| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 10.43 | 10.17 | 10.07 | 10.04 | 9.63 | 9.63 | 9.63 | 7.48 | 6.29 | 6.29 | 5.37 | 5.37 | 5.37 | 5.37 | 5.34 | 4.69 | 4.61 | 4.61 | 4.61 | 4.11 | 4.05 | 3.70 | 3.70 | 3.70 | 3.00 | |

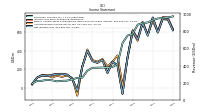

| Earnings Per Share Basic | 0.73 | 0.55 | 0.69 | 0.52 | 0.66 | 0.34 | -0.06 | 0.35 | 0.45 | 0.29 | 0.56 | 0.50 | 0.54 | 0.75 | 0.47 | -0.05 | 0.20 | 0.31 | 0.37 | 0.37 | 0.37 | 0.35 | 0.38 | 0.33 | 0.19 | |

| Earnings Per Share Diluted | 0.72 | 0.55 | 0.69 | 0.52 | 0.67 | 0.34 | -0.06 | 0.35 | 0.45 | 0.28 | 0.54 | 0.50 | 0.54 | 0.74 | 0.47 | -0.05 | 0.20 | 0.31 | 0.37 | 0.37 | 0.37 | 0.35 | 0.38 | 0.33 | 0.19 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

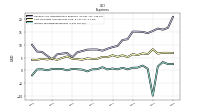

| Revenue From Contract With Customer Excluding Assessed Tax | 931.87 | 904.32 | 898.16 | 877.65 | 769.91 | 751.54 | 662.62 | 416.62 | 383.15 | 375.70 | 376.40 | 374.31 | 373.02 | 339.65 | 257.90 | 255.00 | 237.54 | 222.51 | 220.75 | 214.00 | 226.04 | 232.69 | 220.97 | 218.28 | 187.61 | |

| Revenues | 931.87 | 904.32 | 898.16 | 877.65 | 769.91 | 751.54 | 662.62 | 416.62 | 383.15 | 375.70 | 376.40 | 374.31 | 373.02 | 339.65 | 257.90 | 255.00 | 237.54 | 222.51 | 220.75 | 214.00 | 226.04 | 232.69 | 220.97 | 218.28 | 187.61 | |

| Other Income | 18.28 | 18.18 | 18.52 | 18.34 | 17.82 | 17.86 | 15.56 | 8.39 | 6.91 | 6.94 | 6.99 | 6.97 | 7.09 | 7.28 | 0.73 | 0.69 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | |

| Cost Of Goods And Services Sold | 8.21 | 6.33 | 6.59 | 5.95 | 6.27 | 5.19 | 5.86 | 5.29 | 5.88 | 5.14 | 5.23 | 4.51 | 4.45 | 4.67 | 4.14 | 4.37 | 4.54 | 5.42 | 4.85 | 4.09 | 4.54 | 4.22 | 4.51 | 4.09 | 4.13 | |

| Operating Costs And Expenses | -15.32 | 139.51 | 0.34 | 150.63 | 12.25 | 270.64 | 602.52 | 105.49 | 28.20 | 30.44 | -7.71 | 24.70 | 4.80 | 199.97 | -50.73 | 166.98 | 10.78 | 14.13 | 15.25 | 12.14 | NA | NA | NA | NA | 43.41 | |

| General And Administrative Expense | 15.26 | 14.42 | 14.92 | 15.01 | 15.03 | 12.06 | 11.78 | 9.47 | 9.03 | 8.38 | 7.63 | 8.09 | 8.10 | 8.05 | 7.50 | 7.01 | 5.11 | 6.72 | 6.52 | 6.22 | 4.28 | 5.68 | 7.16 | 7.31 | 9.94 | |

| Interest Expense | 205.18 | 204.93 | 203.59 | 204.36 | 169.33 | 169.35 | 133.13 | 68.14 | 70.44 | 165.10 | 79.81 | 77.05 | 77.42 | 77.40 | 77.69 | 76.09 | 71.45 | 68.53 | 54.82 | 53.59 | 54.30 | 54.05 | 51.44 | 52.88 | 63.35 | |

| Interest Paid Net | 198.68 | 187.24 | 198.65 | 178.05 | 176.69 | 137.32 | 103.87 | 48.92 | 50.65 | 131.84 | 71.03 | 69.70 | 73.74 | 74.75 | 75.19 | 38.78 | 60.39 | 43.51 | 63.88 | 41.60 | 62.90 | 42.59 | 60.69 | 47.13 | 36.78 | |

| Income Tax Expense Benefit | -9.77 | 0.64 | 1.90 | 1.09 | 1.03 | 0.42 | 1.03 | 0.40 | 0.76 | 0.39 | 1.26 | 0.48 | 0.44 | -0.37 | 0.31 | 0.45 | 0.61 | 0.02 | 0.55 | 0.52 | 0.56 | 0.05 | 0.45 | 0.38 | -1.90 | |

| Income Taxes Paid | 0.02 | 1.15 | NA | NA | 0.72 | 0.22 | 2.08 | 0.00 | 0.00 | 0.00 | NA | NA | 0.00 | 0.56 | 0.00 | 0.00 | 0.49 | 0.60 | 0.80 | 0.70 | 0.20 | 0.15 | 1.02 | 0.00 | 0.00 | |

| Profit Loss | 759.72 | 565.46 | 701.58 | 527.86 | 614.84 | 336.88 | -58.14 | 242.69 | 283.80 | 164.18 | 303.08 | 272.10 | 290.41 | 396.22 | 231.64 | -22.07 | 100.71 | 146.51 | 154.13 | 152.93 | 144.63 | 132.02 | 141.36 | 114.10 | 44.54 | |

| Net Income Loss | 747.77 | 556.33 | 690.70 | 518.74 | 604.05 | 330.90 | -57.71 | 240.38 | 281.48 | 161.86 | 300.71 | 269.80 | 288.01 | 398.27 | 229.40 | -24.01 | 98.63 | 144.44 | 152.05 | 150.85 | 142.54 | 129.91 | 139.04 | 114.10 | 44.54 | |

| Comprehensive Income Net Of Tax | 715.40 | 568.90 | 693.93 | 503.83 | 598.09 | 324.94 | 30.13 | 348.99 | 282.36 | 232.68 | 310.04 | 282.18 | 299.75 | 411.28 | 230.35 | -77.15 | 110.67 | 137.32 | 121.36 | 133.66 | 114.95 | 140.02 | 134.40 | 112.12 | 42.66 |

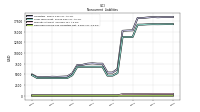

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

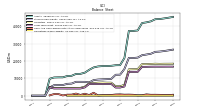

| Assets | 44059.84 | 42832.15 | 42250.61 | 41852.81 | 37575.83 | 37307.98 | 37289.22 | 21741.32 | 17597.37 | 17548.80 | 17219.55 | 17085.00 | 17063.61 | 16851.83 | 16277.63 | 14907.21 | 13265.62 | 12581.47 | 12522.05 | 11448.67 | 11333.37 | 10568.50 | 10564.70 | 10486.24 | 9739.71 | |

| Liabilities | 18402.07 | 18296.47 | 18166.03 | 18178.28 | 15285.71 | 15245.68 | 15174.33 | 6257.53 | 5410.20 | 5420.02 | 7484.48 | 7485.31 | 7569.87 | 7482.29 | 7203.22 | 7183.18 | 5216.63 | 4507.40 | 4449.62 | 4402.78 | 4432.35 | 4361.23 | 4391.76 | 4351.34 | 4963.35 | |

| Liabilities And Stockholders Equity | 44059.84 | 42832.15 | 42250.61 | 41852.81 | 37575.83 | 37307.98 | 37289.22 | 21741.32 | 17597.37 | 17548.80 | 17219.55 | 17085.00 | 17063.61 | 16851.83 | 16277.63 | 14907.21 | 13265.62 | 12581.47 | 12522.05 | 11448.67 | 11333.37 | 10568.50 | 10564.70 | 10486.24 | 9739.71 | |

| Stockholders Equity | 25255.93 | 24164.95 | 23716.72 | 23311.25 | 21933.64 | 21709.58 | 21762.49 | 15404.68 | 12108.27 | 12050.11 | 9656.64 | 9521.56 | 9415.84 | 9291.97 | 8992.75 | 7642.57 | 7965.18 | 7990.31 | 7988.74 | 6962.27 | 6817.45 | 6123.81 | 6089.61 | 6051.90 | 4691.49 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 522.57 | 510.88 | 738.79 | 247.67 | 208.93 | 518.38 | 614.00 | 568.70 | 739.61 | 669.51 | 407.52 | 322.53 | 315.99 | 144.06 | 1680.54 | 369.05 | 1101.89 | 431.42 | 1205.34 | 598.28 | 577.88 | 145.22 | 940.74 | 918.22 | 183.65 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 522.57 | 510.88 | 738.79 | 247.67 | 208.93 | 518.38 | 614.00 | 568.70 | 739.61 | 669.51 | 407.52 | 322.53 | 315.99 | 144.06 | 3680.54 | 2371.08 | 1101.89 | 463.51 | 1233.55 | 622.64 | 598.45 | 145.28 | 954.55 | 932.02 | 197.41 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 88.62 | 86.91 | 86.34 | 86.01 | 85.02 | 84.30 | 83.83 | 83.60 | 83.14 | 82.29 | 82.16 | 81.89 | 80.83 | 80.59 | 80.25 | 80.00 | 78.67 | 78.38 | 77.43 | 77.14 | 75.95 | 75.80 | 75.61 | 75.40 | 75.05 | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 21.67 | 20.52 | 19.51 | 18.63 | 17.81 | 17.00 | 16.18 | 15.40 | 14.63 | 13.86 | 13.09 | 12.33 | 11.63 | 10.89 | 9.98 | 9.13 | 8.27 | 7.38 | 6.38 | 5.37 | 4.44 | 3.51 | 2.58 | 1.66 | 0.75 | |

| Property Plant And Equipment Net | 66.95 | 66.39 | 66.83 | 67.38 | 67.21 | 67.30 | 67.65 | 68.19 | 68.52 | 68.43 | 69.08 | 69.56 | 69.20 | 69.70 | 70.27 | 70.87 | 70.40 | 71.00 | 71.00 | 71.78 | 71.51 | 72.29 | 73.03 | 73.74 | 74.30 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

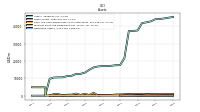

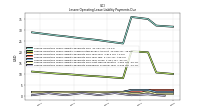

| Long Term Debt | 16724.12 | 16692.73 | 16624.20 | 16606.24 | 13739.67 | 13730.50 | 13721.50 | 5297.01 | 4694.52 | 4692.03 | 6772.90 | 6769.21 | 6765.53 | 6761.83 | 6758.13 | 6754.48 | 4791.56 | 4125.47 | 4124.45 | 4123.35 | 4122.26 | 4148.48 | 4148.48 | 4148.48 | 4816.89 | |

| Deferred Income Tax Liabilities Net | 4.51 | 4.28 | 4.42 | 4.33 | 4.34 | 4.19 | 4.00 | 4.00 | 3.88 | 3.83 | 3.73 | 3.83 | 3.53 | 3.46 | 3.34 | 3.40 | 3.38 | 3.52 | 3.01 | 3.29 | 3.34 | 4.00 | 3.72 | 3.72 | 3.72 | |

| Minority Interest | 401.84 | 370.73 | 367.86 | 363.29 | 356.48 | 352.72 | 352.39 | 79.11 | 78.91 | 78.68 | 78.43 | 78.13 | 77.91 | 77.57 | 81.66 | 81.46 | 83.81 | 83.75 | 83.69 | 83.62 | 83.57 | 83.47 | 83.33 | 83.00 | 84.88 |

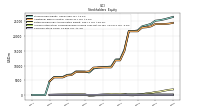

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 25255.93 | 24164.95 | 23716.72 | 23311.25 | 21933.64 | 21709.58 | 21762.49 | 15404.68 | 12108.27 | 12050.11 | 9656.64 | 9521.56 | 9415.84 | 9291.97 | 8992.75 | 7642.57 | 7965.18 | 7990.31 | 7988.74 | 6962.27 | 6817.45 | 6123.81 | 6089.61 | 6051.90 | 4691.49 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 25657.77 | 24535.68 | 24084.58 | 23674.53 | 22290.11 | 22062.30 | 22114.89 | 15483.79 | 12187.17 | 12128.79 | 9735.07 | 9599.69 | 9493.75 | 9369.54 | 9074.41 | 7724.03 | 8048.99 | 8074.07 | 8072.42 | 7045.89 | 6901.02 | 6207.27 | 6172.94 | 6134.90 | 4776.36 | |

| Common Stock Value | 10.43 | 10.17 | 10.07 | 10.04 | 9.63 | 9.63 | 9.63 | 7.48 | 6.29 | 6.29 | 5.37 | 5.37 | 5.37 | 5.37 | 5.34 | 4.69 | 4.61 | 4.61 | 4.61 | 4.11 | 4.05 | 3.70 | 3.70 | 3.70 | 3.00 | |

| Additional Paid In Capital | 24125.87 | 23316.14 | 23014.91 | 22910.51 | 21645.50 | 21641.94 | 21644.20 | 14971.89 | 11755.07 | 11752.85 | 9366.56 | 9364.29 | 9363.54 | 9361.53 | 9296.51 | 8018.57 | 7817.58 | 7816.23 | 7814.83 | 6777.68 | 6648.43 | 5953.73 | 5953.10 | 5952.64 | 4645.82 | |

| Retained Earnings Accumulated Deficit | 965.76 | 652.40 | 518.06 | 220.25 | 93.15 | -133.31 | -88.61 | 315.81 | 346.03 | 290.97 | 355.52 | 232.04 | 139.45 | 29.34 | -191.84 | -262.47 | 208.07 | 246.59 | 239.30 | 219.79 | 187.10 | 160.91 | 137.44 | 95.56 | 42.66 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 153.87 | 186.24 | 173.67 | 170.44 | 185.35 | 191.31 | 197.28 | 109.50 | 0.88 | NA | -70.81 | -80.14 | -92.52 | -104.26 | -117.27 | -118.22 | -65.08 | -77.12 | -70.00 | -39.31 | -22.12 | 5.46 | -4.64 | NA | 0.00 | |

| Minority Interest | 401.84 | 370.73 | 367.86 | 363.29 | 356.48 | 352.72 | 352.39 | 79.11 | 78.91 | 78.68 | 78.43 | 78.13 | 77.91 | 77.57 | 81.66 | 81.46 | 83.81 | 83.75 | 83.69 | 83.62 | 83.57 | 83.47 | 83.33 | 83.00 | 84.88 |

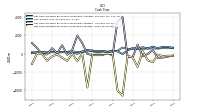

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

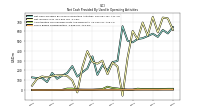

| Net Cash Provided By Used In Operating Activities | 576.49 | 552.11 | 530.38 | 522.03 | 487.92 | 504.34 | 652.96 | 298.17 | 285.43 | 200.45 | 254.74 | 155.73 | 344.12 | 221.02 | 181.05 | 137.45 | 244.96 | 174.26 | 147.30 | 115.64 | 175.56 | 81.85 | 124.18 | 122.48 | 129.44 | |

| Net Cash Provided By Used In Investing Activities | -954.21 | -734.12 | 258.09 | -1468.86 | -414.92 | -246.74 | -4614.11 | -4028.24 | 21.59 | -22.25 | 9.70 | 32.41 | 7.59 | -3715.92 | -0.85 | -839.58 | -5.52 | -806.84 | -447.85 | -101.16 | -308.41 | -792.01 | -40.12 | -0.34 | -1136.25 | |

| Net Cash Provided By Used In Financing Activities | 389.35 | -45.58 | -297.47 | 985.49 | -382.45 | -353.22 | 4006.45 | 3559.16 | -236.92 | 83.79 | -179.45 | -181.60 | -179.77 | -41.59 | 1129.25 | 1971.32 | 398.94 | -137.46 | 911.46 | 9.71 | 586.01 | -99.11 | -61.54 | 612.48 | 1148.45 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 576.49 | 552.11 | 530.38 | 522.03 | 487.92 | 504.34 | 652.96 | 298.17 | 285.43 | 200.45 | 254.74 | 155.73 | 344.12 | 221.02 | 181.05 | 137.45 | 244.96 | 174.26 | 147.30 | 115.64 | 175.56 | 81.85 | 124.18 | 122.48 | 129.44 | |

| Net Income Loss | 747.77 | 556.33 | 690.70 | 518.74 | 604.05 | 330.90 | -57.71 | 240.38 | 281.48 | 161.86 | 300.71 | 269.80 | 288.01 | 398.27 | 229.40 | -24.01 | 98.63 | 144.44 | 152.05 | 150.85 | 142.54 | 129.91 | 139.04 | 114.10 | 44.54 | |

| Profit Loss | 759.72 | 565.46 | 701.58 | 527.86 | 614.84 | 336.88 | -58.14 | 242.69 | 283.80 | 164.18 | 303.08 | 272.10 | 290.41 | 396.22 | 231.64 | -22.07 | 100.71 | 146.51 | 154.13 | 152.93 | 144.63 | 132.02 | 141.36 | 114.10 | 44.54 | |

| Share Based Compensation | 4.02 | 4.02 | 4.03 | 3.47 | 3.63 | 3.49 | 3.24 | 2.63 | 2.30 | 2.40 | 2.40 | 2.28 | 2.01 | 2.01 | 2.01 | 1.35 | 1.40 | 1.40 | 1.37 | 1.05 | 0.86 | 0.62 | 0.47 | 0.39 | 1.39 |

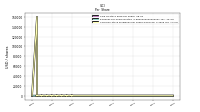

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -954.21 | -734.12 | 258.09 | -1468.86 | -414.92 | -246.74 | -4614.11 | -4028.24 | 21.59 | -22.25 | 9.70 | 32.41 | 7.59 | -3715.92 | -0.85 | -839.58 | -5.52 | -806.84 | -447.85 | -101.16 | -308.41 | -792.01 | -40.12 | -0.34 | -1136.25 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 389.35 | -45.58 | -297.47 | 985.49 | -382.45 | -353.22 | 4006.45 | 3559.16 | -236.92 | 83.79 | -179.45 | -181.60 | -179.77 | -41.59 | 1129.25 | 1971.32 | 398.94 | -137.46 | 911.46 | 9.71 | 586.01 | -99.11 | -61.54 | 612.48 | 1148.45 | |

| Payments Of Dividends | 422.08 | 382.86 | 396.30 | 382.61 | 375.41 | 346.52 | 269.32 | 227.86 | 226.43 | 177.10 | 177.25 | 178.01 | 177.03 | 158.65 | 139.40 | 137.13 | 137.10 | 132.44 | 118.08 | 116.34 | 106.39 | 97.02 | 59.28 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 931.87 | 904.32 | 898.16 | 877.65 | 769.91 | 751.54 | 662.62 | 416.62 | 383.15 | 375.70 | 376.40 | 374.31 | 373.02 | 339.65 | 257.90 | 255.00 | 237.54 | 222.51 | 220.75 | 214.00 | 226.04 | 232.69 | 220.97 | 218.28 | 187.61 | |

| V I C I Properties L P | 921.31 | 896.89 | 887.01 | 867.80 | 759.80 | 744.86 | 652.45 | 408.00 | 374.21 | 369.20 | 368.12 | 367.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 931.87 | 904.32 | 898.16 | 877.65 | 769.91 | 751.54 | 662.62 | 416.62 | 383.15 | 375.70 | 376.40 | 374.31 | 373.02 | 339.65 | 257.90 | 255.00 | 237.54 | 222.51 | 220.75 | 214.00 | 226.04 | 232.69 | 220.97 | 218.28 | 187.61 |