| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | NA | NA | NA | 0.01 | NA | NA | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

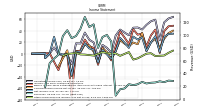

| Earnings Per Share Basic | 0.01 | 0.18 | 0.13 | 0.03 | 0.19 | 0.16 | 0.19 | 0.06 | 0.12 | 0.17 | 0.02 | -0.05 | -0.09 | 0.04 | -0.10 | 0.04 | 0.07 | 0.11 | 0.02 | 0.02 | -0.38 | 0.09 | -0.07 | -0.35 | NA | NA | NA | |

| Earnings Per Share Diluted | 0.02 | 0.18 | 0.13 | 0.03 | 0.12 | 0.15 | 0.15 | 0.06 | 0.11 | 0.14 | 0.02 | -0.05 | -0.09 | 0.04 | -0.10 | 0.04 | 0.06 | 0.11 | 0.02 | 0.02 | -0.38 | 0.09 | -0.07 | -0.35 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

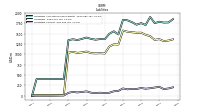

| Revenue From Contract With Customer Excluding Assessed Tax | 211.01 | 209.93 | 204.46 | 191.90 | 186.07 | 197.66 | 187.49 | 170.38 | 169.98 | 162.09 | 128.66 | 89.86 | 100.16 | 96.91 | 79.81 | 116.71 | 112.46 | 128.24 | 109.58 | 98.46 | 95.11 | 107.60 | 98.20 | 69.24 | 63.16 | 56.09 | 18.99 | |

| Revenues | 27.79 | 25.93 | 25.51 | 24.35 | 26.91 | 23.18 | 21.88 | 23.23 | 16.59 | 15.33 | 5.31 | 89.86 | 100.16 | 96.91 | 79.81 | 116.71 | 112.46 | 128.24 | 109.58 | 98.46 | 95.11 | 107.60 | 98.20 | 69.24 | 63.16 | 56.09 | 18.99 | |

| Operating Costs And Expenses | 76.92 | 68.87 | 65.66 | 61.84 | 59.53 | 60.54 | 55.20 | 51.06 | 48.13 | 48.31 | 36.43 | 30.49 | 30.23 | 26.54 | 26.70 | 32.26 | 31.54 | 32.97 | 31.80 | 29.34 | 28.58 | 27.82 | 28.80 | 23.68 | NA | NA | NA | |

| Costs And Expenses | 187.68 | 150.76 | 148.25 | 141.80 | 144.03 | 152.16 | 142.33 | 138.38 | 133.25 | 120.22 | 97.15 | 88.11 | 90.08 | 81.64 | 86.76 | 97.30 | 88.27 | 91.58 | 91.94 | 80.50 | 113.22 | 81.41 | 86.41 | 76.50 | NA | NA | NA | |

| Selling General And Administrative Expense | 73.06 | 42.28 | 43.20 | 40.01 | 40.22 | 41.13 | 40.15 | 41.63 | 37.16 | 31.58 | 26.23 | 28.44 | 25.45 | 17.51 | 20.82 | 25.89 | 22.78 | 21.29 | 20.86 | 20.55 | 53.52 | 21.69 | 27.59 | 33.28 | NA | NA | NA | |

| Operating Income Loss | 23.33 | 59.17 | 56.21 | 50.10 | 42.04 | 45.50 | 45.16 | 32.01 | 36.73 | 41.87 | 31.51 | 1.75 | 10.09 | 15.27 | -6.95 | 19.41 | 24.19 | 36.66 | 17.64 | 17.97 | -18.11 | -2.18 | -3.46 | -0.26 | 10.83 | -0.18 | -0.19 | |

| Interest Expense | 20.86 | 20.38 | 22.77 | 22.69 | 20.35 | 20.26 | 14.48 | 14.28 | 12.46 | 11.64 | 11.68 | 9.16 | 9.30 | 9.58 | 9.54 | 12.45 | 14.11 | 14.93 | 15.66 | 16.03 | 17.01 | 20.31 | 19.58 | 12.65 | NA | NA | NA | |

| Interest Expense Debt | 20.90 | 20.40 | 22.80 | 22.70 | -48.93 | 20.30 | 14.50 | 14.30 | 12.40 | 11.60 | 11.70 | 9.20 | 9.30 | 9.60 | 9.50 | 12.50 | 14.10 | 14.90 | 15.70 | 16.00 | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 25.74 | 16.41 | 26.90 | 17.06 | 23.59 | 14.03 | 17.85 | 8.19 | 16.98 | 5.75 | 6.06 | 7.00 | 7.62 | 8.00 | 8.38 | 11.82 | 12.89 | 14.16 | 14.25 | 13.89 | 15.20 | 17.39 | 22.10 | 5.75 | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | -1.98 | -0.21 | -1.35 | 0.00 | 3.00 | NA | NA | 0.00 | 0.00 | 0.00 | -5.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 5.13 | 4.44 | 4.53 | 3.38 | 3.01 | 4.64 | 4.57 | 4.45 | 3.60 | 3.70 | 3.57 | 2.91 | 3.40 | 3.15 | 3.27 | 2.77 | 2.59 | 2.47 | 2.81 | 2.14 | 2.27 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Income Tax Expense Benefit | -1.88 | 11.50 | 12.52 | 7.84 | 6.78 | 8.40 | 12.64 | 6.82 | 8.94 | 11.49 | 8.90 | -2.89 | 2.25 | 3.99 | -4.02 | 3.21 | 3.83 | 6.70 | 1.73 | 1.32 | -16.26 | 2.31 | -0.24 | -6.61 | NA | 0.55 | NA | |

| Income Taxes Paid Net | 16.38 | 14.72 | 20.27 | 2.63 | 4.17 | 17.43 | 24.88 | 1.15 | 21.27 | 9.51 | 4.76 | 0.24 | 3.90 | 7.60 | 0.82 | 0.32 | 0.49 | 8.42 | 20.16 | -4.71 | -0.10 | 0.01 | 0.53 | 0.32 | NA | NA | NA | |

| Profit Loss | 3.02 | 30.31 | 19.11 | 4.58 | 28.22 | 24.58 | 29.64 | 10.04 | 19.07 | 27.31 | 3.99 | -8.91 | -1.42 | 6.69 | -15.39 | 6.67 | 9.18 | 17.75 | 3.59 | 2.82 | -56.96 | -0.69 | -1.55 | 0.80 | 0.48 | 0.25 | 0.54 | |

| Net Income Loss | 3.02 | 30.31 | 19.11 | 4.58 | 28.22 | 24.58 | 29.64 | 10.04 | 19.07 | 27.31 | 3.99 | -8.91 | -1.42 | 6.69 | -15.39 | 6.67 | 9.18 | 17.75 | 3.59 | 2.82 | -37.95 | -0.69 | -1.55 | 0.80 | 29.18 | 0.25 | 0.54 | |

| Comprehensive Income Net Of Tax | 9.27 | 26.12 | 19.83 | 4.49 | 36.29 | 16.41 | 19.26 | 12.75 | 17.42 | 23.49 | 4.34 | -9.11 | 2.78 | 9.15 | -15.90 | 3.31 | 14.16 | 16.09 | 2.19 | 4.14 | -39.33 | 5.79 | -8.51 | -22.16 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

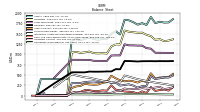

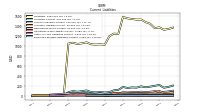

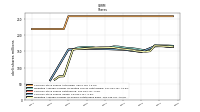

| Assets | 1789.98 | 1756.08 | 1906.16 | 1710.89 | 1756.27 | 1718.33 | 1779.86 | 1824.48 | 1837.06 | 1481.92 | 1559.19 | 1497.21 | 1367.33 | 1371.97 | 1355.12 | 1374.13 | 1407.43 | 1375.86 | 1346.45 | 1365.61 | 1344.78 | 406.20 | 405.04 | 404.78 | 403.70 | 402.87 | 402.40 | |

| Liabilities | 1368.52 | 1352.02 | 1440.86 | 1473.78 | 1525.20 | 1523.44 | 1535.64 | 1548.67 | 1577.09 | 1238.25 | 1242.77 | 1188.69 | 1020.89 | 1028.05 | 1023.37 | 1029.73 | 1068.08 | 1048.27 | 1036.62 | 1060.79 | 1042.73 | 18.95 | 17.10 | 15.29 | 15.01 | 14.66 | 14.44 | |

| Liabilities And Stockholders Equity | 1789.98 | 1756.08 | 1906.16 | 1710.89 | 1756.27 | 1718.33 | 1779.86 | 1824.48 | 1837.06 | 1481.92 | 1559.19 | 1497.21 | 1367.33 | 1371.97 | 1355.12 | 1374.13 | 1407.43 | 1375.86 | 1346.45 | 1365.61 | 1344.78 | 406.20 | 405.04 | 404.78 | 403.70 | 402.87 | 402.40 | |

| Stockholders Equity | 421.47 | 404.06 | 465.30 | 237.11 | 231.07 | 194.89 | 244.22 | 275.81 | 259.96 | 243.67 | 316.43 | 308.52 | 346.44 | 343.92 | 331.75 | 344.40 | 339.35 | 327.59 | 309.83 | 304.82 | 302.06 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 439.54 | 411.29 | 542.59 | 332.43 | 362.59 | 317.44 | 348.37 | 362.98 | 348.07 | 372.13 | 421.56 | 482.80 | 328.04 | 311.58 | 270.70 | 265.91 | 272.44 | 288.10 | 235.47 | 223.58 | 185.15 | 0.20 | 0.43 | 1.83 | 0.96 | 0.83 | 1.34 | |

| Cash And Cash Equivalents At Carrying Value | 136.31 | 114.38 | 210.08 | 64.27 | 105.20 | 51.58 | 86.39 | 93.38 | 101.28 | 128.25 | 147.35 | 249.60 | 120.26 | 129.16 | 113.24 | 113.58 | 131.51 | 135.56 | 92.25 | 91.48 | 65.05 | 0.01 | 0.17 | 1.67 | 0.83 | 0.63 | 1.08 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 139.72 | 118.33 | 213.50 | 67.82 | 109.11 | 55.63 | 90.56 | 97.39 | 104.43 | 131.19 | 150.50 | 250.42 | 120.89 | 129.71 | 113.95 | 115.09 | 132.43 | 137.72 | 93.99 | 93.19 | 67.08 | 53.68 | 31.69 | 17.87 | 10.51 | NA | NA | |

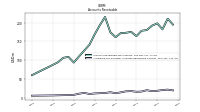

| Accounts Receivable Net Current | 197.82 | 191.75 | 179.94 | 178.25 | 163.79 | 175.15 | 172.82 | 171.91 | 160.98 | 174.46 | 214.93 | 192.99 | 168.78 | 141.02 | 125.25 | 109.84 | 93.51 | 108.68 | 106.26 | 94.63 | 87.51 | NA | NA | NA | 60.18 | NA | NA | |

| Inventory Net | 17.97 | 19.94 | 19.79 | 18.92 | 19.31 | 17.92 | 16.55 | 15.45 | 12.09 | NA | NA | NA | 0.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Current | 0.76 | 1.65 | 1.39 | 0.33 | 1.97 | 1.10 | 1.73 | 1.33 | 1.81 | 1.32 | 1.61 | 1.63 | 0.89 | 0.17 | 0.45 | 0.45 | 0.69 | 0.20 | 0.20 | 0.03 | 0.40 | NA | NA | NA | 0.05 | NA | NA | |

| Prepaid Expense And Other Assets Current | 46.96 | 41.20 | 92.51 | 33.26 | 39.60 | 35.95 | 34.62 | 38.74 | 41.46 | 39.05 | 32.26 | 24.51 | 24.32 | 24.71 | 18.96 | 24.62 | 26.49 | 26.62 | 21.65 | 19.01 | 17.60 | NA | NA | NA | 15.79 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

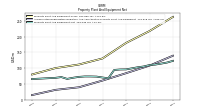

| Property Plant And Equipment Gross | 262.87 | NA | NA | NA | 217.81 | NA | NA | NA | 180.04 | NA | NA | NA | 130.85 | NA | NA | NA | 111.58 | NA | NA | NA | 100.22 | NA | NA | NA | 79.84 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 139.62 | NA | NA | NA | 108.04 | NA | NA | NA | 83.97 | NA | NA | NA | 60.56 | NA | NA | NA | 39.31 | NA | NA | NA | 30.98 | NA | NA | NA | 14.47 | NA | NA | |

| Amortization Of Intangible Assets | 16.70 | 18.90 | 20.00 | 22.00 | 25.20 | 26.60 | 27.10 | 27.30 | 23.00 | 22.90 | 21.20 | 22.70 | 22.90 | 23.60 | 23.50 | 23.50 | 23.40 | 23.10 | 23.10 | 23.10 | 23.10 | 23.10 | 22.20 | 12.30 | NA | NA | NA | |

| Property Plant And Equipment Net | 123.25 | 117.83 | 114.47 | 111.38 | 109.78 | 105.27 | 102.75 | 99.35 | 96.07 | 95.79 | 94.31 | 67.74 | 70.28 | 73.16 | 73.60 | 73.63 | 72.27 | 69.48 | 65.91 | 71.69 | 69.24 | NA | NA | NA | 65.37 | NA | NA | |

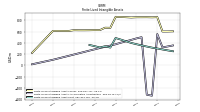

| Goodwill | 835.84 | 832.82 | 835.32 | 834.30 | 833.48 | 827.69 | 832.81 | 837.91 | 838.87 | 637.74 | 641.52 | 586.22 | 586.43 | 583.34 | 581.62 | 581.73 | 584.15 | 563.45 | 564.64 | 565.60 | 564.72 | NA | NA | NA | 294.41 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 301.02 | 315.75 | 335.78 | 355.68 | 377.42 | 399.99 | 429.81 | 460.08 | 487.30 | 317.03 | 340.64 | 319.15 | 342.14 | 363.53 | 386.36 | 409.96 | 434.44 | 444.51 | 468.21 | 491.85 | 514.54 | NA | NA | NA | 203.75 | NA | NA | |

| Finite Lived Intangible Assets Net | 301.02 | 315.75 | 335.78 | 355.68 | 377.42 | 399.99 | 429.81 | 460.08 | 487.30 | 317.03 | 340.64 | 319.15 | 342.14 | 363.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 33.92 | 16.96 | 15.44 | 12.61 | 12.48 | 12.51 | 12.58 | 8.73 | 14.56 | 15.67 | 16.32 | 2.54 | 2.70 | 2.90 | 3.24 | 3.09 | 3.11 | 2.39 | 2.20 | 2.07 | 1.85 | NA | NA | NA | 0.98 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

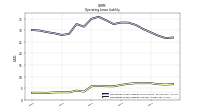

| Liabilities Current | 214.77 | 197.57 | 180.81 | 168.64 | 186.81 | 161.09 | 165.50 | 154.15 | 175.19 | 116.93 | 106.74 | 70.43 | 64.04 | 72.01 | 65.02 | 72.00 | 104.88 | 90.32 | 78.72 | 91.79 | 68.74 | 4.94 | 3.10 | 1.27 | 0.20 | 0.11 | 0.44 | |

| Long Term Debt Current | 9.02 | 9.02 | 9.02 | 9.02 | 21.93 | 9.02 | 11.95 | 11.95 | 36.95 | 9.43 | 9.41 | 6.50 | 9.10 | 9.10 | 9.10 | 9.10 | 28.78 | 9.10 | 9.10 | 9.10 | 9.10 | NA | NA | NA | 3.25 | NA | NA | |

| Accounts Payable Current | 78.75 | 89.76 | 78.41 | 71.47 | 79.87 | 69.14 | 69.11 | 63.05 | 67.56 | 48.63 | 47.40 | 41.33 | 34.51 | 45.60 | 36.35 | 39.20 | 50.83 | 57.19 | 49.32 | 52.24 | 45.19 | NA | NA | NA | 20.16 | NA | NA | |

| Other Accrued Liabilities Current | 4.25 | 2.76 | 2.73 | 4.36 | 3.68 | 3.51 | 5.21 | 4.51 | 3.71 | 2.04 | 2.81 | 1.97 | 1.92 | 0.74 | 2.02 | 1.56 | 1.30 | 1.48 | 1.12 | 0.64 | 1.19 | NA | NA | NA | 0.42 | NA | NA | |

| Accrued Liabilities Current | 93.12 | 59.46 | 51.64 | 52.04 | 48.85 | 45.07 | 49.60 | 46.67 | 38.44 | 53.66 | 44.73 | 17.39 | 15.64 | 17.31 | 19.57 | 23.70 | 25.28 | 24.02 | 20.30 | 30.45 | 14.44 | 4.91 | 3.08 | 0.16 | 0.07 | 0.04 | 0.42 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1038.13 | 1039.37 | 1138.71 | 1149.73 | 1211.98 | 1213.03 | 1217.12 | 1218.23 | 1243.75 | 974.79 | 975.48 | 972.45 | 842.04 | 842.73 | 843.42 | 844.61 | 866.47 | 867.29 | 868.24 | 868.87 | 869.35 | NA | NA | NA | 428.69 | NA | NA | |

| Long Term Debt Noncurrent | 1029.11 | 1030.35 | 1129.69 | 1140.71 | 1190.05 | 1204.01 | 1205.17 | 1206.28 | 1206.80 | 965.36 | 966.07 | 965.95 | 832.94 | 833.62 | 834.32 | 835.51 | 837.69 | 858.19 | 859.13 | 859.77 | 860.25 | NA | NA | NA | 425.44 | NA | NA | |

| Deferred Income Tax Liabilities Net | 18.36 | 19.02 | 20.58 | 20.92 | 21.15 | 18.64 | 21.83 | 28.29 | 47.52 | 12.38 | 20.79 | 21.32 | 21.15 | 21.51 | 22.69 | NA | 25.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 14.20 | 9.56 | 7.39 | 7.20 | 5.88 | 5.35 | 5.49 | 13.27 | 5.69 | 1.04 | 1.06 | 0.55 | 0.49 | 0.16 | 0.25 | 0.27 | 2.18 | 2.87 | NA | NA | 3.37 | NA | NA | NA | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 29.12 | 30.55 | 32.33 | 33.34 | 33.36 | 32.69 | 34.35 | 35.85 | 34.98 | 31.57 | 32.72 | 28.45 | 27.99 | 28.72 | 29.24 | 29.92 | 30.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

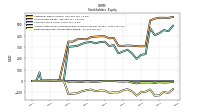

| Stockholders Equity | 421.47 | 404.06 | 465.30 | 237.11 | 231.07 | 194.89 | 244.22 | 275.81 | 259.96 | 243.67 | 316.43 | 308.52 | 346.44 | 343.92 | 331.75 | 344.40 | 339.35 | 327.59 | 309.83 | 304.82 | 302.06 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | |

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | NA | NA | NA | 0.01 | NA | NA | |

| Additional Paid In Capital | 557.51 | 549.37 | 533.63 | 306.97 | 305.42 | 307.47 | 311.25 | 312.99 | 309.88 | 311.00 | 379.24 | 375.67 | 394.00 | 394.26 | 391.24 | 387.99 | 367.27 | 369.67 | 368.00 | 346.89 | 348.02 | NA | 4.36 | 2.81 | 3.62 | NA | NA | |

| Retained Earnings Accumulated Deficit | -125.89 | -128.91 | -74.39 | -93.50 | -98.08 | -128.24 | -90.85 | -71.38 | -81.42 | -100.48 | -99.77 | -103.77 | -84.36 | -82.94 | -89.63 | -74.24 | -80.22 | -89.40 | -107.15 | -110.74 | -113.31 | -0.06 | 0.64 | 2.19 | 1.38 | 0.91 | 0.65 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -10.18 | -16.43 | -12.24 | -12.96 | -12.87 | -20.93 | -12.77 | -2.39 | -5.09 | -3.45 | 0.37 | 0.02 | 0.21 | -3.98 | -6.45 | -5.94 | -2.58 | -7.56 | -5.89 | -4.50 | -5.82 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

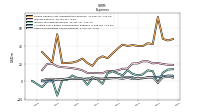

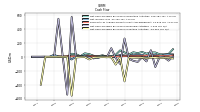

| Net Cash Provided By Used In Operating Activities | 35.73 | 62.44 | 62.71 | 45.22 | 69.56 | 52.40 | 65.13 | 31.25 | 63.89 | 91.81 | 28.46 | 9.01 | 2.56 | 21.81 | 7.70 | 14.84 | 38.22 | 49.80 | 8.43 | 37.35 | 43.98 | 0.82 | 0.16 | 1.05 | 0.89 | 0.52 | 0.95 | |

| Net Cash Provided By Used In Investing Activities | -16.60 | -10.17 | -11.94 | -19.58 | -12.16 | -13.13 | -11.43 | -11.87 | -353.56 | -7.31 | -111.45 | -3.65 | -5.90 | -4.00 | -6.12 | -8.13 | -37.49 | -3.30 | -5.01 | -9.17 | -559.60 | -1.38 | -1.67 | -0.21 | NA | -0.98 | -0.73 | |

| Net Cash Provided By Used In Financing Activities | 0.66 | -146.36 | 94.53 | -66.63 | -5.41 | -73.01 | -57.87 | -28.65 | 263.39 | -101.69 | -16.89 | 123.92 | -6.05 | -2.45 | -2.42 | -23.08 | -7.39 | -2.42 | -2.39 | -2.31 | 573.86 | -545.22 | -2.37 | 548.00 | 0.00 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

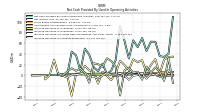

| Net Cash Provided By Used In Operating Activities | 35.73 | 62.44 | 62.71 | 45.22 | 69.56 | 52.40 | 65.13 | 31.25 | 63.89 | 91.81 | 28.46 | 9.01 | 2.56 | 21.81 | 7.70 | 14.84 | 38.22 | 49.80 | 8.43 | 37.35 | 43.98 | 0.82 | 0.16 | 1.05 | 0.89 | 0.52 | 0.95 | |

| Net Income Loss | 3.02 | 30.31 | 19.11 | 4.58 | 28.22 | 24.58 | 29.64 | 10.04 | 19.07 | 27.31 | 3.99 | -8.91 | -1.42 | 6.69 | -15.39 | 6.67 | 9.18 | 17.75 | 3.59 | 2.82 | -37.95 | -0.69 | -1.55 | 0.80 | 29.18 | 0.25 | 0.54 | |

| Profit Loss | 3.02 | 30.31 | 19.11 | 4.58 | 28.22 | 24.58 | 29.64 | 10.04 | 19.07 | 27.31 | 3.99 | -8.91 | -1.42 | 6.69 | -15.39 | 6.67 | 9.18 | 17.75 | 3.59 | 2.82 | -56.96 | -0.69 | -1.55 | 0.80 | 0.48 | 0.25 | 0.54 | |

| Depreciation Depletion And Amortization | 26.23 | 27.53 | 29.00 | 30.31 | 33.39 | 35.08 | 34.54 | 35.67 | 32.00 | 29.53 | 27.01 | 28.21 | 28.74 | 29.42 | 29.16 | 29.25 | 29.07 | 28.70 | 28.86 | 28.94 | 28.51 | 28.79 | 27.50 | 18.55 | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 6.61 | 14.78 | 4.85 | 16.22 | -8.16 | 6.73 | 4.81 | 14.30 | 9.50 | -37.53 | 16.30 | 26.67 | 31.68 | 15.73 | 20.79 | 22.40 | -13.69 | 4.92 | 13.06 | 8.37 | 13.02 | 7.21 | -0.12 | 3.61 | NA | NA | NA | |

| Increase Decrease In Inventories | -2.21 | 1.01 | 0.23 | -0.18 | 1.25 | 1.66 | 1.68 | 5.72 | -2.42 | 0.55 | -1.61 | 0.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | -19.80 | -2.50 | -2.48 | -2.25 | -0.04 | -1.61 | 3.07 | -18.77 | -1.96 | -7.85 | -1.11 | 0.28 | -0.83 | -1.42 | -1.81 | -0.68 | -1.47 | 2.14 | -10.49 | -1.07 | -7.92 | -5.57 | -4.14 | -6.80 | NA | NA | NA | |

| Share Based Compensation | 5.13 | 4.44 | 4.53 | 3.38 | 3.01 | 4.64 | 4.57 | 4.45 | 3.60 | 3.70 | 3.57 | 2.91 | 3.40 | 3.15 | 3.27 | 2.77 | 2.59 | 2.47 | 2.81 | 2.14 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -16.60 | -10.17 | -11.94 | -19.58 | -12.16 | -13.13 | -11.43 | -11.87 | -353.56 | -7.31 | -111.45 | -3.65 | -5.90 | -4.00 | -6.12 | -8.13 | -37.49 | -3.30 | -5.01 | -9.17 | -559.60 | -1.38 | -1.67 | -0.21 | NA | -0.98 | -0.73 | |

| Payments To Acquire Property Plant And Equipment | 16.48 | 10.40 | 11.73 | 18.37 | 12.26 | 13.20 | 11.25 | 11.48 | 9.37 | 7.38 | 4.55 | 3.70 | 5.94 | 4.02 | 6.16 | 8.14 | 12.19 | 3.30 | 4.97 | 9.22 | 6.95 | 8.51 | 5.22 | 5.88 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 0.66 | -146.36 | 94.53 | -66.63 | -5.41 | -73.01 | -57.87 | -28.65 | 263.39 | -101.69 | -16.89 | 123.92 | -6.05 | -2.45 | -2.42 | -23.08 | -7.39 | -2.42 | -2.39 | -2.31 | 573.86 | -545.22 | -2.37 | 548.00 | 0.00 | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.00 | 100.00 | NA | NA | 0.00 | 69.79 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

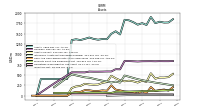

| Revenues | 27.79 | 25.93 | 25.51 | 24.35 | 26.91 | 23.18 | 21.88 | 23.23 | 16.59 | 15.33 | 5.31 | 89.86 | 100.16 | 96.91 | 79.81 | 116.71 | 112.46 | 128.24 | 109.58 | 98.46 | 95.11 | 107.60 | 98.20 | 69.24 | 63.16 | 56.09 | 18.99 | |

| 12.45 | 13.46 | 10.27 | 9.70 | 8.56 | 9.58 | 8.44 | 7.80 | 5.27 | 7.49 | 1.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 8.49 | 6.54 | 8.58 | 7.22 | 8.66 | 8.10 | 7.98 | 8.60 | 4.96 | 1.55 | 0.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 6.21 | 4.92 | 5.93 | 6.74 | 8.30 | 4.52 | 4.99 | 6.20 | 5.33 | 5.32 | 3.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| Non Us | 9.20 | 8.90 | 8.40 | 7.20 | 7.10 | 17.00 | 13.00 | 23.30 | 36.10 | 13.80 | 5.00 | 2.80 | 2.90 | 3.60 | 3.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Customer | 0.64 | 1.01 | 0.73 | 0.69 | 1.39 | 0.99 | 0.47 | 0.65 | 0.96 | 0.97 | 0.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 211.01 | 209.93 | 204.46 | 191.90 | 186.07 | 197.66 | 187.49 | 170.38 | 169.98 | 162.09 | 128.66 | 89.86 | 100.16 | 96.91 | 79.81 | 116.71 | 112.46 | 128.24 | 109.58 | 98.46 | 95.11 | 107.60 | 98.20 | 69.24 | 63.16 | 56.09 | 18.99 | |

| Operating, Product, Government Solutions | 3.24 | 5.19 | 3.26 | 2.69 | 2.28 | 12.29 | 8.86 | 5.60 | 22.55 | 20.28 | 12.23 | 0.10 | 9.18 | 13.93 | 16.99 | 17.22 | 7.62 | 17.48 | 6.52 | 0.39 | 1.28 | 2.40 | 1.15 | 0.23 | NA | NA | NA | |

| Operating, Product, Parking Solutions | 5.95 | 3.71 | 5.15 | 4.51 | 4.82 | 4.75 | 4.13 | 3.65 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Service, Commercial Services | 94.54 | 98.15 | 94.45 | 85.64 | 81.56 | 86.06 | 84.89 | 73.47 | 71.47 | 77.26 | 66.48 | 45.69 | 48.19 | 44.15 | 27.27 | 61.24 | 68.17 | 77.63 | 68.09 | 62.59 | 58.42 | 71.97 | 59.77 | 32.45 | NA | NA | NA | |

| Operating, Service, Government Solutions | 90.72 | 85.09 | 84.99 | 83.23 | 82.30 | 77.44 | 74.67 | 73.22 | 69.42 | 64.55 | 49.95 | 44.07 | 42.79 | 38.83 | 35.54 | 38.26 | 36.67 | 33.12 | 34.97 | 35.48 | 35.40 | 33.23 | 37.27 | 36.56 | NA | NA | NA | |

| Operating, Service, Parking Solutions | 16.56 | 17.79 | 16.60 | 15.83 | 15.10 | 17.12 | 14.94 | 14.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Commercial Services | 94.54 | 98.15 | 94.45 | 85.64 | 81.56 | 86.06 | 84.89 | 73.47 | 71.47 | 77.26 | 66.48 | 45.69 | 48.19 | 44.15 | 27.27 | 61.24 | 68.17 | 77.63 | 68.09 | 62.59 | 58.42 | 71.97 | 59.77 | 32.45 | NA | NA | NA | |

| Operating, Government Solutions | 93.96 | 90.28 | 88.25 | 85.92 | 84.58 | 89.73 | 83.53 | 78.83 | 91.97 | 84.84 | 62.18 | 44.17 | 51.97 | 52.76 | 52.54 | 55.47 | 44.29 | 50.61 | 41.48 | 35.87 | 36.68 | 35.63 | 38.43 | 36.79 | NA | NA | NA | |

| Operating, Parking Solutions | 22.51 | 21.50 | 21.75 | 20.34 | 19.93 | 21.87 | 19.07 | 18.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product | 9.20 | 8.90 | 8.41 | 7.21 | 7.11 | 17.04 | 12.98 | 9.25 | 25.13 | 20.28 | 12.23 | 0.10 | 9.18 | 13.93 | 16.99 | 17.22 | 7.62 | 17.48 | 6.52 | 0.39 | 1.28 | 2.40 | 1.15 | 0.23 | NA | NA | NA | |

| Service | 201.82 | 201.03 | 196.05 | 184.70 | 178.97 | 180.62 | 174.50 | 161.13 | 144.85 | 141.81 | 116.43 | 89.76 | 90.98 | 82.98 | 62.81 | 99.50 | 104.84 | 110.76 | 103.06 | 98.07 | 93.82 | 105.20 | 97.04 | 69.01 | NA | NA | NA |