| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 58.58 | 58.58 | 58.58 | 58.37 | 58.31 | 58.31 | 58.24 | 49.50 | 49.46 | 49.47 | 36.80 | 36.50 | 36.50 | 36.41 | 36.41 | 36.21 | 36.18 | 36.60 | 36.93 | 36.69 | 36.68 | 36.68 | 36.63 | 36.46 | 36.42 | 36.40 | 36.40 | 36.25 | 36.07 | 35.89 | 10.84 | 10.62 | 10.45 | 10.39 | 10.20 | 10.04 | 9.90 | 9.77 | 9.75 | 9.58 | 9.40 | 9.25 | 7.42 | 7.27 | 7.20 | 7.15 | 7.13 | 6.95 | 6.89 | 6.88 | NA | 6.68 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 29.34 | 29.34 | 29.36 | NA | 29.40 | 29.35 | 27.48 | NA | 26.73 | 24.38 | 22.86 | NA | 22.80 | 22.74 | 22.74 | NA | 22.81 | 22.95 | 22.95 | NA | 22.97 | 22.98 | 22.94 | NA | 22.96 | 23.24 | 23.00 | NA | 22.80 | 22.70 | 15.06 | NA | 14.99 | 14.94 | 14.85 | NA | 14.75 | 14.70 | 14.70 | NA | 14.56 | 14.24 | 13.85 | NA | 13.97 | 13.94 | 13.89 | NA | 13.84 | 13.88 | 13.84 | NA | 13.81 | 13.79 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 29.22 | 29.22 | 29.18 | NA | 29.14 | 29.13 | 27.23 | NA | 26.48 | 24.14 | 22.62 | NA | 22.58 | 22.56 | 22.52 | NA | 22.55 | 22.69 | 22.66 | NA | 22.64 | 22.62 | 22.58 | NA | 22.54 | 22.78 | 22.49 | NA | 22.39 | 22.34 | 14.84 | NA | 14.75 | 14.71 | 14.65 | NA | 14.57 | 14.54 | 14.51 | NA | 14.41 | 14.20 | 13.81 | NA | 13.88 | 13.87 | 13.84 | NA | 13.80 | 13.79 | 13.75 | NA | 13.70 | 13.69 | NA | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

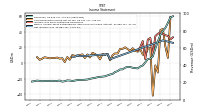

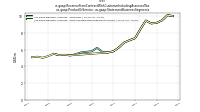

| Revenues | 88.92 | 83.06 | 79.47 | 75.15 | 67.41 | 59.11 | 49.98 | 47.51 | 46.95 | 43.10 | 39.52 | 38.34 | 36.14 | 36.51 | 36.88 | 37.80 | 37.97 | 36.97 | 35.03 | 35.00 | 33.02 | 32.00 | 29.73 | 29.09 | 28.11 | 27.01 | 26.63 | 26.37 | 25.94 | 25.16 | 24.70 | 24.04 | 23.28 | 23.00 | 22.85 | 22.78 | 22.69 | 22.01 | 21.60 | 22.07 | 22.27 | 21.29 | 20.84 | 22.03 | 21.69 | 21.36 | 21.81 | 21.57 | 21.62 | 21.57 | 21.29 | 21.72 | 22.02 | 21.45 | 20.96 | |

| Marketing And Advertising Expense | 1.36 | 1.78 | 1.09 | 1.54 | 1.24 | 1.45 | 0.77 | 1.79 | 1.01 | 0.82 | 0.52 | 0.83 | 0.52 | 0.47 | 0.56 | 1.37 | 0.73 | 0.90 | 0.62 | 0.91 | 0.74 | 0.81 | 0.65 | 0.97 | 0.61 | 0.69 | 0.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 27.61 | 22.13 | 16.39 | 9.89 | 5.03 | 2.12 | 1.22 | 1.33 | 1.47 | 1.52 | 1.69 | 2.09 | 2.45 | 2.98 | 4.44 | 5.08 | 5.90 | 6.19 | 5.37 | 5.09 | 4.50 | 3.33 | 2.44 | 2.07 | 1.95 | 1.78 | 1.45 | 1.29 | 1.18 | 1.21 | 1.23 | 1.22 | 1.20 | 1.20 | 1.23 | 1.27 | 1.33 | 1.36 | 1.38 | 2.23 | 2.25 | 2.32 | 2.37 | 3.72 | 2.90 | 3.07 | 3.26 | 3.55 | 3.83 | 3.96 | 3.97 | 4.40 | 4.80 | 4.90 | 5.16 | |

| Interest Income Expense Net | 61.31 | 60.93 | 63.07 | 65.26 | 62.38 | 56.98 | 48.76 | 46.18 | 45.48 | 41.58 | 37.83 | 36.25 | 33.70 | 33.53 | 32.45 | 32.72 | 32.07 | 30.77 | 29.66 | 29.91 | 28.52 | 28.67 | 27.30 | 27.02 | 26.16 | 25.23 | 25.18 | 25.07 | 24.76 | 23.95 | 23.47 | 22.82 | 22.08 | 21.80 | 21.61 | 21.51 | 21.36 | 20.66 | 20.23 | 19.84 | 20.02 | 18.98 | 18.46 | 18.31 | 18.80 | 18.30 | 18.55 | 18.02 | 17.79 | 17.61 | 17.32 | 17.32 | 17.21 | 16.55 | 15.79 | |

| Interest Paid Net | 26.84 | 22.10 | 16.03 | 9.63 | 6.13 | 0.96 | 1.19 | 1.42 | 1.70 | 1.14 | 1.83 | 2.02 | 2.60 | 2.93 | 4.66 | 5.15 | 6.20 | 5.89 | 5.42 | 5.01 | 4.32 | 3.11 | 2.38 | 2.05 | 1.92 | 1.75 | 1.44 | 1.26 | 1.20 | 1.20 | 1.24 | 1.22 | 1.20 | 1.20 | 1.24 | 1.26 | 1.33 | 1.35 | 1.38 | 2.23 | 2.26 | 2.32 | 2.40 | 3.76 | 2.98 | 3.02 | 3.26 | 3.48 | 3.85 | 4.05 | 4.00 | 4.51 | 4.84 | NA | NA | |

| Allocated Share Based Compensation Expense | 1.03 | 1.03 | 1.15 | 1.11 | 1.24 | 1.06 | 0.99 | 1.14 | 1.17 | 1.41 | 0.85 | 0.63 | 0.84 | 0.98 | 0.82 | 0.85 | 0.88 | 0.99 | 0.86 | 1.10 | 0.89 | 1.21 | 0.82 | 0.88 | 0.67 | 0.68 | 0.66 | 0.83 | 0.57 | 0.56 | 0.51 | 0.57 | 0.57 | 0.49 | 0.50 | 0.56 | 0.69 | 0.48 | 0.29 | 0.47 | 0.49 | 0.45 | 0.53 | 0.36 | 0.38 | 0.39 | 0.35 | 0.30 | 0.30 | 0.32 | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | NA | NA | NA | 39.08 | 37.56 | 34.45 | 9.39 | 32.11 | 30.06 | 5.05 | 28.17 | 20.42 | 16.12 | 15.72 | 15.48 | 19.59 | 21.02 | 17.57 | 17.48 | 16.92 | 17.43 | 16.74 | 16.46 | 10.49 | 15.80 | 14.96 | 13.93 | 14.62 | 14.35 | 13.79 | 13.51 | 13.82 | 13.64 | 13.15 | 13.51 | 12.03 | 14.60 | 11.66 | 11.81 | 8.70 | 10.77 | 9.14 | 9.79 | 8.78 | 9.07 | 8.60 | 8.98 | 7.42 | 8.25 | 8.44 | 7.69 | 8.12 | 8.87 | 7.71 | 7.32 | |

| Income Tax Expense Benefit | 7.64 | 7.97 | 8.13 | 9.17 | 9.02 | 7.55 | 1.45 | 7.53 | 6.90 | 0.86 | 5.46 | 2.69 | 1.59 | 2.35 | 2.25 | 2.94 | 3.78 | 1.03 | 1.84 | 2.27 | 3.56 | 3.16 | 3.05 | 5.54 | 4.10 | 4.36 | 3.14 | 4.01 | 3.88 | 3.68 | 3.68 | 4.18 | 4.35 | 4.15 | 4.25 | 3.31 | 4.71 | 3.63 | 3.63 | 2.39 | 3.09 | 2.73 | 3.02 | 2.27 | 2.39 | 2.50 | 2.48 | 1.08 | 2.47 | 2.44 | 2.20 | 2.07 | 2.51 | 2.15 | 2.34 | |

| Income Taxes Paid Net | 11.45 | NA | NA | NA | 1.62 | NA | NA | NA | 0.00 | 13.46 | -0.10 | NA | 9.19 | 0.42 | 0.00 | 4.66 | 3.90 | 5.38 | 0.00 | 1.72 | 3.71 | NA | NA | 4.78 | 6.59 | NA | NA | 3.67 | 3.70 | NA | NA | 3.65 | 3.40 | 6.77 | 0.00 | 4.28 | 3.67 | NA | NA | 2.12 | 1.10 | NA | NA | 2.66 | 2.83 | NA | NA | 2.01 | 1.61 | NA | NA | 2.59 | 2.27 | NA | NA | |

| Profit Loss | 27.09 | 27.66 | 29.05 | 29.91 | 28.54 | 26.90 | 7.94 | 24.59 | 23.16 | 4.18 | 22.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 6.00 | NA | NA | NA | 5.56 | NA | |

| Other Comprehensive Income Loss Net Of Tax | -20.49 | -6.47 | 14.59 | 12.38 | -40.58 | -29.74 | -49.66 | -5.31 | -4.42 | 4.84 | -11.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.77 | -5.94 | -1.01 | 1.50 | 3.31 | -2.47 | 1.79 | -2.63 | 1.86 | 1.46 | -0.41 | 1.20 | 2.05 | -2.12 | 0.08 | -5.12 | -0.48 | -0.84 | 0.38 | 0.46 | -0.04 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Comprehensive Income Net Of Tax | 6.60 | 21.19 | 43.64 | 42.20 | -12.12 | -2.94 | -41.75 | 19.28 | 18.74 | 9.02 | 10.92 | 17.61 | 14.59 | 15.73 | 19.01 | 15.60 | 17.90 | 20.12 | 18.27 | 18.15 | 12.28 | 12.38 | 10.00 | 3.55 | 11.78 | 10.72 | 11.56 | 4.68 | 9.46 | 11.61 | 13.15 | 7.17 | 11.08 | 6.37 | 11.12 | 10.19 | 9.48 | 9.24 | 10.22 | 4.20 | 7.76 | 1.28 | 6.29 | 5.67 | 7.06 | 6.57 | 6.47 | 6.06 | 6.80 | 7.44 | 5.63 | 4.14 | 7.53 | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 27.09 | 27.66 | 29.05 | 29.82 | 28.45 | 26.79 | 7.91 | 24.59 | 23.16 | 4.18 | 22.71 | 17.74 | 14.53 | 13.37 | 13.23 | 16.65 | 17.23 | 16.54 | 15.64 | 14.66 | 13.88 | 13.58 | 13.40 | 4.95 | 11.70 | 10.60 | 10.79 | 10.62 | 10.47 | 10.11 | 9.84 | 9.65 | 9.28 | 9.00 | 9.26 | 8.72 | 9.89 | 8.03 | 8.18 | 6.31 | 7.68 | 6.41 | 6.77 | 6.51 | 6.68 | 6.10 | 6.50 | 6.34 | 5.77 | 6.00 | 5.49 | 6.05 | 6.37 | 5.56 | 4.98 | |

| Interest Income Expense After Provision For Loan Loss | 58.54 | 58.58 | 60.45 | 61.89 | 57.57 | 57.18 | 46.48 | 48.08 | 47.01 | 37.44 | 39.30 | 34.85 | 29.28 | 27.98 | 26.90 | 32.72 | 31.67 | 30.77 | 29.06 | 29.91 | 27.79 | 27.44 | 26.56 | 26.12 | 26.01 | 24.63 | 24.28 | 24.57 | 23.51 | 23.20 | 22.97 | 22.07 | 22.08 | 21.80 | 21.61 | 21.51 | 23.46 | 19.30 | 19.88 | 18.27 | 18.69 | 17.65 | 16.14 | 15.84 | 16.32 | 15.82 | 14.47 | 14.92 | 13.69 | 15.01 | 14.52 | 13.63 | 14.52 | 14.16 | 13.10 | |

| Noninterest Expense | 46.70 | 45.80 | 45.31 | 45.95 | 44.87 | 44.67 | 56.30 | 34.57 | 34.56 | 48.18 | 24.97 | 28.13 | 26.20 | 24.88 | 23.95 | 26.29 | 23.96 | 25.46 | 22.64 | 24.57 | 21.78 | 22.14 | 21.03 | 27.18 | 21.32 | 21.35 | 21.15 | 21.27 | 20.52 | 20.19 | 19.54 | 18.32 | 18.43 | 18.87 | 17.78 | 19.25 | 18.71 | 17.70 | 17.54 | 19.38 | 17.57 | 18.82 | 15.58 | 17.18 | 17.05 | 16.51 | 14.74 | 16.73 | 13.30 | 14.72 | 14.83 | 15.08 | 13.91 | 14.38 | 13.76 | |

| Noninterest Income | 22.90 | 22.86 | 22.05 | 23.14 | 24.86 | 21.94 | 19.20 | 18.60 | 17.61 | 15.79 | 13.84 | 13.70 | 13.04 | 12.62 | 12.54 | 13.16 | 13.30 | 12.26 | 11.06 | 11.58 | 11.43 | 11.44 | 10.92 | 11.54 | 11.10 | 11.68 | 10.80 | 11.32 | 11.36 | 10.78 | 10.08 | 10.07 | 9.98 | 10.22 | 9.67 | 9.77 | 9.85 | 10.06 | 9.47 | 9.81 | 9.65 | 10.31 | 9.23 | 10.13 | 9.79 | 9.29 | 9.24 | 9.23 | 7.86 | 8.15 | 8.01 | 9.58 | 8.26 | 7.92 | 7.98 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

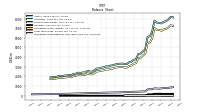

| Assets | 7903.43 | 7732.55 | 7667.65 | 7496.26 | 7554.21 | 7583.10 | 7777.15 | 6646.02 | 6181.19 | 6088.07 | 4794.07 | 4608.63 | 4365.13 | 4334.53 | 3784.59 | 3724.20 | 3533.93 | 3463.82 | 3281.02 | 3302.92 | 3324.80 | 3323.84 | 3285.48 | 3239.65 | 3155.91 | 3126.76 | 3033.34 | 3039.48 | 2938.66 | 2909.52 | 2824.11 | 2816.80 | 2624.61 | 2482.69 | 2512.26 | 2563.87 | 2407.87 | 2411.38 | 2354.24 | 2389.26 | 2289.76 | 2258.60 | 2121.07 | 2148.26 | 2102.59 | 2083.63 | 2040.59 | 2053.10 | 1987.95 | 1943.38 | NA | 1902.94 | NA | NA | NA | |

| Liabilities | 7096.51 | 6924.47 | 6873.28 | 6735.83 | 6823.46 | 6832.94 | 7015.93 | 5970.16 | 5517.64 | 5436.98 | 4350.84 | 4167.93 | 3936.53 | 3914.30 | 3374.88 | 3317.90 | 3137.82 | 3074.46 | 2903.02 | 2936.42 | 2971.82 | 2978.32 | 2947.78 | 2906.00 | 2821.66 | 2800.26 | 2713.66 | 2725.61 | 2627.09 | 2604.47 | 2527.78 | 2530.28 | 2343.66 | 2210.30 | 2244.66 | 2303.97 | 2156.43 | 2167.76 | 2117.26 | 2159.82 | 2063.22 | 2038.25 | 1912.17 | 1943.19 | 1901.17 | 1887.33 | 1848.77 | 1865.41 | 1804.40 | 1764.56 | NA | 1733.08 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 7903.43 | 7732.55 | 7667.65 | 7496.26 | 7554.21 | 7583.10 | 7777.15 | 6646.02 | 6181.19 | 6088.07 | 4794.07 | 4608.63 | 4365.13 | 4334.53 | 3784.59 | 3724.20 | 3533.93 | 3463.82 | 3281.02 | 3302.92 | 3324.80 | 3323.84 | 3285.48 | 3239.65 | 3155.91 | 3126.76 | 3033.34 | 3039.48 | 2938.66 | 2909.52 | 2824.11 | 2816.80 | 2624.61 | 2482.69 | 2512.26 | 2563.87 | 2407.87 | 2411.38 | 2354.24 | 2389.26 | 2289.76 | 2258.60 | 2121.07 | 2148.26 | 2102.59 | 2083.63 | 2040.59 | 2053.10 | 1987.95 | 1943.38 | NA | 1902.94 | NA | NA | NA | |

| Stockholders Equity | 806.92 | 808.08 | 794.37 | 760.43 | 727.75 | 747.13 | 758.14 | 675.87 | 663.55 | 651.09 | 443.23 | 440.70 | 428.60 | 420.23 | 409.70 | 406.30 | 396.11 | 389.37 | 377.99 | 366.50 | 352.98 | 345.51 | 337.70 | 333.64 | 334.25 | 326.50 | 319.69 | 313.87 | 311.57 | 305.05 | 296.32 | 286.52 | 280.95 | 272.38 | 267.60 | 259.89 | 251.45 | 243.61 | 236.98 | 229.44 | 226.53 | 220.35 | 208.90 | 205.07 | 201.42 | 196.30 | 191.82 | 187.69 | 183.55 | NA | NA | 169.86 | NA | NA | NA | |

| Tier One Risk Based Capital | 756.41 | 736.24 | 715.04 | 698.04 | 666.36 | 643.90 | 623.95 | 556.59 | 539.60 | 523.43 | 444.90 | 430.89 | 418.46 | 409.25 | 377.77 | 391.32 | 379.93 | 373.55 | 379.03 | 370.13 | 360.07 | 350.99 | 341.94 | 334.63 | 333.31 | NA | 319.03 | 314.15 | 305.89 | 298.34 | 291.09 | 284.79 | 276.68 | 269.95 | 262.52 | 255.31 | 248.26 | 239.96 | 234.46 | 228.83 | 253.65 | 247.41 | 233.37 | 228.97 | 224.48 | 219.73 | NA | 211.54 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

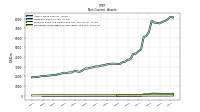

| Available For Sale Securities Debt Securities | 1020.25 | 1092.72 | 1131.85 | 1144.62 | 1149.17 | 1140.04 | 1150.36 | 1180.30 | 1070.15 | 1006.91 | 672.17 | 586.98 | 429.18 | 485.25 | 445.81 | 470.74 | 375.60 | 423.58 | 507.13 | 437.00 | 550.09 | 574.57 | 598.08 | 574.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

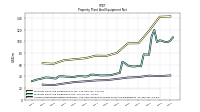

| Property Plant And Equipment Gross | NA | NA | NA | 142.05 | NA | NA | NA | 117.99 | NA | NA | NA | 96.65 | NA | NA | NA | 96.44 | NA | NA | NA | 80.23 | NA | NA | NA | 75.05 | NA | NA | NA | 75.33 | NA | NA | NA | 70.95 | NA | NA | NA | 69.28 | NA | NA | NA | 67.44 | NA | NA | NA | 61.38 | NA | NA | NA | 62.32 | NA | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 40.44 | NA | NA | NA | 41.10 | NA | NA | NA | 38.63 | NA | NA | NA | 37.82 | NA | NA | NA | 35.47 | NA | NA | NA | 33.39 | NA | NA | NA | 32.94 | NA | NA | NA | 31.39 | NA | NA | NA | 30.19 | NA | NA | NA | 27.63 | NA | NA | NA | 24.85 | NA | NA | NA | 25.71 | NA | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 1.17 | 1.17 | 1.18 | 1.61 | 1.61 | 1.61 | 0.71 | 0.28 | 0.29 | 0.13 | 0.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 98.42 | 98.78 | 100.76 | 101.61 | 98.74 | 119.46 | 108.83 | 76.89 | 77.35 | 77.64 | 57.07 | 58.02 | 56.91 | 56.83 | 57.28 | 58.62 | 62.39 | 65.07 | 45.72 | 44.76 | 43.62 | 42.35 | 41.68 | 41.66 | 41.50 | 41.43 | 41.83 | 42.38 | 42.90 | 42.72 | 39.98 | 39.56 | 39.95 | 40.20 | 40.06 | 39.09 | 38.82 | 39.25 | 39.26 | 39.81 | 39.99 | 39.72 | 36.09 | 36.53 | 37.44 | 37.89 | 37.93 | 36.61 | 35.38 | 34.56 | NA | 31.66 | NA | NA | NA | |

| Goodwill | 194.07 | 194.07 | 194.07 | 194.07 | 202.52 | 202.52 | 202.52 | 135.83 | 135.83 | 136.53 | 12.51 | 12.51 | 12.51 | 12.51 | 12.51 | 12.51 | 12.59 | 12.83 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | NA | NA | NA | 0.68 | NA | NA | NA | 0.68 | NA | NA | NA | 0.68 | NA | NA | NA | 0.68 | NA | NA | NA | 0.68 | NA | NA | NA | 0.68 | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 47.79 | 39.78 | 34.85 | 41.38 | 44.76 | 24.63 | 12.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 397.42 | 410.25 | 433.90 | 431.83 | 433.37 | 460.85 | 535.81 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | 445.20 | 450.03 | 468.75 | 473.22 | 478.12 | 485.45 | 548.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 1195.72 | 1238.25 | 1266.36 | 1297.98 | 1317.16 | 1254.65 | 1225.82 | 1190.38 | 1072.99 | 1003.87 | 675.48 | 574.72 | 416.77 | 472.80 | 436.45 | 469.31 | 372.96 | 421.88 | 510.45 | 443.74 | 561.37 | 583.78 | 605.67 | 577.41 | 571.95 | 576.78 | 556.95 | 571.94 | 533.87 | 557.74 | 561.91 | 564.39 | 498.63 | NA | NA | 509.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | NA | NA | NA | NA | 0.00 | 0.02 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 47.79 | 39.78 | 34.85 | 41.38 | 44.76 | 24.63 | 12.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Next Rolling Twelve Months Fair Value | 50.19 | NA | 63.71 | 14.80 | 13.80 | 15.81 | 60.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling After Ten Years Fair Value | 0.56 | NA | 0.58 | 0.60 | 1.78 | 0.74 | 0.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling Year Six Through Ten Fair Value | 22.18 | NA | 24.17 | 23.77 | 23.89 | 26.29 | 26.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling Year Two Through Five Fair Value | 147.00 | NA | 147.73 | 194.41 | 193.71 | 199.37 | 216.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 334.50 | NA | NA | NA | 320.74 | NA | NA | NA | 289.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 6402.81 | 6208.38 | 6357.19 | 6391.25 | 6500.77 | 6549.13 | 6745.49 | 5787.51 | 5342.02 | 5260.11 | 4199.96 | 3988.63 | 3754.52 | 3727.16 | 3198.88 | 3133.94 | 2946.31 | 2883.45 | 2752.54 | 2794.36 | 2598.04 | 2540.46 | 2573.36 | 2578.30 | 2481.97 | 2478.55 | 2544.26 | 2520.55 | 2390.60 | 2349.95 | 2366.10 | 2371.70 | 2141.58 | 2071.76 | 2110.23 | 2123.63 | 2007.82 | 1987.39 | 1987.39 | 1980.94 | 1882.45 | 1864.84 | 1736.88 | 1781.69 | 1690.03 | 1664.29 | 1627.32 | 1617.74 | 1576.56 | 1532.37 | NA | 1493.47 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 26.64 | 26.54 | 26.44 | 26.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | NA | NA | NA | NA | 3.00 | 3.03 | 3.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 806.92 | 808.08 | 794.37 | 760.43 | 727.75 | 747.13 | 758.14 | 675.87 | 663.55 | 651.09 | 443.23 | 440.70 | 428.60 | 420.23 | 409.70 | 406.30 | 396.11 | 389.37 | 377.99 | 366.50 | 352.98 | 345.51 | 337.70 | 333.64 | 334.25 | 326.50 | 319.69 | 313.87 | 311.57 | 305.05 | 296.32 | 286.52 | 280.95 | 272.38 | 267.60 | 259.89 | 251.45 | 243.61 | 236.98 | 229.44 | 226.53 | 220.35 | 208.90 | 205.07 | 201.42 | 196.30 | 191.82 | 187.69 | 183.55 | NA | NA | 169.86 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 806.92 | 808.08 | 794.37 | 760.43 | 730.75 | 750.16 | 761.22 | 675.87 | 663.55 | 651.09 | 443.23 | 440.70 | NA | NA | NA | 406.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 178.82 | NA | 169.86 | NA | NA | NA | |

| Common Stock Value | 58.58 | 58.58 | 58.58 | 58.37 | 58.31 | 58.31 | 58.24 | 49.50 | 49.46 | 49.47 | 36.80 | 36.50 | 36.50 | 36.41 | 36.41 | 36.21 | 36.18 | 36.60 | 36.93 | 36.69 | 36.68 | 36.68 | 36.63 | 36.46 | 36.42 | 36.40 | 36.40 | 36.25 | 36.07 | 35.89 | 10.84 | 10.62 | 10.45 | 10.39 | 10.20 | 10.04 | 9.90 | 9.77 | 9.75 | 9.58 | 9.40 | 9.25 | 7.42 | 7.27 | 7.20 | 7.15 | 7.13 | 6.95 | 6.89 | 6.88 | NA | 6.68 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 384.40 | 383.39 | 382.39 | 377.70 | 376.09 | 374.88 | 372.56 | 243.11 | 241.25 | 240.20 | 46.88 | 41.89 | 41.26 | 39.42 | 38.37 | 35.71 | 34.61 | 37.78 | 39.91 | 36.80 | 35.60 | 34.72 | 32.92 | 31.92 | 30.68 | 29.75 | 29.00 | 26.68 | 24.05 | 21.96 | 45.73 | 44.18 | 42.22 | 41.21 | 39.35 | 38.19 | 36.71 | 35.24 | 34.61 | 33.26 | 31.62 | 30.33 | 19.12 | 17.73 | 17.05 | 16.45 | 15.96 | 14.60 | 14.12 | 13.81 | NA | 12.21 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 491.85 | 473.53 | 454.34 | 439.90 | 421.27 | 401.27 | 384.95 | 391.20 | 375.46 | 359.63 | 362.61 | 353.57 | 341.97 | 335.57 | 328.48 | 333.70 | 323.59 | 313.93 | 303.66 | 298.16 | 289.34 | 281.16 | 274.00 | 267.19 | 267.68 | 260.96 | 255.01 | 252.44 | 247.01 | 241.75 | 235.81 | 231.09 | 225.18 | 219.47 | 214.10 | 209.58 | 204.22 | 197.57 | 192.78 | 188.82 | 185.62 | 180.96 | 177.42 | 174.65 | 170.91 | 166.81 | 163.31 | 160.67 | 156.79 | 153.41 | NA | 147.84 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -127.91 | -107.42 | -100.94 | -115.54 | -127.92 | -87.34 | -57.60 | -7.94 | -2.63 | 1.79 | -3.05 | 8.74 | 8.87 | 8.82 | 6.45 | 0.68 | 1.73 | 1.07 | -2.51 | -5.14 | -8.64 | -7.04 | -5.84 | -1.93 | -0.53 | -0.61 | -0.72 | -1.50 | 4.44 | 5.45 | 3.95 | 0.63 | 3.10 | 1.31 | 3.95 | 2.08 | 0.62 | 1.03 | -0.17 | -2.22 | -0.10 | -0.18 | 4.94 | 5.42 | 6.26 | 5.89 | 5.43 | 5.46 | 5.75 | 4.72 | NA | 3.14 | NA | NA | NA | |

| Minority Interest | NA | NA | NA | NA | 3.00 | 3.03 | 3.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.03 | 1.03 | 1.15 | NA | 1.24 | 1.06 | 0.99 | NA | 1.17 | 1.41 | 0.85 | NA | 0.84 | 0.98 | 0.82 | NA | 0.88 | 0.99 | 0.86 | 1.10 | 0.89 | 1.21 | 0.82 | 0.88 | 0.67 | 0.68 | 0.66 | 0.83 | 0.57 | 0.56 | 0.51 | 0.57 | 0.57 | 0.49 | 0.50 | 0.56 | 0.69 | 0.48 | 0.29 | 0.47 | 0.49 | 0.45 | 0.53 | 0.36 | 0.38 | 0.39 | 0.35 | 0.30 | 0.30 | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | NA | NA | NA | NA | 0.12 | 0.15 | 0.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 32.52 | 34.12 | 9.76 | 37.62 | 49.36 | 18.24 | 3.52 | 38.97 | 15.96 | 19.94 | 27.23 | 39.34 | 9.10 | 15.98 | 12.70 | 18.78 | 17.75 | 10.84 | 11.05 | 20.18 | 12.18 | 22.60 | 10.93 | 4.10 | 20.25 | 13.74 | 15.59 | 13.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -164.89 | -135.16 | -17.34 | -139.39 | -199.62 | -10.08 | -35.34 | -90.71 | -56.17 | 275.65 | -207.65 | -225.30 | 43.66 | -569.35 | -53.73 | -84.16 | -43.32 | 13.65 | -49.34 | 106.88 | 61.78 | -47.62 | -132.61 | -82.59 | -22.05 | -57.28 | 47.22 | -121.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 111.08 | -1.63 | 157.21 | -60.79 | -93.69 | -185.98 | -177.68 | 427.99 | 84.96 | -88.38 | 195.45 | 212.90 | 13.85 | 523.25 | 45.82 | 178.89 | 45.74 | -19.80 | -49.31 | -48.60 | -8.47 | 23.14 | 39.31 | 88.66 | 5.75 | 79.19 | -21.30 | 97.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 32.52 | 34.12 | 9.76 | 37.62 | 49.36 | 18.24 | 3.52 | 38.97 | 15.96 | 19.94 | 27.23 | 39.34 | 9.10 | 15.98 | 12.70 | 18.78 | 17.75 | 10.84 | 11.05 | 20.18 | 12.18 | 22.60 | 10.93 | 4.10 | 20.25 | 13.74 | 15.59 | 13.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 27.09 | 27.66 | 29.05 | 29.91 | 28.54 | 26.90 | 7.94 | 24.59 | 23.16 | 4.18 | 22.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 6.00 | NA | NA | NA | 5.56 | NA | |

| Deferred Income Tax Expense Benefit | -1.35 | -1.80 | 2.26 | -1.48 | -1.47 | 3.54 | 1.23 | 1.56 | 1.53 | 0.86 | 1.45 | -3.58 | -1.99 | -2.22 | 0.28 | -0.93 | -0.96 | -2.93 | -1.03 | 0.22 | -0.53 | -0.45 | 0.49 | 5.59 | -1.29 | -0.54 | 0.03 | 0.55 | -0.77 | -0.73 | 1.18 | -0.48 | 0.15 | 0.08 | 1.09 | -0.05 | -0.05 | -0.95 | 0.70 | 1.80 | -0.29 | 0.22 | -1.15 | -1.45 | -0.43 | -0.34 | -0.71 | -0.89 | -0.55 | -0.49 | -0.15 | 0.42 | -0.79 | NA | NA | |

| Share Based Compensation | 1.03 | 1.03 | 1.15 | 1.11 | 1.24 | 1.06 | 0.99 | 1.14 | 1.17 | 1.41 | 0.85 | 0.63 | 0.84 | 0.98 | 0.82 | 0.85 | 0.88 | 0.99 | 0.86 | 1.10 | 0.89 | 1.21 | 0.82 | 0.88 | 0.67 | 0.68 | 0.66 | 0.83 | 0.57 | 0.56 | 0.51 | 0.57 | 0.57 | 0.49 | 0.50 | 0.56 | 0.69 | 0.48 | 0.29 | 0.47 | 0.49 | 0.45 | 0.53 | 0.36 | 0.38 | 0.39 | 0.35 | 0.30 | 0.30 | 0.32 | 0.25 | 0.25 | 0.25 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -164.89 | -135.16 | -17.34 | -139.39 | -199.62 | -10.08 | -35.34 | -90.71 | -56.17 | 275.65 | -207.65 | -225.30 | 43.66 | -569.35 | -53.73 | -84.16 | -43.32 | 13.65 | -49.34 | 106.88 | 61.78 | -47.62 | -132.61 | -82.59 | -22.05 | -57.28 | 47.22 | -121.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 2.06 | 1.64 | 1.83 | 3.15 | 1.73 | 12.62 | 0.95 | 1.34 | 1.49 | 1.19 | 0.56 | 1.39 | 1.54 | 0.96 | 1.56 | 0.92 | 0.86 | 1.32 | 2.00 | 2.14 | 2.22 | 1.58 | 1.11 | 1.05 | 0.89 | 0.53 | 0.31 | 0.42 | 1.25 | 3.49 | 1.17 | 0.32 | 0.52 | 0.89 | 1.73 | 1.01 | 0.31 | 0.69 | 0.51 | 0.56 | 1.02 | 0.44 | 0.35 | 0.07 | 0.31 | 0.81 | 2.10 | 1.97 | 1.53 | 2.57 | 2.18 | 1.53 | 3.29 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 111.08 | -1.63 | 157.21 | -60.79 | -93.69 | -185.98 | -177.68 | 427.99 | 84.96 | -88.38 | 195.45 | 212.90 | 13.85 | 523.25 | 45.82 | 178.89 | 45.74 | -19.80 | -49.31 | -48.60 | -8.47 | 23.14 | 39.31 | 88.66 | 5.75 | 79.19 | -21.30 | 97.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends | 8.77 | 8.47 | 8.56 | 8.46 | 8.45 | 8.11 | 8.29 | 7.42 | 7.42 | 7.19 | 6.17 | 6.10 | 6.11 | 6.16 | 6.12 | 6.07 | 5.85 | 5.89 | 5.73 | 5.66 | 5.66 | 5.23 | 5.21 | 4.74 | 4.51 | 4.53 | 4.29 | 4.28 | 4.04 | 4.04 | 3.73 | 3.72 | 3.56 | 3.55 | 3.39 | 3.39 | 3.23 | 3.23 | 3.08 | 3.07 | 2.91 | 2.90 | 2.79 | 2.78 | 2.64 | 2.64 | 2.63 | 2.49 | 2.48 | 2.48 | 2.47 | 4.80 | 2.31 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 88.92 | 83.06 | 79.47 | 75.15 | 67.41 | 59.11 | 49.98 | 47.51 | 46.95 | 43.10 | 39.52 | 38.34 | 36.14 | 36.51 | 36.88 | 37.80 | 37.97 | 36.97 | 35.03 | 35.00 | 33.02 | 32.00 | 29.73 | 29.09 | 28.11 | 27.01 | 26.63 | 26.37 | 25.94 | 25.16 | 24.70 | 24.04 | 23.28 | 23.00 | 22.85 | 22.78 | 22.69 | 22.01 | 21.60 | 22.07 | 22.27 | 21.29 | 20.84 | 22.03 | 21.69 | 21.36 | 21.81 | 21.57 | 21.62 | 21.57 | 21.29 | 21.72 | 22.02 | 21.45 | 20.96 | |

| Product Sales Commissions And Fees | 0.79 | 0.80 | 0.75 | 0.83 | 0.89 | 0.73 | 0.61 | 0.76 | 0.78 | 0.55 | 0.46 | 0.49 | 0.43 | 0.39 | 0.47 | 0.38 | 0.40 | 0.36 | 0.36 | 0.43 | 0.44 | 0.40 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Treasury Management | 2.63 | 2.55 | 2.32 | 2.28 | 2.22 | 2.19 | 1.90 | 1.87 | 1.77 | 1.73 | 1.54 | 1.51 | 1.37 | 1.25 | 1.28 | 1.37 | 1.26 | 1.20 | 1.16 | 1.26 | 1.15 | 1.11 | 0.95 | 1.11 | 1.08 | 1.08 | 0.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit And Debit Card | 4.87 | 4.71 | 4.48 | 5.05 | 4.71 | 4.75 | 4.12 | 4.01 | 3.89 | 3.28 | 2.27 | 2.22 | 2.22 | 2.06 | 1.98 | 2.11 | 2.10 | 2.17 | 1.74 | 1.81 | 1.76 | 1.69 | 1.51 | 1.57 | 1.49 | 1.51 | 1.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account | 2.27 | 2.20 | 2.15 | 2.18 | 2.18 | 2.06 | 1.86 | 1.91 | 1.77 | 1.23 | 0.94 | 1.08 | 1.00 | 0.80 | 1.28 | 1.49 | 1.44 | 1.34 | 1.25 | 1.42 | 1.48 | 1.45 | 1.51 | 1.59 | 1.57 | 1.52 | 1.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fiduciary And Trust | 10.03 | 10.15 | 9.53 | 9.22 | 9.15 | 9.49 | 8.47 | 7.38 | 7.13 | 6.86 | 6.25 | 5.80 | 5.66 | 5.73 | 6.22 | 5.80 | 5.74 | 5.66 | 5.44 | 5.31 | 5.38 | 5.34 | 5.50 | 5.23 | 5.03 | 5.15 | 5.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Advisory Management And Administrative Service | 0.79 | 0.80 | 0.75 | 0.83 | 0.89 | 0.73 | 0.61 | 0.76 | 0.78 | 0.55 | 0.46 | 0.49 | 0.43 | 0.39 | 0.47 | 0.38 | 0.40 | 0.36 | 0.36 | 0.43 | 0.44 | 0.40 | 0.40 | 0.48 | 0.40 | 0.36 | 0.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product And Service Other | 0.61 | 1.09 | 1.23 | 1.53 | 1.42 | 1.15 | 0.97 | 1.34 | 1.09 | 0.63 | 0.77 | 0.73 | 0.22 | 0.59 | 0.28 | 0.85 | 1.03 | 0.55 | 0.46 | 0.24 | 0.31 | 0.51 | 0.29 | 0.65 | 0.36 | 0.45 | 0.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product Sales Commissions And Fees, Commercial Banking | 0.79 | 0.80 | 0.75 | 0.83 | 0.89 | 0.73 | 0.61 | 0.76 | 0.78 | 0.55 | 0.46 | 0.49 | 0.43 | 0.39 | 0.47 | 0.38 | 0.40 | 0.36 | 0.36 | 0.43 | 0.44 | 0.40 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Treasury Management, Commercial Banking | 2.63 | 2.55 | 2.32 | 2.28 | 2.22 | 2.19 | 1.90 | 1.87 | 1.77 | 1.73 | 1.54 | 1.51 | 1.37 | 1.25 | 1.28 | 1.37 | 1.26 | 1.20 | 1.16 | 1.26 | 1.15 | 1.11 | 0.95 | 1.11 | 1.08 | 1.08 | 0.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit And Debit Card, Commercial Banking | 4.87 | 4.71 | 4.48 | 5.05 | 4.71 | 4.75 | 4.12 | 4.01 | 3.89 | 3.28 | 2.27 | 2.22 | 2.22 | 2.06 | 1.98 | 2.11 | 2.10 | 2.17 | 1.74 | 1.81 | 1.76 | 1.69 | 1.51 | 1.57 | 1.49 | 1.51 | 1.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account, Commercial Banking | 2.27 | 2.20 | 2.15 | 2.18 | 2.18 | 2.06 | 1.86 | 1.91 | 1.77 | 1.23 | 0.94 | 1.08 | 1.00 | 0.80 | 1.28 | 1.49 | 1.44 | 1.34 | 1.25 | 1.42 | 1.48 | 1.45 | 1.51 | 1.59 | 1.57 | 1.52 | 1.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fiduciary And Trust, Investment Management And Trust | 10.03 | 10.15 | 9.53 | 9.22 | 9.15 | 9.49 | 8.47 | 7.38 | 7.13 | 6.86 | 6.25 | 5.80 | 5.66 | NA | NA | NA | NA | NA | NA | 5.31 | 5.38 | 5.34 | 5.50 | 5.23 | 5.03 | 5.15 | 5.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fiduciary And Trust,WMT | 10.03 | 10.15 | 9.53 | 9.22 | 9.15 | 9.49 | 8.47 | 7.38 | 7.13 | 6.86 | 6.25 | 5.80 | 5.66 | 5.73 | 6.22 | 5.80 | 5.74 | 5.66 | 5.44 | 5.31 | 5.38 | 5.34 | 5.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |