| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.36 | 0.36 | 0.36 | 0.36 | 0.00 | 0.00 | 0.00 | NA | 0.00 | 0.00 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 42.20 | NA | 43.30 | 43.80 | 44.40 | NA | 43.40 | 46.50 | 47.90 | NA | 43.70 | 43.80 | 41.40 | NA | 41.20 | 41.20 | 41.50 | NA | 43.40 | 45.20 | 46.10 | NA | 32.80 | 27.25 | 27.31 | NA | 27.71 | 27.96 | 27.90 | NA | 27.68 | 28.83 | 29.64 | NA | 32.13 | 32.52 | 33.01 | NA | 34.40 | 35.20 | 35.90 | NA | 36.70 | 36.60 | 36.60 | NA | 36.20 | 36.10 | 35.70 | 34.20 | 33.70 | 33.70 | 33.70 | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 35.50 | NA | 36.40 | 36.90 | 37.40 | NA | 39.50 | 41.30 | 42.40 | NA | 42.90 | 42.90 | 41.40 | NA | 41.20 | 41.20 | 41.50 | NA | 43.40 | 44.70 | 45.60 | NA | 32.80 | 26.73 | 26.68 | NA | 27.09 | 27.32 | 27.25 | NA | 27.15 | 28.34 | 29.12 | NA | 31.45 | 31.86 | 32.30 | NA | 33.40 | 34.30 | 34.90 | NA | 35.50 | 35.40 | 35.20 | NA | 34.40 | 34.30 | 34.00 | NA | 33.70 | 33.70 | 33.70 | NA | NA | |

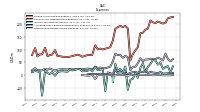

| Earnings Per Share Basic | 1.32 | 1.00 | 1.16 | 2.46 | 2.32 | 2.30 | 2.76 | 3.30 | 1.36 | 1.43 | 0.24 | 0.15 | -0.68 | -0.88 | -1.51 | -1.68 | -2.56 | 1.74 | -0.21 | 1.11 | 0.52 | 0.92 | -1.75 | 0.40 | 1.35 | 4.05 | 1.50 | 1.62 | 1.24 | 1.83 | 0.99 | 1.28 | 0.84 | 1.08 | 0.69 | 1.07 | 1.05 | 0.02 | 0.77 | 1.03 | 0.55 | 0.16 | 0.70 | 0.87 | 0.52 | -0.33 | 0.18 | 0.25 | 0.25 | 0.24 | -6.57 | 0.47 | 0.58 | NA | NA | |

| Earnings Per Share Diluted | 1.22 | 0.95 | 1.09 | 2.17 | 2.06 | 2.09 | 2.53 | 2.97 | 1.23 | 1.41 | 0.23 | 0.15 | -0.68 | -0.88 | -1.51 | -1.68 | -2.56 | 1.71 | -0.21 | 1.10 | 0.51 | 0.91 | -1.75 | 0.39 | 1.32 | 3.95 | 1.47 | 1.58 | 1.21 | 1.80 | 0.97 | 1.26 | 0.82 | 1.06 | 0.67 | 1.05 | 1.03 | 0.01 | 0.75 | 1.00 | 0.54 | 0.15 | 0.67 | 0.85 | 0.50 | -0.33 | 0.17 | 0.24 | 0.24 | 0.23 | -6.57 | 0.47 | 0.58 | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

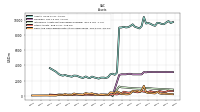

| Revenue From Contract With Customer Excluding Assessed Tax | 1112.00 | 1111.00 | 1105.00 | 1098.00 | 1091.00 | 1112.00 | 1178.00 | 1092.00 | 981.00 | 1028.00 | 983.00 | 911.00 | 700.00 | 747.00 | 585.00 | 410.00 | 938.00 | 1145.00 | 1010.00 | 999.00 | 992.00 | 1052.00 | 702.00 | 558.84 | 535.37 | 481.22 | 496.00 | 529.91 | 496.19 | 564.74 | 406.99 | 429.94 | 425.04 | 541.07 | 407.14 | 422.83 | 454.88 | 511.00 | 413.00 | 410.00 | 402.00 | 527.00 | 412.00 | 421.00 | 389.00 | 499.00 | 383.00 | 383.00 | 372.00 | 484.00 | 378.00 | 380.00 | 371.00 | 479.00 | 360.00 | |

| Revenues | 1195.00 | 1194.00 | 1186.00 | 1178.00 | 1169.00 | 1188.00 | 1252.00 | 1164.00 | 1052.00 | 1100.00 | 1052.00 | 979.00 | 759.00 | 747.00 | 649.00 | 480.00 | 1010.00 | 1145.00 | 1082.00 | 1068.00 | 1060.00 | 1052.00 | 750.00 | 594.69 | 570.85 | 481.22 | 486.99 | 497.62 | 487.49 | 564.74 | 406.99 | 429.94 | 425.04 | 541.07 | 407.14 | 422.83 | 454.88 | 511.00 | 413.00 | 410.00 | 402.00 | 527.00 | 412.00 | 421.00 | 389.00 | 499.00 | 383.00 | 383.00 | 372.00 | 484.00 | 378.00 | 380.00 | 371.00 | 479.00 | 360.00 | |

| Costs And Expenses | 1058.00 | 1092.00 | 1081.00 | 1003.00 | 1015.00 | 992.00 | 1012.00 | 957.00 | 911.00 | 935.00 | 896.00 | 870.00 | 739.00 | 730.00 | 673.00 | 521.00 | 1060.00 | 991.00 | 1012.00 | 925.00 | 969.00 | 939.00 | 698.00 | 546.93 | 517.17 | 429.60 | 428.30 | 430.20 | 433.93 | 481.38 | 364.26 | 375.45 | 380.36 | 479.65 | 362.98 | 369.81 | 395.46 | 492.00 | 367.00 | 352.00 | 367.00 | 505.00 | 370.00 | 377.00 | 361.00 | 530.00 | 365.00 | 373.00 | 355.00 | 459.00 | 684.00 | 352.00 | 338.00 | 478.00 | 328.00 | |

| General And Administrative Expense | 63.00 | 84.00 | 57.00 | 64.00 | 68.00 | 62.00 | 62.00 | 64.00 | 61.00 | 61.00 | 54.00 | 66.00 | 46.00 | 33.00 | 32.00 | 19.00 | 70.00 | 75.00 | 68.00 | 79.00 | 78.00 | 84.00 | 53.00 | 32.99 | 29.43 | 26.49 | 26.67 | 29.53 | 27.54 | 33.33 | 21.62 | 24.59 | 25.30 | NA | 23.21 | 22.89 | 22.78 | NA | 22.00 | 23.00 | 22.00 | NA | 23.00 | 22.00 | 21.00 | 17.00 | 22.00 | 26.00 | 21.00 | 25.00 | 18.00 | 19.00 | 19.00 | 27.00 | 19.00 | |

| Selling And Marketing Expense | 223.00 | 205.00 | 202.00 | 206.00 | 210.00 | 204.00 | 207.00 | 214.00 | 182.00 | 178.00 | 166.00 | 164.00 | 109.00 | 97.00 | 82.00 | 57.00 | 183.00 | 193.00 | 188.00 | 193.00 | 188.00 | 181.00 | 135.00 | 109.31 | 105.93 | 103.50 | 100.53 | 104.03 | 100.66 | 116.95 | 79.02 | 78.92 | 78.41 | NA | 71.63 | 77.14 | 80.00 | NA | 74.00 | 72.00 | 71.00 | NA | 72.00 | 74.00 | 74.00 | 98.00 | 80.00 | 78.00 | 74.00 | 107.00 | 81.00 | 81.00 | 73.00 | 106.00 | 78.00 | |

| Interest Paid Net | 52.00 | 63.00 | 42.00 | 55.00 | 44.00 | 45.00 | 35.00 | 39.00 | 30.00 | 48.00 | 47.00 | 36.00 | 53.00 | 36.00 | 56.00 | 26.00 | 58.00 | 32.00 | 54.00 | 27.00 | 54.00 | 27.00 | 15.60 | 5.10 | 7.30 | 6.00 | 5.70 | 5.10 | 4.80 | 8.60 | 5.70 | 4.30 | 4.60 | NA | 6.40 | 5.50 | 6.60 | NA | 5.00 | 8.00 | 6.00 | NA | 9.00 | 9.00 | 8.00 | 5.00 | 12.00 | 11.00 | 10.00 | 13.00 | 12.00 | NA | NA | NA | NA | |

| Interest Income Expense Nonoperating Net | -40.00 | -39.00 | -36.00 | -36.00 | -34.00 | -27.00 | -34.00 | -30.00 | -27.00 | -36.00 | -41.00 | -44.00 | -43.00 | -38.00 | -37.00 | -42.00 | -33.00 | -32.00 | -31.00 | -35.00 | -34.00 | -31.00 | -14.00 | -4.11 | -4.32 | -4.39 | -2.64 | -1.76 | -0.78 | -2.58 | -2.26 | -2.09 | -1.98 | NA | -2.84 | -3.01 | -2.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 7.00 | 6.00 | 6.00 | 12.00 | 7.00 | 9.00 | 10.00 | 12.00 | 8.00 | 18.00 | 11.00 | 14.00 | 8.00 | 13.00 | 11.00 | 9.00 | 4.00 | 8.00 | 9.00 | 11.00 | 9.00 | 20.00 | 5.00 | 6.12 | 3.60 | 3.94 | 3.90 | 5.17 | 3.28 | 3.95 | 3.14 | 4.33 | 2.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 35.00 | 31.00 | 24.00 | 50.00 | 41.00 | 57.00 | 59.00 | 43.00 | 32.00 | 11.00 | 47.00 | 27.00 | -11.00 | 7.00 | -14.00 | -19.00 | -58.00 | 33.00 | 10.00 | 25.00 | 15.00 | 44.00 | -10.00 | 6.62 | 10.71 | -63.03 | 22.37 | 21.12 | 18.66 | 30.92 | 14.04 | 24.86 | 15.76 | NA | 14.61 | 23.40 | 23.29 | NA | 18.00 | 22.00 | 13.00 | NA | 15.00 | 14.00 | 11.00 | -3.00 | 12.00 | 4.00 | 8.00 | 19.00 | -81.00 | 12.00 | 14.00 | 16.00 | 11.00 | |

| Income Taxes Paid Net | 50.00 | 3.00 | 5.00 | 77.00 | 56.00 | 6.00 | 18.00 | 40.00 | -7.00 | 6.00 | 8.00 | 3.00 | -30.00 | 16.00 | -60.00 | 8.00 | 4.00 | 6.00 | -13.00 | 48.00 | 12.00 | 23.00 | 5.00 | 9.00 | 4.00 | 11.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 46.00 | 33.00 | 42.00 | 90.00 | 87.00 | 88.00 | 110.00 | 135.00 | 58.00 | 59.00 | 11.00 | 8.00 | -25.00 | -31.00 | -58.00 | -62.00 | -105.00 | 76.00 | -7.00 | 49.00 | 24.00 | 63.00 | -58.00 | 11.00 | 36.00 | 119.00 | 40.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 6.00 | 25.00 | 30.00 | 19.00 | -11.00 | 6.00 | 8.00 | 9.00 | 8.00 | -221.00 | 16.00 | 19.00 | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -2.00 | -3.00 | -3.00 | -1.00 | -3.00 | 0.00 | 8.00 | 7.00 | 16.00 | 9.00 | 3.00 | 3.00 | 6.00 | 4.00 | 3.00 | -1.00 | -24.00 | 5.00 | -4.00 | -13.00 | -3.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -1.00 | -2.00 | -5.00 | 5.00 | 3.00 | 9.00 | 7.00 | -5.00 | 20.00 | 23.00 | -1.00 | 7.00 | 3.00 | 19.00 | 8.00 | 2.00 | -41.00 | -17.00 | -8.00 | -15.00 | -2.00 | -10.00 | 0.00 | -7.21 | 6.24 | -0.41 | 4.97 | 2.49 | 4.24 | -6.64 | -0.63 | -0.20 | 1.56 | NA | -1.45 | 3.30 | -5.60 | NA | -3.00 | -0.09 | 0.01 | NA | 0.00 | 0.00 | -1.00 | 3.00 | 1.00 | -6.00 | 4.00 | -10.00 | 1.00 | NA | NA | NA | NA | |

| Net Income Loss | 47.00 | 35.00 | 42.00 | 90.00 | 87.00 | 88.00 | 109.00 | 136.00 | 58.00 | 61.00 | 10.00 | 6.00 | -28.00 | -37.00 | -62.00 | -70.00 | -106.00 | 74.00 | -9.00 | 49.00 | 24.00 | 44.00 | -58.00 | 10.76 | 35.98 | 108.04 | 40.76 | 44.28 | 33.70 | 49.82 | 26.81 | 36.31 | 24.41 | 33.15 | 21.55 | 34.04 | 34.05 | 1.00 | 25.00 | 36.00 | 19.00 | 6.00 | 25.00 | 30.00 | 18.00 | -7.00 | 6.00 | 8.00 | 9.00 | 8.00 | -221.00 | 16.00 | 19.00 | 18.00 | 19.00 | |

| Comprehensive Income Net Of Tax | 46.00 | 33.00 | 37.00 | 95.00 | 90.00 | 97.00 | 116.00 | 131.00 | 78.00 | 84.00 | 9.00 | 13.00 | -25.00 | -18.00 | -54.00 | -68.00 | -147.00 | 57.00 | -17.00 | 34.00 | 22.00 | 56.00 | -58.00 | 3.55 | 42.23 | 107.63 | 45.73 | 46.76 | 37.94 | 43.18 | 26.18 | 36.11 | 25.96 | NA | 20.10 | 37.34 | 28.45 | NA | 22.00 | 36.00 | 19.00 | NA | 25.00 | 30.00 | 17.00 | -4.00 | 7.00 | 2.00 | 13.00 | -2.00 | -220.00 | 16.00 | 19.00 | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 52.00 | 40.00 | 47.00 | 95.00 | 91.00 | 89.00 | 110.00 | 138.00 | 59.00 | 61.00 | 10.00 | 6.00 | -28.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

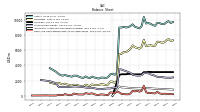

| Assets | 9867.00 | 9680.00 | 9453.00 | 9482.00 | 9602.00 | 9639.00 | 9237.00 | 9340.00 | 9503.00 | 9613.00 | 9543.00 | 10414.00 | 9187.00 | 8898.00 | 9011.00 | 9117.00 | 9432.00 | 9214.00 | 9059.00 | 9023.00 | 9112.00 | 9018.00 | 9013.00 | 3057.57 | 2759.95 | 2906.19 | 2823.04 | 2433.44 | 2346.17 | 2391.42 | 2386.17 | 2253.55 | 2330.78 | 2395.03 | 2527.03 | 2323.21 | 2388.87 | 2540.00 | 2347.00 | 2410.00 | 2519.00 | 2632.00 | 2660.00 | 2511.00 | 2569.00 | 2604.00 | 2746.00 | 2647.00 | 2721.00 | 2846.00 | 3165.00 | NA | NA | 3642.00 | NA | |

| Liabilities | 7489.00 | 7298.00 | 7043.00 | 7004.00 | 7122.00 | 7141.00 | 6609.00 | 6594.00 | 6679.00 | 6627.00 | 6539.00 | 7402.00 | 6449.00 | 6216.00 | 6328.00 | 6397.00 | 6660.00 | 6183.00 | 5937.00 | 5753.00 | 5761.00 | 5552.00 | 5492.00 | 1991.93 | 1693.72 | 1861.17 | 1873.81 | 1464.62 | 1412.92 | 1483.60 | 1517.90 | 1406.81 | 1411.76 | 1418.76 | 1491.06 | 1262.59 | 1346.36 | 1460.00 | 1217.00 | 1236.00 | 1331.00 | 1423.00 | 1442.00 | 1321.00 | 1401.00 | 1453.00 | 1594.00 | 1493.00 | 1573.00 | 1712.00 | 1517.00 | NA | NA | 1738.00 | NA | |

| Liabilities And Stockholders Equity | 9867.00 | 9680.00 | 9453.00 | 9482.00 | 9602.00 | 9639.00 | 9237.00 | 9340.00 | 9503.00 | 9613.00 | 9543.00 | 10414.00 | 9187.00 | 8898.00 | 9011.00 | 9117.00 | 9432.00 | 9214.00 | 9059.00 | 9023.00 | 9112.00 | 9018.00 | 9013.00 | 3057.57 | 2759.95 | 2906.19 | 2823.04 | 2433.44 | 2346.17 | 2391.42 | 2386.17 | 2253.55 | 2330.78 | 2395.03 | 2527.03 | 2323.21 | 2388.87 | 2540.00 | 2347.00 | 2410.00 | 2519.00 | 2632.00 | 2660.00 | 2511.00 | 2569.00 | 2604.00 | 2746.00 | 2647.00 | 2721.00 | 2846.00 | 3165.00 | NA | NA | 3642.00 | NA | |

| Stockholders Equity | 2379.00 | 2382.00 | 2408.00 | 2476.00 | 2478.00 | 2496.00 | 2626.00 | 2745.00 | 2814.00 | 2976.00 | 2973.00 | 2982.00 | 2709.00 | 2651.00 | 2658.00 | 2699.00 | 2759.00 | 3019.00 | 3112.00 | 3264.00 | 3346.00 | 3461.00 | 3496.00 | 1065.64 | 1066.23 | 1045.02 | 949.22 | 968.82 | 933.25 | 907.82 | 868.27 | 846.75 | 919.03 | 976.27 | 1035.97 | 1060.62 | 1042.51 | 1080.00 | 1130.00 | 1174.00 | 1188.00 | 1209.00 | 1218.00 | 1190.00 | 1168.00 | 1151.00 | 1152.00 | 1154.00 | 1148.00 | 1134.00 | 1648.00 | NA | NA | 1904.00 | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

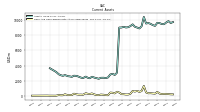

| Cash And Cash Equivalents At Carrying Value | 237.00 | 248.00 | 265.00 | 242.00 | 306.00 | 524.00 | 294.00 | 324.00 | 354.00 | 342.00 | 448.00 | 1312.00 | 643.00 | 524.00 | 660.00 | 566.00 | 651.00 | 287.00 | 183.00 | 179.00 | 222.00 | 231.00 | 441.00 | 547.67 | 323.83 | 409.06 | 440.07 | 85.15 | 101.84 | 147.10 | 174.76 | 97.42 | 106.61 | 177.06 | 321.69 | 250.91 | 272.18 | 347.00 | 146.00 | 170.00 | 159.00 | 200.00 | 288.00 | 104.00 | 119.00 | 103.00 | 212.00 | 83.00 | 77.00 | 110.00 | 25.00 | 25.00 | 29.00 | 26.00 | 39.00 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 550.00 | 574.00 | 503.00 | 480.00 | 574.00 | 854.00 | 543.00 | 606.00 | 650.00 | 803.00 | 882.00 | 1680.00 | 1178.00 | 992.00 | 1028.00 | 907.00 | 1020.00 | 701.00 | 505.00 | 516.00 | 578.00 | 614.00 | 806.00 | 718.20 | 385.13 | 490.61 | 501.77 | 143.90 | 165.87 | 213.10 | 292.60 | 165.76 | NA | 248.51 | NA | NA | NA | 456.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Construction In Progress Gross | NA | 52.00 | NA | NA | NA | 91.00 | NA | NA | NA | 37.00 | NA | NA | NA | 68.00 | NA | NA | NA | 82.00 | 51.00 | 38.00 | 17.00 | 32.00 | NA | NA | NA | 22.88 | NA | NA | NA | 27.49 | NA | NA | NA | 26.47 | NA | NA | NA | 12.00 | NA | NA | NA | 11.00 | NA | NA | NA | 9.00 | NA | 6.00 | NA | 9.00 | NA | NA | NA | NA | NA | |

| Goodwill | 3117.00 | 3117.00 | 3117.00 | 3117.00 | 3117.00 | 3117.00 | 3117.00 | 3117.00 | 3142.00 | 3150.00 | 3086.00 | 3116.00 | 2817.00 | 2817.00 | 2817.00 | 2817.00 | 2817.00 | 2892.00 | 2890.00 | 2824.00 | 2828.00 | 2828.00 | 2747.00 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 839.00 | 854.00 | 868.00 | 884.00 | 898.00 | 911.00 | 924.00 | 941.00 | 978.00 | 993.00 | 1007.00 | 1017.00 | 938.00 | 952.00 | 963.00 | 977.00 | 989.00 | 1027.00 | 1044.00 | 1075.00 | 1092.00 | 1107.00 | 1216.00 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | 791.00 | NA | NA | NA | 848.00 | 861.00 | 878.00 | 914.00 | 929.00 | 943.00 | 953.00 | 874.00 | 888.00 | NA | NA | NA | 945.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Debt And Capital Lease Obligations | 3111.00 | 3049.00 | 3031.00 | 3001.00 | 3129.00 | 3088.00 | 2749.00 | 2748.00 | 2751.00 | 2631.00 | NA | NA | NA | 2680.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 711.00 | 538.00 | 570.00 | 597.00 | 678.00 | 751.00 | 647.00 | 686.00 | 678.00 | 793.00 | 714.00 | 774.00 | 850.00 | 833.00 | NA | NA | 1022.00 | NA | |

| Deferred Income Tax Liabilities Net | 328.00 | 280.00 | 335.00 | 344.00 | 339.00 | 331.00 | 374.00 | 342.00 | 333.00 | 350.00 | 325.00 | 347.00 | 286.00 | 274.00 | 306.00 | 289.00 | 290.00 | 300.00 | 307.00 | NA | NA | 318.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | -1.00 | NA | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 1.00 | 10.00 | 10.00 | 31.00 | 30.00 | 29.00 | 31.00 | 25.00 | 21.00 | 13.00 | 12.00 | 10.00 | 6.00 | 5.00 | 5.00 | 25.00 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2379.00 | 2382.00 | 2408.00 | 2476.00 | 2478.00 | 2496.00 | 2626.00 | 2745.00 | 2814.00 | 2976.00 | 2973.00 | 2982.00 | 2709.00 | 2651.00 | 2658.00 | 2699.00 | 2759.00 | 3019.00 | 3112.00 | 3264.00 | 3346.00 | 3461.00 | 3496.00 | 1065.64 | 1066.23 | 1045.02 | 949.22 | 968.82 | 933.25 | 907.82 | 868.27 | 846.75 | 919.03 | 976.27 | 1035.97 | 1060.62 | 1042.51 | 1080.00 | 1130.00 | 1174.00 | 1188.00 | 1209.00 | 1218.00 | 1190.00 | 1168.00 | 1151.00 | 1152.00 | 1154.00 | 1148.00 | 1134.00 | 1648.00 | NA | NA | 1904.00 | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2378.00 | 2382.00 | 2410.00 | 2478.00 | 2480.00 | 2498.00 | 2628.00 | 2746.00 | 2824.00 | 2986.00 | 3004.00 | 3012.00 | 2738.00 | 2682.00 | 2683.00 | 2720.00 | 2772.00 | 3031.00 | 3122.00 | 3270.00 | 3351.00 | 3466.00 | 3521.00 | 1066.00 | 1066.00 | 1041.00 | NA | NA | NA | 895.00 | NA | NA | NA | 978.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1134.00 | NA | NA | NA | 1904.00 | NA | |

| Common Stock Value | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.36 | 0.36 | 0.36 | 0.36 | 0.00 | 0.00 | 0.00 | NA | 0.00 | 0.00 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 3951.00 | 3955.00 | 3953.00 | 3947.00 | 3937.00 | 3941.00 | 3968.00 | 3963.00 | 3945.00 | 4072.00 | 4056.00 | 4047.00 | 3843.00 | 3760.00 | 3749.00 | 3736.00 | 3729.00 | 3738.00 | 3740.00 | 3730.00 | 3717.00 | 3721.00 | 3697.00 | 1190.45 | 1184.11 | 1188.54 | 1184.63 | 1161.51 | 1159.45 | 1162.28 | 1142.48 | 1139.37 | 1149.44 | 1150.73 | 1138.05 | 1135.14 | 1128.62 | 1137.00 | 1109.00 | 1129.00 | 1127.00 | 1130.00 | 1122.00 | 1119.00 | 1116.00 | 1116.00 | 1113.00 | 1122.00 | 1118.00 | 1117.00 | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 763.00 | 742.00 | 734.00 | 718.00 | 654.00 | 593.00 | 533.00 | 448.00 | 338.00 | 275.00 | 237.00 | 250.00 | 244.00 | 272.00 | 309.00 | 371.00 | 441.00 | 569.00 | 520.00 | 548.00 | 519.00 | 523.00 | 478.00 | 554.79 | 554.71 | 533.60 | 436.20 | 404.87 | 370.14 | 346.34 | 306.02 | 287.33 | 259.50 | 243.78 | 219.59 | 205.83 | 179.71 | 155.00 | 162.00 | 137.00 | 101.00 | 82.00 | 76.00 | 51.00 | 32.00 | 14.00 | 21.00 | 15.00 | 7.00 | -2.00 | NA | NA | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 15.00 | 16.00 | 18.00 | 23.00 | 18.00 | 15.00 | 6.00 | -1.00 | 4.00 | -16.00 | -39.00 | -38.00 | -45.00 | -48.00 | -67.00 | -75.00 | -77.00 | -36.00 | -19.00 | -11.00 | 4.00 | 6.00 | 16.00 | 15.77 | 22.99 | 16.75 | 17.16 | 12.19 | 9.70 | 5.46 | 12.10 | 12.73 | 12.94 | 11.38 | 13.30 | 14.76 | 11.45 | 17.00 | 20.00 | 23.00 | 23.00 | 23.00 | 20.00 | 20.00 | 20.00 | 21.00 | 18.00 | 17.00 | 23.00 | 19.00 | 29.00 | NA | NA | 28.00 | NA | |

| Minority Interest | -1.00 | NA | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 1.00 | 10.00 | 10.00 | 31.00 | 30.00 | 29.00 | 31.00 | 25.00 | 21.00 | 13.00 | 12.00 | 10.00 | 6.00 | 5.00 | 5.00 | 25.00 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 3.00 | 83.00 | 122.00 | 77.00 | -50.00 | 142.00 | 162.00 | 89.00 | 129.00 | 40.00 | 155.00 | 208.00 | -60.00 | 141.00 | 231.00 | 49.00 | -122.00 | 202.00 | 124.00 | 28.00 | 28.00 | 30.00 | 8.55 | 35.20 | 23.25 | 71.17 | 56.87 | -31.57 | 45.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 108.00 | 50.00 | 48.00 | NA | 89.00 | 45.00 | -11.00 | 5.00 | 52.00 | 81.00 | 25.00 | 72.00 | 89.00 | 111.00 | 49.00 | 39.00 | NA | |

| Net Cash Provided By Used In Investing Activities | -69.00 | -27.00 | -32.00 | -16.00 | -37.00 | -33.00 | 34.00 | 25.00 | -10.00 | -26.00 | -11.00 | -168.00 | -8.00 | -8.00 | 14.00 | -17.00 | -21.00 | 36.00 | -14.00 | -12.00 | 27.00 | 16.00 | -1404.07 | -7.17 | -11.76 | -5.36 | -11.57 | -8.17 | -13.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 33.00 | NA | NA | NA | 22.00 | 2.00 | -4.00 | -14.00 | 19.00 | 19.00 | 7.00 | -21.00 | 4.00 | 57.00 | NA | |

| Net Cash Provided By Used In Financing Activities | 43.00 | 13.00 | -65.00 | -155.00 | -194.00 | 199.00 | -257.00 | -156.00 | -272.00 | -92.00 | -941.00 | 461.00 | 255.00 | -172.00 | -125.00 | -148.00 | 468.00 | -41.00 | -120.00 | -78.00 | -92.00 | -238.00 | 1483.64 | 306.06 | -118.70 | -77.26 | 311.87 | 17.36 | -81.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | -103.00 | -80.00 | -122.00 | NA | 99.00 | -38.00 | 5.00 | -116.00 | 80.00 | -59.00 | -77.00 | -6.00 | -96.00 | -94.00 | -50.00 | -109.00 | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 3.00 | 83.00 | 122.00 | 77.00 | -50.00 | 142.00 | 162.00 | 89.00 | 129.00 | 40.00 | 155.00 | 208.00 | -60.00 | 141.00 | 231.00 | 49.00 | -122.00 | 202.00 | 124.00 | 28.00 | 28.00 | 30.00 | 8.55 | 35.20 | 23.25 | 71.17 | 56.87 | -31.57 | 45.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 108.00 | 50.00 | 48.00 | NA | 89.00 | 45.00 | -11.00 | 5.00 | 52.00 | 81.00 | 25.00 | 72.00 | 89.00 | 111.00 | 49.00 | 39.00 | NA | |

| Net Income Loss | 47.00 | 35.00 | 42.00 | 90.00 | 87.00 | 88.00 | 109.00 | 136.00 | 58.00 | 61.00 | 10.00 | 6.00 | -28.00 | -37.00 | -62.00 | -70.00 | -106.00 | 74.00 | -9.00 | 49.00 | 24.00 | 44.00 | -58.00 | 10.76 | 35.98 | 108.04 | 40.76 | 44.28 | 33.70 | 49.82 | 26.81 | 36.31 | 24.41 | 33.15 | 21.55 | 34.04 | 34.05 | 1.00 | 25.00 | 36.00 | 19.00 | 6.00 | 25.00 | 30.00 | 18.00 | -7.00 | 6.00 | 8.00 | 9.00 | 8.00 | -221.00 | 16.00 | 19.00 | 18.00 | 19.00 | |

| Profit Loss | 46.00 | 33.00 | 42.00 | 90.00 | 87.00 | 88.00 | 110.00 | 135.00 | 58.00 | 59.00 | 11.00 | 8.00 | -25.00 | -31.00 | -58.00 | -62.00 | -105.00 | 76.00 | -7.00 | 49.00 | 24.00 | 63.00 | -58.00 | 11.00 | 36.00 | 119.00 | 40.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 6.00 | 25.00 | 30.00 | 19.00 | -11.00 | 6.00 | 8.00 | 9.00 | 8.00 | -221.00 | 16.00 | 19.00 | NA | NA | |

| Increase Decrease In Inventories | -17.00 | -7.00 | -34.00 | -30.00 | -16.00 | -30.00 | -49.00 | 3.00 | -28.00 | -2.00 | -45.00 | -40.00 | 26.00 | -22.00 | -1.00 | -3.00 | 8.00 | -55.00 | 66.00 | -37.00 | -39.00 | 59.00 | -31.16 | -35.42 | -1.42 | -15.55 | -11.11 | 5.94 | -21.94 | -10.42 | -7.81 | -1.05 | 14.97 | NA | 17.16 | -23.75 | -44.88 | NA | -25.00 | -17.00 | -20.00 | NA | -11.00 | -12.00 | -10.00 | -5.00 | -12.00 | -23.00 | -28.00 | -35.00 | -18.00 | -33.00 | -27.00 | NA | NA | |

| Share Based Compensation | 7.00 | 6.00 | 6.00 | 12.00 | 7.00 | 9.00 | 10.00 | 12.00 | 8.00 | 18.00 | 11.00 | 14.00 | 8.00 | 13.00 | 11.00 | 9.00 | 3.00 | 8.00 | 8.00 | 10.00 | 7.00 | 10.00 | 9.28 | 6.12 | 3.60 | 3.94 | 3.90 | 5.17 | 3.28 | 3.95 | 3.14 | 4.33 | 2.52 | NA | 3.04 | 3.94 | 2.64 | NA | 3.00 | 4.00 | 2.00 | NA | 2.00 | 4.00 | 2.00 | 4.00 | 2.00 | 3.00 | 3.00 | 4.00 | 3.00 | 2.00 | 2.00 | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -69.00 | -27.00 | -32.00 | -16.00 | -37.00 | -33.00 | 34.00 | 25.00 | -10.00 | -26.00 | -11.00 | -168.00 | -8.00 | -8.00 | 14.00 | -17.00 | -21.00 | 36.00 | -14.00 | -12.00 | 27.00 | 16.00 | -1404.07 | -7.17 | -11.76 | -5.36 | -11.57 | -8.17 | -13.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 33.00 | NA | NA | NA | 22.00 | 2.00 | -4.00 | -14.00 | 19.00 | 19.00 | 7.00 | -21.00 | 4.00 | 57.00 | NA | |

| Payments To Acquire Property Plant And Equipment | 16.00 | 26.00 | 29.00 | 26.00 | 37.00 | 29.00 | 13.00 | 14.00 | 9.00 | 28.00 | 8.00 | 4.00 | 7.00 | 5.00 | 2.00 | 17.00 | 17.00 | 14.00 | 13.00 | 9.00 | 10.00 | 23.00 | 9.51 | 4.73 | 2.76 | 5.13 | 9.82 | 6.29 | 5.05 | 12.32 | 7.30 | 8.81 | 6.33 | NA | 5.16 | 5.16 | 10.56 | NA | 5.00 | 2.00 | 1.00 | NA | 4.00 | 4.00 | 3.00 | 6.00 | 4.00 | 4.00 | 3.00 | 4.00 | 3.00 | 2.00 | 6.00 | 6.00 | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 43.00 | 13.00 | -65.00 | -155.00 | -194.00 | 199.00 | -257.00 | -156.00 | -272.00 | -92.00 | -941.00 | 461.00 | 255.00 | -172.00 | -125.00 | -148.00 | 468.00 | -41.00 | -120.00 | -78.00 | -92.00 | -238.00 | 1483.64 | 306.06 | -118.70 | -77.26 | 311.87 | 17.36 | -81.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | -103.00 | -80.00 | -122.00 | NA | 99.00 | -38.00 | 5.00 | -116.00 | 80.00 | -59.00 | -77.00 | -6.00 | -96.00 | -94.00 | -50.00 | -109.00 | NA | |

| Payments Of Dividends | 54.00 | 26.00 | 0.00 | 26.00 | 54.00 | 24.00 | 0.00 | 26.00 | 49.00 | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 45.00 | 20.00 | 0.00 | 20.00 | 41.00 | 19.00 | 0.07 | 10.67 | 21.25 | 9.44 | 0.04 | 9.54 | 19.01 | 8.13 | 0.00 | 8.48 | 17.59 | NA | 7.92 | 0.00 | 8.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Dividends | 26.00 | NA | 26.00 | 26.00 | 26.00 | NA | 24.00 | 26.00 | 26.00 | NA | 23.00 | NA | NA | NA | NA | NA | 22.00 | NA | 19.00 | 20.00 | 20.00 | 21.00 | 19.00 | 11.00 | 10.67 | 10.63 | 9.44 | 9.54 | 9.53 | 9.48 | 8.13 | 8.48 | 8.69 | NA | 7.79 | 7.92 | 8.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 24.00 | 38.00 | 86.00 | 82.00 | 80.00 | 173.00 | 216.00 | 193.00 | 119.00 | 74.00 | NA | NA | NA | 0.00 | 0.00 | 0.00 | 82.00 | 123.00 | 127.00 | 109.00 | 106.00 | 94.00 | 0.12 | 0.00 | 1.88 | 5.24 | 79.20 | 3.87 | 0.00 | 14.47 | 0.00 | 90.13 | 73.23 | NA | 39.87 | 14.96 | 51.28 | NA | 70.71 | 52.01 | 37.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-30 | 2016-09-09 | 2016-06-17 | 2016-03-25 | 2016-01-01 | 2015-09-11 | 2015-06-19 | 2015-03-27 | 2015-01-02 | 2014-09-12 | 2014-06-20 | 2014-03-28 | 2014-01-03 | 2013-09-06 | 2013-06-14 | 2013-03-22 | 2012-12-28 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-30 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 1195.00 | 1194.00 | 1186.00 | 1178.00 | 1169.00 | 1188.00 | 1252.00 | 1164.00 | 1052.00 | 1100.00 | 1052.00 | 979.00 | 759.00 | 747.00 | 649.00 | 480.00 | 1010.00 | 1145.00 | 1082.00 | 1068.00 | 1060.00 | 1052.00 | 750.00 | 594.69 | 570.85 | 481.22 | 486.99 | 497.62 | 487.49 | 564.74 | 406.99 | 429.94 | 425.04 | 541.07 | 407.14 | 422.83 | 454.88 | 511.00 | 413.00 | 410.00 | 402.00 | 527.00 | 412.00 | 421.00 | 389.00 | 499.00 | 383.00 | 383.00 | 372.00 | 484.00 | 378.00 | 380.00 | 371.00 | 479.00 | 360.00 | |

| Corporate Non | NA | -1.00 | -4.00 | 1.00 | 1.00 | 13.00 | -1.00 | -1.00 | 12.00 | 8.00 | 1.00 | 10.00 | 12.00 | 28.00 | 7.00 | 17.00 | -5.00 | 22.00 | 3.00 | 2.00 | 5.00 | 3.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating | 1195.00 | 1195.00 | 1190.00 | 1177.00 | 1168.00 | 1175.00 | 1253.00 | 1165.00 | 1040.00 | 1092.00 | 1051.00 | 969.00 | 747.00 | 719.00 | 642.00 | 463.00 | 1015.00 | 1123.00 | 1079.00 | 1066.00 | 1055.00 | 1049.00 | 749.00 | 594.69 | 570.85 | 481.22 | 486.99 | 497.62 | 487.49 | 549.26 | 406.99 | 429.94 | 425.04 | NA | 407.14 | 422.83 | 454.88 | NA | 413.00 | 410.00 | 402.00 | NA | 412.00 | 421.00 | 390.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Exchangeand Third Party Management | 65.00 | 62.00 | 64.00 | 65.00 | 71.00 | 62.00 | 71.00 | 74.00 | 84.00 | 71.00 | 77.00 | 86.00 | 86.00 | 73.00 | 71.00 | 58.00 | 107.00 | 103.00 | 112.00 | 115.00 | 124.00 | 121.00 | 40.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Vacation Ownership | 1130.00 | 1133.00 | 1126.00 | 1112.00 | 1097.00 | 1113.00 | 1182.00 | 1091.00 | 956.00 | 1021.00 | 974.00 | 883.00 | 661.00 | 646.00 | 571.00 | 405.00 | 908.00 | 1020.00 | 967.00 | 951.00 | 931.00 | 928.00 | 709.00 | 595.00 | 571.00 | 562.00 | 530.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 1112.00 | 1111.00 | 1105.00 | 1098.00 | 1091.00 | 1112.00 | 1178.00 | 1092.00 | 981.00 | 1028.00 | 983.00 | 911.00 | 700.00 | 747.00 | 585.00 | 410.00 | 938.00 | 1145.00 | 1010.00 | 999.00 | 992.00 | 1052.00 | 702.00 | 558.84 | 535.37 | 481.22 | 496.00 | 529.91 | 496.19 | 564.74 | 406.99 | 429.94 | 425.04 | 541.07 | 407.14 | 422.83 | 454.88 | 511.00 | 413.00 | 410.00 | 402.00 | 527.00 | 412.00 | 421.00 | 389.00 | 499.00 | 383.00 | 383.00 | 372.00 | 484.00 | 378.00 | 380.00 | 371.00 | 479.00 | 360.00 | |

| Corporate Non | NA | -1.00 | -4.00 | 1.00 | 1.00 | 13.00 | -1.00 | -1.00 | 12.00 | 8.00 | 1.00 | 10.00 | 12.00 | 28.00 | 7.00 | 17.00 | -5.00 | 22.00 | 3.00 | 2.00 | 5.00 | 3.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate Non, Management Service | -1.00 | -1.00 | 0.00 | -1.00 | -1.00 | 0.00 | -1.00 | -1.00 | -3.00 | -4.00 | -4.00 | -5.00 | -6.00 | -8.00 | -5.00 | -5.00 | -4.00 | -3.00 | -3.00 | -3.00 | -4.00 | -3.00 | -1.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate Non, Service Other | 12.00 | 11.00 | 12.00 | 9.00 | 10.00 | 23.00 | 8.00 | 6.00 | 35.00 | 40.00 | 44.00 | 42.00 | 45.00 | 75.00 | 50.00 | 38.00 | 47.00 | 57.00 | 34.00 | 33.00 | 36.00 | 27.00 | 8.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate Non, Cost Reimbursement | -11.00 | NA | -16.00 | -7.00 | -8.00 | NA | -8.00 | -6.00 | -20.00 | NA | -39.00 | -27.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate Non, Management And Exchange | 11.00 | 10.00 | 12.00 | 8.00 | 9.00 | 23.00 | 7.00 | 5.00 | 32.00 | 36.00 | 40.00 | 37.00 | 39.00 | 67.00 | 45.00 | 33.00 | 43.00 | 54.00 | 31.00 | 30.00 | 32.00 | 24.00 | 7.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Management Service, Exchangeand Third Party Management | 5.00 | 6.00 | 5.00 | 5.00 | 8.00 | 6.00 | 7.00 | 11.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Management Service, Vacation Ownership | 52.00 | 46.00 | 44.00 | 45.00 | 45.00 | 42.00 | 41.00 | 41.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Service Other, Exchangeand Third Party Management | 46.00 | 41.00 | 44.00 | 45.00 | 47.00 | 42.00 | 47.00 | 46.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Service Other, Vacation Ownership | 31.00 | 38.00 | 37.00 | 32.00 | 29.00 | 32.00 | 32.00 | 33.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Time Share, Vacation Ownership | 352.00 | 375.00 | 319.00 | 391.00 | 375.00 | 439.00 | 444.00 | 425.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Ancillary Revenues, Exchangeand Third Party Management | 1.00 | 2.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Ancillary Revenues, Vacation Ownership | 65.00 | 59.00 | 62.00 | 70.00 | 61.00 | 58.00 | 63.00 | 66.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Cost Reimbursement, Exchangeand Third Party Management | 2.00 | NA | 4.00 | 3.00 | 5.00 | NA | 5.00 | 5.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Cost Reimbursement, Vacation Ownership | 400.00 | NA | 455.00 | 359.00 | 368.00 | NA | 374.00 | 325.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Management And Exchange, Exchangeand Third Party Management | 52.00 | 49.00 | 50.00 | 51.00 | 56.00 | 49.00 | 55.00 | 58.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Management And Exchange, Vacation Ownership | 148.00 | 143.00 | 143.00 | 147.00 | 135.00 | 132.00 | 136.00 | 140.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Rental, Exchangeand Third Party Management | 11.00 | 9.00 | 10.00 | 11.00 | 10.00 | 9.00 | 11.00 | 11.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Rental, Vacation Ownership | 147.00 | 127.00 | 128.00 | 135.00 | 141.00 | 104.00 | 154.00 | 129.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Exchangeand Third Party Management | 65.00 | 62.00 | 64.00 | 65.00 | 71.00 | 62.00 | 71.00 | 74.00 | 84.00 | 71.00 | 77.00 | 86.00 | 86.00 | 73.00 | 71.00 | 58.00 | 107.00 | 103.00 | 112.00 | 115.00 | 124.00 | 121.00 | 40.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Vacation Ownership | 1047.00 | 1050.00 | 1045.00 | 1032.00 | 1019.00 | 1037.00 | 1108.00 | 1019.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Exchangeand Third Party Management, Transferred At Point In Time | 41.00 | 34.00 | 37.00 | NA | 42.00 | 35.00 | 40.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Exchangeand Third Party Management, Transferred Over Time | 24.00 | 28.00 | 27.00 | NA | 29.00 | 27.00 | 31.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Vacation Ownership, Transferred At Point In Time | 422.00 | 441.00 | 387.00 | NA | 441.00 | 507.00 | 511.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Vacation Ownership, Transferred Over Time | 625.00 | 609.00 | 658.00 | NA | 578.00 | 530.00 | 597.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate Non, Transferred Over Time | NA | -1.00 | -4.00 | 1.00 | 1.00 | 13.00 | -1.00 | -1.00 | 12.00 | 8.00 | 1.00 | 10.00 | 12.00 | 28.00 | 7.00 | 17.00 | -5.00 | 22.00 | 3.00 | 2.00 | 5.00 | 3.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Service | 56.00 | 51.00 | 49.00 | 49.00 | 52.00 | 48.00 | 47.00 | 51.00 | 49.00 | 45.00 | 46.00 | 43.00 | 37.00 | 31.00 | 36.00 | 33.00 | 44.00 | 42.00 | 44.00 | 46.00 | 48.00 | 55.00 | 35.00 | 25.32 | 24.00 | 22.00 | 23.00 | 22.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Service Other | 89.00 | 90.00 | 93.00 | 86.00 | 86.00 | 97.00 | 87.00 | 85.00 | 118.00 | 118.00 | 123.00 | 124.00 | 128.00 | 156.00 | 123.00 | 106.00 | 136.00 | 144.00 | 124.00 | 126.00 | 133.00 | 115.00 | 49.00 | 16.91 | 18.00 | 21.00 | 16.00 | 16.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Time Share | 352.00 | 375.00 | 319.00 | 391.00 | 375.00 | 439.00 | 444.00 | 425.00 | 310.00 | 364.00 | 330.00 | 296.00 | 163.00 | 137.00 | 98.00 | 53.00 | 258.00 | 389.00 | 350.00 | 350.00 | 301.00 | 358.00 | 252.00 | 205.17 | 175.00 | 208.00 | 183.00 | 201.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Ancillary Revenues | 66.00 | 61.00 | 63.00 | 71.00 | 62.00 | 59.00 | 64.00 | 67.00 | 55.00 | 54.00 | 56.00 | 53.00 | 28.00 | 20.00 | 17.00 | 6.00 | 47.00 | 59.00 | 63.00 | 67.00 | 58.00 | 55.00 | 42.00 | 35.41 | 28.00 | 27.00 | 31.00 | 33.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cost Reimbursement | 391.00 | 398.00 | 443.00 | 355.00 | 365.00 | 356.00 | 371.00 | 324.00 | 316.00 | 301.00 | 298.00 | 274.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management And Exchange | 211.00 | 202.00 | 205.00 | 206.00 | 200.00 | 204.00 | 198.00 | 203.00 | 222.00 | 217.00 | 225.00 | 220.00 | 193.00 | 207.00 | 176.00 | 145.00 | 227.00 | 245.00 | 231.00 | 239.00 | 239.00 | 225.00 | 126.00 | 78.00 | 70.00 | 70.00 | 70.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rental | 158.00 | 136.00 | 138.00 | 146.00 | 151.00 | 113.00 | 165.00 | 140.00 | 133.00 | 146.00 | 130.00 | 121.00 | 89.00 | 67.00 | 56.00 | 18.00 | 135.00 | 156.00 | 149.00 | 158.00 | 165.00 | 132.00 | 90.00 | 74.56 | 75.00 | 59.00 | 66.00 | 69.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transferred At Point In Time | 463.00 | 475.00 | 424.00 | 503.00 | 483.00 | 542.00 | 551.00 | 536.00 | 414.00 | 457.00 | 427.00 | 395.00 | 243.00 | 202.00 | 149.00 | 88.00 | 359.00 | 498.00 | 470.00 | 471.00 | 421.00 | 456.00 | 311.00 | 244.04 | 207.66 | 244.00 | 218.00 | 239.61 | 197.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transferred Over Time | 649.00 | 636.00 | 681.00 | 595.00 | 608.00 | 570.00 | 627.00 | 556.00 | 567.00 | 571.00 | 556.00 | 516.00 | 457.00 | 484.00 | 436.00 | 322.00 | 579.00 | 581.00 | 540.00 | 528.00 | 571.00 | 532.00 | 391.00 | 314.80 | 327.71 | 282.00 | 278.00 | 290.30 | 298.88 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |