| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

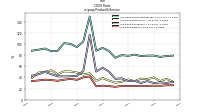

| Weighted Average Number Of Diluted Shares Outstanding | 103.21 | 103.33 | 103.19 | NA | 103.01 | 61.57 | 107.70 | NA | 116.44 | 117.79 | 70.73 | NA | 117.04 | 70.52 | 69.96 | NA | 69.62 | 69.56 | 116.69 | NA | 117.07 | 117.00 | 116.95 | NA | 115.94 | 67.31 | 65.84 | NA | 41.29 | 30.19 | 9.89 | NA | 9.89 | 9.89 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 57.96 | 57.83 | 57.65 | NA | 57.89 | 59.51 | 61.01 | NA | 69.04 | 70.21 | 70.73 | NA | 70.82 | 70.52 | 69.96 | NA | 69.62 | 69.56 | 69.40 | NA | 69.25 | 69.12 | 68.80 | NA | 68.06 | 67.31 | 65.69 | NA | 41.14 | 30.03 | 9.89 | NA | 9.89 | 9.89 | NA | |

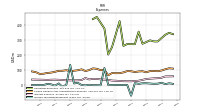

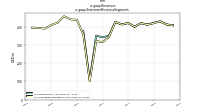

| Earnings Per Share Basic | 0.61 | 0.68 | 0.77 | 1.57 | 0.86 | 0.26 | 0.79 | 2.17 | 1.03 | 1.24 | -0.92 | 0.43 | 0.62 | -1.01 | -2.18 | 0.07 | -0.22 | -0.06 | 0.16 | 0.13 | 0.21 | 1.20 | 0.74 | 0.43 | 0.17 | -0.39 | 0.30 | 0.48 | 0.20 | 0.01 | NA | NA | NA | 0.29 | NA | |

| Earnings Per Share Diluted | 0.60 | 0.65 | 0.75 | 1.49 | 0.83 | 0.26 | 0.77 | 1.63 | 0.93 | 1.12 | -0.92 | 0.43 | 0.56 | -1.01 | -2.18 | 0.05 | -0.22 | -0.06 | 0.16 | 0.11 | 0.20 | 0.82 | 0.65 | 0.35 | 0.16 | -0.39 | 0.30 | 0.48 | 0.20 | 0.01 | NA | NA | NA | 0.29 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

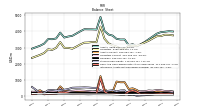

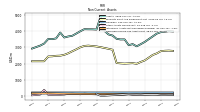

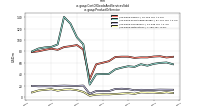

| Revenues | 411.61 | 416.13 | 433.64 | 425.47 | 414.44 | 422.24 | 401.64 | 422.35 | 414.77 | 428.16 | 352.62 | 343.41 | 353.18 | 108.47 | 377.39 | 460.79 | 465.86 | 482.87 | 447.02 | 431.47 | 412.33 | 416.19 | 421.04 | 394.02 | 400.37 | 403.49 | 417.73 | 394.55 | 347.14 | 351.49 | 359.25 | 347.95 | 323.60 | 337.82 | 342.77 | |

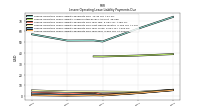

| Operating Expenses | 289.07 | 289.22 | 296.36 | NA | 273.74 | 354.00 | 270.84 | NA | 271.87 | 259.64 | 423.77 | NA | 252.27 | 202.13 | 374.68 | NA | 451.62 | 437.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Selling General And Administrative Expense | 91.85 | 93.48 | 92.50 | 84.98 | 91.57 | 90.19 | 86.30 | 91.49 | 92.60 | 84.09 | 78.91 | 78.65 | 79.49 | 65.23 | 101.27 | 98.93 | 107.76 | 110.60 | 99.06 | 92.95 | 104.36 | 98.07 | 95.11 | 91.53 | 98.52 | 94.78 | 94.42 | 87.71 | 82.74 | 80.15 | 75.09 | 73.92 | 85.32 | 90.27 | NA | |

| Operating Income Loss | 122.54 | 126.91 | 137.28 | 221.56 | 140.70 | 68.24 | 130.79 | 161.28 | 142.90 | 168.52 | -71.15 | 78.63 | 100.91 | -93.66 | 2.71 | 60.13 | 14.24 | 45.48 | 66.14 | 71.96 | 54.62 | 137.79 | 107.84 | 212.76 | 56.46 | -31.23 | 92.40 | 72.26 | 73.35 | 69.87 | 93.96 | 84.28 | 56.82 | 64.34 | 81.75 | |

| Interest Expense | 45.50 | 44.34 | 42.46 | 40.18 | 34.29 | 28.75 | 26.67 | 25.01 | 25.31 | 25.61 | 27.27 | 28.63 | 29.80 | 33.98 | 36.06 | 37.74 | 40.52 | 40.98 | 37.44 | 46.80 | 33.59 | 31.60 | 31.11 | 31.32 | 31.33 | 33.85 | 34.94 | 35.77 | 35.27 | 34.08 | 35.07 | 35.46 | 36.05 | 36.52 | NA | |

| Interest Paid Net | 44.01 | 40.08 | 42.26 | 35.46 | 33.81 | 24.62 | 26.30 | 19.57 | 27.16 | 19.03 | 32.21 | 25.25 | 29.52 | 33.21 | 21.06 | 41.13 | 31.54 | 44.09 | 26.37 | 41.67 | 23.12 | 36.31 | 23.32 | 22.14 | 32.93 | 24.74 | 38.72 | 21.50 | 39.27 | 16.46 | 39.09 | 20.42 | 40.21 | NA | NA | |

| Income Tax Expense Benefit | 9.25 | 8.42 | 10.19 | 11.96 | 11.78 | 8.07 | 12.72 | -70.44 | 0.35 | 0.58 | 0.22 | 0.90 | 0.00 | 0.00 | 113.19 | -1.86 | -0.84 | -0.95 | 1.92 | -2.45 | 0.62 | 14.85 | 10.86 | 133.53 | 2.36 | -11.81 | 10.68 | -4.08 | 4.79 | 7.50 | 0.00 | 0.00 | 0.00 | 0.00 | NA | |

| Income Taxes Paid Net | 6.30 | NA | NA | 6.20 | 7.40 | NA | NA | 1.60 | 1.80 | NA | NA | NA | NA | 0.00 | 0.00 | 0.13 | 0.00 | 0.00 | -0.07 | 0.00 | 0.00 | 0.00 | -0.18 | -9.59 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 68.42 | 74.91 | 85.53 | 170.22 | 95.45 | 32.44 | 92.25 | 200.11 | 117.94 | 143.35 | -106.56 | 49.63 | 72.04 | -118.42 | -177.80 | 6.84 | -26.80 | -7.07 | 20.28 | 13.18 | 25.07 | 99.10 | 82.13 | 46.01 | 22.31 | -50.49 | 45.21 | 41.10 | 33.44 | 21.73 | 59.50 | 48.56 | 21.01 | 28.11 | 45.57 | |

| Net Income Loss | 35.52 | 39.51 | 44.68 | 91.75 | 49.61 | 15.75 | 48.35 | 148.67 | 71.25 | 86.71 | -64.78 | 29.71 | 43.63 | -71.54 | -152.20 | 4.83 | -15.66 | -3.85 | 11.32 | 8.95 | 14.68 | 82.73 | 51.18 | 29.51 | 11.78 | -25.92 | 19.78 | 20.40 | 8.27 | 5.65 | 57.64 | 48.70 | 19.06 | 25.79 | 44.11 | |

| Comprehensive Income Net Of Tax | NA | NA | NA | 91.75 | 49.61 | 15.75 | 48.35 | 149.21 | 71.26 | 86.76 | -64.78 | 30.46 | 43.64 | -71.88 | -152.60 | 4.39 | -16.07 | -4.28 | 10.88 | 8.54 | 14.31 | 82.41 | 50.85 | 29.38 | 11.55 | -27.97 | 22.01 | 26.41 | 8.84 | 4.20 | 57.41 | 50.09 | 17.97 | 27.99 | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 61.51 | 67.48 | 76.95 | NA | 85.83 | 16.01 | 83.03 | NA | 108.13 | 131.45 | -64.78 | NA | 66.07 | -71.54 | -152.20 | NA | -15.66 | -3.85 | 18.40 | NA | 22.89 | 95.59 | 75.49 | NA | 18.28 | -25.73 | 19.76 | NA | 8.23 | NA | 6.32 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

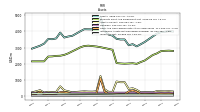

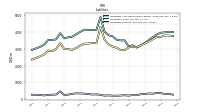

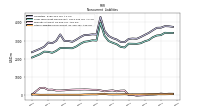

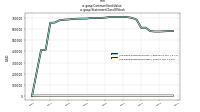

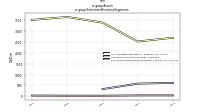

| Assets | 3861.44 | 3687.59 | 3517.23 | 3345.75 | 3203.61 | 3070.33 | 3209.49 | 3140.33 | 3502.01 | 3497.95 | 3537.65 | 3739.95 | 3808.88 | 4027.35 | 4898.39 | 4114.19 | 4127.46 | 4129.72 | 4135.64 | 4009.53 | 3866.08 | 3725.08 | 3683.89 | 3619.61 | 3927.66 | 3564.07 | 3516.48 | 3526.16 | 3242.64 | 3112.71 | NA | 2932.11 | NA | NA | NA | |

| Liabilities | 3703.82 | 3566.88 | 3423.60 | 3313.51 | 3195.51 | 3098.08 | 3112.70 | 3090.30 | 2911.15 | 2923.12 | 3059.89 | 3135.31 | 3257.04 | 3548.20 | 4303.51 | 3331.59 | 3344.63 | 3312.07 | 3303.17 | 3192.53 | 3052.18 | 2927.86 | 2979.91 | 2982.32 | 3340.46 | 2983.04 | 2852.89 | 2892.80 | 2658.14 | 2546.40 | NA | 2358.40 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 3861.44 | 3687.59 | 3517.23 | 3345.75 | 3203.61 | 3070.33 | 3209.49 | 3140.33 | 3502.01 | 3497.95 | 3537.65 | 3739.95 | 3808.88 | 4027.35 | 4898.39 | 4114.19 | 4127.46 | 4129.72 | 4135.64 | 4009.53 | 3866.08 | 3725.08 | 3683.89 | 3619.61 | 3927.66 | 3564.07 | 3516.48 | 3526.16 | 3242.64 | 3112.71 | NA | 2932.11 | NA | NA | NA | |

| Stockholders Equity | 123.31 | 99.99 | 75.08 | 43.78 | 32.42 | 13.73 | 87.81 | 59.49 | 346.60 | 337.36 | 275.52 | 352.60 | 320.65 | 276.16 | 345.75 | 500.72 | 500.07 | 520.16 | 528.57 | 519.62 | 516.68 | 506.78 | 426.62 | 381.82 | 342.01 | 335.84 | 367.60 | 349.75 | 189.99 | 184.59 | NA | 552.92 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 289.94 | 209.92 | 218.11 | 221.00 | 212.21 | 370.51 | 469.99 | 429.14 | 849.69 | 845.26 | 890.06 | 248.96 | 250.39 | 410.01 | 1226.60 | 281.63 | 260.00 | 263.47 | 278.86 | 261.96 | 243.83 | 212.15 | 286.37 | 341.56 | 590.80 | 245.69 | 235.74 | 249.84 | 193.92 | 350.25 | NA | 211.85 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 122.83 | 100.95 | 107.71 | 117.29 | 101.10 | 256.27 | 336.57 | 275.28 | 89.92 | 90.99 | 117.91 | 121.18 | 108.86 | 270.12 | 1091.15 | 128.84 | 106.44 | 100.23 | 109.25 | 114.61 | 110.58 | 108.42 | 179.19 | 231.47 | 222.43 | 125.31 | 119.42 | 133.78 | 96.33 | 251.41 | 122.56 | 116.43 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | NA | NA | NA | 117.29 | NA | NA | NA | 307.25 | NA | NA | NA | 125.70 | 113.24 | 274.48 | 1095.24 | 132.91 | 110.50 | 104.16 | 113.00 | 118.26 | 114.20 | 111.92 | 182.58 | 234.74 | 486.83 | 128.14 | 122.02 | 136.15 | NA | NA | NA | 116.62 | NA | NA | NA | |

| Receivables Net Current | 76.99 | 41.74 | 44.08 | 43.63 | 35.04 | 31.66 | 34.87 | 36.74 | 32.47 | 33.27 | 35.40 | 35.13 | 48.59 | 51.57 | 39.90 | 56.68 | 53.78 | 53.38 | 56.91 | 51.29 | 52.32 | 43.99 | 45.38 | 48.73 | 41.83 | 41.24 | 45.81 | 43.55 | 35.12 | 33.44 | NA | 35.51 | NA | NA | NA | |

| Inventory Net | 13.64 | 14.00 | 13.42 | 13.20 | 12.86 | 12.52 | 11.90 | 11.73 | 11.47 | 12.26 | 12.44 | 13.08 | 14.15 | 14.42 | 16.18 | 17.77 | 17.32 | 18.18 | 15.35 | 14.91 | 12.67 | 12.73 | 11.64 | 12.57 | 11.46 | 11.13 | 10.86 | 11.96 | 9.42 | 10.13 | NA | 10.33 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 32.64 | 27.68 | 27.32 | 24.04 | 27.95 | 32.91 | 19.51 | 20.42 | 28.76 | 20.49 | 19.00 | 13.83 | 15.50 | 16.15 | 19.38 | 17.64 | 20.46 | 40.77 | 50.23 | 34.42 | 39.60 | 17.66 | 19.51 | 19.37 | 17.22 | 11.40 | 14.88 | 11.40 | 11.38 | 11.66 | NA | 8.87 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

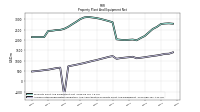

| Property Plant And Equipment Gross | NA | NA | NA | 3364.00 | NA | NA | NA | 3178.42 | NA | NA | NA | 4082.05 | NA | NA | NA | 4091.85 | NA | NA | NA | 3860.12 | NA | NA | NA | 3231.97 | NA | NA | NA | 3004.21 | NA | NA | NA | 2619.53 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 1254.41 | 1227.62 | 1199.53 | 1168.98 | 1142.83 | 1118.96 | 1190.30 | 1168.81 | 1147.20 | 1125.59 | 1092.13 | 1224.08 | 1184.19 | 1131.43 | 1083.66 | 1030.09 | 989.13 | 939.48 | 888.83 | 847.72 | 805.90 | 767.07 | 726.66 | -689.86 | 663.59 | 641.12 | 603.20 | 566.08 | 544.67 | 517.74 | NA | 478.87 | NA | NA | NA | |

| Property Plant And Equipment Net | 2631.59 | 2533.76 | 2363.61 | 2195.02 | 2096.93 | 1986.01 | 2023.55 | 2009.61 | 1995.98 | 2011.05 | 2033.24 | 2857.97 | 2916.03 | 2968.89 | 3020.31 | 3061.76 | 3088.32 | 3114.89 | 3093.84 | 3012.41 | 2882.54 | 2762.02 | 2637.32 | 2542.11 | 2490.21 | 2480.76 | 2448.15 | 2438.13 | 2141.11 | 2141.46 | NA | 2140.66 | NA | NA | NA | |

| Goodwill | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.70 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | 195.68 | NA | 195.68 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 83.20 | 83.59 | 83.99 | 84.39 | 84.78 | 85.17 | 86.77 | 87.17 | 87.58 | 87.98 | 88.39 | 100.82 | 101.97 | 104.15 | 106.33 | 108.51 | 110.69 | 112.86 | 115.04 | 117.22 | 119.40 | 121.83 | 124.25 | 128.00 | 132.98 | 137.96 | 144.12 | 149.20 | 136.25 | 140.83 | NA | 150.00 | NA | NA | NA | |

| Other Assets Noncurrent | 87.79 | 92.77 | 85.64 | 83.23 | 68.16 | 70.52 | 62.49 | 93.22 | 74.30 | 67.21 | 64.71 | 72.48 | 79.26 | 83.21 | 83.67 | 87.37 | 95.00 | 110.87 | 121.33 | 89.87 | 111.15 | 119.20 | 111.64 | 75.46 | 61.58 | 63.58 | 59.46 | 59.73 | 362.29 | 70.12 | NA | 26.77 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

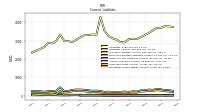

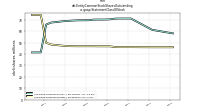

| Liabilities Current | 362.49 | 319.53 | 335.76 | 293.25 | 288.59 | 227.23 | 236.78 | 204.82 | 226.96 | 209.66 | 200.09 | 200.26 | 219.32 | 201.40 | 252.54 | 276.00 | 270.06 | 297.26 | 322.55 | 333.68 | 339.33 | 314.59 | 263.45 | 239.16 | 459.29 | 268.52 | 258.71 | 246.78 | 214.19 | 244.00 | NA | 258.92 | NA | NA | NA | |

| Long Term Debt Current | 26.09 | 26.08 | 26.07 | 26.06 | 25.95 | 25.94 | 25.93 | 25.92 | 25.91 | 25.90 | 26.36 | 22.84 | 24.02 | 20.17 | 26.65 | 33.99 | 33.94 | 33.91 | 33.91 | 33.89 | 34.89 | 34.86 | 34.84 | 30.09 | 277.99 | 71.34 | 45.42 | 46.06 | 47.16 | 62.58 | NA | 88.94 | NA | NA | NA | |

| Accounts Payable Current | 13.44 | 11.48 | 16.40 | 11.38 | 14.42 | 18.67 | 18.21 | 17.47 | 20.47 | 13.88 | 10.42 | 11.21 | 16.72 | 18.99 | 22.16 | 33.97 | 30.07 | 36.43 | 36.06 | 25.90 | 31.85 | 29.76 | 20.99 | 21.63 | 21.42 | 33.55 | 28.33 | 30.71 | 26.16 | 23.70 | NA | 24.26 | NA | NA | NA | |

| Other Accrued Liabilities Current | 31.69 | 32.46 | 32.80 | 26.03 | 26.20 | 20.21 | 29.30 | 22.73 | 24.38 | 23.57 | 20.22 | 18.76 | 34.79 | 30.17 | 30.18 | 21.23 | 26.02 | 27.39 | 23.38 | 21.03 | 26.11 | 24.15 | NA | 21.15 | NA | NA | NA | 28.27 | NA | NA | NA | 28.19 | NA | NA | NA | |

| Taxes Payable Current | 7.62 | 4.59 | 10.57 | NA | 3.01 | NA | 4.83 | 0.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 300.93 | 262.08 | 269.40 | 234.72 | 226.47 | 161.97 | 168.88 | 147.11 | 166.25 | 148.88 | 145.85 | 146.08 | 159.53 | 141.45 | 182.85 | 200.56 | 191.73 | 218.38 | 237.49 | 266.47 | 257.73 | 242.28 | 192.08 | 176.81 | 155.39 | 153.70 | 174.93 | 153.14 | 131.69 | 136.84 | NA | 132.20 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | NA | 2984.78 | NA | NA | NA | 2853.52 | NA | NA | NA | 2902.01 | NA | NA | NA | 3033.29 | NA | NA | NA | 2855.36 | NA | NA | NA | 2618.00 | NA | NA | NA | 2422.00 | NA | NA | NA | 2155.20 | NA | NA | NA | |

| Long Term Debt Noncurrent | 3279.54 | 3183.89 | 3026.82 | 2958.72 | 2854.18 | 2817.93 | 2822.77 | 2827.60 | 2617.01 | 2652.83 | 2801.22 | 2879.16 | 2978.38 | 3265.91 | 3975.21 | 2999.30 | 3016.75 | 2961.23 | 2931.90 | 2821.47 | 2674.90 | 2575.79 | 2581.73 | 2587.73 | 2587.25 | 2427.68 | 2324.22 | 2376.24 | 2389.41 | 2248.71 | NA | 2066.26 | NA | NA | NA | |

| Minority Interest | 34.31 | 20.72 | 18.56 | -11.54 | -24.32 | -41.48 | 8.97 | -9.46 | 244.26 | 237.47 | 202.25 | 252.04 | 231.19 | 203.00 | 249.13 | 281.88 | 282.76 | 297.49 | 303.90 | 297.38 | 297.22 | 290.44 | 277.35 | 255.47 | 245.19 | 245.19 | 295.99 | 283.60 | 394.51 | 381.72 | NA | 20.79 | NA | NA | NA | |

| Other Liabilities Noncurrent | 40.83 | 42.50 | 40.05 | 39.58 | 32.25 | 32.43 | 32.65 | 30.72 | 39.15 | 32.60 | 30.55 | 28.50 | 31.94 | 53.48 | 48.70 | 31.23 | 32.76 | 28.64 | 23.78 | 10.22 | 10.54 | 10.07 | 10.34 | 11.29 | 11.58 | 10.16 | 10.23 | 10.04 | 7.81 | 6.96 | NA | 30.97 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | NA | NA | NA | 29.66 | NA | NA | NA | 21.88 | NA | NA | NA | 10.95 | 11.72 | 11.88 | 10.53 | 10.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

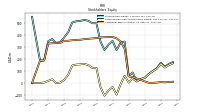

| Stockholders Equity | 123.31 | 99.99 | 75.08 | 43.78 | 32.42 | 13.73 | 87.81 | 59.49 | 346.60 | 337.36 | 275.52 | 352.60 | 320.65 | 276.16 | 345.75 | 500.72 | 500.07 | 520.16 | 528.57 | 519.62 | 516.68 | 506.78 | 426.62 | 381.82 | 342.01 | 335.84 | 367.60 | 349.75 | 189.99 | 184.59 | NA | 552.92 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 157.62 | 120.71 | 93.63 | 32.24 | 8.10 | -27.75 | 96.78 | 50.03 | 590.86 | 574.83 | 477.77 | 604.64 | 551.84 | 479.15 | 594.88 | 782.60 | 782.83 | 817.65 | 832.47 | 817.00 | 813.90 | 797.22 | 703.97 | 637.29 | 587.20 | 581.02 | 663.59 | 633.35 | 584.50 | 566.31 | NA | 573.71 | NA | NA | NA | |

| Additional Paid In Capital | 3.46 | 1.10 | 1.17 | NA | NA | NA | 50.25 | 55.03 | 286.36 | 348.37 | 373.28 | 385.58 | 384.10 | 383.25 | 380.97 | 376.23 | 372.94 | 369.93 | 367.04 | 361.97 | 360.62 | 358.07 | 353.38 | 352.94 | 335.63 | 334.24 | 332.65 | 329.00 | 188.44 | 187.74 | NA | 0.00 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 119.26 | 98.30 | 73.33 | 43.20 | 31.84 | 13.14 | 36.94 | 3.85 | 60.12 | -11.13 | -97.85 | -33.07 | -62.78 | -106.42 | -34.89 | 124.42 | 126.64 | 149.32 | 160.18 | 155.87 | 153.88 | 146.16 | 70.38 | 25.72 | 3.09 | -1.88 | 30.80 | 17.63 | 3.77 | -0.36 | NA | 0.00 | NA | NA | NA | |

| Minority Interest | 34.31 | 20.72 | 18.56 | -11.54 | -24.32 | -41.48 | 8.97 | -9.46 | 244.26 | 237.47 | 202.25 | 252.04 | 231.19 | 203.00 | 249.13 | 281.88 | 282.76 | 297.49 | 303.90 | 297.38 | 297.22 | 290.44 | 277.35 | 255.47 | 245.19 | 245.19 | 295.99 | 283.60 | 394.51 | 381.72 | NA | 20.79 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 4.50 | 4.93 | 5.38 | 4.79 | 4.74 | 4.70 | 3.54 | 3.32 | 3.33 | 3.37 | 2.74 | 2.61 | 0.63 | 3.59 | 4.06 | 4.00 | 4.39 | 4.55 | 3.87 | 2.36 | 3.36 | 3.15 | 2.48 | 2.22 | 2.01 | 2.35 | 1.41 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 20.89 | 32.81 | 11.50 | 67.17 | 30.35 | 33.13 | 21.80 | 188.11 | 17.66 | 23.83 | 7.56 | 0.00 | 0.00 | 0.00 | 4.62 | 4.68 | 4.68 | 4.69 | 4.69 | 4.69 | 4.77 | 4.98 | 5.50 | 6.00 | 8.60 | 16.24 | 7.45 | 10.81 | 14.15 | 13.09 | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

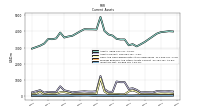

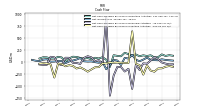

| Net Cash Provided By Used In Operating Activities | 100.22 | 94.66 | 140.52 | 124.77 | 139.79 | 120.19 | 157.47 | 133.14 | 164.24 | 192.82 | 119.76 | 127.24 | 141.97 | -104.30 | 47.88 | 99.98 | 73.50 | 88.54 | 54.60 | 85.02 | 69.96 | 84.97 | 106.05 | 110.15 | 76.37 | 7.84 | 94.69 | 107.16 | 73.07 | 69.91 | 96.07 | 98.73 | 72.55 | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -136.40 | -204.16 | -179.97 | -72.28 | -265.25 | -64.48 | -40.13 | 644.36 | -22.50 | -19.35 | -16.25 | -12.56 | -17.16 | -8.54 | -31.29 | -28.38 | -108.13 | -111.46 | -157.17 | -202.29 | -152.84 | -114.43 | -137.13 | -82.28 | -66.69 | -90.73 | -41.95 | -34.60 | -326.74 | -50.32 | -32.43 | -24.71 | -35.90 | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 58.07 | 102.75 | 29.87 | -36.30 | -29.71 | -167.98 | -56.05 | -565.04 | -142.73 | -200.27 | -106.63 | -102.21 | -286.05 | -707.91 | 945.73 | -49.19 | 40.98 | 14.08 | 97.30 | 121.33 | 85.15 | -41.21 | -21.08 | -18.84 | 87.44 | 88.78 | -67.10 | -35.11 | 98.59 | 109.26 | -57.70 | -60.25 | -51.82 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

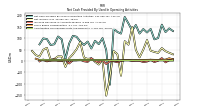

| Net Cash Provided By Used In Operating Activities | 100.22 | 94.66 | 140.52 | 124.77 | 139.79 | 120.19 | 157.47 | 133.14 | 164.24 | 192.82 | 119.76 | 127.24 | 141.97 | -104.30 | 47.88 | 99.98 | 73.50 | 88.54 | 54.60 | 85.02 | 69.96 | 84.97 | 106.05 | 110.15 | 76.37 | 7.84 | 94.69 | 107.16 | 73.07 | 69.91 | 96.07 | 98.73 | 72.55 | NA | NA | |

| Net Income Loss | 35.52 | 39.51 | 44.68 | 91.75 | 49.61 | 15.75 | 48.35 | 148.67 | 71.25 | 86.71 | -64.78 | 29.71 | 43.63 | -71.54 | -152.20 | 4.83 | -15.66 | -3.85 | 11.32 | 8.95 | 14.68 | 82.73 | 51.18 | 29.51 | 11.78 | -25.92 | 19.78 | 20.40 | 8.27 | 5.65 | 57.64 | 48.70 | 19.06 | 25.79 | 44.11 | |

| Profit Loss | 68.42 | 74.91 | 85.53 | 170.22 | 95.45 | 32.44 | 92.25 | 200.11 | 117.94 | 143.35 | -106.56 | 49.63 | 72.04 | -118.42 | -177.80 | 6.84 | -26.80 | -7.07 | 20.28 | 13.18 | 25.07 | 99.10 | 82.13 | 46.01 | 22.31 | -50.49 | 45.21 | 41.10 | 33.44 | 21.73 | 59.50 | 48.56 | 21.01 | 28.11 | 45.57 | |

| Depreciation Depletion And Amortization | 32.53 | 32.74 | 31.09 | 31.06 | 30.79 | 33.10 | 33.42 | 33.35 | 34.02 | 36.16 | 54.26 | 57.64 | 57.30 | 57.92 | 58.53 | 57.60 | 57.92 | 55.84 | 50.85 | 46.86 | 44.23 | 45.99 | 43.16 | 43.50 | 42.66 | 46.81 | 45.25 | 42.56 | 36.24 | 38.44 | 39.43 | 33.97 | 32.89 | 35.81 | NA | |

| Increase Decrease In Other Operating Capital Net | -0.24 | -1.37 | 0.25 | -1.23 | 0.51 | -0.15 | -0.23 | -1.16 | -0.27 | -0.83 | -0.96 | -0.80 | 1.61 | -0.27 | -1.18 | -0.84 | -0.84 | -0.90 | 0.87 | -9.59 | -2.83 | -0.09 | 8.41 | -0.65 | -2.32 | -1.40 | -0.45 | -0.10 | -0.35 | -0.77 | -0.25 | -0.54 | -1.85 | NA | NA | |

| Increase Decrease In Accounts Payable | 0.98 | -4.87 | 5.44 | -2.63 | -4.85 | 0.56 | 0.77 | -0.04 | 3.92 | 3.66 | -0.18 | -5.47 | -1.54 | -1.05 | -13.34 | 3.80 | -6.35 | 0.56 | 11.68 | -4.08 | -1.55 | 5.30 | 3.01 | 3.04 | -11.16 | 6.71 | 0.23 | 0.84 | 8.20 | 1.75 | -1.86 | 6.22 | -1.69 | NA | NA | |

| Share Based Compensation | 4.40 | 4.80 | 5.30 | 4.72 | 4.70 | 4.60 | 3.50 | 3.29 | 3.30 | 3.40 | 2.74 | 2.61 | 0.60 | 3.60 | 4.05 | 4.00 | 4.50 | 4.50 | 3.90 | 2.39 | 3.30 | 3.10 | 2.45 | 2.19 | 2.00 | 2.33 | 1.41 | 1.20 | 1.41 | 3.70 | 0.60 | 2.60 | 4.20 | 9.90 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -136.40 | -204.16 | -179.97 | -72.28 | -265.25 | -64.48 | -40.13 | 644.36 | -22.50 | -19.35 | -16.25 | -12.56 | -17.16 | -8.54 | -31.29 | -28.38 | -108.13 | -111.46 | -157.17 | -202.29 | -152.84 | -114.43 | -137.13 | -82.28 | -66.69 | -90.73 | -41.95 | -34.60 | -326.74 | -50.32 | -32.43 | -24.71 | -35.90 | NA | NA | |

| Payments To Acquire Productive Assets | 135.41 | 201.60 | 175.50 | 130.02 | 97.20 | 62.43 | 38.95 | 26.41 | 14.73 | 12.14 | 8.01 | 5.13 | 12.08 | 10.49 | 30.79 | 28.83 | 52.84 | 111.57 | 160.03 | 171.68 | 149.91 | 119.97 | 137.73 | 80.42 | 66.16 | 60.52 | 41.33 | 42.87 | 31.87 | 56.33 | 31.30 | 26.04 | 52.72 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 58.07 | 102.75 | 29.87 | -36.30 | -29.71 | -167.98 | -56.05 | -565.04 | -142.73 | -200.27 | -106.63 | -102.21 | -286.05 | -707.91 | 945.73 | -49.19 | 40.98 | 14.08 | 97.30 | 121.33 | 85.15 | -41.21 | -21.08 | -18.84 | 87.44 | 88.78 | -67.10 | -35.11 | 98.59 | 109.26 | -57.70 | -60.25 | -51.82 | NA | NA | |

| Payments Of Dividends | 14.49 | 14.49 | 15.04 | 71.95 | 14.44 | 14.50 | 15.79 | 203.76 | 0.01 | NA | NA | 0.00 | 0.17 | 0.03 | 7.11 | 6.97 | 6.96 | 7.00 | 6.97 | 6.93 | 6.93 | 6.93 | 6.91 | 6.85 | 6.79 | 6.77 | 6.57 | 6.53 | 4.11 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | NA | NA | NA | 0.00 | 19.00 | 111.73 | 10.77 | 376.89 | 85.72 | 26.58 | 11.71 | 0.01 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

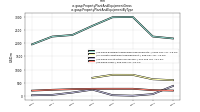

| Revenues | 411.61 | 416.13 | 433.64 | 425.47 | 414.44 | 422.24 | 401.64 | 422.35 | 414.77 | 428.16 | 352.62 | 343.41 | 353.18 | 108.47 | 377.39 | 460.79 | 465.86 | 482.87 | 447.02 | 431.47 | 412.33 | 416.19 | 421.04 | 394.02 | 400.37 | 403.49 | 417.73 | 394.55 | 347.14 | 351.49 | 359.25 | 347.95 | 323.60 | 337.82 | 342.77 | |

| Casino | 272.75 | 269.51 | 288.24 | 283.26 | 282.39 | 280.64 | 279.77 | 289.47 | 288.98 | 304.21 | 259.94 | 240.51 | 239.87 | 75.61 | 208.27 | 255.78 | 238.27 | 245.27 | 244.93 | 240.76 | 230.72 | 232.76 | 236.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Food And Beverage | 72.78 | 77.62 | 78.15 | 73.81 | 69.80 | 73.76 | 65.70 | 68.88 | 64.79 | 64.89 | 46.87 | 43.73 | 45.85 | 14.98 | 88.33 | 110.82 | 128.02 | 137.79 | 104.93 | 100.97 | 94.67 | 94.63 | 90.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Hotel Other | 24.05 | 24.11 | 23.07 | 21.60 | 22.99 | 23.32 | 19.18 | 20.48 | 21.07 | 19.64 | 15.56 | 13.99 | 14.49 | 6.45 | 21.36 | 26.12 | 27.82 | 26.91 | 25.92 | 27.05 | 26.39 | 24.92 | 22.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Service | NA | NA | 0.24 | 2.41 | 0.20 | 0.24 | 0.21 | 0.22 | 0.40 | 0.27 | 8.31 | 25.78 | 30.90 | 5.94 | 19.36 | 21.31 | 23.58 | 23.59 | 23.16 | 20.52 | 21.25 | 21.16 | 24.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Occupancy | 42.04 | 44.89 | 43.94 | 44.38 | 39.06 | 44.28 | 36.77 | 43.30 | 39.52 | 39.15 | 21.94 | 19.40 | 22.07 | 5.49 | 40.08 | 46.75 | 48.17 | 49.31 | 48.08 | 42.17 | 39.31 | 42.72 | 46.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Casino, Las Vegas Operations | 272.75 | 269.51 | 288.24 | 283.26 | 282.39 | 280.64 | 279.77 | 289.47 | 288.98 | 304.21 | 259.94 | 240.51 | 239.87 | 75.61 | 208.27 | 255.78 | 238.27 | 245.27 | 244.93 | 240.76 | 230.72 | 232.76 | 236.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Food And Beverage, Las Vegas Operations | 72.78 | 77.62 | 78.15 | 73.81 | 69.80 | 73.76 | 65.70 | 68.88 | 64.79 | 64.89 | 46.87 | 43.73 | 45.85 | 14.98 | 88.33 | 110.82 | 128.02 | 137.79 | 104.93 | 100.97 | 94.67 | 94.63 | 90.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Hotel Other, Las Vegas Operations | 20.40 | 20.56 | 19.49 | 17.98 | 20.11 | 21.19 | 17.27 | 18.64 | 19.20 | 17.89 | 13.84 | 12.34 | 12.79 | 4.89 | 19.69 | 24.45 | 26.11 | 25.24 | 24.27 | 25.43 | 24.84 | 23.43 | 21.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Hotel Other, Corporate And Other | 3.65 | 3.55 | 3.59 | 3.62 | 2.88 | 2.13 | 1.91 | 1.84 | 1.87 | 1.75 | 1.72 | 1.65 | 1.70 | 1.56 | 1.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Service, Las Vegas Operations | NA | NA | 0.24 | 0.20 | 0.20 | 0.24 | 0.21 | 0.22 | 0.20 | 0.27 | 0.22 | 0.21 | 0.18 | 0.05 | 0.10 | 0.14 | 0.13 | 0.14 | 0.16 | 0.15 | 0.13 | 0.14 | 0.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Occupancy, Las Vegas Operations | 42.04 | 44.89 | 43.94 | 44.38 | 39.06 | 44.28 | 36.77 | 43.30 | 39.52 | 39.15 | 21.94 | 19.40 | 22.07 | 5.49 | 40.08 | 46.75 | 48.17 | 49.31 | 48.08 | 42.17 | 39.31 | 42.72 | 46.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Las Vegas Operations | 407.96 | 412.58 | 430.05 | 419.65 | 411.56 | 420.11 | 399.73 | 420.52 | 412.69 | 426.41 | 342.82 | 316.19 | 320.76 | 101.02 | 356.46 | 437.94 | 440.69 | 457.75 | 422.37 | 409.48 | 389.67 | 393.68 | 395.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Reportable | 407.96 | 412.58 | 430.05 | 421.85 | 411.56 | 420.11 | 399.73 | 420.52 | 412.90 | 426.41 | 350.90 | 341.76 | 351.48 | 106.91 | 375.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |