| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 171.87 | 171.36 | 170.86 | 170.81 | 170.71 | 170.14 | 170.10 | 170.01 | 169.91 | 169.38 | 169.17 | 169.11 | 168.98 | 168.13 | 167.41 | 167.41 | 167.36 | 166.80 | 143.30 | 143.09 | 143.08 | 142.53 | 142.50 | |

| Weighted Average Number Of Diluted Shares Outstanding | 147.12 | NA | 146.74 | 146.55 | 146.73 | NA | 146.42 | 146.31 | 146.66 | NA | 147.70 | 149.75 | 149.78 | NA | 147.98 | 147.73 | 148.40 | NA | NA | 118.09 | 119.14 | 121.81 | 123.03 | |

| Weighted Average Number Of Shares Outstanding Basic | 146.43 | NA | 146.17 | 146.11 | 145.80 | NA | 145.39 | 145.33 | 145.27 | NA | 146.31 | 148.11 | 148.47 | NA | 147.31 | 147.29 | 147.31 | NA | NA | 117.24 | 118.40 | 120.90 | 122.20 | |

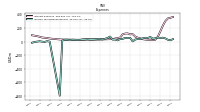

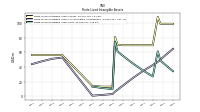

| Earnings Per Share Basic | 0.78 | 0.42 | 0.60 | 1.13 | 1.33 | 1.36 | 1.34 | 1.17 | 1.12 | 1.32 | 1.22 | 1.20 | 1.20 | 0.96 | 0.57 | 0.58 | 0.21 | 0.98 | 0.88 | 0.85 | 0.92 | 0.79 | 0.60 | |

| Earnings Per Share Diluted | 0.78 | 0.41 | 0.60 | 1.13 | 1.32 | 1.35 | 1.33 | 1.16 | 1.11 | 1.31 | 1.21 | 1.19 | 1.19 | 0.96 | 0.56 | 0.57 | 0.20 | 0.97 | 0.87 | 0.84 | 0.91 | 0.78 | 0.60 | |

| Tier One Risk Based Capital To Risk Weighted Assets | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | |

| Capital To Risk Weighted Assets | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

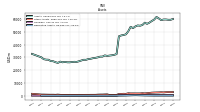

| Revenue From Contract With Customer Including Assessed Tax | 214.99 | 135.82 | 196.77 | 260.63 | 292.02 | 294.79 | 288.21 | 240.60 | 225.13 | 214.18 | 232.84 | 218.42 | 217.68 | 198.19 | 174.75 | 265.91 | 200.84 | 231.10 | 56.52 | 55.85 | 56.35 | 52.32 | 51.84 | |

| Revenues | 214.99 | 135.82 | 196.77 | 260.63 | 292.02 | 294.79 | 288.21 | 240.60 | 225.13 | 214.18 | 232.84 | 218.42 | 217.68 | 198.19 | 174.75 | 265.91 | 200.84 | 231.10 | 56.52 | 55.85 | 56.35 | 52.32 | 51.84 | |

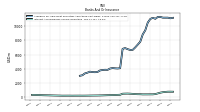

| Interest Expense | 363.86 | 351.08 | 342.88 | 303.61 | 236.13 | 153.31 | 73.38 | 28.38 | 23.81 | 25.97 | 27.59 | 30.88 | 35.96 | 47.55 | 58.56 | 75.00 | 110.64 | 106.98 | 59.46 | 52.32 | 45.26 | 35.08 | 34.41 | |

| Interest Expense Long Term Debt | 29.59 | 31.70 | 50.52 | 55.91 | 42.53 | 38.33 | 22.16 | 8.77 | 10.14 | 11.50 | 11.46 | 11.48 | 10.91 | 15.41 | 15.19 | 16.75 | 18.70 | 16.92 | 12.98 | 12.16 | 12.45 | 14.24 | 16.25 | |

| Interest Income Expense Net | 418.85 | 437.21 | 443.16 | 455.53 | 480.75 | 501.35 | 477.92 | 425.39 | 392.25 | 392.31 | 384.92 | 381.86 | 373.86 | 385.93 | 376.99 | 376.57 | 373.26 | 399.27 | 297.93 | 291.62 | 284.58 | 262.57 | 251.10 | |

| Interest Paid Net | 385.19 | 332.50 | 302.31 | 271.48 | 206.62 | 130.60 | 59.11 | 25.05 | 27.28 | 24.03 | 30.12 | 32.17 | 46.60 | 51.24 | 73.36 | 85.35 | 109.34 | 114.32 | 58.06 | 41.30 | 47.45 | NA | NA | |

| Income Tax Expense Benefit | 36.94 | 20.78 | 27.73 | 47.80 | 57.71 | 54.13 | 59.58 | 49.86 | 42.70 | 68.98 | 53.94 | 56.81 | 49.16 | 36.72 | 39.79 | 30.87 | 3.60 | 54.95 | 38.78 | 18.95 | 30.94 | 54.67 | 41.79 | |

| Income Taxes Paid Net | 28.80 | 9.67 | 2.09 | 5.83 | 52.16 | 36.12 | 51.47 | 41.60 | 46.49 | 53.49 | 35.44 | 66.78 | 48.51 | 42.58 | 68.00 | -0.66 | 0.92 | 13.30 | 0.67 | 1.72 | 38.44 | 2.43 | 8.56 | |

| Profit Loss | 124.07 | 69.57 | 96.47 | 173.94 | 202.16 | 205.77 | 203.04 | 178.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 151.68 | 105.07 | 109.06 | 111.18 | 98.01 | 76.00 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -13.07 | 81.31 | 6.96 | -22.98 | 37.75 | 12.49 | -77.16 | -37.56 | -105.28 | -31.73 | -9.03 | -4.17 | -22.37 | -7.90 | -7.40 | 6.34 | 80.41 | -5.47 | 0.00 | 0.00 | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -131.12 | 562.33 | -284.23 | -105.85 | 152.79 | 92.20 | -507.61 | -364.64 | -579.74 | -76.86 | -51.19 | 30.45 | -143.36 | -16.28 | -28.06 | -53.94 | 191.27 | -10.29 | 49.30 | -18.00 | -17.94 | 8.27 | 6.89 | |

| Net Income Loss | 124.51 | 70.34 | 97.09 | 174.11 | 202.16 | 205.77 | 203.04 | 178.05 | 171.04 | 200.40 | 186.77 | 186.20 | 187.09 | 150.41 | 91.57 | 93.19 | 38.52 | 151.68 | 105.07 | 109.06 | 111.18 | 98.01 | 76.00 | |

| Comprehensive Income Net Of Tax | -6.61 | 632.67 | -187.13 | 68.26 | 354.95 | 297.97 | -304.56 | -186.59 | -408.71 | 123.54 | 135.59 | 216.65 | 43.74 | 134.13 | 63.52 | 39.25 | 229.79 | 141.39 | 154.37 | 91.06 | 93.24 | 106.28 | 82.89 | |

| Preferred Stock Dividends Income Statement Impact | 9.69 | 9.70 | 9.67 | 8.29 | 8.29 | 8.29 | 8.29 | 8.29 | 8.29 | 8.29 | 8.29 | 8.29 | 8.29 | NA | 8.29 | 8.29 | 8.29 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 114.82 | 60.65 | 87.42 | 165.82 | 193.87 | 197.48 | 194.75 | 169.76 | 162.75 | 192.11 | 178.48 | 177.91 | 178.80 | 142.12 | 83.28 | 84.90 | 30.23 | 143.39 | 101.92 | 99.33 | 108.62 | 95.45 | 73.44 | |

| Net Income Loss Available To Common Stockholders Diluted | 114.82 | NA | NA | NA | 193.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 108.62 | 95.45 | 73.44 | |

| Interest Income Expense After Provision For Loan Loss | 364.87 | 391.74 | 370.59 | 416.65 | 448.60 | 466.46 | 452.34 | 412.70 | 380.85 | 447.52 | 392.79 | 406.46 | 392.43 | 374.87 | 333.61 | 234.72 | 214.54 | 374.80 | 285.78 | 276.64 | 272.79 | 222.89 | 240.84 | |

| Noninterest Expense | 322.74 | 352.86 | 353.53 | 307.18 | 321.85 | 309.00 | 294.01 | 282.05 | 272.45 | 295.21 | 267.03 | 270.53 | 267.13 | 302.50 | 316.65 | 284.14 | 276.28 | 266.12 | 209.92 | 220.30 | 204.06 | 205.65 | 191.75 | |

| Noninterest Income | 118.89 | 51.47 | 107.14 | 112.28 | 133.13 | 102.44 | 104.30 | 97.27 | 105.33 | 117.07 | 114.95 | 107.09 | 110.96 | 114.76 | 114.41 | 173.48 | 103.86 | 97.95 | 67.99 | 71.67 | 73.39 | 135.44 | 68.70 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

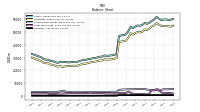

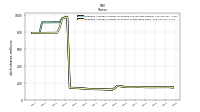

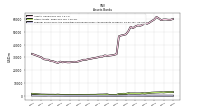

| Assets | 59835.12 | 59809.53 | 59342.93 | 60655.59 | 61840.03 | 59731.38 | 58639.52 | 57382.75 | 56419.55 | 57317.23 | 55509.13 | 54938.66 | 55159.01 | 54394.16 | 53040.54 | 54121.99 | 50619.58 | 48203.28 | 32669.19 | 32075.12 | 31740.31 | 31642.12 | 30687.97 | |

| Liabilities | 54793.48 | 54665.39 | 54781.36 | 55847.82 | 57069.89 | 55255.58 | 54409.81 | 52798.31 | 51594.91 | 52020.43 | 50256.33 | 49700.94 | 49997.29 | 49232.82 | 47976.00 | 49069.02 | 45554.38 | 43261.59 | 29535.59 | 29035.05 | 28572.61 | 28645.04 | 27690.02 | |

| Liabilities And Stockholders Equity | 59835.12 | 59809.53 | 59342.93 | 60655.59 | 61840.03 | 59731.38 | 58639.52 | 57382.75 | 56419.55 | 57317.23 | 55509.13 | 54938.66 | 55159.01 | 54394.16 | 53040.54 | 54121.99 | 50619.58 | 48203.28 | 32669.19 | 32075.12 | 31740.31 | 31642.12 | 30687.97 | |

| Stockholders Equity | 5017.92 | 5119.99 | 4536.96 | 4782.53 | 4770.13 | 4475.80 | 4229.72 | 4584.44 | 4824.64 | 5296.80 | 5252.80 | 5237.71 | 5161.72 | 5161.33 | 5064.54 | 5052.97 | 5065.20 | 4941.69 | 3133.60 | 3040.07 | 3167.69 | 2997.08 | 2997.95 | |

| Tier One Risk Based Capital | NA | 5743.67 | NA | NA | NA | 5463.34 | NA | NA | NA | 4925.76 | NA | NA | NA | 4572.01 | NA | NA | NA | 4280.60 | 3090.42 | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 2423.50 | 2451.43 | 2137.63 | 2054.15 | 3365.40 | 1977.78 | 1867.80 | 1665.06 | 1553.50 | 3009.85 | 2687.42 | 3262.68 | 3328.27 | 4252.92 | 1985.36 | 1571.22 | 1823.83 | 1186.92 | 1143.56 | 1011.93 | 1091.79 | 1738.91 | 898.22 | |

| Available For Sale Securities Debt Securities | 9694.51 | 9788.66 | 9237.19 | 9621.17 | 9732.62 | 9678.10 | 9587.51 | 9889.85 | 10463.10 | 10918.33 | 10481.07 | 9442.17 | 8825.76 | 7962.44 | 7566.52 | 7197.49 | 6937.24 | 6778.67 | 3991.63 | 3883.57 | 3929.96 | 3825.44 | 3827.06 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amortization Of Intangible Assets | NA | 3.20 | 3.00 | 2.40 | NA | 2.10 | 2.10 | 2.10 | 2.10 | 2.40 | 2.40 | 2.40 | 2.40 | 2.70 | 2.60 | 2.60 | 2.60 | 2.90 | NA | 0.29 | 0.29 | NA | NA | |

| Goodwill | 480.44 | 480.44 | 479.85 | 475.57 | 452.39 | 452.39 | 452.39 | 452.39 | 452.39 | 452.39 | 452.39 | 452.39 | 452.39 | 452.39 | 452.39 | 497.27 | 497.27 | 497.27 | 57.31 | 57.31 | 57.31 | 57.31 | 57.09 | |

| Finite Lived Intangible Assets Net | NA | 45.93 | 49.10 | 61.54 | NA | 27.12 | 29.24 | 31.36 | 33.48 | 35.60 | 37.98 | 40.35 | 42.73 | 45.11 | 47.75 | 50.39 | 53.03 | 55.67 | 9.88 | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 11152.74 | 11091.25 | 11174.75 | 11173.87 | 11175.79 | 11273.33 | 11276.70 | 11013.92 | 11157.76 | 10991.51 | 10493.84 | 9398.50 | 8828.43 | 7801.86 | 7395.27 | 6998.35 | 6656.75 | 6647.79 | 4085.91 | 4044.42 | 4066.60 | 3849.86 | 3864.90 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | 9314.08 | NA | NA | NA | 3908.15 | NA | NA | NA | 3025.02 | NA | NA | NA | 4016.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

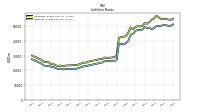

| Deposits | 50580.24 | 50739.18 | 50203.89 | 50080.39 | 49953.94 | 48871.56 | 47697.56 | 49034.70 | 48656.24 | 49427.28 | 47688.42 | 47171.96 | 47368.95 | 46691.57 | 44665.90 | 44194.58 | 39826.58 | 38405.50 | 26720.32 | 26433.66 | 26442.69 | 26186.23 | 25218.82 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 2031.73 | 1932.53 | 2704.70 | 4021.41 | 5146.25 | 4109.60 | 4434.33 | 1804.10 | 805.26 | 1204.23 | 1203.76 | 1203.29 | 1202.83 | 1202.49 | 1628.38 | 2327.92 | 3152.34 | 2153.90 | 1657.16 | 1656.91 | 1656.65 | 1882.61 | 2107.24 | |

| Minority Interest | 23.72 | 24.16 | 24.61 | 25.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

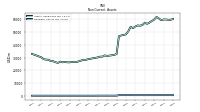

| Stockholders Equity | 5017.92 | 5119.99 | 4536.96 | 4782.53 | 4770.13 | 4475.80 | 4229.72 | 4584.44 | 4824.64 | 5296.80 | 5252.80 | 5237.71 | 5161.72 | 5161.33 | 5064.54 | 5052.97 | 5065.20 | 4941.69 | 3133.60 | 3040.07 | 3167.69 | 2997.08 | 2997.95 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 5041.64 | 5144.15 | 4561.57 | 4807.77 | 4770.13 | 4475.80 | 4229.72 | 4584.44 | 4824.64 | 5296.80 | NA | NA | NA | 5161.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Common Stock Value | 171.87 | 171.36 | 170.86 | 170.81 | 170.71 | 170.14 | 170.10 | 170.01 | 169.91 | 169.38 | 169.17 | 169.11 | 168.98 | 168.13 | 167.41 | 167.41 | 167.36 | 166.80 | 143.30 | 143.09 | 143.08 | 142.53 | 142.50 | |

| Additional Paid In Capital | 3957.58 | 3955.82 | 3940.51 | 3933.55 | 3925.45 | 3920.35 | 3916.73 | 3908.12 | 3899.27 | 3894.11 | 3883.29 | 3872.95 | 3864.28 | 3851.21 | 3832.14 | 3826.73 | 3821.36 | 3819.34 | 3060.56 | 3049.23 | 3045.01 | 3033.68 | 3029.75 | |

| Retained Earnings Accumulated Deficit | 2574.02 | 2517.23 | 2512.33 | 2480.69 | 2370.63 | 2234.77 | 2084.54 | 1940.35 | 1821.54 | 1709.98 | 1567.37 | 1436.98 | 1307.72 | 1178.02 | 1084.74 | 1050.53 | 1014.24 | 1068.33 | 843.77 | 770.81 | 700.69 | 535.00 | 457.52 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1248.19 | -1117.07 | -1679.40 | -1395.17 | -1289.33 | -1442.12 | -1534.31 | -1026.70 | -662.07 | -82.32 | -5.46 | 45.73 | 15.28 | 158.63 | 174.91 | 202.97 | 256.91 | 65.64 | -94.42 | -143.72 | -125.72 | -39.60 | -47.87 | |

| Minority Interest | 23.72 | 24.16 | 24.61 | 25.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 8.97 | 6.63 | 7.54 | 7.83 | 10.08 | 5.44 | 7.44 | 6.84 | 7.90 | 6.05 | 5.51 | 6.87 | 7.66 | 4.77 | 4.95 | 5.35 | 3.57 | 3.09 | 4.14 | 4.18 | 4.37 | 3.74 | 3.48 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

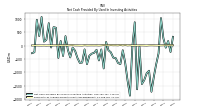

| Net Cash Provided By Used In Operating Activities | 24.08 | 266.21 | 302.31 | 359.66 | 354.44 | 580.66 | 399.84 | 29.66 | 181.33 | -49.33 | 406.82 | 416.30 | 20.23 | 225.39 | 674.63 | -902.75 | 19.76 | 256.94 | 164.91 | 139.83 | 157.88 | 239.78 | 109.02 | |

| Net Cash Provided By Used In Investing Activities | -78.34 | 276.34 | 1025.64 | -285.57 | -692.45 | -1161.69 | -1722.08 | -937.64 | -1034.07 | -1283.03 | -1433.54 | -38.07 | -1629.52 | 870.57 | -51.13 | -1868.38 | -1304.03 | -639.54 | -463.96 | -449.45 | -249.58 | -853.42 | -143.31 | |

| Net Cash Provided By Used In Financing Activities | 26.34 | -228.76 | -1244.47 | -1385.34 | 1725.63 | 691.01 | 1524.99 | 1019.54 | -603.62 | 1654.79 | 451.47 | -443.82 | 684.64 | 1171.60 | -209.36 | 2518.52 | 1921.19 | 387.05 | 430.69 | 229.77 | 124.47 | 622.88 | 31.01 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 24.08 | 266.21 | 302.31 | 359.66 | 354.44 | 580.66 | 399.84 | 29.66 | 181.33 | -49.33 | 406.82 | 416.30 | 20.23 | 225.39 | 674.63 | -902.75 | 19.76 | 256.94 | 164.91 | 139.83 | 157.88 | 239.78 | 109.02 | |

| Net Income Loss | 124.51 | 70.34 | 97.09 | 174.11 | 202.16 | 205.77 | 203.04 | 178.05 | 171.04 | 200.40 | 186.77 | 186.20 | 187.09 | 150.41 | 91.57 | 93.19 | 38.52 | 151.68 | 105.07 | 109.06 | 111.18 | 98.01 | 76.00 | |

| Profit Loss | 124.07 | 69.57 | 96.47 | 173.94 | 202.16 | 205.77 | 203.04 | 178.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 151.68 | 105.07 | 109.06 | 111.18 | 98.01 | 76.00 | |

| Deferred Income Tax Expense Benefit | 2.45 | -5.99 | 3.63 | 18.49 | 0.71 | 22.67 | -8.57 | -4.48 | 1.25 | 8.79 | 11.10 | 7.18 | 17.93 | -25.76 | -5.69 | -43.76 | -10.98 | 44.04 | 26.86 | 4.14 | 2.62 | 43.72 | 34.47 | |

| Share Based Compensation | 7.91 | 7.37 | 7.90 | 8.24 | 8.71 | 5.52 | 7.87 | 6.18 | 8.33 | 6.31 | 8.35 | 5.47 | 7.66 | 4.77 | 4.95 | 5.35 | 3.57 | 3.09 | 4.14 | 4.18 | 4.37 | 3.74 | 3.48 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -78.34 | 276.34 | 1025.64 | -285.57 | -692.45 | -1161.69 | -1722.08 | -937.64 | -1034.07 | -1283.03 | -1433.54 | -38.07 | -1629.52 | 870.57 | -51.13 | -1868.38 | -1304.03 | -639.54 | -463.96 | -449.45 | -249.58 | -853.42 | -143.31 | |

| Payments To Acquire Property Plant And Equipment | 18.49 | 11.65 | 7.85 | 6.18 | 6.52 | 8.62 | 10.23 | 8.60 | 2.66 | 5.96 | 7.58 | 8.39 | 4.03 | 7.32 | 2.60 | 13.24 | 6.94 | 21.01 | 14.12 | 12.25 | 17.57 | 19.33 | 9.89 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

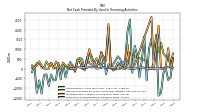

| Net Cash Provided By Used In Financing Activities | 26.34 | -228.76 | -1244.47 | -1385.34 | 1725.63 | 691.01 | 1524.99 | 1019.54 | -603.62 | 1654.79 | 451.47 | -443.82 | 684.64 | 1171.60 | -209.36 | 2518.52 | 1921.19 | 387.05 | 430.69 | 229.77 | 124.47 | 622.88 | 31.01 | |

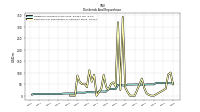

| Payments Of Dividends Common Stock | 55.73 | 55.56 | 55.54 | 55.50 | 49.47 | 49.44 | 49.42 | 49.44 | 47.85 | 48.10 | 48.65 | 49.09 | 48.83 | 48.61 | 48.61 | 48.59 | 44.15 | 44.48 | 29.20 | 29.51 | 29.68 | 18.33 | 0.00 | |

| Payments For Repurchase Of Common Stock | 30.02 | NA | NA | NA | NA | 0.00 | 0.00 | 3.32 | 9.67 | 32.79 | 74.64 | NA | NA | 0.00 | 0.00 | 0.00 | 16.25 | 36.54 | 40.27 | 57.99 | 50.08 | 90.56 | 30.20 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 214.99 | 135.82 | 196.77 | 260.63 | 292.02 | 294.79 | 288.21 | 240.60 | 225.13 | 214.18 | 232.84 | 218.42 | 217.68 | 198.19 | 174.75 | 265.91 | 200.84 | 231.10 | 56.52 | 55.85 | 56.35 | 52.32 | 51.84 | |

| Corporate Non | -154.51 | -268.40 | -190.45 | -156.92 | -146.12 | -92.22 | -77.47 | -88.47 | -88.53 | -98.87 | -80.32 | -93.90 | -102.83 | -142.79 | -126.01 | -55.99 | -89.55 | -74.19 | NA | NA | NA | NA | NA | |

| Operating, Community Banking | 74.89 | 79.83 | 82.21 | 88.99 | 103.56 | 85.22 | 88.17 | 80.28 | 80.48 | 156.80 | 159.95 | 165.97 | 167.94 | 183.76 | 181.84 | 170.64 | 155.39 | 157.27 | NA | NA | NA | NA | NA | |

| Operating, Consumer Banking | 104.22 | 113.79 | 120.71 | 129.99 | 127.73 | 110.64 | 98.69 | 78.29 | 74.48 | 73.28 | 77.64 | 79.51 | 82.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Financial Management Services | 30.14 | 29.14 | 23.02 | 23.61 | 25.71 | 22.23 | 21.07 | 19.27 | 19.47 | 23.21 | 26.30 | 24.51 | 31.90 | 31.33 | -6.12 | 23.52 | 20.77 | 27.32 | NA | NA | NA | NA | NA | |

| Operating, Wholesale Banking | 160.26 | 181.46 | 161.27 | 174.94 | 181.15 | 168.91 | 157.75 | 151.25 | 139.23 | 133.04 | 126.92 | 121.84 | 120.67 | 125.89 | 125.05 | 127.74 | 114.22 | 120.70 | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 214.99 | 135.82 | 196.77 | 260.63 | 292.02 | 294.79 | 288.21 | 240.60 | 225.13 | 214.18 | 232.84 | 218.42 | 217.68 | 198.19 | 174.75 | 265.91 | 200.84 | 231.10 | 56.52 | 55.85 | 56.35 | 52.32 | 51.84 |