| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 44.90 | 44.86 | 44.71 | 44.66 | 44.64 | 44.63 | 45.16 | 45.12 | 46.12 | 47.31 | 47.19 | 47.06 | 47.03 | 47.00 | 34.16 | 34.97 | 35.63 | 35.62 | 35.56 | 35.53 | 35.52 | 35.51 | 35.46 | 24.00 | 23.99 | 23.98 | 23.93 | 23.90 | 23.89 | 23.88 | 23.83 | 24.30 | 24.43 | 24.56 | 24.73 | 25.05 | 25.08 | 25.07 | 25.04 | 24.99 | 24.98 | 24.97 | 24.95 | 24.91 | 24.90 | 24.89 | 24.14 | 24.09 | 24.08 | 24.09 | NA | 24.05 | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 44.94 | 44.89 | 44.83 | NA | 44.79 | 45.18 | 45.42 | NA | 47.20 | 47.69 | 47.53 | NA | 47.41 | 47.39 | 34.98 | NA | 35.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

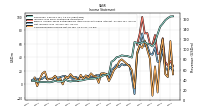

| Earnings Per Share Basic | 0.46 | 0.55 | 1.14 | 0.76 | 0.75 | 1.21 | 0.97 | 1.00 | 1.21 | 1.20 | 1.59 | 1.19 | 0.94 | -0.31 | 0.29 | 0.80 | 0.82 | 0.79 | 0.85 | 0.72 | 0.82 | 0.68 | 0.61 | 0.34 | 0.62 | 0.61 | 0.63 | 0.55 | 0.56 | 0.45 | 0.45 | 0.53 | 0.45 | 0.42 | 0.45 | 0.37 | 0.44 | 0.28 | 0.44 | 0.38 | 0.48 | 0.49 | 0.42 | 0.40 | 0.44 | 0.30 | 0.35 | 0.31 | 0.47 | 0.34 | 0.30 | 0.35 | 0.35 | 0.26 | |

| Earnings Per Share Diluted | 0.46 | 0.55 | 1.14 | 0.76 | 0.75 | 1.21 | 0.96 | 1.00 | 1.20 | 1.19 | 1.58 | 1.19 | 0.94 | -0.31 | 0.28 | 0.80 | 0.82 | 0.79 | 0.85 | 0.72 | 0.82 | 0.68 | 0.61 | 0.34 | 0.62 | 0.61 | 0.63 | 0.55 | 0.56 | 0.44 | 0.45 | 0.52 | 0.45 | 0.42 | 0.45 | 0.36 | 0.44 | 0.28 | 0.43 | 0.38 | 0.48 | 0.49 | 0.42 | 0.39 | 0.44 | 0.30 | 0.35 | 0.30 | 0.47 | 0.34 | 0.30 | 0.35 | 0.35 | 0.26 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 162.41 | 158.15 | 151.35 | 145.30 | 130.42 | 113.91 | 106.04 | 110.07 | 111.13 | 114.82 | 114.26 | 111.79 | 112.98 | 114.93 | 83.86 | 85.39 | 87.08 | 87.21 | 88.18 | 85.61 | 84.37 | 78.60 | 75.50 | 50.68 | 49.59 | 48.58 | 45.96 | 44.24 | 42.86 | 41.80 | 41.65 | 41.07 | 40.32 | 38.85 | 38.07 | 37.98 | 37.15 | 36.99 | 36.25 | 37.11 | 40.18 | 35.78 | 36.28 | 36.20 | 37.49 | 35.56 | 34.62 | 34.71 | 35.00 | 35.01 | 34.75 | 36.11 | 37.37 | 37.51 | |

| Insurance Commissions And Fees | NA | NA | NA | 0.00 | 0.00 | 0.81 | 2.12 | 1.33 | 2.29 | 1.25 | 2.15 | 1.36 | 2.12 | 1.19 | 2.13 | 1.33 | 2.12 | 1.26 | 1.90 | 1.14 | 2.02 | 1.18 | 1.82 | 1.31 | 1.95 | 1.22 | 1.75 | 1.23 | 1.79 | 0.95 | 1.45 | 1.03 | 1.65 | 0.88 | 1.62 | 0.98 | 1.41 | 0.96 | 1.64 | 1.24 | 1.19 | 1.04 | 1.35 | 1.33 | 1.02 | 0.93 | 1.20 | 1.47 | 1.04 | 0.95 | 1.18 | 1.33 | 0.98 | 0.93 | |

| Interest Expense | 77.33 | 67.68 | 54.05 | 38.66 | 17.46 | 7.96 | 4.58 | 4.80 | 4.53 | 6.78 | 9.66 | 11.96 | 15.50 | 13.41 | 19.52 | 19.81 | 20.29 | 21.03 | 21.43 | 19.46 | 16.78 | 14.78 | 12.61 | 7.18 | 6.89 | 6.25 | 5.71 | 5.28 | 5.13 | 5.07 | 5.53 | 5.30 | 5.20 | 4.92 | 4.70 | 4.75 | 4.73 | 4.68 | 4.66 | 4.76 | 4.87 | 4.85 | 4.95 | 5.28 | 5.71 | 5.75 | 5.91 | 6.26 | 6.67 | 6.85 | 6.74 | 7.16 | 7.87 | 8.51 | |

| Interest Income Expense Net | 85.08 | 90.47 | 97.30 | 106.64 | 112.96 | 105.95 | 101.45 | 105.27 | 106.60 | 108.05 | 104.60 | 99.83 | 97.48 | 101.51 | 64.33 | 65.58 | 66.79 | 66.19 | 66.75 | 66.14 | 67.59 | 63.82 | 62.89 | 43.49 | 42.70 | 42.33 | 40.25 | 38.97 | 37.73 | 36.73 | 36.12 | 35.78 | 35.12 | 33.93 | 33.37 | 33.23 | 32.42 | 32.31 | 31.59 | 32.35 | 35.31 | 30.93 | 31.33 | 30.92 | 31.79 | 29.81 | 28.70 | 28.45 | 28.33 | 28.15 | 28.01 | 28.95 | 29.50 | 29.00 | |

| Interest Paid Net | 49.84 | 67.57 | 52.92 | 34.61 | 13.77 | 8.07 | 5.78 | 6.67 | 8.93 | 10.71 | 11.53 | 15.53 | 14.63 | 15.42 | 17.05 | 18.97 | 22.13 | 21.89 | 21.45 | 18.23 | 15.69 | 14.91 | 11.68 | 7.13 | 6.85 | 6.46 | 5.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 6.89 | 8.71 | 17.23 | 11.78 | 11.59 | 18.36 | 14.33 | 14.67 | 19.07 | 18.27 | 24.54 | 18.23 | 14.29 | -5.35 | 0.30 | 8.61 | 9.53 | 8.95 | 9.34 | 8.54 | 9.11 | 7.47 | 6.71 | 11.93 | 8.23 | 6.97 | 7.60 | 6.88 | 6.73 | 5.01 | 5.12 | 6.37 | 5.17 | 5.01 | 5.47 | 4.09 | 5.43 | 2.72 | 5.35 | 4.50 | 6.42 | 6.35 | 5.29 | 4.90 | 5.64 | 3.65 | 3.86 | 2.96 | 6.08 | 3.67 | 3.13 | 3.88 | 3.96 | 2.55 | |

| Income Taxes Paid Net | 4.59 | NA | NA | NA | 17.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Taxes Paid | NA | NA | NA | 19.68 | 17.36 | NA | NA | 13.56 | 20.12 | 15.95 | 22.28 | 28.33 | 10.57 | 17.53 | 0.00 | 10.38 | 4.79 | 18.63 | 0.00 | 6.57 | 7.49 | 11.58 | 0.01 | 8.81 | 6.64 | 16.28 | 0.01 | 5.51 | 3.84 | 6.59 | 6.40 | 6.24 | 4.95 | 5.52 | 4.36 | 3.25 | 1.76 | 10.14 | 0.01 | 7.54 | 3.75 | 8.72 | 0.00 | 4.94 | 4.24 | 2.73 | 1.36 | 3.56 | 2.54 | 1.39 | 2.21 | 2.00 | 0.00 | NA | |

| Other Comprehensive Income Loss Net Of Tax | NA | NA | NA | NA | NA | -28.18 | -60.73 | -7.41 | -5.96 | 7.49 | -21.36 | 1.21 | 2.67 | 8.48 | 10.68 | -1.62 | 0.86 | 5.49 | 6.70 | 8.67 | -3.86 | -2.94 | -9.28 | -3.38 | 0.23 | 1.82 | 1.08 | -11.08 | -1.42 | 1.65 | 5.53 | -3.10 | 2.39 | -2.74 | 2.97 | -4.46 | -1.60 | 3.88 | 4.32 | -0.08 | -0.47 | -12.16 | -1.58 | -5.12 | 1.86 | 1.74 | -0.41 | 0.10 | 7.66 | 7.74 | NA | NA | NA | NA | |

| Net Income Loss | 20.75 | 24.75 | 51.25 | 33.98 | 33.58 | 54.80 | 43.94 | 45.40 | 56.98 | 57.26 | 75.46 | 56.66 | 44.64 | -14.34 | 9.99 | 28.46 | 29.38 | 28.28 | 30.32 | 25.57 | 29.23 | 24.40 | 21.66 | 8.27 | 15.09 | 14.74 | 15.11 | 13.32 | 13.47 | 10.65 | 10.81 | 12.80 | 10.99 | 10.33 | 11.22 | 9.15 | 11.14 | 6.98 | 10.93 | 9.61 | 12.09 | 12.16 | 10.56 | 9.88 | 10.99 | 7.21 | 8.48 | 7.26 | 11.26 | 8.30 | 7.29 | 8.28 | 8.48 | 6.26 | |

| Comprehensive Income Net Of Tax | 10.88 | 15.11 | 67.21 | 45.10 | -12.03 | 26.62 | -16.80 | 37.99 | 51.02 | 64.75 | 54.11 | 57.87 | 47.31 | -5.86 | 20.66 | 26.83 | 30.24 | 33.76 | 37.02 | 34.23 | 25.37 | 21.46 | 12.38 | 4.89 | 15.32 | 16.56 | 16.19 | 2.24 | 12.05 | 12.30 | 16.34 | 9.70 | 13.39 | 7.59 | 14.19 | 4.69 | 9.54 | 10.87 | 15.25 | 9.54 | 11.62 | 0.01 | 8.98 | 4.76 | 12.85 | 8.95 | 8.07 | 7.36 | 18.92 | 16.04 | 7.65 | -2.73 | 10.04 | NA | |

| Net Income Loss Available To Common Stockholders Basic | 20.72 | 24.71 | 51.08 | 33.87 | 33.47 | 54.61 | 43.67 | 45.12 | 56.62 | 56.78 | 74.82 | 56.20 | 44.27 | -14.46 | 9.92 | 28.27 | 29.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 7.26 | 11.26 | 8.30 | NA | 6.60 | 6.41 | 5.06 | |

| Interest Income Expense After Provision For Loan Loss | 82.72 | 85.42 | 118.84 | 95.84 | 94.07 | 102.90 | 99.82 | 103.68 | 114.83 | 112.25 | 139.31 | 104.32 | 90.48 | 42.83 | 39.87 | 63.93 | 65.27 | 64.55 | 66.88 | 62.74 | 65.70 | 62.09 | 60.89 | 42.97 | 41.76 | 41.00 | 40.06 | 38.40 | 36.95 | 33.77 | 34.89 | 33.93 | 33.41 | 32.72 | 32.78 | 32.37 | 32.61 | 32.15 | 32.57 | 31.76 | 34.18 | 33.81 | 31.25 | 29.75 | 31.55 | 28.22 | 28.04 | 26.17 | 31.85 | 27.00 | 26.50 | 26.63 | 27.05 | 22.89 | |

| Noninterest Expense | 72.47 | 69.14 | 66.31 | 64.38 | 65.78 | 64.99 | 62.15 | 66.14 | 63.18 | 62.98 | 68.17 | 61.66 | 60.94 | 85.44 | 47.75 | 46.08 | 44.92 | 43.89 | 44.19 | 42.67 | 42.39 | 45.08 | 49.64 | 35.06 | 31.19 | 32.87 | 29.98 | 30.54 | 29.33 | 30.87 | 32.32 | 27.00 | 29.63 | 29.48 | 29.24 | 30.48 | 28.63 | 34.14 | 27.55 | 29.30 | 26.89 | 27.51 | 27.82 | 27.22 | 27.17 | 28.86 | 26.68 | 27.32 | 25.85 | 25.84 | 26.06 | 26.20 | 25.14 | 24.76 | |

| Noninterest Income | 17.39 | 17.18 | 15.95 | 14.30 | 16.88 | 35.24 | 20.59 | 22.54 | 24.39 | 26.26 | 28.87 | 32.23 | 29.39 | 22.92 | 18.17 | 19.22 | 18.57 | 16.56 | 16.97 | 14.03 | 15.03 | 14.87 | 17.12 | 12.29 | 12.75 | 13.57 | 12.63 | 12.34 | 12.58 | 12.75 | 13.36 | 12.24 | 12.39 | 12.11 | 13.16 | 11.34 | 12.59 | 11.69 | 11.25 | 11.65 | 11.22 | 12.21 | 12.42 | 12.25 | 12.24 | 11.49 | 10.97 | 11.37 | 11.34 | 10.80 | 9.99 | 11.72 | 10.54 | 10.67 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

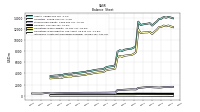

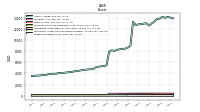

| Assets | 14135.08 | 13994.55 | 14129.01 | 13833.12 | 13765.60 | 13303.01 | 12967.42 | 12590.73 | 13017.46 | 12925.58 | 12873.37 | 12798.43 | 12678.13 | 13290.45 | 8929.60 | 8629.00 | 8437.54 | 8398.52 | 8327.90 | 8243.27 | 8034.56 | 8152.60 | 7894.92 | 5446.68 | 5334.79 | 5270.52 | 5201.16 | 5091.38 | 4810.61 | 4739.45 | 4716.61 | 4655.38 | 4611.03 | 4507.37 | 4401.38 | 4397.13 | 4248.73 | 4234.34 | 4169.00 | 4106.10 | 4052.97 | 4072.62 | 3932.03 | 3955.21 | 3887.43 | 3855.18 | 3668.27 | 3711.37 | 3626.04 | 3612.02 | NA | 3519.39 | NA | NA | |

| Liabilities | 12597.17 | 12455.51 | 12592.14 | 12349.35 | 12313.74 | 11825.84 | 11478.51 | 11071.05 | 11471.40 | 11363.30 | 11361.67 | 11328.47 | 11253.38 | 11900.35 | 7813.27 | 7496.03 | 7297.50 | 7279.07 | 7232.05 | 7175.37 | 6991.85 | 7126.25 | 6880.31 | 4882.86 | 4770.31 | 4715.84 | 4656.90 | 4557.81 | 4273.96 | 4209.97 | 4194.22 | 4130.95 | 4087.44 | 3988.49 | 3879.61 | 3875.38 | 3726.33 | 3717.07 | 3658.61 | 3606.74 | 3559.09 | 3586.97 | 3443.08 | 3471.69 | 3405.62 | 3383.71 | 3216.36 | 3265.26 | 3185.25 | 3188.33 | NA | 3111.82 | NA | NA | |

| Liabilities And Stockholders Equity | 14135.08 | 13994.55 | 14129.01 | 13833.12 | 13765.60 | 13303.01 | 12967.42 | 12590.73 | 13017.46 | 12925.58 | 12873.37 | 12798.43 | 12678.13 | 13290.45 | 8929.60 | 8629.00 | 8437.54 | 8398.52 | 8327.90 | 8243.27 | 8034.56 | 8152.60 | 7894.92 | 5446.68 | 5334.79 | 5270.52 | 5201.16 | 5091.38 | 4810.61 | 4739.45 | 4716.61 | 4655.38 | 4611.03 | 4507.37 | 4401.38 | 4397.13 | 4248.73 | 4234.34 | 4169.00 | 4106.10 | 4052.97 | 4072.62 | 3932.03 | 3955.21 | 3887.43 | 3855.18 | 3668.27 | 3711.37 | 3626.04 | 3612.02 | NA | 3519.39 | NA | NA | |

| Stockholders Equity | 1537.91 | 1539.03 | 1536.87 | 1483.77 | 1451.86 | 1477.17 | 1488.91 | 1519.68 | 1546.06 | 1562.28 | 1511.69 | 1469.95 | 1424.75 | 1390.09 | 1116.33 | 1132.97 | 1140.04 | 1119.44 | 1095.85 | 1067.90 | 1042.72 | 1026.35 | 1014.61 | 563.82 | 564.48 | 554.68 | 544.26 | 533.57 | 536.65 | 529.48 | 522.39 | 524.43 | 523.59 | 518.87 | 521.77 | 521.75 | 522.40 | 517.27 | 510.39 | 499.36 | 493.88 | 485.64 | 488.95 | 483.51 | 481.81 | 471.46 | 451.92 | 446.11 | 440.79 | 423.68 | 409.08 | 407.57 | 451.72 | 483.68 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 717.59 | 430.13 | 495.71 | 192.23 | 258.81 | 221.28 | 552.83 | 420.02 | 1114.63 | 630.49 | 228.62 | 297.00 | 224.88 | 834.72 | 261.11 | 146.10 | 209.94 | 231.68 | 133.65 | 101.48 | 78.58 | 294.77 | 219.42 | 112.50 | 102.18 | 76.94 | 101.87 | 134.12 | NA | NA | NA | 72.88 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | NA | NA | NA | 22.21 | NA | NA | NA | 21.16 | NA | NA | NA | 13.26 | NA | NA | NA | 10.16 | NA | NA | NA | 10.16 | NA | NA | NA | 10.16 | NA | NA | NA | 10.16 | NA | NA | NA | 9.95 | NA | NA | NA | 9.95 | NA | NA | NA | 9.95 | NA | NA | NA | 9.95 | NA | NA | NA | 9.95 | NA | NA | NA | NA | NA | NA | |

| Machinery And Equipment Gross | NA | NA | NA | 58.51 | NA | NA | NA | 48.89 | NA | NA | NA | 49.61 | NA | NA | NA | 46.47 | NA | NA | NA | 44.80 | NA | NA | NA | 37.45 | NA | NA | NA | 35.15 | NA | NA | NA | 31.42 | NA | NA | NA | 37.76 | NA | NA | NA | 39.76 | NA | NA | NA | 38.51 | NA | NA | NA | 39.68 | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.57 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | NA | NA | NA | 1259.94 | 1465.90 | 1429.56 | 1441.03 | 1427.88 | 1348.02 | 1357.20 | NA | NA | 1072.77 | 893.70 | 900.46 | 925.96 | 936.77 | 926.15 | 942.26 | 976.66 | 729.29 | 755.86 | 779.87 | 812.87 | 732.33 | 654.42 | 699.26 | 703.65 | 590.83 | 606.90 | 625.10 | 656.99 | 671.49 | 691.38 | 720.16 | 735.55 | 750.56 | NA | NA | NA | 824.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 149.91 | NA | NA | NA | 140.25 | NA | NA | NA | 133.65 | NA | NA | NA | 127.44 | NA | NA | NA | 124.58 | NA | NA | NA | 111.89 | NA | NA | NA | 107.53 | NA | NA | NA | 102.73 | NA | NA | NA | 110.93 | NA | NA | NA | 110.65 | NA | NA | NA | 109.92 | NA | NA | NA | 110.58 | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 82.84 | NA | NA | NA | 80.56 | NA | NA | NA | 75.93 | NA | NA | NA | 68.83 | NA | NA | NA | 62.64 | NA | NA | NA | 57.13 | NA | NA | NA | 53.97 | NA | NA | NA | 49.52 | NA | NA | NA | 61.53 | NA | NA | NA | 64.73 | NA | NA | NA | 61.59 | NA | NA | NA | 62.10 | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 1.25 | 1.27 | 1.31 | 1.41 | 1.43 | 1.47 | 1.51 | 1.61 | 1.64 | 1.66 | 1.70 | 1.66 | 1.97 | 2.00 | 0.60 | 0.48 | 0.49 | 0.48 | 0.49 | 0.54 | 0.54 | 0.54 | 0.54 | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 | 0.03 | 0.03 | 0.03 | 0.05 | 0.11 | 0.11 | 0.11 | 0.11 | 0.12 | 0.22 | 0.37 | 0.46 | 0.46 | 0.46 | 0.46 | 0.48 | 0.48 | 0.47 | 0.46 | 0.46 | 0.46 | 0.46 | 0.46 | 0.47 | 0.49 | 0.50 | |

| Property Plant And Equipment Net | 72.31 | 71.20 | 69.23 | 67.07 | 64.70 | 63.24 | 61.43 | 59.69 | 58.36 | 55.59 | 55.36 | 57.72 | 58.74 | 59.39 | 57.62 | 58.62 | 59.49 | 60.37 | 61.00 | 61.94 | 62.10 | 62.27 | 60.35 | 54.76 | 54.11 | 53.23 | 53.35 | 53.56 | 53.36 | 53.05 | 53.31 | 53.21 | 52.57 | 51.61 | 51.30 | 49.40 | 45.84 | 45.30 | 45.64 | 45.92 | 46.66 | 46.90 | 47.70 | 48.33 | 48.78 | 49.24 | 48.75 | 48.48 | 48.75 | 48.92 | NA | 49.00 | NA | NA | |

| Goodwill | 363.44 | 363.44 | 363.44 | 363.44 | 363.44 | 363.44 | 370.22 | 370.22 | 370.22 | 370.22 | 370.22 | 370.22 | 370.55 | 370.55 | 369.71 | 347.15 | 347.15 | 347.15 | 347.15 | 347.15 | 345.42 | 346.31 | 342.91 | 85.77 | 85.77 | 85.77 | 85.77 | 85.77 | 85.77 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.17 | 84.81 | 84.81 | 81.89 | 81.89 | 76.82 | 76.82 | 76.82 | 76.82 | NA | 76.82 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 16.04 | 17.28 | 18.55 | 19.86 | 21.26 | 22.69 | 24.41 | 25.92 | 27.53 | 29.16 | 30.82 | 32.52 | 34.17 | 36.14 | 19.78 | 7.84 | 8.32 | 8.81 | 9.30 | 9.79 | 10.33 | 10.87 | 11.41 | 0.58 | 0.60 | 0.63 | 0.65 | 0.68 | 0.72 | 0.08 | 0.10 | 0.14 | 0.19 | 0.30 | 0.40 | 0.51 | 0.62 | 0.74 | 0.96 | 1.33 | 1.79 | 2.24 | 2.70 | 3.16 | 3.64 | 4.02 | 4.27 | 4.73 | 5.20 | 5.66 | NA | 6.58 | NA | NA | |

| Finite Lived Intangible Assets Net | 16.04 | 17.28 | 18.55 | 19.86 | 21.26 | 22.69 | 24.41 | 25.92 | 27.53 | 29.16 | 30.82 | 32.52 | NA | NA | NA | NA | 34.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.57 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 47.05 | 39.15 | 34.80 | 39.33 | 39.62 | 23.42 | 9.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.88 | 0.73 | 2.47 | 0.88 | 2.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 194.41 | 208.66 | 219.42 | 220.12 | 226.03 | 250.91 | 275.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 211.70 | 220.22 | 217.88 | 221.69 | 222.26 | 223.13 | 224.31 | 220.69 | 216.01 | 220.05 | 220.84 | 216.42 | 222.02 | 213.24 | 169.40 | 157.75 | 184.17 | 193.43 | 103.05 | NA | 104.12 | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | NA | NA | 1374.10 | 1326.33 | 1466.35 | 1419.02 | 1422.26 | 1418.93 | 1310.16 | 1323.18 | NA | NA | 1067.39 | 885.80 | 893.45 | 926.12 | 945.74 | 947.48 | 958.10 | 988.26 | 728.15 | 748.80 | 772.93 | 808.66 | 729.62 | 634.84 | 677.04 | 683.88 | 579.94 | 589.93 | 611.86 | 638.95 | 658.08 | NA | NA | NA | 749.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 47.05 | 39.15 | 34.80 | 39.33 | 39.62 | 23.42 | 9.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.88 | 0.73 | 2.47 | 0.88 | 2.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 241.46 | 247.81 | 254.22 | 259.45 | 265.65 | 274.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 1722.48 | NA | NA | NA | 1002.13 | NA | NA | NA | 1208.91 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 11151.01 | 10958.92 | 11075.99 | 10953.42 | 10749.49 | 10969.46 | 10852.79 | 10624.73 | 10987.40 | 10866.47 | 10677.75 | 10033.07 | 9964.97 | 10076.83 | 6593.87 | 6440.32 | 6493.90 | 6389.75 | 6224.52 | 5914.88 | 5898.39 | 5837.83 | 5627.21 | 3963.66 | 3955.79 | 3885.45 | 3799.20 | 3577.54 | 3537.16 | 3510.14 | 3412.31 | 3263.73 | 3275.67 | 3247.35 | 3109.89 | 3066.51 | 3028.79 | 3038.67 | 2959.20 | 2877.22 | 2916.47 | 2926.65 | 2919.21 | 2913.03 | 2880.26 | 2852.05 | 2681.07 | 2656.52 | 2640.32 | 2657.86 | NA | 2549.87 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | 1372.98 | 1242.17 | 1416.34 | 730.65 | 500.79 | 313.80 | 320.14 | 367.71 | 516.36 | 1149.32 | 1137.22 | 1670.75 | NA | 936.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

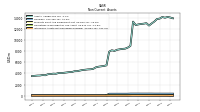

| Stockholders Equity | 1537.91 | 1539.03 | 1536.87 | 1483.77 | 1451.86 | 1477.17 | 1488.91 | 1519.68 | 1546.06 | 1562.28 | 1511.69 | 1469.95 | 1424.75 | 1390.09 | 1116.33 | 1132.97 | 1140.04 | 1119.44 | 1095.85 | 1067.90 | 1042.72 | 1026.35 | 1014.61 | 563.82 | 564.48 | 554.68 | 544.26 | 533.57 | 536.65 | 529.48 | 522.39 | 524.43 | 523.59 | 518.87 | 521.77 | 521.75 | 522.40 | 517.27 | 510.39 | 499.36 | 493.88 | 485.64 | 488.95 | 483.51 | 481.81 | 471.46 | 451.92 | 446.11 | 440.79 | 423.68 | 409.08 | 407.57 | 451.72 | 483.68 | |

| Common Stock Value | 44.90 | 44.86 | 44.71 | 44.66 | 44.64 | 44.63 | 45.16 | 45.12 | 46.12 | 47.31 | 47.19 | 47.06 | 47.03 | 47.00 | 34.16 | 34.97 | 35.63 | 35.62 | 35.56 | 35.53 | 35.52 | 35.51 | 35.46 | 24.00 | 23.99 | 23.98 | 23.93 | 23.90 | 23.89 | 23.88 | 23.83 | 24.30 | 24.43 | 24.56 | 24.73 | 25.05 | 25.08 | 25.07 | 25.04 | 24.99 | 24.98 | 24.97 | 24.95 | 24.91 | 24.90 | 24.89 | 24.14 | 24.09 | 24.08 | 24.09 | NA | 24.05 | NA | NA | |

| Additional Paid In Capital Common Stock | 741.00 | 737.74 | 735.51 | 734.27 | 732.24 | 730.28 | 752.67 | 751.07 | 799.77 | 850.55 | 849.61 | 846.92 | 845.40 | 843.88 | 562.89 | 586.62 | 609.10 | 608.01 | 607.48 | 606.57 | 605.62 | 604.63 | 604.40 | 168.19 | 167.46 | 166.71 | 166.61 | 165.87 | 164.94 | 164.04 | 163.52 | 175.59 | 178.43 | 181.50 | 186.34 | 194.65 | 194.90 | 194.25 | 193.71 | 193.44 | 192.96 | 192.33 | 191.62 | 191.69 | 191.24 | 190.73 | 177.95 | 177.83 | 177.45 | 177.30 | NA | 177.34 | NA | NA | |

| Retained Earnings Accumulated Deficit | 887.51 | 882.05 | 872.63 | 836.79 | 818.05 | 799.71 | 760.35 | 732.03 | 701.30 | 659.58 | 617.55 | 557.27 | 514.83 | 484.39 | 512.93 | 515.71 | 498.02 | 479.39 | 461.86 | 441.55 | 425.99 | 406.76 | 392.36 | 378.49 | 376.51 | 367.71 | 359.25 | 350.41 | 343.37 | 335.68 | 330.81 | 325.84 | 318.94 | 313.40 | 308.55 | 302.88 | 298.80 | 292.71 | 290.29 | 283.90 | 278.82 | 270.77 | 262.64 | 255.61 | 249.24 | 241.27 | 236.99 | 230.94 | 226.11 | 216.80 | NA | 205.10 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -135.49 | -125.62 | -115.99 | -131.95 | -143.07 | -97.45 | -69.27 | -8.54 | -1.13 | 4.83 | -2.65 | 18.70 | 17.49 | 14.82 | 6.34 | -4.33 | -2.71 | -3.56 | -9.05 | -15.75 | -24.42 | -20.56 | -17.62 | -6.86 | -3.48 | -3.71 | -5.53 | -6.61 | 4.46 | 5.89 | 4.23 | -1.30 | 1.80 | -0.59 | 2.15 | -0.82 | 3.63 | 5.23 | 1.35 | -2.97 | -2.89 | -2.42 | 9.73 | 11.31 | 16.43 | 14.58 | 12.84 | 13.25 | 13.15 | 5.48 | NA | -2.62 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.76 | 2.73 | 1.24 | 1.68 | 1.56 | 3.18 | 1.47 | 1.66 | 1.33 | 1.36 | 0.95 | 1.03 | 1.03 | 1.04 | 0.75 | 0.78 | 0.79 | 0.78 | 0.69 | 0.70 | 0.69 | 0.67 | 0.58 | 0.55 | 0.56 | 0.56 | 0.50 | 0.64 | 0.64 | 0.52 | 0.48 | 0.53 | 0.51 | 0.52 | 0.42 | 0.46 | 0.47 | 0.46 | 0.40 | 0.38 | 0.39 | 0.60 | 0.32 | 0.32 | 0.39 | 0.34 | 0.40 | 0.27 | 0.35 | 0.34 | 0.25 | 0.11 | 0.31 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 52.86 | 22.87 | 31.42 | 45.89 | 68.91 | 36.42 | 65.10 | 62.77 | 78.09 | 47.52 | 28.02 | 59.68 | 41.17 | 28.11 | 13.01 | 57.03 | 11.72 | 3.87 | 27.32 | 43.77 | 49.51 | 10.12 | 44.26 | 12.35 | 16.80 | 6.01 | 34.26 | NA | NA | NA | NA | NA | NA | 10.02 | 10.29 | 12.26 | 16.87 | 2.79 | 21.76 | 14.07 | 40.91 | 34.88 | 6.28 | 20.26 | 2.70 | 7.33 | 22.50 | 9.09 | 2.16 | 18.52 | 37.95 | 8.46 | 12.10 | NA | |

| Net Cash Provided By Used In Investing Activities | 114.91 | 72.05 | 33.64 | -127.65 | -482.61 | -673.56 | -335.38 | -322.99 | 398.96 | 328.65 | -96.37 | -57.28 | 8.07 | -993.58 | -157.40 | -291.50 | -37.29 | 55.41 | 32.11 | -194.53 | -122.26 | -177.99 | -10.23 | -109.50 | -37.99 | -91.56 | -153.29 | NA | NA | NA | NA | NA | NA | -98.15 | -16.35 | -140.07 | -40.64 | -57.09 | -24.53 | -71.70 | -32.84 | -154.92 | 26.27 | -71.05 | 104.90 | -146.50 | 56.09 | -85.47 | -46.58 | -22.87 | -44.62 | 57.49 | -11.16 | NA | |

| Net Cash Provided By Used In Financing Activities | 119.70 | -160.50 | 238.42 | 15.18 | 451.22 | 305.60 | 403.08 | -434.39 | 7.08 | 25.70 | -0.03 | 69.72 | -659.09 | 1539.08 | 259.39 | 170.63 | 3.83 | 38.75 | -27.26 | 173.66 | -143.44 | 243.22 | 72.89 | 107.47 | 46.44 | 60.62 | 86.78 | NA | NA | NA | NA | NA | NA | 96.62 | -9.01 | 132.07 | 4.93 | 48.91 | 44.55 | 51.99 | -35.51 | 142.96 | -34.37 | 57.93 | -151.17 | 159.70 | -48.60 | 77.89 | -5.47 | 46.06 | 22.55 | -82.56 | -105.38 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 52.86 | 22.87 | 31.42 | 45.89 | 68.91 | 36.42 | 65.10 | 62.77 | 78.09 | 47.52 | 28.02 | 59.68 | 41.17 | 28.11 | 13.01 | 57.03 | 11.72 | 3.87 | 27.32 | 43.77 | 49.51 | 10.12 | 44.26 | 12.35 | 16.80 | 6.01 | 34.26 | NA | NA | NA | NA | NA | NA | 10.02 | 10.29 | 12.26 | 16.87 | 2.79 | 21.76 | 14.07 | 40.91 | 34.88 | 6.28 | 20.26 | 2.70 | 7.33 | 22.50 | 9.09 | 2.16 | 18.52 | 37.95 | 8.46 | 12.10 | NA | |

| Net Income Loss | 20.75 | 24.75 | 51.25 | 33.98 | 33.58 | 54.80 | 43.94 | 45.40 | 56.98 | 57.26 | 75.46 | 56.66 | 44.64 | -14.34 | 9.99 | 28.46 | 29.38 | 28.28 | 30.32 | 25.57 | 29.23 | 24.40 | 21.66 | 8.27 | 15.09 | 14.74 | 15.11 | 13.32 | 13.47 | 10.65 | 10.81 | 12.80 | 10.99 | 10.33 | 11.22 | 9.15 | 11.14 | 6.98 | 10.93 | 9.61 | 12.09 | 12.16 | 10.56 | 9.88 | 10.99 | 7.21 | 8.48 | 7.26 | 11.26 | 8.30 | 7.29 | 8.28 | 8.48 | 6.26 | |

| Increase Decrease In Other Operating Capital Net | -0.26 | 0.27 | -0.08 | 0.41 | 0.81 | 0.29 | 2.20 | -0.87 | -0.12 | -0.54 | -0.37 | 0.26 | -1.90 | 4.04 | -5.05 | 3.06 | -1.18 | -0.17 | -0.99 | 0.02 | -1.28 | -1.96 | -0.75 | -1.65 | 0.08 | -0.95 | -2.65 | 1.14 | 1.38 | 0.14 | -0.79 | -1.56 | -0.99 | -1.01 | -1.05 | 8.25 | -0.83 | -1.11 | -1.32 | -9.34 | -1.35 | -0.41 | -1.94 | 3.36 | -3.46 | -2.13 | -1.72 | -0.24 | -1.74 | -1.64 | -2.27 | -0.45 | -1.57 | NA | |

| Deferred Income Tax Expense Benefit | -3.06 | -0.69 | 8.50 | -3.00 | -7.46 | -3.21 | 4.18 | -0.03 | 1.40 | 1.75 | 9.12 | -6.60 | -1.68 | -16.08 | -5.21 | 1.26 | -1.34 | 0.73 | 1.07 | -1.30 | 4.60 | 4.03 | -1.67 | 5.93 | 0.70 | -0.33 | -0.21 | -0.30 | 0.59 | -0.57 | 0.63 | -1.42 | 1.30 | -0.55 | 0.67 | -0.31 | 0.09 | 0.29 | 0.74 | 0.40 | -0.06 | 1.89 | 1.11 | 1.62 | 1.12 | -0.45 | 1.64 | 1.31 | 2.92 | 1.16 | 1.29 | 1.43 | 1.28 | NA | |

| Share Based Compensation | 2.76 | 2.73 | 1.24 | 1.68 | 1.56 | 3.18 | 1.47 | 1.66 | 1.33 | 1.36 | 0.95 | 1.03 | 1.03 | 1.04 | 0.75 | 0.78 | 0.79 | 0.78 | 0.69 | 0.70 | 0.69 | 0.67 | 0.58 | 0.55 | 0.56 | 0.56 | 0.50 | 0.80 | 0.35 | 0.52 | 0.48 | 0.53 | 0.51 | 0.52 | 0.42 | 0.35 | 0.25 | 0.46 | 0.40 | 0.38 | 0.39 | 0.60 | 0.32 | 0.32 | 0.39 | 0.41 | 0.33 | 0.27 | 0.35 | 0.34 | 0.25 | 0.11 | 0.31 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 114.91 | 72.05 | 33.64 | -127.65 | -482.61 | -673.56 | -335.38 | -322.99 | 398.96 | 328.65 | -96.37 | -57.28 | 8.07 | -993.58 | -157.40 | -291.50 | -37.29 | 55.41 | 32.11 | -194.53 | -122.26 | -177.99 | -10.23 | -109.50 | -37.99 | -91.56 | -153.29 | NA | NA | NA | NA | NA | NA | -98.15 | -16.35 | -140.07 | -40.64 | -57.09 | -24.53 | -71.70 | -32.84 | -154.92 | 26.27 | -71.05 | 104.90 | -146.50 | 56.09 | -85.47 | -46.58 | -22.87 | -44.62 | 57.49 | -11.16 | NA | |

| Payments To Acquire Property Plant And Equipment | 2.58 | 3.50 | 3.83 | 4.02 | 2.95 | 4.17 | 3.44 | 4.38 | 5.03 | NA | NA | 1.64 | 1.70 | 1.00 | 0.70 | 0.88 | 1.81 | 1.39 | 1.07 | 1.86 | 1.76 | 3.95 | 2.84 | 2.85 | 2.19 | 1.26 | 1.13 | 1.55 | 1.66 | 1.14 | 1.45 | 1.83 | 2.18 | 1.51 | 3.04 | 5.02 | 1.75 | 0.94 | 0.86 | 0.48 | 0.96 | 0.37 | 0.55 | 0.71 | 0.73 | 1.65 | 1.30 | 0.92 | 0.98 | 1.14 | 0.97 | 1.89 | 0.63 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 119.70 | -160.50 | 238.42 | 15.18 | 451.22 | 305.60 | 403.08 | -434.39 | 7.08 | 25.70 | -0.03 | 69.72 | -659.09 | 1539.08 | 259.39 | 170.63 | 3.83 | 38.75 | -27.26 | 173.66 | -143.44 | 243.22 | 72.89 | 107.47 | 46.44 | 60.62 | 86.78 | NA | NA | NA | NA | NA | NA | 96.62 | -9.01 | 132.07 | 4.93 | 48.91 | 44.55 | 51.99 | -35.51 | 142.96 | -34.37 | 57.93 | -151.17 | 159.70 | -48.60 | 77.89 | -5.47 | 46.06 | 22.55 | -82.56 | -105.38 | NA | |

| Payments Of Dividends | 15.29 | 15.32 | 15.25 | 15.24 | 15.24 | 15.44 | 15.45 | 14.68 | 15.25 | 15.24 | 15.18 | 14.22 | 14.21 | 14.20 | 10.54 | 10.76 | 10.75 | 10.75 | 10.01 | 10.00 | 10.01 | 10.00 | 9.27 | 6.29 | 6.28 | 6.29 | 6.28 | 6.27 | 5.79 | 5.78 | 5.84 | 5.90 | 5.46 | 5.48 | 5.56 | 5.06 | 5.06 | 4.55 | 4.54 | 4.54 | 4.04 | 4.03 | 3.52 | 3.52 | 3.01 | 2.93 | 2.43 | 2.43 | 1.95 | 1.95 | 1.94 | 0.94 | 1.14 | NA | |

| Payments For Repurchase Of Common Stock | NA | NA | NA | 0.00 | 0.00 | NA | NA | 52.95 | NA | NA | NA | 0.00 | 0.00 | 0.00 | 25.70 | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 13.27 | 3.75 | 3.95 | 5.88 | 9.04 | 0.91 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 162.41 | 158.15 | 151.35 | 145.30 | 130.42 | 113.91 | 106.04 | 110.07 | 111.13 | 114.82 | 114.26 | 111.79 | 112.98 | 114.93 | 83.86 | 85.39 | 87.08 | 87.21 | 88.18 | 85.61 | 84.37 | 78.60 | 75.50 | 50.68 | 49.59 | 48.58 | 45.96 | 44.24 | 42.86 | 41.80 | 41.65 | 41.07 | 40.32 | 38.85 | 38.07 | 37.98 | 37.15 | 36.99 | 36.25 | 37.11 | 40.18 | 35.78 | 36.28 | 36.20 | 37.49 | 35.56 | 34.62 | 34.71 | 35.00 | 35.01 | 34.75 | 36.11 | 37.37 | 37.51 | |

| Intersegment Elimination | NA | NA | NA | -0.10 | -0.03 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.03 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Community Banking | NA | NA | NA | 145.30 | 130.42 | 113.91 | 106.04 | 110.07 | 111.13 | 114.82 | 114.26 | 111.79 | 112.98 | 114.93 | 83.86 | 85.40 | 87.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Insurance | NA | NA | NA | 0.10 | 0.02 | 0.00 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Investment Management | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Reclassification Out Of Accumulated Other Comprehensive Income, A O C I Accumulated Gain Loss Debt Securities Available For Sale Transferred To Held To Maturity Parent | -0.45 | -0.46 | -0.41 | -0.51 | -0.61 | -0.80 | -0.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |