | 92.38 | 86.84 | 79.70 | 77.65 | 71.30 | 67.18 | 60.54 | 58.57 | 54.81 | 51.70 | 50.12 | 47.62 | 44.53 | 42.16 | 38.30 | 36.01 | 33.76 | 30.41 | 28.02 | 26.28 | 24.16 | 22.15 | 20.99 | 19.16 | 16.83 | 15.67 | 14.32 | 14.04 | 12.83 | |

| Subscriptions | 125.93 | 118.83 | 116.00 | 115.19 | 108.03 | 106.64 | 100.78 | 96.58 | 95.33 | 91.54 | 89.15 | 85.07 | 76.10 | 74.45 | 70.17 | 66.23 | 61.66 | 56.14 | 54.09 | 50.10 | 46.96 | 41.90 | 41.16 | 38.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transactional Services | 15.88 | 16.24 | 17.04 | 16.26 | 16.66 | 15.93 | 17.73 | 17.05 | 17.48 | 17.36 | 17.71 | 16.28 | 14.38 | 14.48 | 13.91 | 12.82 | 12.42 | 12.26 | 12.19 | 11.52 | 11.30 | 10.42 | 8.90 | 8.62 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product And Service Other | 20.31 | 19.90 | 21.50 | 21.56 | 21.85 | 22.18 | 21.79 | 20.44 | 19.08 | 17.84 | 16.71 | 15.17 | 18.51 | 14.88 | 13.50 | 13.33 | 12.77 | 11.29 | 11.37 | 9.67 | 8.92 | 8.23 | 8.51 | 7.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |