| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Common Stock Par Or Stated Value Per Share | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | |

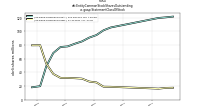

| Weighted Average Number Of Diluted Shares Outstanding | 141.88 | 141.03 | 140.33 | NA | 138.57 | 136.85 | 135.54 | NA | 142.29 | 142.12 | 140.33 | NA | 136.67 | 122.61 | 120.18 | NA | 116.68 | 114.57 | NA | NA | NA | 121.70 | NA | NA | NA | 4.88 | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 141.88 | 141.03 | 140.33 | NA | 138.57 | 136.85 | 135.54 | NA | 133.69 | 132.71 | 129.67 | NA | 125.69 | 122.61 | 120.18 | NA | 116.68 | 114.57 | NA | NA | NA | 102.65 | NA | NA | NA | 4.88 | NA | NA | NA | NA | NA | |

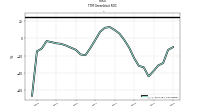

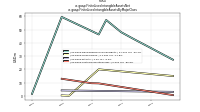

| Earnings Per Share Basic | -2.33 | -0.76 | -1.38 | -1.72 | -0.88 | -0.82 | -0.19 | 0.17 | 0.52 | 0.55 | 0.59 | 0.53 | 0.10 | -0.35 | -0.45 | -0.13 | -0.22 | -0.08 | NA | 0.06 | -0.09 | 0.01 | -0.07 | 0.07 | -8.79 | -3.18 | -1.79 | NA | -2.66 | -2.98 | -4.10 | |

| Earnings Per Share Diluted | -2.33 | -0.76 | -1.38 | -1.72 | -0.88 | -0.82 | -0.19 | 0.17 | 0.48 | 0.52 | 0.54 | 0.49 | 0.09 | -0.35 | -0.45 | -0.13 | -0.22 | -0.08 | NA | 0.05 | -0.09 | 0.00 | -0.07 | 0.06 | -8.79 | -3.18 | -1.79 | NA | -2.66 | -2.98 | -4.10 |

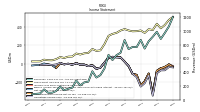

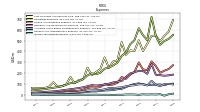

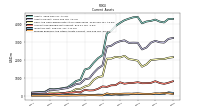

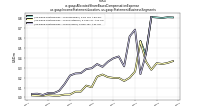

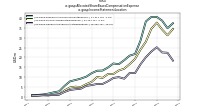

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

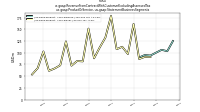

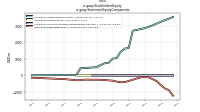

| Revenue From Contract With Customer Excluding Assessed Tax | 912.02 | 847.19 | 740.99 | 867.06 | 761.37 | 764.41 | 733.70 | 865.33 | 679.95 | 645.12 | 574.18 | 649.89 | 451.66 | 356.07 | 320.77 | 411.23 | 260.93 | 250.10 | 206.66 | 275.74 | 173.38 | 156.81 | 136.58 | 188.26 | 124.78 | 99.63 | 100.09 | 147.34 | 89.05 | 83.81 | 78.45 | |

| Revenues | 912.02 | 847.19 | 740.99 | 867.06 | 761.37 | 764.41 | 733.70 | 865.33 | 679.95 | 645.12 | 574.18 | 649.89 | 451.66 | 356.07 | 320.77 | 411.23 | 260.93 | 250.10 | 206.66 | 275.74 | 173.38 | 156.81 | 136.58 | 188.26 | 124.78 | 99.63 | 100.09 | 147.34 | 89.05 | 83.81 | 78.45 | |

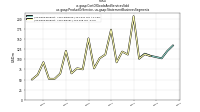

| Cost Of Goods And Services Sold | 543.20 | 468.92 | 403.39 | 502.68 | 404.59 | 409.26 | 368.89 | 485.69 | 316.03 | 306.85 | 247.41 | 344.43 | 236.84 | 209.24 | 179.66 | 249.58 | 142.45 | 135.89 | 105.77 | 163.45 | 94.39 | 79.06 | 73.46 | 114.80 | 74.89 | 61.99 | 61.25 | NA | 63.00 | NA | NA | |

| Gross Profit | 368.82 | 378.27 | 337.60 | 364.38 | 356.79 | 355.15 | 364.81 | 379.64 | 363.92 | 338.27 | 326.77 | 305.46 | 214.82 | 146.84 | 141.10 | 161.65 | 118.48 | 114.21 | 100.89 | 112.29 | 78.99 | 77.75 | 63.11 | 73.46 | 49.90 | 37.64 | 38.84 | 44.66 | 26.05 | 25.08 | 25.26 | |

| Operating Expenses | 718.61 | 504.23 | 550.06 | 614.27 | 503.78 | 465.66 | 388.30 | 358.28 | 295.07 | 269.18 | 250.97 | 240.31 | 202.85 | 189.04 | 196.27 | 179.03 | 145.03 | 124.59 | 111.63 | 106.80 | 90.74 | 77.88 | 70.01 | 63.97 | 57.79 | 51.02 | 46.67 | NA | 40.15 | NA | NA | |

| Research And Development Expense | 282.20 | 192.39 | 220.09 | 220.67 | 207.61 | 196.64 | 164.00 | 126.44 | 120.31 | 113.28 | 101.58 | 94.73 | 88.39 | 84.39 | 88.28 | 78.79 | 68.49 | 61.99 | 55.74 | 51.00 | 45.37 | 40.20 | 34.13 | 31.30 | 28.53 | 25.78 | 22.34 | NA | 18.23 | NA | NA | |

| General And Administrative Expense | 128.72 | 84.65 | 96.05 | 96.04 | 86.80 | 84.05 | 77.78 | 68.49 | 65.07 | 62.23 | 60.51 | 49.49 | 43.51 | 40.49 | 39.74 | 38.42 | 29.87 | 26.03 | 22.09 | 21.20 | 19.77 | 15.43 | 15.57 | 13.54 | 13.04 | 10.58 | 10.28 | NA | 9.08 | NA | NA | |

| Selling And Marketing Expense | 307.69 | 227.19 | 233.92 | 297.56 | 209.36 | 184.97 | 146.52 | 163.35 | 109.70 | 93.68 | 88.87 | 96.09 | 70.96 | 64.16 | 68.25 | 61.81 | 46.67 | 36.57 | 33.81 | 34.60 | 25.60 | 22.26 | 20.32 | 19.13 | 16.22 | 14.67 | 14.05 | NA | 12.84 | NA | NA | |

| Operating Income Loss | -349.79 | -125.96 | -212.46 | -249.90 | -146.99 | -110.51 | -23.49 | 21.36 | 68.85 | 69.08 | 75.81 | 65.15 | 11.97 | -42.21 | -55.16 | -17.38 | -26.55 | -10.39 | -10.74 | 5.49 | -11.75 | -0.13 | -6.90 | 9.49 | -7.89 | -13.38 | -7.83 | NA | -14.10 | NA | NA | |

| Interest Paid Net | 0.01 | 0.00 | 0.87 | 1.36 | 1.09 | 0.79 | 0.66 | 0.65 | 0.64 | 0.64 | 0.65 | 0.67 | 0.68 | 1.05 | 1.07 | 0.88 | 1.25 | 0.42 | 0.54 | 0.04 | 0.45 | NA | NA | 0.57 | 0.45 | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 91.31 | 89.58 | 96.47 | 104.28 | 99.05 | 87.02 | 69.58 | 54.05 | 50.40 | 42.55 | 40.54 | 38.73 | 34.91 | 30.04 | 30.41 | 26.02 | 22.62 | 18.67 | 17.86 | 16.44 | 11.50 | 5.31 | 4.43 | 3.44 | 2.92 | 2.42 | 2.17 | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 3.18 | 1.63 | 3.56 | -0.97 | 1.95 | 2.58 | 2.17 | -1.07 | -0.33 | -3.61 | -0.79 | -0.70 | -0.55 | 0.46 | -0.15 | -0.36 | -0.10 | -0.38 | -0.14 | -0.08 | -0.17 | -0.35 | 0.13 | 0.17 | 0.06 | 0.04 | 0.05 | NA | 0.05 | NA | NA | |

| Income Taxes Paid | 1.07 | 2.50 | 1.45 | 0.37 | 1.89 | 4.24 | 0.51 | 0.41 | 0.47 | 0.21 | 0.28 | 0.39 | 0.14 | 0.24 | 0.24 | 0.08 | 0.05 | 0.08 | 0.56 | 0.16 | 0.06 | 0.17 | 0.18 | 0.06 | 0.10 | 0.04 | 0.03 | NA | NA | NA | NA | |

| Net Income Loss | -330.07 | -107.59 | -193.60 | -237.19 | -122.18 | -112.32 | -26.31 | 23.69 | 68.94 | 73.47 | 76.30 | 67.31 | 12.95 | -43.15 | -54.61 | -15.72 | -25.16 | -9.33 | -9.73 | 6.78 | -9.53 | 0.53 | -6.63 | 6.94 | -46.23 | -15.51 | -8.70 | 3.23 | -12.74 | -14.11 | -19.13 | |

| Comprehensive Income Net Of Tax | -330.31 | -107.56 | -193.28 | -236.41 | -122.89 | -112.65 | -26.39 | 23.70 | 68.94 | 73.47 | 76.30 | 67.31 | 12.95 | -43.15 | -54.61 | -15.69 | -25.16 | -9.33 | -9.71 | 6.77 | -9.53 | 0.53 | -6.63 | 6.94 | -46.23 | NA | NA | NA | NA | NA | NA |

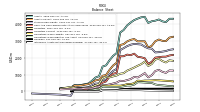

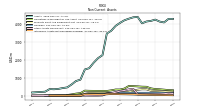

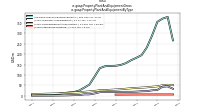

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

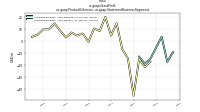

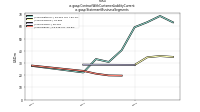

| Assets | 4190.78 | 4156.75 | 4055.40 | 4412.60 | 4392.20 | 4313.53 | 4226.25 | 4082.14 | 3912.30 | 3638.56 | 3487.14 | 2270.54 | 2104.01 | 1846.42 | 1541.71 | 1470.23 | 897.30 | 820.83 | 628.13 | 465.00 | 428.36 | 381.67 | 360.48 | 371.90 | 225.50 | NA | NA | 179.08 | NA | NA | NA | |

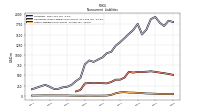

| Liabilities | 1883.31 | 1623.48 | 1504.76 | 1766.05 | 1614.28 | 1517.64 | 1413.08 | 1315.54 | 1228.67 | 1077.53 | 1045.83 | 942.53 | 887.63 | 830.87 | 865.80 | 771.81 | 433.53 | 360.14 | 267.20 | 220.35 | 206.48 | 169.90 | 167.00 | 219.62 | 268.30 | NA | NA | 159.72 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 4190.78 | 4156.75 | 4055.40 | 4412.60 | 4392.20 | 4313.53 | 4226.25 | 4082.14 | 3912.30 | 3638.56 | 3487.14 | 2270.54 | 2104.01 | 1846.42 | 1541.71 | 1470.23 | 897.30 | 820.83 | 628.13 | 465.00 | 428.36 | 381.67 | 360.48 | 371.90 | 225.50 | NA | NA | 179.08 | NA | NA | NA | |

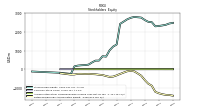

| Stockholders Equity | 2307.47 | 2533.28 | 2550.64 | 2646.56 | 2777.93 | 2795.89 | 2813.16 | 2766.61 | 2683.63 | 2561.03 | 2441.31 | 1328.02 | 1216.38 | 1015.55 | 675.91 | 698.43 | 463.78 | 460.68 | 360.93 | 244.65 | 221.88 | 211.76 | 193.48 | 152.28 | -255.97 | NA | NA | -193.82 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

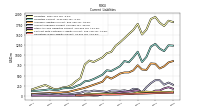

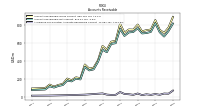

| Assets Current | 2971.00 | 2701.49 | 2595.35 | 2964.88 | 2970.94 | 2962.82 | 3102.79 | 3054.51 | 2961.78 | 2799.23 | 2749.39 | 1697.64 | 1533.10 | 1276.29 | 968.60 | 925.66 | 686.89 | 649.95 | 520.37 | 432.94 | 397.80 | 353.78 | 336.81 | 344.92 | 197.51 | NA | NA | 165.22 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 2003.41 | 1755.26 | 1630.05 | 1961.96 | 2018.62 | 2050.41 | 2235.09 | 2146.04 | 2179.74 | 2083.27 | 2077.51 | 1092.82 | 1047.48 | 885.83 | 588.29 | 515.48 | 386.00 | 375.51 | 236.50 | 155.56 | 137.67 | 174.17 | 160.75 | 177.25 | NA | NA | NA | NA | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 2044.12 | 1795.97 | 1670.77 | 1961.96 | 2020.35 | 2052.14 | 2236.72 | 2147.67 | 2181.26 | 2084.73 | 2077.60 | 1093.25 | NA | NA | NA | 517.33 | NA | NA | NA | 155.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 720.40 | 707.68 | 703.42 | 760.79 | 719.19 | 714.61 | 675.71 | 752.39 | 595.91 | 587.48 | 496.17 | 523.85 | 391.28 | 306.72 | 295.36 | 332.67 | 196.04 | 204.04 | 174.19 | 183.08 | 133.90 | 123.61 | 106.09 | 120.55 | 84.84 | NA | NA | 79.33 | NA | NA | NA | |

| Inventory Net | 105.37 | 93.21 | 109.24 | 106.75 | 119.25 | 76.08 | 72.86 | 50.28 | 75.94 | 48.00 | 41.25 | 53.90 | 62.61 | 45.00 | 43.98 | 49.71 | 73.53 | 39.44 | 33.40 | 35.59 | 68.80 | 39.43 | 38.06 | 32.74 | 35.45 | NA | NA | 43.57 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 101.11 | 104.62 | 111.93 | 135.38 | 113.89 | 121.72 | 119.13 | 105.80 | 110.18 | 80.48 | 134.38 | 26.64 | 30.98 | 37.20 | 39.43 | 25.94 | 28.91 | 19.06 | 21.89 | 15.37 | 13.87 | 15.13 | 30.55 | 11.37 | 7.70 | NA | NA | 4.98 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 53.20 | 52.56 | 47.68 | 39.47 | 43.56 | 40.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.50 | 10.99 | 27.40 | 42.15 | 42.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

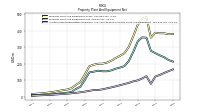

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 357.98 | 483.03 | 470.85 | 435.12 | 366.46 | 302.72 | 264.52 | 248.81 | 234.76 | 218.49 | 207.06 | 201.28 | 200.75 | 194.74 | 184.88 | 135.67 | 90.26 | 73.43 | 53.17 | 44.94 | 41.33 | 36.30 | 31.11 | 27.52 | 24.32 | NA | NA | 17.34 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 79.26 | 125.43 | 111.31 | 100.09 | 94.27 | 85.17 | 78.22 | 71.24 | 64.15 | 57.94 | 52.06 | 46.08 | 42.12 | 41.99 | 36.81 | 32.41 | 28.38 | 25.02 | 22.39 | 19.68 | 18.07 | 16.09 | 14.28 | 12.78 | 11.52 | NA | NA | 7.81 | NA | NA | NA | |

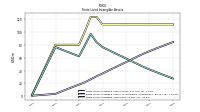

| Amortization Of Intangible Assets | 4.40 | 4.40 | 4.40 | 4.40 | 4.40 | 4.50 | 4.50 | 4.30 | 4.70 | 4.70 | 3.60 | 3.60 | 3.60 | 3.60 | 3.80 | 2.40 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 278.72 | 357.60 | 359.54 | 335.03 | 272.19 | 217.56 | 186.31 | 177.57 | 170.61 | 160.54 | 155.00 | 155.20 | 158.63 | 152.75 | 148.06 | 103.26 | 61.88 | 48.40 | 30.78 | 25.26 | 23.26 | 20.21 | 16.84 | 14.74 | 12.81 | NA | NA | 9.53 | NA | NA | NA | |

| Goodwill | 161.52 | 161.52 | 161.52 | 161.52 | 161.52 | 161.52 | 161.52 | 161.52 | 146.78 | 146.78 | 125.68 | 73.06 | 73.06 | 73.06 | 73.06 | 74.12 | 1.38 | 1.38 | 1.38 | 1.38 | 1.38 | 1.38 | 1.38 | 1.38 | 1.55 | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 45.66 | 50.07 | 54.48 | 58.88 | 70.79 | 75.19 | 79.66 | 84.13 | 92.53 | 97.22 | 79.25 | 62.18 | 65.74 | 69.29 | 72.91 | 76.67 | 1.06 | 1.20 | 1.34 | 1.48 | 1.61 | 1.75 | 1.89 | 2.03 | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 45.66 | 50.07 | 54.48 | 58.88 | 63.29 | 67.69 | 72.16 | 76.63 | 84.03 | 97.22 | 79.25 | 62.18 | 65.74 | 69.29 | 72.91 | 76.67 | NA | NA | NA | 1.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 85.27 | 86.34 | 81.97 | 77.83 | 381.73 | 352.04 | 294.82 | 258.77 | 193.91 | 135.83 | 112.58 | 16.27 | 6.39 | 5.14 | 5.76 | 7.23 | 3.98 | 3.93 | 3.25 | 3.94 | 4.30 | 4.54 | 3.56 | 3.43 | 6.44 | NA | NA | 0.52 | NA | NA | NA |

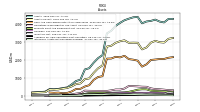

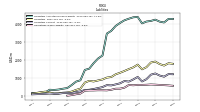

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 1207.74 | 955.50 | 831.30 | 1083.27 | 943.42 | 824.61 | 855.45 | 729.62 | 668.06 | 611.35 | 628.12 | 520.32 | 465.67 | 412.63 | 372.08 | 358.30 | 277.43 | 238.27 | 188.86 | 194.00 | 185.80 | 150.18 | 145.72 | 163.26 | 145.49 | NA | NA | 116.50 | NA | NA | NA | |

| Long Term Debt Current | NA | NA | NA | 79.98 | 82.46 | 84.93 | 88.65 | 9.88 | 8.63 | 7.38 | 6.12 | 4.87 | 4.87 | 4.87 | 4.75 | 4.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Payable Current | 312.28 | 212.91 | 86.88 | 164.80 | 175.03 | 113.77 | 137.55 | 124.92 | 131.82 | 132.48 | 96.47 | 112.31 | 121.76 | 130.60 | 103.42 | 115.23 | 77.42 | 62.00 | 44.62 | 56.58 | 55.30 | 32.93 | 41.15 | 56.41 | 49.17 | NA | NA | 31.40 | NA | NA | NA | |

| Other Accrued Liabilities Current | 82.92 | 103.96 | 76.80 | 137.64 | 124.16 | 106.99 | 101.37 | 86.14 | 72.47 | 59.43 | 64.42 | 41.64 | 11.85 | 9.51 | 13.88 | 12.97 | 6.12 | 9.71 | 7.01 | 6.09 | 7.19 | 5.91 | 6.40 | 7.10 | 8.62 | NA | NA | 5.78 | NA | NA | NA | |

| Accrued Liabilities Current | 797.23 | 638.48 | 646.36 | 750.81 | 625.84 | 575.28 | 574.85 | 549.05 | 482.06 | 423.25 | 477.40 | 347.67 | NA | NA | NA | 198.35 | NA | NA | NA | 91.99 | NA | NA | NA | 72.34 | 65.50 | NA | NA | 46.16 | NA | NA | NA | |

| Contract With Customer Liability Current | 98.24 | 104.11 | 98.06 | 87.68 | 60.10 | 50.64 | 54.41 | 45.76 | NA | NA | NA | 55.47 | NA | NA | NA | 39.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Liabilities Noncurrent | 52.97 | 55.43 | 63.30 | 69.91 | 76.39 | 77.59 | 87.87 | 82.48 | 60.22 | 21.16 | 4.54 | 3.12 | 1.67 | 1.95 | 3.67 | 1.70 | 1.03 | 2.47 | 3.09 | 6.75 | 7.31 | 7.29 | 7.73 | 7.85 | 8.60 | NA | NA | 4.14 | NA | NA | NA | |

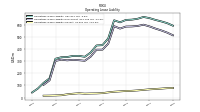

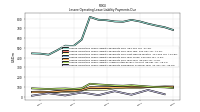

| Operating Lease Liability Noncurrent | 600.05 | 589.48 | 585.65 | 584.65 | 568.19 | 587.98 | 444.12 | 394.72 | 394.51 | 336.95 | 303.16 | 307.94 | 311.07 | 306.75 | 312.63 | 301.69 | 142.13 | 105.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2307.47 | 2533.28 | 2550.64 | 2646.56 | 2777.93 | 2795.89 | 2813.16 | 2766.61 | 2683.63 | 2561.03 | 2441.31 | 1328.02 | 1216.38 | 1015.55 | 675.91 | 698.43 | 463.78 | 460.68 | 360.93 | 244.65 | 221.88 | 211.76 | 193.48 | 152.28 | -255.97 | NA | NA | -193.82 | NA | NA | NA | |

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 3526.91 | 3422.41 | 3332.22 | 3234.86 | 3129.82 | 3024.90 | 2929.52 | 2856.57 | 2797.30 | 2743.63 | 2697.38 | 1660.38 | 1616.05 | 1428.17 | 1045.38 | 1012.22 | 761.88 | 733.63 | 624.55 | 498.55 | 482.55 | 462.90 | 445.14 | 435.61 | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1219.30 | -889.23 | -781.63 | -588.03 | -350.83 | -228.65 | -116.33 | -90.02 | -113.71 | -182.64 | -256.11 | -332.41 | -399.71 | -412.66 | -369.51 | -313.83 | -298.12 | -272.96 | -263.63 | -253.90 | -260.67 | -251.15 | -251.67 | -283.34 | -290.28 | NA | NA | -219.83 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.17 | 0.07 | 0.04 | -0.29 | -1.07 | -0.37 | -0.04 | 0.04 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | -0.00 | 0.00 | 0.00 | -0.02 | -0.01 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 91.31 | 89.58 | 96.47 | 104.28 | 99.02 | 87.04 | 69.59 | 54.18 | 50.52 | 42.67 | 40.68 | 38.73 | 34.91 | 30.04 | 30.41 | 26.02 | 22.62 | 18.67 | 17.86 | 16.44 | 11.50 | 5.31 | 4.43 | 3.44 | NA | NA | NA | NA | NA | NA | NA |

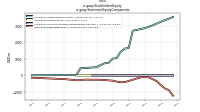

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

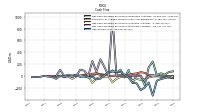

| Net Cash Provided By Used In Operating Activities | 245.89 | 147.05 | -153.41 | 7.35 | 14.39 | -111.75 | 101.80 | -25.43 | 108.75 | 48.96 | 95.80 | 47.05 | 21.05 | 34.16 | 45.94 | -10.58 | 10.25 | 24.74 | -10.70 | 23.22 | 2.17 | 3.17 | -14.64 | 6.10 | 0.98 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -6.78 | -23.07 | -59.24 | -65.38 | -44.11 | -77.44 | -14.76 | -12.02 | -14.12 | -44.16 | -106.52 | -6.37 | -11.90 | -18.79 | -44.26 | -113.19 | -5.38 | -1.60 | 9.87 | -4.87 | -46.25 | -5.61 | -3.41 | -2.67 | -5.10 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 13.20 | 0.61 | -79.11 | -1.74 | 3.40 | 4.59 | 2.10 | 3.85 | 1.90 | 2.33 | 995.07 | 4.35 | 151.71 | 282.17 | 70.82 | 254.20 | 5.62 | 90.39 | 108.12 | -0.46 | 7.58 | 15.85 | 1.54 | 106.90 | 0.87 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 245.89 | 147.05 | -153.41 | 7.35 | 14.39 | -111.75 | 101.80 | -25.43 | 108.75 | 48.96 | 95.80 | 47.05 | 21.05 | 34.16 | 45.94 | -10.58 | 10.25 | 24.74 | -10.70 | 23.22 | 2.17 | 3.17 | -14.64 | 6.10 | 0.98 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -330.07 | -107.59 | -193.60 | -237.19 | -122.18 | -112.32 | -26.31 | 23.69 | 68.94 | 73.47 | 76.30 | 67.31 | 12.95 | -43.15 | -54.61 | -15.72 | -25.16 | -9.33 | -9.73 | 6.78 | -9.53 | 0.53 | -6.63 | 6.94 | -46.23 | -15.51 | -8.70 | 3.23 | -12.74 | -14.11 | -19.13 | |

| Depreciation Depletion And Amortization | 14.50 | 14.10 | 11.20 | 8.00 | 9.00 | 7.00 | 7.00 | 7.10 | 6.20 | 6.10 | 6.00 | 6.10 | 5.80 | 5.20 | 4.70 | 4.00 | 3.40 | 2.70 | 2.70 | 2.40 | 2.10 | 1.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 12.01 | 5.18 | -55.61 | 43.07 | 5.13 | 38.35 | -75.67 | 157.06 | 8.05 | 89.27 | -32.61 | 133.28 | 84.14 | 11.09 | -32.46 | 97.14 | -7.93 | 29.71 | -8.70 | 49.30 | 10.75 | 17.60 | -26.99 | 35.65 | 28.37 | -4.59 | -18.25 | NA | NA | NA | NA | |

| Increase Decrease In Inventories | 12.16 | -16.02 | 2.49 | -12.51 | 43.17 | 3.21 | 22.59 | -25.67 | 27.95 | 6.75 | -12.65 | -8.71 | 17.61 | 1.02 | -5.74 | -23.82 | 34.09 | 6.04 | -2.19 | -33.22 | 29.37 | 1.37 | 5.43 | -2.71 | 8.37 | -10.77 | -5.71 | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 102.49 | 132.35 | -60.05 | -15.36 | 41.42 | -24.18 | 12.31 | -6.71 | -1.29 | 35.29 | -18.86 | -9.59 | -4.85 | 34.50 | -13.65 | NA | NA | NA | NA | NA | NA | NA | NA | 6.91 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 91.31 | 89.58 | 96.47 | 104.28 | 99.05 | 87.02 | 69.58 | 54.05 | 50.40 | 42.55 | 40.54 | 38.73 | 34.91 | 30.04 | 30.41 | 26.02 | 22.62 | 18.67 | 17.86 | 16.44 | 11.50 | 5.31 | 4.43 | 3.44 | 2.92 | 2.42 | 2.17 | NA | 2.01 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -6.78 | -23.07 | -59.24 | -65.38 | -44.11 | -77.44 | -14.76 | -12.02 | -14.12 | -44.16 | -106.52 | -6.37 | -11.90 | -18.79 | -44.26 | -113.19 | -5.38 | -1.60 | 9.87 | -4.87 | -46.25 | -5.61 | -3.41 | -2.67 | -5.10 | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 6.78 | 18.07 | 54.24 | 65.38 | 44.11 | 37.45 | 14.76 | 12.02 | 14.12 | 10.18 | 3.72 | 6.37 | 11.90 | 18.79 | 45.32 | 39.13 | 14.88 | 18.10 | 5.07 | 4.96 | 4.35 | 5.61 | 3.41 | 2.56 | 2.08 | 3.03 | 1.56 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 13.20 | 0.61 | -79.11 | -1.74 | 3.40 | 4.59 | 2.10 | 3.85 | 1.90 | 2.33 | 995.07 | 4.35 | 151.71 | 282.17 | 70.82 | 254.20 | 5.62 | 90.39 | 108.12 | -0.46 | 7.58 | 15.85 | 1.54 | 106.90 | 0.87 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

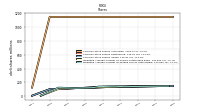

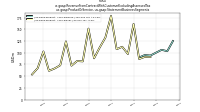

| Revenues | 912.02 | 847.19 | 740.99 | 867.06 | 761.37 | 764.41 | 733.70 | 865.33 | 679.95 | 645.12 | 574.18 | 649.89 | 451.66 | 356.07 | 320.77 | 411.23 | 260.93 | 250.10 | 206.66 | 275.74 | 173.38 | 156.81 | 136.58 | 188.26 | 124.78 | 99.63 | 100.09 | 147.34 | 89.05 | 83.81 | 78.45 | |

| Product, Devices | 125.23 | 103.35 | 106.37 | NA | 94.16 | 95.15 | 89.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product, Player | NA | NA | NA | NA | 90.97 | 91.24 | 86.80 | 161.75 | 97.44 | 112.82 | 107.66 | 178.71 | 132.43 | 111.30 | 88.21 | 151.61 | 81.61 | 82.42 | 72.51 | 124.34 | 73.33 | 66.47 | 61.50 | 102.82 | 67.25 | 53.65 | NA | NA | NA | NA | NA | |

| Service, Platform | 786.78 | 743.84 | 634.62 | 720.97 | 670.40 | 673.16 | 646.90 | 703.58 | 582.51 | 532.30 | 466.53 | 471.18 | 319.23 | 244.78 | 232.56 | 259.62 | 179.32 | 167.68 | 134.15 | 151.40 | 100.05 | 90.34 | 75.08 | 85.44 | 57.53 | 45.98 | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 912.02 | 847.19 | 740.99 | 867.06 | 761.37 | 764.41 | 733.70 | 865.33 | 679.95 | 645.12 | 574.18 | 649.89 | 451.66 | 356.07 | 320.77 | 411.23 | 260.93 | 250.10 | 206.66 | 275.74 | 173.38 | 156.81 | 136.58 | 188.26 | 124.78 | 99.63 | 100.09 | 147.34 | 89.05 | 83.81 | 78.45 | |

| Product, Devices | 125.23 | 103.35 | 106.37 | NA | 94.16 | 95.15 | 89.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product, Player | NA | NA | NA | NA | 90.97 | 91.24 | 86.80 | 161.75 | 97.44 | 112.82 | 107.66 | 178.71 | 132.43 | 111.30 | 88.21 | 151.61 | 81.61 | 82.42 | 72.51 | 124.34 | 73.33 | 66.47 | 61.50 | 102.82 | 67.25 | 53.65 | NA | NA | NA | NA | NA | |

| Service, Platform | 786.78 | 743.84 | 634.62 | 720.97 | 670.40 | 673.16 | 646.90 | 703.58 | 582.51 | 532.30 | 466.53 | 471.18 | 319.23 | 244.78 | 232.56 | 259.62 | 179.32 | 167.68 | 134.15 | 151.40 | 100.05 | 90.34 | 75.08 | 85.44 | 57.53 | 45.98 | NA | NA | NA | NA | NA |