| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | 134.36 | 134.21 | 134.55 | NA | 137.60 | 138.96 | 139.57 | NA | 138.06 | 138.93 | 137.19 | 128.35 | 127.59 | 124.58 | 126.08 | NA | 121.12 | 109.51 | 100.78 | NA | 102.96 | 104.77 | 105.04 | NA | 105.42 | 107.18 | 104.77 | 97.79 | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 133.09 | 133.08 | 133.55 | NA | 136.44 | 137.91 | 138.60 | NA | 129.85 | 131.35 | 130.84 | 127.96 | 124.91 | 123.64 | 123.12 | NA | 115.20 | 105.07 | 100.09 | NA | 99.96 | 99.94 | 99.90 | NA | 99.56 | 98.94 | 98.25 | 97.79 | NA | NA | NA | NA | |

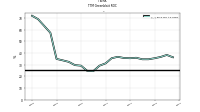

| Earnings Per Share Basic | 0.17 | 0.24 | 0.29 | 0.25 | 0.49 | 0.22 | 0.25 | 0.28 | 0.20 | 0.23 | 0.20 | -0.01 | 0.18 | 0.13 | 0.02 | 0.18 | 0.08 | 0.11 | 0.21 | 0.12 | 0.08 | 0.19 | 0.24 | 1.80 | 0.10 | 0.19 | 0.16 | -0.05 | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.17 | 0.24 | 0.28 | 0.24 | 0.48 | 0.22 | 0.25 | 0.26 | 0.19 | 0.21 | 0.19 | -0.01 | 0.18 | 0.13 | 0.02 | 0.17 | 0.07 | 0.10 | 0.21 | 0.12 | 0.08 | 0.18 | 0.23 | 1.74 | 0.09 | 0.18 | 0.15 | -0.05 | NA | NA | NA | NA |

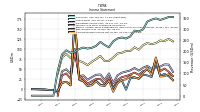

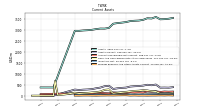

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

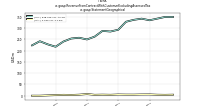

| Revenue From Contract With Customer Excluding Assessed Tax | 352.80 | 352.36 | 345.40 | 339.46 | 346.23 | 340.47 | 332.05 | 297.16 | 287.97 | 291.49 | 265.42 | 256.04 | 260.86 | 256.23 | 243.49 | 216.67 | 227.21 | 241.06 | 222.74 | 214.81 | 210.98 | 215.85 | 208.74 | 196.22 | 192.25 | 203.18 | 184.54 | 112.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Revenues | 352.80 | 352.36 | 345.40 | 339.46 | 346.23 | 340.47 | 332.05 | 297.16 | 287.97 | 291.49 | 265.42 | 256.04 | 260.86 | 256.23 | 243.49 | 216.67 | 227.21 | 241.06 | 222.74 | 214.81 | 210.98 | 215.85 | 208.74 | 196.22 | 192.25 | 203.18 | 184.54 | 112.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Gain Loss On Investments | 0.01 | 0.00 | 0.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

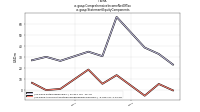

| Cost Of Goods And Services Sold | 233.02 | 226.37 | 224.69 | 217.52 | 230.81 | 227.77 | 216.43 | 186.78 | 188.99 | 186.38 | 169.90 | 160.27 | 169.70 | 166.85 | 164.15 | 145.89 | 156.79 | 157.61 | 147.55 | 146.01 | 150.60 | 148.99 | 137.50 | NA | NA | NA | NA | 73.28 | NA | NA | NA | NA | |

| Gross Profit | 119.78 | 125.99 | 120.72 | 121.93 | 115.42 | 112.70 | 115.62 | 110.38 | 98.98 | 105.11 | 95.52 | 95.77 | 91.16 | 89.37 | 79.34 | 70.78 | 70.42 | 83.45 | 75.19 | 68.80 | 60.38 | 66.86 | 71.24 | 80.79 | 78.36 | 88.44 | 79.30 | 38.71 | NA | NA | NA | NA | |

| Operating Expenses | 76.30 | 64.28 | 58.62 | 65.36 | 61.03 | 61.73 | 57.28 | 56.42 | 52.38 | 51.98 | 48.47 | 51.54 | 49.82 | 54.80 | 64.17 | 31.24 | 46.85 | 46.57 | 39.08 | 38.46 | 36.69 | 32.21 | 38.37 | -19.97 | 39.65 | 38.65 | 34.57 | 48.32 | NA | NA | NA | NA | |

| General And Administrative Expense | 26.92 | 28.20 | 28.20 | 29.15 | 30.50 | 30.13 | 29.67 | 29.92 | 23.57 | 23.50 | 22.18 | 21.60 | 21.91 | 24.15 | 25.20 | 14.94 | 17.74 | 19.28 | 17.47 | 13.45 | 13.57 | 11.19 | 14.56 | 9.53 | 14.49 | 15.74 | 13.18 | 7.32 | NA | NA | NA | NA | |

| Marketing And Advertising Expense | 22.14 | 20.18 | 13.90 | 19.40 | 15.82 | 15.59 | 11.95 | 11.99 | 14.77 | 13.14 | 11.78 | 12.74 | 11.76 | 11.16 | 10.06 | 9.59 | 10.63 | 10.70 | 8.86 | 7.70 | 9.56 | 8.94 | 8.87 | 8.70 | 8.87 | 8.11 | 7.32 | 5.25 | NA | NA | NA | NA | |

| Operating Income Loss | 43.48 | 61.72 | 62.09 | 56.57 | 54.39 | 50.97 | 58.35 | 53.96 | 46.60 | 53.13 | 47.05 | 44.23 | 41.34 | 34.58 | 15.17 | 39.53 | 23.57 | 36.88 | 36.11 | 30.34 | 23.69 | 34.65 | 32.87 | 100.76 | 38.72 | 49.79 | 44.72 | -9.61 | -2.30 | -2.14 | -0.21 | -0.01 | |

| Interest Expense | 10.43 | 10.28 | 10.19 | 11.27 | 10.28 | 9.74 | 9.67 | 9.86 | 9.93 | 9.95 | 10.02 | 10.26 | 10.27 | 10.58 | 11.72 | 9.52 | 9.81 | 10.30 | 10.24 | 10.34 | 9.97 | 9.75 | 9.34 | 9.34 | 9.97 | 10.04 | 9.83 | 6.65 | NA | NA | NA | NA | |

| Interest Paid Net | 10.12 | 17.98 | 10.10 | 10.08 | 10.74 | 8.92 | 9.68 | 9.55 | 9.57 | 9.64 | 9.81 | 9.89 | 10.00 | 11.13 | 10.76 | 10.38 | 11.13 | 11.38 | 11.09 | 6.64 | 10.61 | 10.42 | 9.94 | 10.35 | NA | NA | NA | 0.00 | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 10.07 | 11.41 | 13.44 | 12.38 | 9.77 | 11.26 | 13.69 | 8.90 | 9.88 | 11.73 | 10.01 | 8.38 | 6.28 | 5.49 | 0.25 | 5.98 | 3.03 | 9.06 | -1.18 | 3.64 | 2.60 | 0.19 | 6.52 | -98.81 | 10.32 | 11.31 | 9.98 | -7.76 | NA | NA | NA | NA | |

| Income Taxes Paid Net | 1.17 | 5.08 | 6.42 | NA | 7.53 | 12.00 | -0.51 | NA | 3.07 | 6.68 | -8.19 | NA | 5.98 | 0.01 | -0.59 | NA | 0.60 | 1.82 | -0.01 | NA | 0.13 | 3.45 | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 22.81 | 32.49 | 38.29 | 32.89 | 66.27 | 30.48 | 34.56 | 36.53 | 26.19 | 29.85 | 26.73 | -1.43 | 22.61 | 16.17 | 2.35 | 21.72 | 8.79 | 11.48 | 21.13 | 11.83 | 7.94 | 19.28 | 23.84 | 179.69 | 9.55 | 18.83 | 15.83 | -4.40 | -2.14 | -1.98 | -0.21 | -0.01 | |

| Comprehensive Income Net Of Tax | 22.06 | 37.59 | 32.71 | 31.80 | 79.45 | 35.75 | 52.78 | 40.18 | 26.76 | 29.36 | 32.89 | 24.95 | 22.71 | 14.85 | -6.46 | 21.82 | 8.30 | 9.69 | 19.91 | 9.92 | 8.20 | 20.05 | 25.92 | 181.05 | 9.81 | 18.53 | 15.83 | -4.40 | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | NA | NA | NA | NA | 66.27 | 30.48 | 34.56 | NA | 26.19 | 29.85 | 26.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

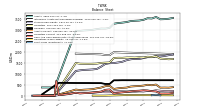

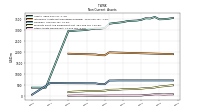

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

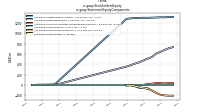

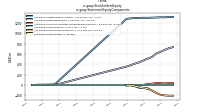

| Assets | 3554.60 | 3517.41 | 3499.03 | 3492.20 | 3600.18 | 3529.21 | 3540.36 | 3466.31 | 3434.99 | 3425.12 | 3410.75 | 3365.47 | 3339.84 | 3319.62 | 3289.58 | 3097.70 | 3066.78 | 3068.98 | 3043.84 | 3010.71 | 2993.62 | 2982.63 | 2964.52 | 2966.28 | NA | NA | NA | NA | 375.56 | 375.90 | NA | NA | |

| Liabilities | 1677.25 | 1665.67 | 1683.24 | 1695.12 | 1802.70 | 1768.47 | 1779.48 | 1747.32 | 1756.00 | 1742.18 | 1747.27 | 1743.88 | 1730.83 | 1733.20 | 1718.48 | 1517.48 | 1509.51 | 1498.55 | 1467.48 | 1460.46 | 1458.10 | 1459.53 | 1462.60 | 1493.70 | NA | NA | NA | NA | 17.24 | 15.44 | NA | NA | |

| Liabilities And Stockholders Equity | 3554.60 | 3517.41 | 3499.03 | 3492.20 | 3600.18 | 3529.21 | 3540.36 | 3466.31 | 3434.99 | 3425.12 | 3410.75 | 3365.47 | 3339.84 | 3319.62 | 3289.58 | 3097.70 | 3066.78 | 3068.98 | 3043.84 | 3010.71 | 2993.62 | 2982.63 | 2964.52 | 2966.28 | NA | NA | NA | NA | 375.56 | 375.90 | NA | NA | |

| Stockholders Equity | 1877.35 | 1851.74 | 1815.79 | 1797.08 | 1797.48 | 1760.73 | 1760.88 | 1718.99 | 1678.99 | 1682.94 | 1663.48 | 1621.59 | 1549.62 | 1518.79 | 1490.52 | 1485.79 | 1452.21 | 1326.33 | 1221.38 | 1199.80 | 1188.46 | 1179.29 | 1158.45 | 1130.33 | NA | NA | NA | NA | 5.00 | 5.00 | 5.00 | 0.01 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 388.92 | 366.42 | 371.07 | 367.06 | 508.99 | 477.87 | 498.36 | 460.72 | 441.75 | 432.85 | 417.95 | 369.55 | 357.05 | 337.31 | 306.29 | 453.16 | 433.49 | 370.65 | 338.57 | 299.44 | 283.90 | 275.21 | 259.79 | 279.03 | NA | NA | NA | NA | 0.16 | 0.66 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 127.76 | 99.37 | 101.67 | 98.58 | 190.83 | 206.83 | 238.43 | 249.16 | 228.10 | 218.81 | 197.85 | 173.03 | 152.30 | 127.78 | 96.17 | 285.09 | 266.87 | 189.28 | 160.48 | 146.38 | 127.40 | 115.27 | 100.45 | 135.70 | 101.17 | 66.22 | 45.67 | 26.86 | 0.01 | 0.45 | 1.31 | 0.11 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 127.76 | 99.37 | 101.67 | 98.58 | 190.83 | 206.83 | 238.43 | 249.16 | 228.10 | 218.81 | 197.85 | 173.03 | 152.30 | 127.78 | 96.17 | 285.09 | 266.87 | 189.28 | 160.48 | 146.38 | 127.40 | 115.27 | 100.45 | 135.70 | NA | NA | NA | 26.86 | NA | NA | NA | NA | |

| Short Term Investments | NA | NA | NA | 17.91 | 41.89 | 20.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 188.16 | 181.73 | 189.95 | 168.78 | 199.92 | 178.77 | 193.09 | 148.18 | 156.72 | 148.73 | 159.49 | 125.55 | 136.93 | 141.18 | 147.06 | 104.89 | 115.86 | 128.19 | 129.23 | 105.70 | 107.46 | 110.47 | 113.45 | 101.00 | NA | NA | NA | 89.20 | NA | NA | NA | NA | |

| Inventory Net | 62.05 | 67.24 | 67.50 | 65.41 | 65.44 | 60.81 | 59.87 | 52.81 | 49.31 | 52.16 | 52.14 | 49.35 | 47.71 | 51.78 | 50.74 | 47.61 | 38.58 | 42.89 | 43.16 | 38.58 | 37.08 | 38.19 | 39.97 | 34.34 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 10.95 | 18.08 | 11.95 | 16.38 | 10.91 | 10.54 | 6.97 | 10.56 | 7.62 | 13.15 | 8.47 | 21.61 | 20.12 | 16.57 | 12.32 | 15.57 | 12.18 | 10.29 | 5.70 | 8.81 | 11.96 | 11.28 | 5.92 | 7.97 | NA | NA | NA | NA | NA | NA | NA | NA |

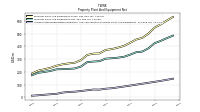

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 631.02 | 602.51 | 572.52 | 547.40 | 499.87 | 466.72 | 453.98 | 427.98 | 403.90 | 390.03 | 378.76 | 371.99 | 345.18 | 343.02 | 332.41 | 292.71 | 272.07 | 266.49 | 259.54 | 248.31 | 231.98 | 220.38 | 209.25 | 187.57 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 146.62 | 137.95 | 129.56 | 122.09 | 114.79 | 107.28 | 99.93 | 92.68 | 85.41 | 78.50 | 71.77 | 68.03 | 61.07 | 61.88 | 55.78 | 50.33 | 44.96 | 42.74 | 37.90 | 27.96 | 24.66 | 20.54 | 16.74 | 13.45 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 5.88 | 5.88 | 5.88 | 5.88 | 5.88 | 5.88 | 5.88 | 5.88 | 5.88 | 5.88 | 5.88 | 6.18 | 6.74 | 7.11 | 6.48 | 5.63 | 5.75 | 6.01 | 5.99 | 6.07 | 5.99 | 5.99 | 5.99 | 6.04 | 5.99 | 5.99 | 5.87 | 3.92 | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 484.41 | 464.56 | 442.96 | 425.31 | 385.08 | 359.44 | 354.06 | 335.31 | 318.49 | 311.54 | 307.00 | 303.96 | 284.12 | 281.14 | 276.63 | 242.38 | 227.11 | 223.75 | 221.64 | 220.35 | 207.32 | 199.84 | 192.51 | 174.12 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 706.62 | 707.13 | 702.92 | 701.90 | 535.85 | 535.85 | 574.64 | 575.64 | 575.60 | 578.35 | 578.35 | 579.45 | 579.45 | NA | NA | NA | 588.46 | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 1903.25 | 1909.12 | 1915.00 | 1920.88 | 1926.76 | 1932.64 | 1938.51 | 1944.39 | 1950.27 | 1956.15 | 1962.03 | 1967.90 | 1974.08 | 1980.86 | 1987.93 | 1853.32 | 1858.94 | 1889.22 | 1895.23 | 1901.21 | 1905.11 | 1911.10 | 1917.09 | 1923.09 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 71.41 | 70.69 | 63.38 | 72.33 | 72.73 | 52.65 | 42.82 | 19.28 | 17.86 | 17.98 | 17.17 | 17.45 | 17.46 | 17.39 | 16.82 | 12.99 | 11.38 | 10.71 | 12.76 | 14.06 | 18.96 | 18.14 | 15.68 | 10.59 | NA | NA | NA | NA | NA | NA | NA | NA |

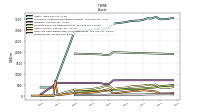

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

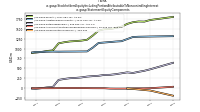

| Liabilities Current | 212.31 | 203.23 | 206.88 | 224.31 | 244.62 | 212.00 | 215.12 | 193.63 | 198.26 | 185.30 | 186.97 | 189.53 | 196.37 | 203.03 | 185.03 | 159.93 | 158.66 | 166.93 | 154.66 | 141.10 | 133.45 | 135.65 | 133.91 | 127.85 | NA | NA | NA | NA | 4.12 | 2.32 | NA | NA | |

| Accounts Payable Current | 89.54 | 87.50 | 91.77 | 85.67 | 95.96 | 84.15 | 90.59 | 68.10 | 71.14 | 67.75 | 76.11 | 61.43 | 60.10 | 67.17 | 67.11 | 68.57 | 69.81 | 72.16 | 74.65 | 65.29 | 74.24 | 70.86 | 65.75 | 49.99 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Current | 13.46 | 11.88 | 11.81 | 16.42 | 12.60 | 13.22 | 14.54 | 11.18 | 11.86 | 12.04 | 11.00 | 11.12 | 19.07 | NA | NA | 10.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt And Capital Lease Obligations | 978.54 | 982.05 | 998.23 | 999.09 | 1088.91 | 1092.80 | 1096.87 | 1099.97 | 1103.33 | 1107.02 | 1110.10 | 1113.04 | 1106.37 | 1109.29 | 1112.39 | 975.40 | 972.84 | 972.12 | 974.44 | 976.74 | 979.53 | 982.33 | 985.12 | 987.92 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 368.42 | 361.93 | 353.38 | 347.03 | 343.01 | 336.59 | 331.66 | 317.85 | 315.54 | 310.99 | 303.88 | 295.01 | 298.39 | 293.33 | 290.34 | 256.05 | 252.99 | 273.57 | 275.24 | 277.95 | 276.54 | 272.97 | 273.28 | 267.77 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 1.33 | 1.30 | 1.62 | 1.59 | 1.57 | 1.64 | 1.61 | 1.60 | 1.59 | 1.58 | 1.57 | 1.56 | 1.34 | 1.34 | 1.32 | 0.00 | NA | 0.11 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1877.35 | 1851.74 | 1815.79 | 1797.08 | 1797.48 | 1760.73 | 1760.88 | 1718.99 | 1678.99 | 1682.94 | 1663.48 | 1621.59 | 1549.62 | 1518.79 | 1490.52 | 1485.79 | 1452.21 | 1326.33 | 1221.38 | 1199.80 | 1188.46 | 1179.29 | 1158.45 | 1130.33 | NA | NA | NA | NA | 5.00 | 5.00 | 5.00 | 0.01 | |

| Additional Paid In Capital | 1318.97 | 1315.42 | 1311.29 | 1311.63 | 1307.81 | 1304.97 | 1302.04 | 1303.25 | 1300.33 | 1297.67 | 1290.88 | 1238.77 | 1185.00 | 1176.82 | 1163.26 | 1152.06 | 1140.13 | 1022.53 | 927.57 | 925.90 | 924.48 | 923.50 | 922.72 | 920.72 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 733.18 | 710.37 | 677.88 | 639.60 | 606.70 | 540.43 | 509.96 | 475.40 | 438.87 | 412.68 | 382.83 | 399.21 | 375.60 | 353.00 | 336.83 | 334.48 | 312.76 | 303.97 | 292.49 | 271.37 | 259.53 | 251.59 | 232.31 | 208.28 | NA | NA | NA | NA | -4.80 | -2.66 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 33.85 | 34.60 | 29.50 | 35.08 | 36.17 | 22.99 | 17.72 | -0.51 | -4.16 | -4.73 | -4.25 | -10.41 | -11.00 | -11.03 | -9.58 | -0.76 | -0.69 | -0.19 | 1.31 | 2.52 | 4.43 | 4.18 | 3.41 | 1.32 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Treasury Stock Value | NA | NA | NA | NA | NA | 107.68 | 68.85 | 59.17 | 56.06 | 22.69 | 6.00 | 6.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

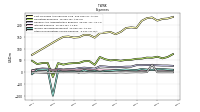

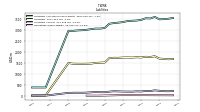

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

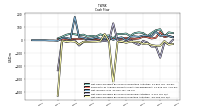

| Net Cash Provided By Used In Operating Activities | 54.87 | 60.42 | 27.93 | 84.60 | 77.04 | 55.64 | 31.53 | 55.39 | 60.34 | 54.45 | 32.85 | 51.25 | 47.31 | 47.54 | 13.14 | 36.62 | 33.29 | 45.68 | 28.39 | 33.78 | 28.69 | 42.86 | 38.32 | 45.91 | 49.99 | 41.51 | 26.27 | 13.61 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -29.16 | -33.74 | -6.43 | -42.21 | -42.88 | -37.97 | -24.86 | -28.73 | -14.51 | -11.29 | -10.88 | -19.88 | -9.18 | -13.66 | -331.54 | -7.77 | 48.94 | -7.47 | -10.84 | -11.67 | -13.94 | -12.85 | -32.49 | -10.81 | -8.49 | -10.99 | -4.91 | -428.20 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 3.13 | -29.44 | -18.38 | -135.04 | -48.10 | -49.20 | -17.47 | -5.55 | -36.44 | -22.00 | 2.75 | -10.72 | -13.63 | -2.78 | 130.35 | -10.63 | -4.64 | -9.41 | -3.44 | -3.13 | -2.63 | -15.19 | -41.09 | -0.57 | -6.55 | -9.97 | -2.54 | -232.34 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 54.87 | 60.42 | 27.93 | 84.60 | 77.04 | 55.64 | 31.53 | 55.39 | 60.34 | 54.45 | 32.85 | 51.25 | 47.31 | 47.54 | 13.14 | 36.62 | 33.29 | 45.68 | 28.39 | 33.78 | 28.69 | 42.86 | 38.32 | 45.91 | 49.99 | 41.51 | 26.27 | 13.61 | NA | NA | NA | NA | |

| Net Income Loss | 22.81 | 32.49 | 38.29 | 32.89 | 66.27 | 30.48 | 34.56 | 36.53 | 26.19 | 29.85 | 26.73 | -1.43 | 22.61 | 16.17 | 2.35 | 21.72 | 8.79 | 11.48 | 21.13 | 11.83 | 7.94 | 19.28 | 23.84 | 179.69 | 9.55 | 18.83 | 15.83 | -4.40 | -2.14 | -1.98 | -0.21 | -0.01 | |

| Depreciation Depletion And Amortization | 15.02 | 14.73 | 15.33 | 15.59 | 16.55 | 14.65 | 13.30 | 13.69 | 12.77 | 12.53 | 12.69 | 13.94 | 14.52 | 13.66 | 12.82 | 10.66 | 10.74 | 11.06 | 10.88 | 10.04 | 10.72 | 10.56 | 10.09 | 9.59 | 9.72 | 9.59 | 9.27 | 5.84 | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 6.53 | -8.30 | 21.17 | -31.14 | 21.30 | -14.25 | 44.85 | -8.51 | 8.05 | -11.01 | 34.20 | -11.54 | -4.21 | -6.14 | 17.46 | -10.97 | -8.97 | -1.04 | 23.55 | -1.78 | -3.01 | -2.98 | 11.44 | 0.28 | 0.61 | 4.06 | 6.82 | -3.71 | NA | NA | NA | NA | |

| Increase Decrease In Inventories | -5.19 | -0.26 | 2.09 | -0.04 | 4.63 | 0.94 | 7.05 | 3.50 | -2.85 | 0.02 | 2.80 | 1.64 | -3.33 | 1.04 | -5.18 | 9.03 | -0.86 | -0.27 | 4.58 | 1.10 | -1.11 | -1.55 | -2.01 | 0.53 | 0.01 | 1.71 | 1.65 | -8.89 | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | 6.76 | 6.75 | 8.31 | 4.41 | 1.73 | 3.05 | 7.32 | 0.71 | 4.35 | 7.29 | 6.65 | 8.23 | 4.60 | 4.62 | -0.65 | 4.60 | 3.88 | 8.52 | -2.88 | 2.33 | 2.94 | 0.21 | 4.79 | -101.26 | 7.49 | 7.05 | 5.46 | -7.82 | NA | NA | NA | NA | |

| Share Based Compensation | 3.47 | 3.53 | 3.01 | 2.85 | 2.61 | 2.65 | 2.34 | 2.58 | 2.64 | 1.64 | 2.72 | 2.09 | 2.08 | 2.43 | 2.08 | 2.07 | 2.38 | 2.50 | 2.28 | 1.36 | 1.52 | 1.10 | 1.62 | -0.58 | 3.63 | 3.84 | 0.52 | 26.75 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -29.16 | -33.74 | -6.43 | -42.21 | -42.88 | -37.97 | -24.86 | -28.73 | -14.51 | -11.29 | -10.88 | -19.88 | -9.18 | -13.66 | -331.54 | -7.77 | 48.94 | -7.47 | -10.84 | -11.67 | -13.94 | -12.85 | -32.49 | -10.81 | -8.49 | -10.99 | -4.91 | -428.20 | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 24.98 | 31.70 | 23.46 | 64.13 | 18.94 | 13.27 | 23.03 | 27.44 | 13.31 | 9.80 | 10.25 | 18.60 | 10.01 | 12.05 | 11.32 | 6.45 | 13.02 | 5.91 | 9.49 | 11.70 | 13.05 | 11.82 | 8.02 | 10.16 | 7.65 | 10.58 | 4.52 | 6.49 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 3.13 | -29.44 | -18.38 | -135.04 | -48.10 | -49.20 | -17.47 | -5.55 | -36.44 | -22.00 | 2.75 | -10.72 | -13.63 | -2.78 | 130.35 | -10.63 | -4.64 | -9.41 | -3.44 | -3.13 | -2.63 | -15.19 | -41.09 | -0.57 | -6.55 | -9.97 | -2.54 | -232.34 | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.00 | 5.76 | 13.67 | 36.01 | 45.54 | 38.83 | 9.68 | 3.11 | 33.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 352.80 | 352.36 | 345.40 | 339.46 | 346.23 | 340.47 | 332.05 | 297.16 | 287.97 | 291.49 | 265.42 | 256.04 | 260.86 | 256.23 | 243.49 | 216.67 | 227.21 | 241.06 | 222.74 | 214.81 | 210.98 | 215.85 | 208.74 | 196.22 | 192.25 | 203.18 | 184.54 | 112.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 352.80 | 352.36 | 345.40 | 339.46 | 346.23 | 340.47 | 332.05 | 297.16 | 287.97 | 291.49 | 265.42 | 256.04 | 260.86 | 256.23 | 243.49 | 216.67 | 227.21 | 241.06 | 222.74 | 214.81 | 210.98 | 215.85 | 208.74 | 196.22 | 192.25 | 203.18 | 184.54 | 112.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Cookies | 37.43 | 34.82 | 36.97 | 36.09 | 38.89 | 37.03 | 35.68 | 30.63 | 29.15 | 28.99 | 27.72 | 28.74 | 26.75 | 23.61 | 17.12 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Sweet Baked Goods | 315.37 | 317.54 | 308.43 | 303.37 | 307.33 | 303.44 | 296.37 | 266.53 | 258.82 | 262.49 | 237.70 | 227.30 | 234.10 | 232.62 | 226.36 | 216.67 | 220.16 | 229.27 | 212.88 | 203.13 | 201.69 | 204.24 | 199.29 | 185.33 | 182.01 | 191.69 | 174.79 | 105.21 | NA | NA | NA | NA | |

| 4.38 | 3.75 | 4.26 | 5.51 | 5.32 | 4.69 | 4.76 | 5.23 | 3.97 | 4.59 | 3.92 | 7.14 | 4.42 | 3.15 | 3.82 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| US | 348.42 | 348.61 | 341.14 | 333.95 | 340.90 | 335.79 | 327.29 | 291.93 | 284.00 | 286.90 | 261.50 | 248.90 | 256.43 | 253.08 | 239.67 | 216.67 | 227.21 | 241.06 | 222.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Cookies | 4.38 | 3.75 | 4.26 | 5.51 | 5.32 | 4.69 | 4.76 | 5.23 | 3.97 | 4.59 | 3.92 | 7.14 | 4.42 | 3.15 | 3.82 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| US, Cookies | 33.05 | 31.07 | 32.71 | 30.58 | 33.57 | 32.35 | 30.92 | 25.40 | 25.18 | 24.41 | 23.80 | 21.60 | 22.33 | 20.46 | 13.31 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| US, Sweet Baked Goods | 315.37 | 317.54 | 308.43 | 303.37 | 307.33 | 303.44 | 296.37 | 266.53 | 258.82 | 262.49 | 237.70 | 227.30 | 234.10 | 232.62 | 226.36 | 216.67 | 220.16 | 229.27 | 212.88 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |