| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 8.49 | 8.52 | 8.51 | 8.46 | 7.16 | 6.15 | 6.14 | 6.12 | 5.85 | 5.83 | 5.54 | 5.53 | 5.52 | 5.52 | 5.30 | 5.27 | 5.15 | 5.15 | 5.15 | 5.14 | 5.14 | 4.73 | 4.72 | 4.70 | 4.69 | 4.35 | 4.34 | 4.08 | 3.80 | 3.80 | 3.80 | 3.79 | 3.44 | 3.44 | 3.30 | 3.30 | 3.30 | 2.60 | 2.60 | 2.60 | 2.36 | 9.49 | 9.49 | 9.48 | 9.48 | 9.48 | 9.48 | 9.47 | 9.47 | 9.47 | 9.35 | 9.35 | |

| Earnings Per Share Basic | 0.35 | 0.37 | 0.37 | 0.15 | 0.32 | 0.48 | 0.53 | 0.34 | 0.63 | 0.40 | 0.57 | 0.61 | 0.54 | 0.42 | 0.47 | 0.01 | 0.53 | 0.50 | 0.45 | 0.44 | 0.31 | 0.35 | 0.36 | 0.38 | 0.29 | 0.33 | 0.18 | 0.20 | 0.29 | 0.24 | 0.14 | 0.11 | 0.18 | 0.13 | 0.18 | 0.18 | -0.07 | 0.12 | 0.07 | 0.09 | 1.96 | 0.47 | 0.02 | 0.01 | -0.01 | -0.01 | -0.03 | 0.00 | 0.02 | 0.02 | 0.00 | -0.12 | |

| Earnings Per Share Diluted | 0.34 | 0.37 | 0.37 | 0.15 | 0.33 | 0.47 | 0.53 | 0.33 | 0.62 | 0.40 | 0.56 | 0.60 | 0.53 | 0.42 | 0.47 | 0.01 | 0.52 | 0.49 | 0.45 | 0.44 | 0.31 | 0.34 | 0.35 | 0.38 | 0.29 | 0.32 | 0.18 | 0.20 | 0.29 | 0.24 | 0.14 | 0.11 | 0.18 | 0.13 | 0.18 | 0.18 | -0.07 | 0.12 | 0.07 | 0.09 | 1.94 | 0.46 | 0.02 | 0.01 | -0.01 | -0.01 | -0.03 | 0.00 | 0.02 | 0.02 | 0.00 | -0.12 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 147.80 | 149.87 | 148.26 | 135.17 | 105.32 | 73.97 | 69.31 | 67.12 | 64.40 | 64.42 | 60.35 | 62.30 | 65.59 | 60.49 | 64.84 | 63.44 | 62.87 | 63.09 | 62.29 | 62.29 | 59.49 | 48.71 | 46.52 | 45.26 | 43.32 | 40.40 | 38.21 | 31.89 | 32.01 | 31.93 | 29.24 | 26.03 | 25.18 | 25.28 | 21.99 | 22.02 | 21.07 | 14.62 | 14.10 | 13.80 | 13.92 | 14.76 | 14.26 | 14.03 | 14.44 | 14.37 | 14.71 | 14.77 | 15.35 | 15.31 | 15.48 | 16.50 | |

| Gain Loss On Investments | -2.44 | -0.39 | -0.18 | 0.11 | 0.02 | -0.36 | -0.30 | -0.45 | -0.38 | -0.03 | -0.06 | -0.11 | -0.02 | 0.00 | 1.23 | 0.02 | 2.54 | -0.85 | -0.47 | -0.01 | -0.42 | -0.05 | -0.05 | -0.10 | 0.11 | -0.05 | 0.02 | 0.00 | 0.01 | 0.23 | 0.05 | 0.09 | 0.00 | 0.16 | 0.00 | 0.00 | 0.11 | 0.34 | 0.00 | 0.02 | 0.00 | 0.28 | 0.11 | 0.03 | 0.58 | 0.05 | 3.62 | 3.37 | 1.08 | 0.14 | 0.00 | 0.00 | |

