| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 178.19 | 178.19 | 178.19 | 178.19 | 178.19 | 178.19 | 178.19 | 148.48 | 148.48 | 142.98 | 142.55 | 142.44 | 141.75 | 141.72 | 141.67 | 141.61 | 141.42 | 116.65 | 116.57 | 116.47 | 116.24 | 116.15 | 116.03 | 115.82 | 92.73 | 92.57 | |

| Earnings Per Share Basic | 0.13 | 0.27 | 0.27 | 0.28 | 0.34 | 0.35 | 0.18 | 0.27 | 0.27 | 0.29 | 0.29 | 0.28 | 0.26 | 0.25 | 0.23 | 0.21 | 0.10 | 0.24 | 0.22 | 0.33 | 0.22 | 0.20 | 0.21 | 0.12 | 0.09 | 0.14 | |

| Earnings Per Share Diluted | 0.14 | 0.27 | 0.27 | 0.28 | 0.35 | 0.34 | 0.18 | 0.27 | 0.26 | 0.29 | 0.29 | 0.28 | 0.25 | 0.25 | 0.23 | 0.21 | 0.10 | 0.24 | 0.22 | 0.33 | 0.22 | 0.20 | 0.21 | 0.12 | 0.09 | 0.14 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

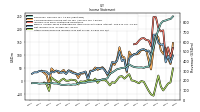

| Interest And Fee Income Loans And Leases | 762.89 | 753.64 | 715.17 | 655.23 | 599.01 | 496.52 | 415.58 | 317.37 | 319.14 | 309.75 | 315.31 | 313.18 | 313.97 | 315.79 | 321.88 | 333.07 | 315.31 | 298.38 | 296.93 | 288.28 | 282.85 | 265.87 | 247.69 | 237.59 | 195.09 | 186.77 | |

| Insurance Commissions And Fees | 3.22 | 2.34 | 3.14 | 2.42 | 2.90 | 3.75 | 3.46 | 1.86 | 2.00 | 1.61 | 2.64 | 1.56 | 1.97 | 1.82 | 1.66 | 1.95 | 2.49 | 2.75 | 2.65 | 2.52 | 3.72 | 3.65 | 4.03 | 3.82 | 4.22 | 4.52 | |

| Interest Expense | 420.91 | 400.60 | 367.69 | 284.21 | 180.73 | 82.74 | 34.79 | 22.79 | 24.68 | 27.77 | 32.74 | 39.13 | 46.14 | 54.26 | 65.97 | 98.45 | 105.23 | 108.64 | 107.51 | 101.58 | 92.54 | 80.24 | 69.37 | 59.90 | 48.54 | 46.80 | |

| Interest Expense Long Term Debt | 28.53 | 29.16 | 26.88 | 19.20 | 15.62 | 11.73 | 10.31 | 9.53 | 10.38 | 11.31 | 14.13 | 15.15 | 17.97 | 19.32 | 17.50 | 16.42 | 17.46 | 16.89 | 14.30 | 14.57 | 15.30 | 16.16 | 17.06 | 17.23 | 16.34 | 15.14 | |

| Interest Income Expense Net | 397.27 | 412.42 | 419.76 | 436.02 | 465.82 | 453.99 | 418.16 | 317.67 | 315.30 | 301.03 | 300.91 | 292.67 | 287.92 | 283.09 | 282.56 | 265.34 | 238.54 | 220.62 | 220.23 | 218.65 | 222.05 | 216.80 | 210.75 | 207.60 | 171.97 | 164.85 | |

| Interest Paid Net | 417.30 | 370.50 | 327.50 | 244.25 | 151.63 | 72.35 | 37.47 | 19.68 | 28.70 | 27.07 | 44.60 | 38.00 | 49.05 | 51.65 | 73.54 | 104.80 | 102.99 | 113.85 | 105.41 | 93.41 | 84.62 | 81.00 | 65.94 | 58.88 | 45.18 | NA | |

| Income Tax Expense Benefit | 17.41 | 53.49 | 51.76 | 57.16 | 67.55 | 68.41 | 36.55 | 39.31 | 42.27 | 42.42 | 42.88 | 39.32 | 37.97 | 38.89 | 33.47 | 29.13 | 36.97 | 25.31 | 27.53 | 57.20 | 18.07 | 18.05 | 18.96 | 13.18 | 34.96 | 17.09 | |

| Income Taxes Paid | -98.83 | 50.70 | 113.35 | 8.78 | 49.93 | 44.88 | 70.44 | 6.84 | 14.70 | 31.11 | 111.71 | 5.86 | 40.08 | 93.57 | 10.52 | 4.21 | 0.04 | 26.18 | 76.91 | 3.20 | 6.37 | 17.94 | 20.44 | 8.84 | 2.01 | 19.32 | |

| Net Income Loss | 71.55 | 141.35 | 139.06 | 146.55 | 177.59 | 178.12 | 96.41 | 116.73 | 115.04 | 122.58 | 120.51 | 115.71 | 105.36 | 102.37 | 95.60 | 87.27 | 38.10 | 81.89 | 76.47 | 113.33 | 77.10 | 69.56 | 72.80 | 41.97 | 26.10 | 39.65 | |

| Comprehensive Income Net Of Tax | 126.99 | 104.20 | 117.96 | 166.91 | 179.15 | 120.90 | 44.17 | 78.56 | 118.48 | 118.94 | 119.78 | 106.42 | 102.43 | 102.53 | 97.23 | 112.92 | 32.36 | 90.55 | 94.59 | 129.50 | 84.61 | 61.74 | 67.78 | 24.41 | 22.12 | 42.23 | |

| Preferred Stock Dividends Income Statement Impact | 4.10 | 4.13 | 4.03 | 3.87 | 3.63 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 3.17 | 2.68 | |

| Net Income Loss Available To Common Stockholders Basic | 67.45 | 137.22 | 135.03 | 142.68 | 173.96 | 174.95 | 93.24 | 113.56 | 111.87 | 119.41 | 117.34 | 112.54 | 102.19 | 99.20 | 92.43 | 84.10 | 34.93 | 78.72 | 73.30 | 110.16 | 73.93 | 66.39 | 69.63 | 38.79 | 22.93 | 36.97 | |

| Interest Income Expense After Provision For Loan Loss | 376.69 | 403.30 | 413.71 | 421.58 | 458.58 | 451.97 | 374.16 | 314.11 | 303.60 | 297.50 | 292.16 | 284.01 | 268.94 | 252.18 | 241.40 | 230.66 | 233.12 | 211.93 | 218.13 | 210.65 | 214.19 | 210.25 | 203.61 | 196.65 | 169.77 | 163.21 | |

| Noninterest Expense | 340.42 | 267.13 | 282.97 | 272.17 | 266.24 | 261.64 | 299.73 | 197.34 | 184.51 | 174.92 | 171.89 | 160.21 | 173.14 | 160.19 | 157.17 | 155.66 | 196.15 | 145.88 | 141.74 | 147.79 | 153.71 | 151.68 | 149.92 | 173.75 | 136.32 | 132.56 | |

| Noninterest Income | 52.69 | 58.66 | 60.08 | 54.30 | 52.80 | 56.19 | 58.53 | 39.27 | 38.22 | 42.43 | 43.13 | 31.23 | 47.53 | 49.27 | 44.83 | 41.40 | 38.09 | 41.15 | 27.60 | 107.67 | 34.69 | 29.04 | 38.07 | 32.25 | 27.60 | 26.09 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

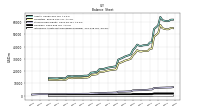

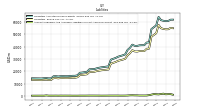

| Assets | 60934.97 | 61183.35 | 61703.69 | 64309.57 | 57462.75 | 55927.50 | 54438.81 | 43551.46 | 43446.44 | 41278.01 | 41274.23 | 41178.01 | 40686.08 | 40747.49 | 41717.26 | 39120.63 | 37436.02 | 33765.54 | 33027.74 | 32476.99 | 31863.09 | 30881.95 | 30182.98 | 29464.36 | 24002.31 | 23780.66 | |

| Liabilities | 54233.58 | 54556.05 | 55128.51 | 57797.99 | 51061.95 | 49653.67 | 48233.89 | 38455.07 | 38362.38 | 36455.51 | 36536.42 | 36518.34 | 36093.96 | 36213.73 | 37242.78 | 34699.63 | 33051.83 | 30207.46 | 29523.62 | 29032.11 | 28512.63 | 27579.01 | 26905.67 | 26219.35 | 21469.14 | 21242.68 | |

| Liabilities And Stockholders Equity | 60934.97 | 61183.35 | 61703.69 | 64309.57 | 57462.75 | 55927.50 | 54438.81 | 43551.46 | 43446.44 | 41278.01 | 41274.23 | 41178.01 | 40686.08 | 40747.49 | 41717.26 | 39120.63 | 37436.02 | 33765.54 | 33027.74 | 32476.99 | 31863.09 | 30881.95 | 30182.98 | 29464.36 | 24002.31 | 23780.66 | |

| Stockholders Equity | 6701.39 | 6627.30 | 6575.18 | 6511.58 | 6400.80 | 6273.83 | 6204.91 | 5096.38 | 5084.07 | 4822.50 | 4737.81 | 4659.67 | 4592.12 | 4533.76 | 4474.49 | 4421.00 | 4384.19 | 3558.07 | 3504.12 | 3444.88 | 3350.45 | 3302.94 | 3277.31 | 3245.00 | 2533.16 | 2537.98 | |

| Tier One Risk Based Capital | 4838.31 | NA | NA | NA | 4530.50 | NA | NA | NA | 3632.77 | NA | NA | NA | 3205.93 | NA | NA | NA | 2968.53 | NA | NA | NA | 2286.68 | NA | NA | NA | 1864.28 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

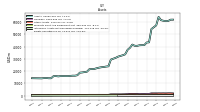

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 891.23 | 1143.82 | 1954.41 | 5705.69 | 947.95 | 1118.35 | 1388.31 | 730.92 | 2049.92 | 1500.16 | 1844.76 | 1633.83 | 1329.20 | 930.71 | 1910.33 | 1005.01 | 434.69 | 498.24 | 455.20 | 466.60 | 428.63 | 356.38 | 472.27 | 496.66 | 416.11 | NA | |

| Equity Securities Fv Ni | 64.46 | 63.19 | 61.01 | 50.15 | 48.73 | 43.32 | 41.72 | 35.99 | 36.47 | 36.07 | 33.87 | 32.97 | 29.38 | 29.03 | 54.38 | 49.70 | 41.41 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

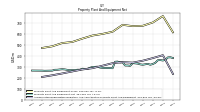

| Property Plant And Equipment Gross | 616.60 | NA | NA | NA | 765.77 | NA | NA | NA | 706.98 | NA | NA | NA | 676.45 | NA | NA | NA | 673.49 | NA | NA | NA | 685.14 | NA | NA | NA | 621.98 | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 235.52 | NA | NA | NA | 407.21 | NA | NA | NA | 380.68 | NA | NA | NA | 356.66 | NA | NA | NA | 338.96 | NA | NA | NA | 343.51 | NA | NA | NA | 334.27 | NA | |

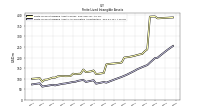

| Amortization Of Intangible Assets | 9.70 | 9.74 | 9.81 | 10.52 | 10.90 | 11.09 | 11.40 | 4.44 | 5.07 | 5.30 | 5.45 | 6.01 | 6.12 | 6.38 | 6.68 | 5.47 | 4.91 | 4.69 | 4.17 | 4.31 | 4.82 | 4.70 | 4.60 | 4.29 | 2.42 | 2.50 | |

| Property Plant And Equipment Net | 381.08 | 387.98 | 386.58 | 365.31 | 358.56 | 362.20 | 360.82 | 337.48 | 326.31 | 319.76 | 327.52 | 323.84 | 319.80 | 323.06 | 329.89 | 332.50 | 334.53 | 309.73 | 312.63 | 312.68 | 341.63 | 341.06 | 348.40 | 346.70 | 287.70 | 289.15 | |

| Goodwill | 1868.94 | 1868.94 | 1868.94 | 1868.94 | 1868.94 | 1871.51 | 1871.51 | 1468.35 | 1459.01 | 1382.44 | 1382.44 | 1382.44 | 1382.44 | 1375.41 | 1375.41 | 1375.41 | 1373.62 | 1084.66 | 1084.66 | 1084.66 | 1084.66 | 1085.71 | 1078.89 | 1078.89 | 690.64 | 690.64 | |

| Intangible Assets Net Excluding Goodwill | 160.33 | 169.27 | 177.95 | 187.17 | 197.46 | 208.23 | 218.64 | 74.88 | 70.39 | 62.52 | 65.52 | 67.97 | 70.45 | 73.87 | 77.92 | 82.69 | 86.77 | 68.15 | 70.58 | 73.58 | 76.99 | 80.77 | 83.97 | 86.49 | 42.51 | 42.86 | |

| Equity Securities Fv Ni | 64.46 | 63.19 | 61.01 | 50.15 | 48.73 | 43.32 | 41.72 | 35.99 | 36.47 | 36.07 | 33.87 | 32.97 | 29.38 | 29.03 | 54.38 | 49.70 | 41.41 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 444.75 | 647.67 | 488.92 | 449.96 | 501.62 | 535.65 | 328.56 | 164.58 | 34.07 | 23.96 | 17.73 | 25.61 | 7.72 | 8.50 | 8.34 | 7.88 | 11.93 | 10.96 | 16.75 | 29.60 | 47.74 | 65.80 | 55.70 | 50.53 | 30.49 | 26.53 | |

| Held To Maturity Securities Fair Value | 3302.31 | 3151.08 | 3278.95 | 3400.48 | 3329.47 | 3186.65 | 3393.72 | 2913.85 | 2660.61 | 2596.31 | 2556.52 | 2413.36 | 2227.61 | 2224.97 | 2194.88 | 2382.94 | 2358.72 | 2121.20 | 2184.79 | 2066.97 | 2034.94 | 2016.35 | 1988.78 | 2014.95 | 1837.62 | 1831.14 | |

| Held To Maturity Securities | 3740.41 | 3798.71 | 3766.84 | 3847.21 | 3828.98 | 3722.02 | 3719.98 | 3073.20 | 2668.70 | 2584.40 | 2533.81 | 2391.03 | 2173.01 | 2170.48 | 2133.43 | 2317.03 | 2336.09 | 2093.76 | 2168.24 | 2074.40 | 2068.25 | 2072.36 | 2030.19 | 2048.58 | 1842.69 | 1823.62 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 6.65 | 0.04 | 1.02 | 3.23 | 2.10 | 0.28 | 2.30 | 5.23 | 25.98 | 35.86 | 40.43 | 47.95 | 62.33 | 62.99 | 69.79 | 73.79 | 34.56 | 38.40 | 33.31 | 22.18 | 14.44 | 9.79 | 14.29 | 16.90 | 25.42 | 34.06 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 444.75 | 647.67 | 488.92 | 449.96 | 501.62 | 535.65 | 328.56 | 164.58 | 34.07 | 23.96 | 17.73 | 25.61 | 7.72 | 8.50 | 8.34 | 7.88 | 11.93 | 10.96 | 16.75 | 29.60 | 47.74 | 65.80 | 55.70 | 50.53 | 30.49 | 26.53 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 2888.84 | 3060.13 | 3021.35 | 3010.74 | 3102.76 | 3109.75 | 3133.14 | 2463.83 | 1683.38 | 1363.98 | 1032.92 | 945.49 | 68.99 | 281.33 | 116.92 | 97.98 | 647.33 | 532.40 | 773.93 | 1011.65 | 1187.77 | 1490.96 | 1292.96 | 1295.28 | 1028.42 | 882.44 | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 3739.21 | 3797.39 | 3765.49 | 3845.58 | 3827.34 | 3720.32 | NA | NA | 2667.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 108.55 | 109.80 | 123.03 | 165.91 | 138.07 | 191.82 | 219.46 | 217.67 | 238.09 | 239.89 | 257.62 | 239.32 | 246.98 | 213.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | 26.73 | 71.92 | 67.62 | 63.35 | 61.22 | 31.72 | 33.19 | 39.66 | 34.20 | 22.84 | 27.36 | 26.31 | 28.29 | 113.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 2751.92 | 2662.78 | 2680.49 | 2066.92 | 1492.66 | 1065.62 | 565.56 | 570.78 | 242.95 | 38.57 | 40.20 | 36.68 | 31.10 | 31.27 | 51.23 | 52.08 | 323.08 | 390.19 | 765.52 | 992.38 | 1086.15 | 746.27 | 637.42 | 625.03 | 663.24 | 265.99 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 136.92 | 397.35 | 340.87 | 943.82 | 1610.10 | 2044.13 | 2567.58 | 1893.05 | 1440.43 | 1325.41 | 992.72 | 908.81 | 37.89 | 250.06 | 65.69 | 45.91 | 324.25 | 142.22 | 8.41 | 19.27 | 101.62 | 744.68 | 655.54 | 670.25 | 365.18 | 616.45 | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 149.63 | 105.17 | 87.95 | 92.03 | 80.93 | 79.84 | 72.40 | 45.92 | 49.32 | 67.33 | 130.98 | 152.37 | 154.90 | 168.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 495.47 | 511.58 | 538.83 | 553.62 | 553.45 | 509.68 | 575.93 | 170.10 | 186.70 | 189.64 | 201.95 | 197.63 | 207.78 | 200.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

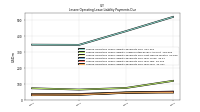

| Time Deposit Maturities Year One | 12332.12 | 10297.95 | 6574.93 | 6859.39 | 7187.39 | NA | NA | NA | 2986.06 | NA | NA | NA | 5877.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 49242.83 | 49885.31 | 49619.82 | 47590.92 | 47636.91 | 45308.84 | 43881.05 | 35647.34 | 35632.41 | 33632.61 | 33194.77 | 32585.21 | 31935.60 | 31187.98 | 31428.01 | 29016.99 | 29185.84 | 25546.12 | 24773.93 | 24907.50 | 24452.97 | 22588.27 | 21640.77 | 21959.85 | 18153.46 | 17312.77 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

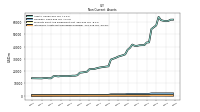

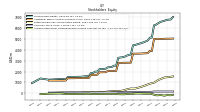

| Stockholders Equity | 6701.39 | 6627.30 | 6575.18 | 6511.58 | 6400.80 | 6273.83 | 6204.91 | 5096.38 | 5084.07 | 4822.50 | 4737.81 | 4659.67 | 4592.12 | 4533.76 | 4474.49 | 4421.00 | 4384.19 | 3558.07 | 3504.12 | 3444.88 | 3350.45 | 3302.94 | 3277.31 | 3245.00 | 2533.16 | 2537.98 | |

| Common Stock Value | 178.19 | 178.19 | 178.19 | 178.19 | 178.19 | 178.19 | 178.19 | 148.48 | 148.48 | 142.98 | 142.55 | 142.44 | 141.75 | 141.72 | 141.67 | 141.61 | 141.42 | 116.65 | 116.57 | 116.47 | 116.24 | 116.15 | 116.03 | 115.82 | 92.73 | 92.57 | |

| Additional Paid In Capital Common Stock | 4989.99 | 4982.75 | 4974.51 | 4967.66 | 4980.23 | 4972.73 | 4965.49 | 3872.24 | 3883.03 | 3672.47 | 3658.64 | 3651.95 | 3637.47 | 3633.32 | 3628.79 | 3624.04 | 3622.21 | 2807.27 | 2804.06 | 2799.43 | 2796.50 | 2793.16 | 2789.19 | 2784.19 | 2060.36 | 2054.84 | |

| Retained Earnings Accumulated Deficit | 1471.37 | 1460.28 | 1379.53 | 1300.98 | 1218.44 | 1100.84 | 982.15 | 945.23 | 883.64 | 818.78 | 744.77 | 672.65 | 611.16 | 553.83 | 499.51 | 452.42 | 443.56 | 454.02 | 412.19 | 375.98 | 299.64 | 262.37 | 232.59 | 199.56 | 216.73 | 214.98 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -146.46 | -201.89 | -164.75 | -143.65 | -164.00 | -165.56 | -108.34 | -56.10 | -17.93 | -21.38 | -17.73 | -17.00 | -7.72 | -4.78 | -4.94 | -6.57 | -32.21 | -26.47 | -35.13 | -53.26 | -69.43 | -76.94 | -69.12 | -64.10 | -46.01 | -34.10 | |

| Treasury Stock Value | 1.39 | 1.72 | 1.99 | 1.29 | 21.75 | 22.06 | 22.26 | 23.15 | 22.86 | 0.04 | 0.10 | 0.05 | 0.23 | 0.01 | 0.23 | 0.20 | 0.48 | 3.08 | 3.26 | 3.44 | 2.19 | 1.49 | 1.06 | 0.16 | 0.34 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

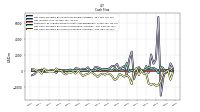

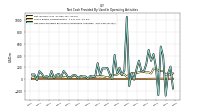

| Net Cash Provided By Used In Operating Activities | -278.58 | 374.10 | 552.36 | -269.68 | 197.88 | 425.07 | 309.53 | 496.00 | 254.10 | 128.79 | 140.86 | 313.40 | 171.04 | -9.54 | 106.00 | -115.98 | 1051.52 | 146.67 | 72.48 | 193.28 | 98.30 | 410.92 | -1.51 | 85.88 | 189.48 | 180.58 | |

| Net Cash Provided By Used In Investing Activities | -103.14 | -265.99 | -1195.82 | -1784.56 | -1854.23 | -1607.60 | -1740.66 | -1585.29 | -339.22 | -343.30 | 101.38 | -499.63 | 369.93 | 24.02 | -1652.71 | -778.90 | -515.64 | -720.58 | -536.02 | -359.10 | -922.48 | -1149.53 | -673.20 | -384.34 | -294.75 | -472.52 | |

| Net Cash Provided By Used In Financing Activities | 129.12 | -918.70 | -3107.82 | 6811.98 | 1485.94 | 912.57 | 2088.53 | -229.71 | 634.89 | -130.10 | -31.30 | 490.86 | -142.48 | -994.09 | 2452.02 | 1465.20 | -599.43 | 616.95 | 452.13 | 203.79 | 896.43 | 622.72 | 650.32 | 379.00 | 177.56 | 277.98 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -278.58 | 374.10 | 552.36 | -269.68 | 197.88 | 425.07 | 309.53 | 496.00 | 254.10 | 128.79 | 140.86 | 313.40 | 171.04 | -9.54 | 106.00 | -115.98 | 1051.52 | 146.67 | 72.48 | 193.28 | 98.30 | 410.92 | -1.51 | 85.88 | 189.48 | 180.58 | |

| Net Income Loss | 71.55 | 141.35 | 139.06 | 146.55 | 177.59 | 178.12 | 96.41 | 116.73 | 115.04 | 122.58 | 120.51 | 115.71 | 105.36 | 102.37 | 95.60 | 87.27 | 38.10 | 81.89 | 76.47 | 113.33 | 77.10 | 69.56 | 72.80 | 41.97 | 26.10 | 39.65 | |

| Share Based Compensation | 7.74 | 8.59 | 8.68 | 8.09 | 7.81 | 7.56 | 6.16 | 7.26 | 5.04 | 5.16 | 5.22 | 5.46 | 4.15 | 3.80 | 4.51 | 3.68 | 3.22 | 3.22 | 4.25 | 4.03 | 3.63 | 3.69 | 4.76 | 7.39 | 2.64 | 2.69 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -103.14 | -265.99 | -1195.82 | -1784.56 | -1854.23 | -1607.60 | -1740.66 | -1585.29 | -339.22 | -343.30 | 101.38 | -499.63 | 369.93 | 24.02 | -1652.71 | -778.90 | -515.64 | -720.58 | -536.02 | -359.10 | -922.48 | -1149.53 | -673.20 | -384.34 | -294.75 | -472.52 | |

| Payments To Acquire Property Plant And Equipment | 4.47 | 22.10 | 31.20 | 18.26 | 18.42 | 15.35 | 12.41 | 22.75 | 19.62 | 7.60 | 4.17 | 8.04 | 3.89 | 6.25 | 5.23 | 9.23 | 7.62 | 6.42 | 5.52 | 3.82 | 9.56 | 4.07 | 8.55 | 4.26 | 4.78 | 0.36 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

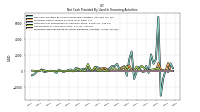

| Net Cash Provided By Used In Financing Activities | 129.12 | -918.70 | -3107.82 | 6811.98 | 1485.94 | 912.57 | 2088.53 | -229.71 | 634.89 | -130.10 | -31.30 | 490.86 | -142.48 | -994.09 | 2452.02 | 1465.20 | -599.43 | 616.95 | 452.13 | 203.79 | 896.43 | 622.72 | 650.32 | 379.00 | 177.56 | 277.98 | |

| Payments Of Dividends Common Stock | 55.92 | 55.88 | 56.00 | 57.61 | 57.65 | 55.73 | 46.41 | 46.20 | 44.81 | 44.66 | 44.67 | 45.53 | 44.43 | 44.41 | 44.44 | 44.68 | 36.50 | 36.49 | 36.49 | 37.05 | 36.44 | 36.42 | 36.38 | 29.61 | 31.74 | 26.14 | |

| Payments For Repurchase Of Common Stock | 0.20 | 0.14 | 2.53 | 8.60 | 0.11 | 0.13 | 0.26 | 23.63 | 23.21 | 0.01 | 0.14 | 0.54 | 0.40 | 0.05 | 2.83 | 2.09 | 0.30 | 0.04 | 0.10 | 1.37 | 1.02 | 0.18 | 0.52 | 2.08 | 0.36 | 0.10 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposit Account | 9.34 | 10.95 | 10.54 | 10.48 | 10.31 | 10.34 | 10.07 | 6.21 | 5.81 | 5.43 | 5.08 | 5.10 | 5.07 | 3.95 | 3.56 | 5.68 | 6.00 | 5.90 | 5.83 | 5.90 | 6.29 | 6.60 | 6.68 | 7.25 | 5.39 | 5.56 | |

| Investment Advisory Management And Administrative Service | 11.98 | 11.42 | 11.18 | 9.59 | 10.72 | 9.28 | 9.58 | 5.13 | 4.50 | 3.55 | 3.53 | 3.33 | 3.11 | 3.07 | 2.83 | 3.41 | 3.35 | 3.30 | 3.10 | 2.90 | 3.00 | 3.14 | 3.26 | 3.23 | 2.93 | 3.06 |