| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

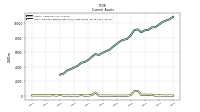

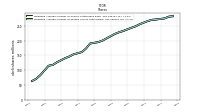

| Common Stock Value | 2.83 | 2.83 | 2.83 | 2.80 | 2.74 | 2.72 | 2.72 | 2.70 | 2.66 | 2.61 | 2.53 | 2.44 | 2.40 | 2.35 | 2.30 | 2.26 | 2.21 | 2.12 | 2.05 | 1.98 | 1.94 | 1.90 | 1.90 | 1.71 | 1.59 | 1.56 | 1.53 | 1.41 | 1.41 | 1.27 | 1.27 | 1.15 | 1.15 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | NA | 282.24 | 280.84 | 275.00 | NA | 271.27 | 270.29 | 266.37 | NA | 255.61 | 248.27 | 243.36 | NA | 232.65 | 228.24 | 222.64 | NA | 207.93 | 200.14 | 194.88 | NA | 190.04 | 172.66 | 160.81 | NA | 153.46 | 146.12 | 140.56 | NA | 126.28 | 117.51 | 114.63 | NA | 82.93 | 70.41 | 63.03 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 282.24 | 280.84 | 275.00 | NA | 271.27 | 270.29 | 266.37 | NA | 255.31 | 248.27 | 243.36 | NA | 232.05 | 227.70 | 222.18 | NA | 207.17 | 199.51 | 194.69 | NA | 189.66 | 172.66 | 160.81 | NA | 153.14 | 145.90 | 140.35 | NA | 126.28 | 117.51 | 114.63 | NA | 82.93 | 70.41 | 63.03 | |

| Earnings Per Share Basic | 0.29 | 0.24 | 0.32 | 0.32 | 0.27 | 0.28 | 0.23 | 0.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.29 | 0.24 | 0.32 | 0.32 | 0.27 | 0.28 | 0.23 | 0.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

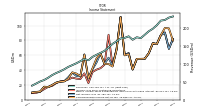

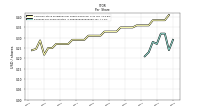

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

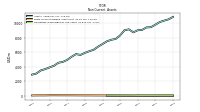

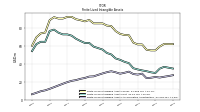

| Revenues | 233.73 | 230.56 | 223.77 | 222.12 | 209.23 | 199.12 | 192.05 | 182.26 | 172.87 | 175.22 | 168.28 | 177.90 | 173.46 | 171.83 | 163.79 | 156.64 | 146.70 | 137.00 | 131.21 | 125.84 | 120.12 | 110.54 | 114.21 | 107.97 | 102.14 | 97.00 | 91.97 | 85.23 | 79.61 | 74.79 | 68.90 | 61.46 | 55.16 | 50.93 | 45.02 | 39.33 | |

| Other Income | 0.82 | 0.29 | 0.74 | 5.12 | 0.12 | 2.07 | 0.22 | 0.37 | 0.12 | 0.88 | 0.41 | 3.06 | 1.20 | 4.28 | 0.48 | 0.52 | 0.42 | 0.36 | 0.51 | 0.42 | 0.44 | 1.00 | 0.61 | 0.29 | 0.15 | 0.22 | 0.17 | 0.05 | 0.04 | 0.04 | 0.02 | 0.02 | 0.03 | 0.02 | 0.35 | 0.01 | |

| Operating Expenses | 159.22 | 160.06 | 145.48 | 138.81 | 151.48 | 135.61 | 134.60 | 142.41 | 137.46 | 124.02 | 128.05 | 117.81 | 125.19 | 119.31 | 110.71 | 108.96 | 104.61 | 89.88 | 88.77 | 85.41 | 82.82 | 88.23 | 78.73 | 80.17 | 73.78 | 67.30 | 64.78 | 60.02 | 54.94 | 52.41 | 50.38 | 44.31 | 41.00 | 40.24 | 35.94 | 30.58 | |

| General And Administrative Expense | 16.17 | 13.43 | 15.94 | 17.02 | 25.55 | 17.46 | 16.09 | 25.01 | 13.94 | 14.73 | 13.13 | 7.88 | 14.46 | 13.57 | 14.27 | 11.98 | 12.51 | 11.51 | 10.85 | 10.85 | 11.20 | 10.26 | 9.29 | 10.24 | 8.73 | 8.10 | 8.54 | 8.59 | 6.99 | 7.14 | 7.21 | 6.63 | 5.47 | 4.96 | 4.88 | 4.18 | |

| Interest Expense | 51.12 | 48.52 | 45.91 | 44.00 | 44.07 | 43.37 | 41.71 | 41.83 | 41.89 | 42.09 | 44.03 | 41.69 | 41.56 | 39.33 | 39.43 | 38.07 | 35.96 | 31.83 | 31.93 | 29.34 | 28.54 | 31.38 | 30.92 | 29.64 | 28.75 | 27.12 | 25.87 | 23.43 | 22.52 | 21.39 | 20.64 | 17.23 | 17.84 | 19.08 | 16.64 | 14.40 | |

| Interest Paid Net | 49.39 | 44.27 | 43.55 | 40.08 | 39.23 | 41.49 | 38.32 | 40.77 | 35.09 | 44.28 | 38.05 | 42.66 | 34.64 | 41.28 | 33.73 | 33.29 | 33.09 | 29.02 | 29.50 | 23.82 | 30.54 | 23.07 | 33.82 | 22.47 | 31.03 | 20.44 | 25.34 | 19.16 | 20.03 | 19.41 | 18.84 | 15.36 | 16.50 | 16.22 | 14.91 | 12.80 | |

| Income Tax Expense Benefit | 0.23 | 0.18 | 0.27 | 0.21 | 0.26 | 0.17 | 0.19 | 0.19 | 0.15 | 0.11 | 0.16 | 0.17 | 0.17 | 0.19 | 0.15 | 0.19 | 0.30 | 0.13 | 0.16 | 0.05 | 0.12 | 0.08 | 0.15 | 0.11 | 0.11 | 0.09 | 0.09 | 0.07 | 0.04 | 0.07 | 0.08 | 0.08 | 0.01 | 0.07 | 0.05 | 0.05 | |

| Profit Loss | 81.79 | 68.58 | 90.50 | 87.02 | 75.02 | 75.94 | 62.43 | 54.96 | 54.72 | 54.63 | 40.60 | 62.66 | 59.84 | 111.62 | 67.96 | 45.56 | 56.58 | 48.23 | 62.20 | 49.96 | 41.01 | 28.58 | 61.06 | 31.39 | 31.94 | 36.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 81.79 | 68.58 | 90.50 | 87.02 | 75.02 | 75.94 | 62.43 | 54.96 | 54.72 | 54.63 | 40.60 | 62.66 | 59.84 | 111.62 | 67.96 | 45.56 | 56.58 | 48.23 | 62.20 | 49.96 | 41.01 | 28.58 | 61.06 | 31.39 | 31.94 | 36.34 | 30.25 | 24.79 | 24.07 | 23.00 | 19.63 | 17.07 | 17.42 | 10.76 | 10.42 | 9.54 | |

| Comprehensive Income Net Of Tax | 79.59 | 96.25 | 96.67 | 87.08 | 75.08 | 76.00 | 62.58 | 55.32 | 55.08 | 54.99 | 40.72 | 61.37 | 59.87 | 111.37 | 66.86 | 44.67 | 48.10 | 48.05 | 62.41 | 55.51 | 42.14 | 28.73 | 60.73 | 31.79 | 35.17 | 36.87 | 28.38 | 24.60 | 24.27 | 22.84 | 19.72 | 16.91 | 17.32 | 10.90 | 10.27 | 9.51 |

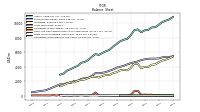

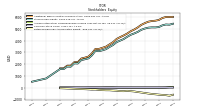

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

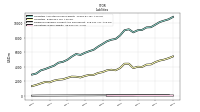

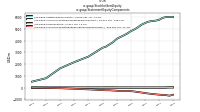

| Assets | 10834.97 | 10505.98 | 10326.49 | 10131.15 | 9773.08 | 9425.00 | 9395.52 | 9054.51 | 9004.34 | 8720.44 | 9137.54 | 9004.30 | 8296.53 | 7813.43 | 7699.97 | 7479.34 | 7113.97 | 6751.75 | 6321.74 | 6128.85 | 5899.78 | 5614.72 | 5736.39 | 5372.23 | 4941.67 | 4663.12 | 4545.09 | 4135.36 | 3911.39 | 3671.46 | 3487.86 | 3065.85 | 2913.61 | NA | NA | NA | |

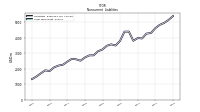

| Liabilities | 5408.65 | 5161.57 | 4965.17 | 4844.16 | 4628.95 | 4312.61 | 4279.68 | 3963.10 | 3988.56 | 3811.71 | 4407.41 | 4405.59 | 3811.14 | 3504.34 | 3581.49 | 3490.19 | 3250.47 | 3133.04 | 2870.69 | 2866.18 | 2728.84 | 2521.51 | 2614.93 | 2635.25 | 2458.41 | 2258.30 | 2205.36 | 2089.01 | 1851.60 | 1895.94 | 1702.21 | 1494.15 | 1330.93 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 10834.97 | 10505.98 | 10326.49 | 10131.15 | 9773.08 | 9425.00 | 9395.52 | 9054.51 | 9004.34 | 8720.44 | 9137.54 | 9004.30 | 8296.53 | 7813.43 | 7699.97 | 7479.34 | 7113.97 | 6751.75 | 6321.74 | 6128.85 | 5899.78 | 5614.72 | 5736.39 | 5372.23 | 4941.67 | 4663.12 | 4545.09 | 4135.36 | 3911.39 | 3671.46 | 3487.86 | 3065.85 | 2913.61 | NA | NA | NA | |

| Stockholders Equity | 5426.32 | 5344.41 | 5361.32 | 5286.99 | 5144.13 | 5112.39 | 5115.84 | 5091.40 | 5015.78 | 4908.72 | 4730.13 | 4598.71 | 4485.39 | 4309.09 | 4118.49 | 3989.16 | 3863.50 | 3618.70 | 3451.05 | 3262.67 | 3170.94 | 3093.21 | 3121.45 | 2736.98 | 2483.26 | 2404.82 | 2339.73 | 2046.35 | 2059.79 | 1775.52 | 1785.65 | 1571.70 | 1582.68 | NA | NA | NA |

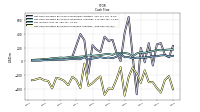

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 35.14 | 46.98 | 30.86 | 39.34 | 64.27 | 37.02 | 168.57 | 145.56 | 166.38 | 144.48 | 699.16 | 633.19 | 99.75 | 27.55 | 25.37 | 37.35 | 27.51 | 25.60 | 43.62 | 35.12 | 42.94 | 34.99 | 468.51 | 103.30 | 54.20 | 30.04 | 118.52 | 30.96 | 67.11 | 28.97 | 66.24 | 30.32 | 136.31 | 44.40 | 94.69 | 55.21 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 39.80 | 50.09 | 32.40 | 41.40 | 70.05 | 42.84 | 258.25 | 154.62 | 176.58 | 161.48 | 713.30 | 647.19 | 111.38 | 73.78 | 40.26 | 51.97 | 43.02 | 32.96 | 56.53 | 47.96 | 49.18 | 50.35 | NA | NA | 73.17 | NA | NA | NA | 83.44 | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Finite Lived Intangible Assets Net | 34.69 | 35.65 | 36.60 | 34.57 | 29.69 | 30.52 | 31.76 | 32.62 | 33.70 | 35.05 | 40.73 | 42.22 | 44.42 | 45.98 | 50.46 | 52.09 | 55.92 | 57.53 | 59.17 | 63.25 | 63.22 | 65.45 | 67.94 | 71.42 | 72.82 | 72.82 | 74.72 | 78.15 | 76.69 | 64.53 | 64.56 | 61.98 | 54.18 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 2100.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 5426.32 | 5344.41 | 5361.32 | 5286.99 | 5144.13 | 5112.39 | 5115.84 | 5091.40 | 5015.78 | 4908.72 | 4730.13 | 4598.71 | 4485.39 | 4309.09 | 4118.49 | 3989.16 | 3863.50 | 3618.70 | 3451.05 | 3262.67 | 3170.94 | 3093.21 | 3121.45 | 2736.98 | 2483.26 | 2404.82 | 2339.73 | 2046.35 | 2059.79 | 1775.52 | 1785.65 | 1571.70 | 1582.68 | NA | NA | NA | |

| Common Stock Value | 2.83 | 2.83 | 2.83 | 2.80 | 2.74 | 2.72 | 2.72 | 2.70 | 2.66 | 2.61 | 2.53 | 2.44 | 2.40 | 2.35 | 2.30 | 2.26 | 2.21 | 2.12 | 2.05 | 1.98 | 1.94 | 1.90 | 1.90 | 1.71 | 1.59 | 1.56 | 1.53 | 1.41 | 1.41 | 1.27 | 1.27 | 1.15 | 1.15 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 6003.33 | 6000.12 | 5997.38 | 5910.86 | 5745.69 | 5682.46 | 5657.12 | 5597.28 | 5475.89 | 5327.12 | 5109.41 | 4930.15 | 4787.93 | 4586.52 | 4424.89 | 4286.25 | 4129.08 | 3858.42 | 3668.96 | 3479.46 | 3381.09 | 3284.35 | 3282.43 | 2903.77 | 2631.84 | 2542.41 | 2469.04 | 2162.79 | 2162.13 | 1864.23 | 1862.95 | 1637.12 | 1636.20 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -609.36 | -690.26 | -642.95 | -624.56 | -602.14 | -570.56 | -541.72 | -506.14 | -459.98 | -417.86 | -378.31 | -330.26 | -302.61 | -277.40 | -306.57 | -298.33 | -267.65 | -250.17 | -228.49 | -227.07 | -214.84 | -194.67 | -164.35 | -170.31 | -151.59 | -137.32 | -128.50 | -117.37 | -103.45 | -89.49 | -78.24 | -66.16 | -54.41 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 29.52 | 31.72 | 4.06 | -2.10 | -2.16 | -2.23 | -2.29 | -2.43 | -2.79 | -3.15 | -3.51 | -3.62 | -2.34 | -2.37 | -2.13 | -1.03 | -0.14 | 8.34 | 8.52 | 8.30 | 2.76 | 1.62 | 1.47 | 1.80 | 1.41 | -1.83 | -2.35 | -0.48 | -0.29 | -0.49 | -0.33 | -0.42 | -0.27 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 0.03 | -0.03 | 83.44 | 166.16 | 55.29 | 18.87 | 55.41 | 114.10 | 145.88 | 215.05 | 176.88 | 148.58 | 197.84 | 158.67 | 135.71 | 158.31 | 268.10 | 187.24 | 187.37 | 98.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

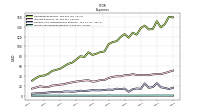

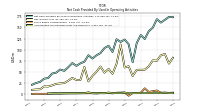

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

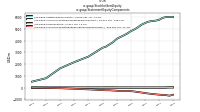

| Net Cash Provided By Used In Operating Activities | 172.97 | 173.58 | 166.98 | 160.89 | 168.59 | 149.49 | 141.40 | 123.89 | 132.93 | 114.81 | 71.63 | 112.20 | 122.66 | 117.39 | 123.43 | 94.85 | 108.61 | 103.61 | 92.23 | 87.24 | 80.02 | 87.40 | 72.89 | 69.12 | 63.54 | 69.90 | 60.56 | 52.31 | 55.31 | 48.32 | 46.20 | 36.07 | 34.70 | 27.49 | 24.94 | 20.98 | |

| Net Cash Provided By Used In Investing Activities | -408.37 | -214.46 | -274.26 | -456.02 | -390.42 | -303.49 | -304.73 | -131.18 | -313.86 | -184.08 | -88.06 | -225.86 | -501.73 | -85.49 | -261.56 | -401.04 | -397.19 | -488.39 | -220.35 | -261.10 | -318.59 | -357.70 | -32.33 | -392.24 | -270.89 | -224.88 | -349.63 | -284.96 | -255.09 | -240.59 | -396.43 | -285.71 | -276.10 | -243.64 | -264.16 | -275.91 | |

| Net Cash Provided By Used In Financing Activities | 225.11 | 58.56 | 98.28 | 266.49 | 249.03 | -61.40 | 266.95 | -14.67 | 196.02 | -482.55 | 82.53 | 649.46 | 416.67 | 1.62 | 126.41 | 315.14 | 298.64 | 361.22 | 136.69 | 172.65 | 237.40 | -178.68 | 309.78 | 398.96 | 234.16 | 66.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 172.97 | 173.58 | 166.98 | 160.89 | 168.59 | 149.49 | 141.40 | 123.89 | 132.93 | 114.81 | 71.63 | 112.20 | 122.66 | 117.39 | 123.43 | 94.85 | 108.61 | 103.61 | 92.23 | 87.24 | 80.02 | 87.40 | 72.89 | 69.12 | 63.54 | 69.90 | 60.56 | 52.31 | 55.31 | 48.32 | 46.20 | 36.07 | 34.70 | 27.49 | 24.94 | 20.98 | |

| Net Income Loss | 81.79 | 68.58 | 90.50 | 87.02 | 75.02 | 75.94 | 62.43 | 54.96 | 54.72 | 54.63 | 40.60 | 62.66 | 59.84 | 111.62 | 67.96 | 45.56 | 56.58 | 48.23 | 62.20 | 49.96 | 41.01 | 28.58 | 61.06 | 31.39 | 31.94 | 36.34 | 30.25 | 24.79 | 24.07 | 23.00 | 19.63 | 17.07 | 17.42 | 10.76 | 10.42 | 9.54 | |

| Profit Loss | 81.79 | 68.58 | 90.50 | 87.02 | 75.02 | 75.94 | 62.43 | 54.96 | 54.72 | 54.63 | 40.60 | 62.66 | 59.84 | 111.62 | 67.96 | 45.56 | 56.58 | 48.23 | 62.20 | 49.96 | 41.01 | 28.58 | 61.06 | 31.39 | 31.94 | 36.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 3.18 | 2.77 | 3.41 | 3.07 | 8.07 | 6.47 | 4.79 | 12.90 | 3.02 | 2.74 | 2.47 | -3.57 | 3.62 | 3.33 | 3.07 | 1.69 | 2.66 | 2.28 | 2.20 | 1.47 | 2.05 | 2.01 | 1.99 | 1.87 | 1.80 | 1.80 | 1.76 | 1.66 | 1.28 | 1.29 | 1.26 | 0.90 | 0.60 | 0.56 | 0.77 | 0.37 |

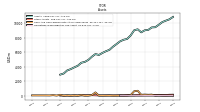

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -408.37 | -214.46 | -274.26 | -456.02 | -390.42 | -303.49 | -304.73 | -131.18 | -313.86 | -184.08 | -88.06 | -225.86 | -501.73 | -85.49 | -261.56 | -401.04 | -397.19 | -488.39 | -220.35 | -261.10 | -318.59 | -357.70 | -32.33 | -392.24 | -270.89 | -224.88 | -349.63 | -284.96 | -255.09 | -240.59 | -396.43 | -285.71 | -276.10 | -243.64 | -264.16 | -275.91 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 225.11 | 58.56 | 98.28 | 266.49 | 249.03 | -61.40 | 266.95 | -14.67 | 196.02 | -482.55 | 82.53 | 649.46 | 416.67 | 1.62 | 126.41 | 315.14 | 298.64 | 361.22 | 136.69 | 172.65 | 237.40 | -178.68 | 309.78 | 398.96 | 234.16 | 66.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 115.90 | 108.83 | 107.64 | 106.69 | 104.82 | 97.79 | 97.20 | 98.19 | 94.08 | 88.66 | 85.45 | 85.01 | 82.18 | 76.14 | 74.68 | 74.16 | 69.91 | 63.61 | 61.39 | 60.65 | 58.90 | 55.10 | 49.70 | 46.21 | 45.17 | 41.38 | 38.04 | 38.03 | 34.25 | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 233.73 | 230.56 | 223.77 | 222.12 | 209.23 | 199.12 | 192.05 | 182.26 | 172.87 | 175.22 | 168.28 | 177.90 | 173.46 | 171.83 | 163.79 | 156.64 | 146.70 | 137.00 | 131.21 | 125.84 | 120.12 | 110.54 | 114.21 | 107.97 | 102.14 | 97.00 | 91.97 | 85.23 | 79.61 | 74.79 | 68.90 | 61.46 | 55.16 | 50.93 | 45.02 | 39.33 |