| Interest Expense | 66.04 | 60.54 | 47.32 | 26.84 | 7.40 | 3.12 | 2.10 | 1.71 | 1.65 | 1.89 | 1.96 | 2.72 | 3.89 | 4.64 | 5.95 | 9.81 | 10.53 | 11.88 | 12.10 | 11.70 | 10.07 | 7.59 | 6.50 | 5.71 | 5.12 | 4.33 | 3.24 | 2.61 | 2.27 | 2.17 | 2.09 | 1.95 | 1.81 | 1.81 | 1.70 | 1.61 | 1.54 | 1.26 | 1.26 | 1.29 | 1.34 | 1.36 | 1.40 | 1.46 | 1.60 | 1.87 | 2.30 | 2.71 | 3.08 | 3.41 | 3.75 | 3.92 | |

| Interest Income Expense Net | 110.82 | 119.31 | 126.96 | 131.15 | 119.71 | 88.28 | 81.65 | 76.52 | 72.29 | 71.32 | 65.80 | 66.61 | 68.79 | 63.50 | 67.27 | 63.18 | 61.76 | 60.95 | 60.14 | 60.77 | 59.98 | 51.56 | 50.21 | 49.76 | 48.23 | 45.75 | 44.16 | 38.16 | 37.42 | 37.45 | 34.49 | 30.22 | 29.10 | 29.01 | 25.67 | 25.71 | 24.73 | 17.23 | 16.73 | 16.22 | 16.28 | 16.82 | 16.11 | 16.00 | 16.21 | 15.95 | 16.01 | 16.64 | 16.97 | 16.87 | 16.54 | 16.32 | |

| Interest Paid Net | 66.30 | 56.94 | 44.53 | 23.46 | 6.84 | 3.13 | 2.11 | 1.67 | 1.64 | 1.87 | 2.77 | 3.69 | 3.71 | 4.08 | 5.50 | 10.26 | 10.88 | 12.05 | 11.78 | 11.42 | 9.35 | 7.03 | 6.39 | 5.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 8.26 | 9.08 | 10.19 | 2.70 | 7.79 | 9.12 | 8.89 | 5.83 | 8.34 | 7.05 | 8.79 | 10.16 | 8.79 | 6.99 | 7.19 | -0.15 | 8.10 | 8.45 | 6.91 | 6.41 | 4.93 | 4.36 | 5.19 | 5.78 | 20.37 | 7.93 | 3.94 | 4.09 | 5.29 | 4.32 | 2.85 | 2.44 | 3.73 | 2.70 | 3.56 | 3.54 | -0.63 | 2.26 | 1.46 | 1.45 | 1.26 | -41.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | |

| Income Taxes Paid Net | 2.00 | -14.00 | 6.07 | 0.01 | 10.00 | 10.00 | NA | NA | 2.69 | 10.50 | NA | NA | 6.00 | 18.22 | 3.49 | 0.00 | 2.50 | 7.50 | 6.00 | 0.00 | 4.00 | 3.00 | 5.00 | 1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | -0.48 | |

| Net Income Loss | 29.54 | 31.41 | 31.25 | 11.83 | 23.93 | 29.24 | 32.76 | 20.59 | 36.33 | 22.94 | 31.41 | 33.72 | 29.35 | 22.63 | 25.08 | 0.71 | 27.18 | 25.61 | 23.25 | 22.70 | 15.96 | 16.32 | 16.96 | 18.03 | 13.05 | 14.22 | 7.68 | 7.93 | 10.77 | 9.13 | 5.33 | 3.97 | 6.04 | 4.44 | 5.80 | 5.86 | -1.52 | 3.00 | 1.92 | 2.30 | 1.85 | 45.14 | 2.95 | 2.04 | 0.24 | 0.45 | -2.33 | 0.94 | 2.55 | 2.65 | 1.11 | -10.21 | |

| Comprehensive Income Net Of Tax | 81.94 | 5.97 | 13.86 | 30.43 | 23.11 | -34.45 | -17.74 | -45.45 | 24.07 | 18.41 | 31.81 | 22.75 | 30.49 | 24.56 | 37.62 | 1.00 | 21.33 | 30.65 | 32.74 | 31.55 | 21.77 | 13.80 | 12.73 | 10.02 | 10.70 | 15.03 | 11.18 | 9.96 | -0.57 | 8.83 | 10.88 | 8.77 | 2.11 | 5.75 | 4.18 | 8.71 | -1.05 | 1.42 | 5.90 | 4.94 | -1.48 | 43.27 | -4.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 106.83 | 116.61 | 127.73 | 99.55 | 105.58 | 83.61 | 80.83 | 69.97 | 76.23 | 66.23 | 70.66 | 72.33 | 66.89 | 64.35 | 59.66 | 33.66 | 56.96 | 58.70 | 57.59 | 59.38 | 57.64 | 45.79 | 47.68 | 48.68 | 45.96 | 45.07 | 42.76 | 36.86 | 36.42 | 36.90 | 33.83 | 30.02 | 28.73 | 28.02 | 24.81 | 25.28 | 24.61 | 18.65 | 18.17 | 16.96 | 15.79 | 15.63 | 15.55 | 15.05 | 15.07 | 15.05 | 9.55 | 14.34 | 16.54 | 16.87 | 15.64 | 12.35 | |

| Noninterest Expense | 86.37 | 93.92 | 107.86 | 107.47 | 91.51 | 61.36 | 56.15 | 58.92 | 50.26 | 55.27 | 45.78 | 46.12 | 43.68 | 51.67 | 42.40 | 47.80 | 38.06 | 38.58 | 41.00 | 43.10 | 49.46 | 37.40 | 38.25 | 37.16 | 39.18 | 34.36 | 41.62 | 34.75 | 30.30 | 33.44 | 34.81 | 32.34 | 27.17 | 29.13 | 24.29 | 23.19 | 34.01 | 19.89 | 20.68 | 18.78 | 18.65 | 18.50 | 19.04 | 18.96 | 19.79 | 20.33 | 20.72 | 21.71 | 19.96 | 19.06 | 19.07 | 27.74 | |

| Noninterest Income | 17.34 | 17.79 | 21.58 | 22.45 | 17.65 | 16.10 | 16.96 | 15.37 | 18.71 | 19.03 | 15.32 | 17.67 | 14.93 | 16.95 | 15.01 | 14.69 | 16.38 | 13.94 | 13.58 | 12.84 | 12.71 | 12.29 | 12.72 | 12.30 | 26.64 | 11.43 | 10.49 | 9.90 | 9.93 | 9.99 | 9.16 | 8.72 | 8.20 | 8.24 | 8.85 | 7.31 | 7.25 | 6.49 | 5.90 | 5.58 | 5.97 | 6.37 | 6.45 | 5.96 | 4.95 | 5.73 | 8.83 | 8.31 | 5.97 | 4.84 | 4.55 | 5.19 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

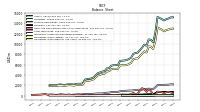

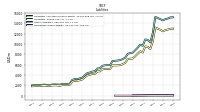

| Assets | 14580.25 | 14823.01 | 15041.93 | 15255.41 | 12145.76 | 10345.24 | 10811.70 | 10904.82 | 9681.43 | 9893.50 | 9316.83 | 8811.82 | 8342.39 | 8287.84 | 8084.01 | 7352.89 | 7108.51 | 6890.65 | 6824.89 | 6783.39 | 6747.66 | 5930.93 | 5922.68 | 5903.10 | 5810.13 | 5340.30 | 5281.30 | 4769.77 | 4680.93 | 4513.93 | 4381.20 | 4001.32 | 3534.78 | 3378.11 | 3233.59 | 3231.96 | 3093.34 | 2361.81 | 2294.16 | 2315.99 | 2268.94 | 2149.78 | 2183.68 | 2202.05 | 2173.93 | 2081.69 | 2106.51 | 2169.07 | 2137.38 | 2051.04 | 2082.86 | 2016.38 | |

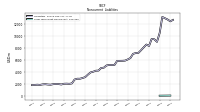

| Liabilities | 12472.16 | 12774.61 | 12987.90 | 13204.32 | 10537.99 | 9057.43 | 9482.13 | 9548.53 | 8370.70 | 8602.98 | 8134.49 | 7656.47 | 7211.99 | 7189.50 | 7053.41 | 6361.11 | 6122.87 | 5927.97 | 5894.65 | 5886.97 | 5883.39 | 5198.10 | 5206.52 | 5201.24 | 5120.47 | 4745.86 | 4703.92 | 4267.28 | 4245.53 | 4078.41 | 3955.78 | 3587.53 | 3181.33 | 3027.83 | 2906.73 | 2910.11 | 2780.68 | 2125.86 | 2059.72 | 2087.61 | 2070.34 | 1945.92 | 2022.43 | 2035.34 | 2008.38 | 1914.48 | 1941.06 | 1998.15 | 1967.30 | 1880.24 | 1911.71 | 1850.08 | |

| Liabilities And Stockholders Equity | 14580.25 | 14823.01 | 15041.93 | 15255.41 | 12145.76 | 10345.24 | 10811.70 | 10904.82 | 9681.43 | 9893.50 | 9316.83 | 8811.82 | 8342.39 | 8287.84 | 8084.01 | 7352.89 | 7108.51 | 6890.65 | 6824.89 | 6783.39 | 6747.66 | 5930.93 | 5922.68 | 5903.10 | 5810.13 | 5340.30 | 5281.30 | 4769.77 | 4680.93 | 4513.93 | 4381.20 | 4001.32 | 3534.78 | 3378.11 | 3233.59 | 3231.96 | 3093.34 | 2361.81 | 2294.16 | 2315.99 | 2268.94 | 2149.78 | 2183.68 | 2202.05 | 2173.93 | 2081.69 | 2106.51 | 2169.07 | 2137.38 | 2051.04 | 2082.86 | 2016.38 | |

| Stockholders Equity | 2108.09 | 2048.39 | 2054.03 | 2051.08 | 1607.78 | 1287.80 | 1329.58 | 1356.29 | 1310.74 | 1290.52 | 1182.35 | 1155.35 | 1130.40 | 1098.34 | 1030.60 | 991.79 | 985.64 | 962.68 | 930.24 | 896.42 | 864.27 | 732.83 | 716.16 | 701.86 | 689.66 | 594.44 | 577.38 | 502.49 | 435.40 | 435.52 | 425.43 | 413.79 | 353.45 | 350.28 | 326.86 | 321.84 | 312.65 | 235.96 | 234.44 | 228.38 | 198.60 | 203.86 | 161.25 | 166.71 | 165.55 | 167.21 | 165.45 | 170.92 | 170.08 | 170.79 | 171.15 | 166.30 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

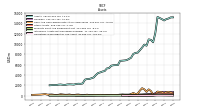

| Cash And Cash Equivalents At Carrying Value | 447.18 | 695.98 | 727.88 | 791.24 | 201.94 | 218.62 | 901.37 | 1222.52 | 737.73 | 1227.69 | 1448.85 | 979.33 | 404.09 | 309.57 | 524.32 | 314.87 | 124.53 | 132.26 | 159.78 | 204.01 | 115.95 | 105.09 | 131.52 | 135.86 | 109.50 | 125.28 | 108.20 | 144.84 | 109.64 | 167.38 | 126.80 | 148.63 | 136.07 | 100.64 | 94.75 | 199.93 | 100.54 | 58.90 | 154.03 | 218.78 | 191.62 | 108.35 | 140.12 | 227.05 | 174.99 | 172.72 | 219.63 | 272.03 | 167.08 | 116.89 | 166.89 | 211.41 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 447.18 | 695.98 | 727.88 | 791.24 | 201.94 | 218.62 | 901.37 | 1222.52 | 737.73 | 1227.69 | 1448.85 | 979.33 | 404.09 | 309.57 | 524.32 | 314.87 | 124.53 | 132.26 | 159.78 | 204.01 | 115.95 | 105.09 | 131.52 | 135.86 | 109.50 | NA | NA | NA | 109.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

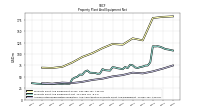

| Land | 35.59 | NA | NA | NA | 37.52 | NA | NA | NA | 23.36 | NA | NA | NA | 22.59 | NA | NA | NA | 18.55 | NA | NA | NA | 18.55 | NA | NA | NA | 18.27 | NA | NA | NA | 14.77 | NA | NA | NA | 14.84 | NA | NA | NA | 13.59 | NA | NA | NA | 8.98 | NA | NA | NA | 8.98 | NA | NA | NA | 8.88 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 181.28 | NA | NA | NA | 178.80 | NA | NA | NA | 129.85 | NA | NA | NA | 134.23 | NA | NA | NA | 120.38 | NA | NA | NA | 121.92 | NA | NA | NA | 112.79 | NA | NA | NA | 101.84 | NA | NA | NA | 93.51 | NA | NA | NA | 81.39 | NA | NA | NA | 71.78 | NA | NA | NA | 69.38 | NA | NA | NA | 69.99 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 67.98 | NA | NA | NA | 61.91 | NA | NA | NA | 57.45 | NA | NA | NA | 59.11 | NA | NA | NA | 53.77 | NA | NA | NA | 50.90 | NA | NA | NA | 45.90 | NA | NA | NA | 43.16 | NA | NA | NA | 38.93 | NA | NA | NA | 36.31 | NA | NA | NA | 37.28 | NA | NA | NA | 34.91 | NA | NA | NA | 35.76 | NA | NA | NA | |

| Amortization Of Intangible Assets | 6.89 | 7.46 | 7.65 | 6.73 | 4.76 | 1.45 | 1.45 | 1.45 | 1.30 | 1.31 | 1.21 | 1.21 | 1.42 | 1.50 | 1.48 | 1.46 | 1.46 | 1.46 | 1.46 | 1.46 | 1.30 | 1.00 | 1.00 | 0.99 | 0.96 | 0.84 | 0.84 | 0.72 | 0.72 | 0.73 | 0.59 | 0.45 | 0.40 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

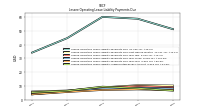

| Property Plant And Equipment Net | 113.30 | 115.75 | 116.96 | 116.52 | 116.89 | 81.65 | 74.78 | 74.62 | 72.40 | 71.25 | 69.39 | 70.39 | 75.12 | 76.39 | 69.04 | 71.54 | 66.61 | 67.87 | 68.74 | 70.41 | 71.02 | 63.53 | 63.99 | 64.58 | 66.88 | 57.09 | 56.77 | 58.61 | 58.68 | 59.03 | 63.82 | 61.42 | 54.58 | 54.90 | 50.03 | 48.19 | 45.09 | 34.81 | 34.65 | 35.06 | 34.51 | 34.65 | 35.03 | 34.62 | 34.47 | 34.88 | 35.04 | 34.15 | 34.23 | 34.60 | 34.89 | 36.05 | |

| Goodwill | 732.42 | 731.97 | 732.91 | 728.40 | 480.32 | 286.61 | 286.61 | 286.61 | 252.15 | 252.15 | 221.18 | 221.18 | 221.18 | 221.18 | 212.15 | 212.09 | 205.29 | 205.29 | 205.26 | 205.26 | 204.75 | 148.56 | 148.56 | 148.56 | 147.58 | 101.75 | 101.74 | 64.65 | 64.65 | 64.65 | 64.12 | 55.20 | 25.21 | 25.86 | 25.21 | 25.22 | 25.31 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 95.64 | 102.40 | 109.72 | 117.41 | 75.45 | 18.58 | 20.06 | 21.55 | 14.85 | 16.15 | 14.11 | 15.38 | 16.75 | 18.16 | 17.95 | 19.46 | 20.07 | 21.32 | 22.67 | 23.96 | 25.98 | 16.51 | 17.32 | 18.25 | 19.10 | 16.10 | 16.94 | 13.85 | 14.57 | 15.29 | 16.15 | 11.52 | 8.59 | 8.99 | 6.82 | 7.14 | 7.45 | 0.13 | 0.33 | 0.52 | 0.72 | 0.91 | 1.11 | 1.30 | 1.50 | 1.70 | 1.89 | 2.09 | 2.29 | 2.50 | 2.71 | 3.14 | |

| Finite Lived Intangible Assets Net | 91.70 | NA | NA | NA | 71.28 | NA | NA | NA | 13.00 | NA | NA | NA | 14.58 | NA | NA | NA | 18.30 | NA | NA | NA | 24.81 | NA | NA | NA | 18.94 | NA | NA | NA | 14.57 | NA | NA | NA | 8.59 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 121.95 | 154.19 | 130.23 | 119.14 | 129.73 | 129.33 | 88.73 | 52.91 | 15.07 | 12.74 | 9.88 | 17.13 | 0.12 | 0.02 | 0.01 | 0.60 | 1.87 | 1.50 | 1.76 | 4.50 | 8.33 | 13.71 | 11.65 | 9.41 | 4.21 | 2.56 | 2.58 | 3.51 | 4.37 | 0.98 | 3.63 | 4.00 | 1.87 | 0.57 | 0.43 | 0.32 | -0.62 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 558.40 | 537.20 | 577.60 | 618.80 | 617.70 | 645.40 | 706.20 | 709.50 | 627.40 | 518.50 | 489.30 | 500.70 | 192.20 | 216.00 | 235.95 | 261.22 | 262.21 | 276.07 | 288.45 | 291.34 | 349.89 | 353.92 | 370.79 | 391.87 | 414.47 | 374.96 | 397.36 | 378.23 | 369.88 | 397.26 | 404.57 | 198.82 | 202.81 | 212.36 | 216.18 | 226.51 | 208.79 | NA | NA | NA | 0.00 | NA | NA | 0.00 | 13.82 | 15.56 | 17.12 | 18.80 | 19.98 | 24.57 | 25.16 | 26.86 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 121.95 | 154.19 | 130.23 | 119.14 | 129.73 | 129.33 | 88.73 | 52.91 | 15.07 | 12.74 | 9.88 | 17.13 | 0.12 | 0.02 | 0.01 | 0.60 | 1.87 | 1.50 | 1.76 | 4.50 | 8.33 | 13.71 | 11.65 | 9.41 | 4.21 | 2.56 | 2.58 | 3.51 | 4.37 | 0.98 | 3.63 | 4.00 | 1.87 | 0.57 | 0.43 | 0.32 | -0.62 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 680.31 | 691.40 | 707.81 | 737.91 | 747.41 | 774.71 | 794.78 | 747.00 | 638.64 | 526.50 | 493.47 | NA | 184.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 11776.93 | 12107.83 | 12283.27 | 12309.70 | 9981.59 | 8765.41 | 9188.95 | 9243.77 | 8067.59 | 8334.17 | 7836.44 | 7385.75 | 6932.56 | 6914.84 | 6666.78 | 5887.50 | 5584.75 | 5673.14 | 5541.21 | 5605.58 | 5177.24 | 4643.51 | 4697.44 | 4719.54 | 4592.72 | 4112.60 | 3975.46 | 3678.64 | 3523.24 | 3510.49 | 3501.32 | 3222.45 | 2844.39 | 2742.30 | 2605.18 | 2609.82 | 2416.53 | 1808.55 | 1805.54 | 1819.80 | 1806.05 | 1698.91 | 1738.61 | 1762.16 | 1758.96 | 1679.47 | 1689.58 | 1737.46 | 1718.74 | 1661.27 | 1681.46 | 1637.23 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt Noncurrent | 106.30 | NA | NA | NA | 84.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

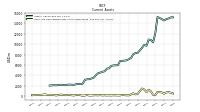

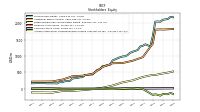

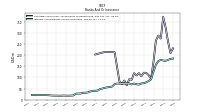

| Stockholders Equity | 2108.09 | 2048.39 | 2054.03 | 2051.08 | 1607.78 | 1287.80 | 1329.58 | 1356.29 | 1310.74 | 1290.52 | 1182.35 | 1155.35 | 1130.40 | 1098.34 | 1030.60 | 991.79 | 985.64 | 962.68 | 930.24 | 896.42 | 864.27 | 732.83 | 716.16 | 701.86 | 689.66 | 594.44 | 577.38 | 502.49 | 435.40 | 435.52 | 425.43 | 413.79 | 353.45 | 350.28 | 326.86 | 321.84 | 312.65 | 235.96 | 234.44 | 228.38 | 198.60 | 203.86 | 161.25 | 166.71 | 165.55 | 167.21 | 165.45 | 170.92 | 170.08 | 170.79 | 171.15 | 166.30 | |

| Common Stock Value | 8.49 | 8.52 | 8.51 | 8.46 | 7.16 | 6.15 | 6.14 | 6.12 | 5.85 | 5.83 | 5.54 | 5.53 | 5.52 | 5.52 | 5.30 | 5.27 | 5.15 | 5.15 | 5.15 | 5.14 | 5.14 | 4.73 | 4.72 | 4.70 | 4.69 | 4.35 | 4.34 | 4.08 | 3.80 | 3.80 | 3.80 | 3.79 | 3.44 | 3.44 | 3.30 | 3.30 | 3.30 | 2.60 | 2.60 | 2.60 | 2.36 | 9.49 | 9.49 | 9.48 | 9.48 | 9.48 | 9.48 | 9.47 | 9.47 | 9.47 | 9.35 | 9.35 | |

| Additional Paid In Capital | 1808.88 | 1813.07 | 1809.43 | 1803.90 | 1377.80 | NA | NA | NA | 963.85 | NA | NA | NA | 856.09 | NA | NA | NA | 786.24 | NA | NA | NA | 778.50 | NA | NA | NA | 661.63 | NA | NA | NA | 454.00 | NA | NA | NA | 399.16 | NA | NA | NA | 379.25 | NA | NA | NA | 277.29 | NA | NA | NA | 222.85 | NA | NA | NA | 218.93 | NA | NA | 218.40 | |

| Retained Earnings Accumulated Deficit | 467.31 | 453.12 | 437.09 | 421.27 | 423.86 | NA | NA | NA | 358.60 | NA | NA | NA | 256.70 | NA | NA | NA | 195.81 | NA | NA | NA | 97.07 | NA | NA | NA | 29.91 | NA | NA | NA | -13.66 | NA | NA | NA | -42.86 | NA | NA | NA | -65.00 | NA | NA | NA | -70.69 | NA | NA | NA | -118.61 | NA | NA | NA | -114.15 | NA | NA | -112.65 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -159.88 | -212.27 | -186.82 | -169.43 | -188.03 | NA | NA | NA | -6.99 | NA | NA | NA | 20.37 | NA | NA | NA | 4.46 | NA | NA | NA | -13.06 | NA | NA | NA | -4.22 | NA | NA | NA | -7.51 | NA | NA | NA | -6.21 | NA | NA | NA | -4.83 | NA | NA | NA | -10.34 | NA | NA | NA | 3.14 | NA | NA | NA | 5.23 | NA | NA | 1.83 | |

| Treasury Stock Value | 16.71 | 14.04 | 14.17 | 13.11 | 13.02 | NA | NA | NA | 10.57 | NA | NA | NA | 8.29 | NA | NA | NA | 6.03 | NA | NA | NA | 3.38 | NA | NA | NA | 2.36 | NA | NA | NA | 1.24 | NA | NA | NA | 0.07 | NA | NA | NA | 0.07 | NA | NA | NA | 0.01 | NA | NA | NA | 0.06 | NA | NA | NA | 0.01 | NA | NA | 0.00 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 3.15 | 3.19 | 4.45 | 2.64 | 4.54 | 2.50 | 2.70 | 1.42 | 2.06 | 2.36 | 2.50 | 1.76 | 1.83 | 1.95 | 1.52 | 2.00 | 1.47 | 1.75 | 1.90 | 2.13 | 2.22 | 1.98 | 2.17 | 1.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

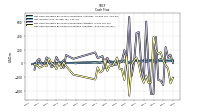

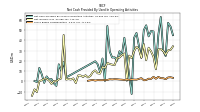

| Net Cash Provided By Used In Operating Activities | 29.88 | 62.66 | 45.03 | 13.04 | 48.50 | 49.02 | 43.81 | 54.53 | 49.81 | 23.05 | 34.62 | 47.10 | 42.37 | -12.15 | 5.74 | 24.69 | 42.44 | 25.88 | 29.34 | 20.08 | 23.42 | 23.25 | 29.05 | 53.89 | 0.47 | 22.31 | 9.37 | 16.76 | 19.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 3.93 | 18.86 | 10.39 | 16.68 | -4.28 | -1.88 | 2.34 | 1.75 | 4.89 | -1.34 | 6.97 | -0.56 | |

| Net Cash Provided By Used In Investing Activities | 39.49 | 159.38 | 135.86 | 192.72 | 383.79 | -282.02 | -288.13 | -178.52 | -283.29 | -194.81 | -19.36 | 84.95 | 39.59 | -18.50 | -472.66 | 109.06 | -242.65 | -83.78 | -79.39 | 84.48 | 10.74 | -41.62 | -34.49 | -109.24 | 59.40 | -111.75 | -134.49 | -58.73 | -236.03 | NA | NA | NA | NA | NA | NA | NA | NA | -164.84 | NA | NA | -40.84 | 16.25 | -72.44 | 7.88 | -86.78 | -17.25 | 3.62 | 71.99 | -41.27 | -26.00 | -50.52 | -25.24 | |

| Net Cash Provided By Used In Financing Activities | -318.17 | -253.94 | -244.25 | 383.54 | -448.96 | -449.76 | -76.82 | 608.77 | -256.48 | -49.39 | 454.27 | 443.18 | 12.55 | -184.11 | 676.36 | 56.60 | 192.48 | 30.38 | 5.82 | -16.50 | -23.31 | -8.06 | 1.10 | 81.70 | -75.64 | 106.53 | 88.48 | 77.16 | 158.69 | NA | NA | NA | NA | NA | NA | NA | NA | 65.82 | NA | NA | 120.19 | -66.87 | -24.88 | 27.50 | 93.32 | -27.79 | -58.36 | 31.21 | 86.58 | -22.67 | -17.10 | 35.97 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 29.88 | 62.66 | 45.03 | 13.04 | 48.50 | 49.02 | 43.81 | 54.53 | 49.81 | 23.05 | 34.62 | 47.10 | 42.37 | -12.15 | 5.74 | 24.69 | 42.44 | 25.88 | 29.34 | 20.08 | 23.42 | 23.25 | 29.05 | 53.89 | 0.47 | 22.31 | 9.37 | 16.76 | 19.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 3.93 | 18.86 | 10.39 | 16.68 | -4.28 | -1.88 | 2.34 | 1.75 | 4.89 | -1.34 | 6.97 | -0.56 | |

| Net Income Loss | 29.54 | 31.41 | 31.25 | 11.83 | 23.93 | 29.24 | 32.76 | 20.59 | 36.33 | 22.94 | 31.41 | 33.72 | 29.35 | 22.63 | 25.08 | 0.71 | 27.18 | 25.61 | 23.25 | 22.70 | 15.96 | 16.32 | 16.96 | 18.03 | 13.05 | 14.22 | 7.68 | 7.93 | 10.77 | 9.13 | 5.33 | 3.97 | 6.04 | 4.44 | 5.80 | 5.86 | -1.52 | 3.00 | 1.92 | 2.30 | 1.85 | 45.14 | 2.95 | 2.04 | 0.24 | 0.45 | -2.33 | 0.94 | 2.55 | 2.65 | 1.11 | -10.21 | |

| Deferred Income Tax Expense Benefit | 12.79 | 6.09 | 8.51 | -17.95 | -11.71 | -2.72 | 3.16 | 0.87 | 0.51 | -1.51 | 2.51 | 2.32 | 1.33 | -2.93 | -5.54 | 2.21 | 2.35 | 0.71 | 2.52 | 1.22 | -5.22 | 1.12 | -0.15 | 4.71 | 20.75 | 7.74 | 3.48 | 3.86 | 5.10 | 4.22 | 2.46 | 2.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 3.15 | 3.19 | 4.45 | 2.64 | 4.54 | 2.50 | 2.70 | 1.42 | 1.19 | 3.23 | 2.50 | 1.76 | 1.83 | 1.95 | 1.52 | 2.00 | 1.47 | 1.75 | 1.90 | 2.13 | 2.22 | 1.98 | 2.17 | 1.45 | 1.48 | 1.25 | 1.23 | 1.31 | 0.88 | 1.47 | 1.13 | 0.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 39.49 | 159.38 | 135.86 | 192.72 | 383.79 | -282.02 | -288.13 | -178.52 | -283.29 | -194.81 | -19.36 | 84.95 | 39.59 | -18.50 | -472.66 | 109.06 | -242.65 | -83.78 | -79.39 | 84.48 | 10.74 | -41.62 | -34.49 | -109.24 | 59.40 | -111.75 | -134.49 | -58.73 | -236.03 | NA | NA | NA | NA | NA | NA | NA | NA | -164.84 | NA | NA | -40.84 | 16.25 | -72.44 | 7.88 | -86.78 | -17.25 | 3.62 | 71.99 | -41.27 | -26.00 | -50.52 | -25.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -318.17 | -253.94 | -244.25 | 383.54 | -448.96 | -449.76 | -76.82 | 608.77 | -256.48 | -49.39 | 454.27 | 443.18 | 12.55 | -184.11 | 676.36 | 56.60 | 192.48 | 30.38 | 5.82 | -16.50 | -23.31 | -8.06 | 1.10 | 81.70 | -75.64 | 106.53 | 88.48 | 77.16 | 158.69 | NA | NA | NA | NA | NA | NA | NA | NA | 65.82 | NA | NA | 120.19 | -66.87 | -24.88 | 27.50 | 93.32 | -27.79 | -58.36 | 31.21 | 86.58 | -22.67 | -17.10 | 35.97 | |

| Payments For Repurchase Of Common Stock | 10.82 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |