| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 113.95 | 113.95 | 113.76 | 113.76 | 113.76 | 97.20 | 91.79 | |

| Weighted Average Number Of Diluted Shares Outstanding | NA | NA | 59.38 | NA | 59.70 | 60.19 | 61.59 | NA | 65.07 | 67.07 | NA | NA | NA | 67.18 | 67.59 | NA | 54.75 | 54.73 | 54.71 | NA | 50.43 | 46.64 | 44.17 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | NA | 59.22 | NA | 59.55 | 60.04 | 61.45 | NA | 64.93 | 66.89 | NA | NA | NA | 67.10 | 67.49 | NA | 54.70 | 54.63 | 54.60 | NA | 50.28 | 46.50 | 44.05 | |

| Earnings Per Share Basic | 0.58 | 0.71 | 0.67 | 0.84 | 0.85 | 0.67 | 0.68 | 0.82 | 0.64 | 1.02 | 1.05 | 0.75 | 0.61 | 0.07 | 0.35 | 0.60 | 0.68 | 0.82 | 0.74 | 0.80 | 0.65 | 0.71 | 0.76 | |

| Earnings Per Share Diluted | 0.58 | 0.71 | 0.67 | 0.83 | 0.85 | 0.67 | 0.68 | 0.82 | 0.64 | 1.01 | 1.05 | 0.75 | 0.61 | 0.07 | 0.35 | 0.60 | 0.68 | 0.82 | 0.74 | 0.80 | 0.64 | 0.71 | 0.76 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

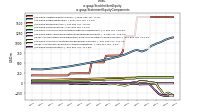

| Interest And Fee Income Loans And Leases | 155.21 | 145.74 | 133.41 | 123.31 | 109.56 | 96.41 | 93.12 | 97.43 | 103.21 | 105.97 | 109.36 | 114.58 | 116.52 | 115.07 | 119.50 | 105.88 | 95.37 | 96.42 | 95.50 | 97.69 | 86.61 | 78.54 | 69.24 | |

| Interest Expense | 65.91 | 54.49 | 36.22 | 19.04 | 9.62 | 6.22 | 4.46 | 4.88 | 6.10 | 7.47 | 8.58 | 10.77 | 13.06 | 15.68 | 22.29 | 21.35 | 21.23 | 21.08 | 20.69 | 19.62 | 18.46 | 16.54 | 13.12 | |

| Interest Income Expense Net | 117.68 | 121.57 | 124.33 | 129.87 | 124.50 | 112.23 | 107.71 | 110.33 | 115.28 | 115.86 | 116.48 | 119.71 | 120.59 | 119.01 | 120.16 | 106.96 | 96.12 | 98.46 | 98.36 | 101.77 | 89.93 | 82.35 | 73.29 | |

| Interest Paid Net | 63.34 | 53.34 | 33.29 | 18.98 | 8.28 | 5.47 | 5.01 | 6.03 | 7.63 | 8.20 | 10.72 | 12.93 | 16.18 | 19.89 | 26.07 | 23.84 | 22.80 | 20.86 | 19.64 | 22.09 | 16.73 | 17.30 | 12.50 | |

| Income Tax Expense Benefit | 7.45 | 9.06 | 9.94 | 11.86 | 12.32 | 10.26 | 9.86 | 12.14 | 10.65 | 18.59 | 18.20 | 11.70 | 7.67 | 0.04 | 3.62 | 7.05 | 8.33 | 10.10 | 8.86 | 10.56 | 6.52 | 7.33 | 7.00 | |

| Income Taxes Paid | 9.54 | NA | NA | 3.08 | 6.63 | NA | NA | 1.13 | 12.54 | NA | NA | 6.60 | 29.25 | NA | NA | 4.36 | 9.37 | NA | NA | 5.65 | 3.05 | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -33.28 | -30.23 | 28.02 | 4.22 | -90.58 | -64.75 | -106.19 | -9.58 | -8.12 | 2.78 | -21.56 | -6.94 | -2.21 | -0.62 | 39.94 | -8.72 | 5.81 | 22.21 | 19.77 | 22.00 | -6.52 | -6.28 | -14.52 | |

| Net Income Loss | 36.84 | 44.88 | 42.34 | 52.21 | 53.03 | 42.75 | 44.12 | 54.15 | 44.41 | 70.59 | 73.11 | 52.85 | 41.30 | 4.49 | 23.40 | 36.38 | 37.35 | 44.81 | 40.34 | 43.93 | 32.49 | 33.17 | 33.53 | |

| Comprehensive Income Net Of Tax | 3.56 | 14.65 | 70.36 | 56.43 | -37.55 | -22.00 | -62.07 | 44.56 | 36.28 | 73.37 | 51.56 | 45.91 | 39.09 | 3.86 | 63.34 | 27.66 | 43.16 | 67.03 | 60.11 | 65.93 | 25.96 | 26.89 | 19.01 | |

| Preferred Stock Dividends Income Statement Impact | 2.53 | 2.53 | 2.53 | 2.53 | 2.53 | 2.53 | 2.53 | 2.53 | 2.53 | 2.53 | 2.53 | 2.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 34.31 | 42.35 | 39.81 | 49.68 | 50.50 | 40.22 | 41.59 | 51.62 | 41.88 | 68.06 | 70.58 | 50.21 | 41.30 | 4.49 | 23.40 | 36.38 | 37.35 | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 111.36 | 118.54 | 120.75 | 126.75 | 125.04 | 113.04 | 111.15 | 123.89 | 117.00 | 136.88 | 144.44 | 119.92 | 104.31 | 57.17 | 90.34 | 105.14 | 92.00 | 95.71 | 95.85 | 98.91 | 88.90 | 80.64 | 71.12 | |

| Noninterest Expense | 97.94 | 96.44 | 96.12 | 90.45 | 91.94 | 87.02 | 87.55 | 88.30 | 94.70 | 83.81 | 86.33 | 88.07 | 89.94 | 85.50 | 91.33 | 92.56 | 73.27 | 71.95 | 74.43 | 70.99 | 76.12 | 63.54 | 54.57 | |

| Noninterest Income | 30.88 | 31.84 | 27.65 | 27.77 | 32.26 | 26.98 | 30.38 | 30.71 | 32.76 | 36.11 | 33.21 | 32.70 | 34.61 | 32.86 | 28.01 | 30.84 | 26.95 | 31.16 | 27.77 | 26.56 | 26.22 | 23.41 | 23.98 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

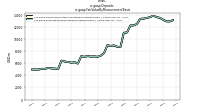

| Assets | 17344.38 | 17356.95 | 17274.63 | 16931.90 | 16604.75 | 16799.62 | 17104.01 | 16927.12 | 16892.11 | 16966.87 | 17057.79 | 16425.61 | 16552.14 | 16755.40 | 15995.57 | 15720.11 | 12593.89 | 12494.65 | 12601.41 | 12458.63 | 12599.48 | 10946.58 | 10245.42 | |

| Liabilities | 14896.44 | 14891.96 | 14799.17 | 14505.24 | 14209.09 | 14331.67 | 14556.70 | 14233.96 | 14168.13 | 14186.03 | 14272.27 | 13668.87 | 13819.17 | 14185.87 | 13409.51 | 13126.19 | 10492.62 | 10420.54 | 10578.27 | 10479.81 | 10672.21 | 9422.48 | 8842.39 | |

| Liabilities And Stockholders Equity | 17344.38 | 17356.95 | 17274.63 | 16931.90 | 16604.75 | 16799.62 | 17104.01 | 16927.12 | 16892.11 | 16966.87 | 17057.79 | 16425.61 | 16552.14 | 16755.40 | 15995.57 | 15720.11 | 12593.89 | 12494.65 | 12601.41 | 12458.63 | 12599.48 | 10946.58 | 10245.42 | |

| Stockholders Equity | 2447.94 | 2465.00 | 2475.46 | 2426.66 | 2395.65 | 2467.95 | 2547.32 | 2693.17 | 2723.98 | 2780.84 | 2785.52 | 2756.74 | 2732.97 | 2569.52 | 2586.06 | 2593.92 | 2101.27 | 2074.12 | 2023.14 | 1978.83 | 1927.27 | 1524.11 | 1403.03 | |

| Tier One Risk Based Capital | NA | NA | NA | 1576.76 | NA | NA | NA | 1586.16 | NA | NA | NA | 1617.41 | NA | NA | NA | 1441.74 | NA | NA | NA | 1258.61 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 495.08 | 562.32 | 597.50 | 408.41 | 378.56 | 450.01 | 1369.50 | 1251.36 | 1121.12 | 846.30 | 759.05 | 905.45 | 760.27 | 890.33 | 593.87 | 234.80 | 244.33 | 194.35 | 336.89 | 169.19 | 273.68 | 155.56 | 100.84 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 495.08 | 562.32 | 597.50 | 408.41 | 378.56 | 450.01 | 1369.50 | 1251.36 | 1121.12 | 846.30 | 759.05 | 905.45 | 760.27 | 890.33 | 593.87 | 234.80 | 244.33 | 194.35 | 336.89 | 169.19 | 273.68 | 155.56 | 100.84 | |

| Equity Securities Fv Ni | 11.45 | 11.95 | 11.84 | 11.51 | 11.96 | 11.41 | 12.76 | 13.47 | 13.45 | 13.49 | 13.12 | 13.05 | 12.52 | 12.28 | 11.23 | 12.34 | 11.64 | 11.82 | 11.98 | 11.74 | 12.78 | 13.49 | NA | |

| Available For Sale Securities Debt Securities | 2196.14 | 2329.22 | 2466.00 | 2529.14 | 2645.75 | 2884.65 | 2911.37 | 3013.46 | 2986.80 | 2964.26 | 2775.21 | 1978.14 | 2045.92 | 2073.95 | 2262.08 | 2393.56 | 2209.20 | 2129.28 | 2145.09 | 2114.13 | 2008.23 | 1796.57 | 1728.38 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 385.67 | NA | NA | NA | 390.10 | NA | NA | NA | 393.57 | NA | NA | NA | 389.92 | NA | NA | NA | 299.90 | NA | NA | NA | |

| Furniture And Fixtures Gross | NA | NA | NA | 111.26 | NA | NA | NA | 109.16 | NA | NA | NA | 106.50 | NA | NA | NA | 102.17 | NA | NA | NA | 76.87 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 212.73 | NA | NA | NA | 208.25 | NA | NA | NA | 200.21 | NA | NA | NA | 187.44 | NA | NA | NA | 132.97 | NA | NA | NA | |

| Amortization Of Intangible Assets | 2.26 | 2.28 | 2.30 | 2.54 | 2.56 | 2.58 | 2.60 | 2.83 | 2.85 | 2.87 | 2.90 | 3.33 | 3.35 | 3.37 | 3.37 | 2.92 | 2.45 | 2.46 | 2.51 | 2.76 | 1.82 | 1.31 | 1.09 | |

| Property Plant And Equipment Net | 226.38 | 219.93 | 224.94 | 220.89 | 221.35 | 216.29 | 219.91 | 229.02 | 232.13 | 235.23 | 239.86 | 249.42 | 248.49 | 255.31 | 258.20 | 261.01 | 178.34 | 179.87 | 180.65 | 166.93 | 159.28 | 131.50 | 128.58 | |

| Goodwill | NA | NA | NA | 1100.00 | NA | NA | NA | 1100.00 | NA | NA | NA | 1100.00 | NA | NA | NA | 1100.00 | NA | NA | NA | 861.90 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 44.60 | NA | NA | NA | 54.90 | NA | NA | NA | 66.30 | NA | NA | NA | 80.40 | NA | NA | NA | 56.97 | NA | NA | NA | |

| Intangible Assets Net Including Goodwill | 1134.51 | 1136.77 | 1139.05 | 1141.36 | 1143.90 | 1146.46 | 1149.04 | 1151.63 | 1154.47 | 1157.32 | 1160.19 | 1163.09 | 1165.57 | 1166.85 | 1170.07 | 1149.15 | 914.71 | 914.68 | 915.60 | 918.85 | 928.08 | 661.62 | 588.34 | |

| Equity Securities Fv Ni | 11.45 | 11.95 | 11.84 | 11.51 | 11.96 | 11.41 | 12.76 | 13.47 | 13.45 | 13.49 | 13.12 | 13.05 | 12.52 | 12.28 | 11.23 | 12.34 | 11.64 | 11.82 | 11.98 | 11.74 | 12.78 | 13.49 | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 212.07 | 152.59 | 132.98 | 164.82 | 196.84 | 129.66 | 70.48 | 3.52 | 4.18 | 1.13 | 3.82 | 0.06 | 0.12 | 0.01 | 0.27 | 0.64 | 0.37 | 0.96 | 3.29 | 9.18 | 17.72 | 12.86 | 11.43 | |

| Held To Maturity Securities Fair Value | 998.99 | 1072.23 | 1107.68 | 1084.39 | 1065.83 | 1153.59 | 1092.99 | 1028.45 | 978.49 | 934.49 | 839.87 | 768.18 | 782.40 | 802.67 | 841.12 | 874.52 | 877.81 | 921.53 | 948.64 | 1020.74 | 1014.36 | 1016.11 | 1005.50 | |

| Held To Maturity Securities | 1210.99 | 1224.47 | 1239.25 | 1248.63 | 1262.47 | 1281.30 | 1157.20 | 1004.82 | 953.92 | 902.17 | 813.74 | 731.21 | 746.77 | 766.42 | 814.41 | 851.75 | 852.82 | 900.61 | 936.48 | 1020.93 | 1025.54 | 1019.75 | 1006.04 | |

| Available For Sale Debt Securities Amortized Cost Basis | 2589.07 | 2678.11 | 2774.87 | 2874.78 | 2996.45 | 3116.06 | 3057.46 | 3019.70 | 2962.38 | 2928.49 | 2742.48 | 1916.66 | 1975.02 | 1999.39 | 2185.97 | 2369.42 | 2177.18 | 2104.11 | 2148.01 | 2142.06 | 2069.66 | 1843.33 | 1766.29 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.06 | 0.35 | 1.42 | 0.58 | 0.20 | 1.96 | 6.27 | 27.15 | 28.76 | 33.44 | 29.95 | 37.03 | 35.76 | 36.26 | 26.98 | 23.41 | 25.36 | 21.89 | 15.45 | 8.99 | 6.54 | 9.22 | 10.89 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 212.07 | 152.59 | 132.98 | 164.82 | 196.84 | 129.66 | 70.48 | 3.52 | 4.18 | 1.13 | 3.82 | 0.06 | 0.12 | 0.01 | 0.27 | 0.64 | 0.37 | 0.96 | 3.29 | 9.18 | 17.72 | 12.86 | 11.43 | |

| Held To Maturity Securities Debt Maturities Next Rolling Twelve Months Fair Value | 18.69 | 18.00 | 22.57 | 25.87 | 26.82 | 30.79 | 24.23 | 26.78 | 16.73 | 11.71 | 11.87 | 8.11 | 12.01 | NA | NA | NA | NA | 15.65 | 9.05 | 6.91 | 6.15 | 6.41 | 6.87 | |

| Held To Maturity Securities Debt Maturities Rolling After Ten Years Fair Value | 466.79 | 560.52 | 598.39 | 605.02 | 619.31 | 716.11 | 675.23 | 632.77 | 584.53 | 546.05 | 449.78 | 389.40 | 368.64 | NA | NA | NA | NA | 274.02 | 283.98 | 283.15 | 290.57 | 293.68 | 282.72 | |

| Held To Maturity Securities Debt Maturities Rolling Year Six Through Ten Fair Value | 406.79 | 383.36 | 375.08 | 352.34 | 321.93 | 304.81 | 276.05 | 246.40 | 242.60 | 235.79 | 237.91 | 248.08 | 275.40 | NA | NA | NA | NA | 358.16 | 378.13 | 423.15 | 413.06 | 418.29 | 424.53 | |

| Held To Maturity Securities Debt Maturities Rolling Year Two Through Five Fair Value | 106.72 | 110.35 | 111.64 | 101.16 | 97.77 | 101.88 | 117.48 | 122.50 | 134.63 | 140.93 | 140.31 | 122.59 | 126.35 | NA | NA | NA | NA | 126.64 | 126.18 | 152.69 | 146.16 | 130.69 | 122.27 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 556.45 | NA | NA | NA | 843.55 | NA | NA | NA | 1000.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 13090.23 | 12861.43 | 12873.20 | 13131.09 | 13444.37 | 13569.30 | 13797.87 | 13565.86 | 13423.31 | 13318.25 | 13287.00 | 12429.37 | 12201.42 | 12186.45 | 11043.33 | 11004.01 | 8664.36 | 8694.93 | 8916.33 | 8831.63 | 8941.76 | 7668.60 | 7226.33 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Debt And Capital Lease Obligations | 1513.77 | 1763.14 | 1672.81 | 1121.47 | 466.16 | 551.52 | 563.18 | 458.67 | 529.20 | 641.80 | 763.63 | 983.24 | 1368.68 | 1712.49 | 2111.58 | 1897.85 | 1642.97 | 1573.96 | 1512.97 | 1534.54 | 1615.28 | 1671.89 | 1538.97 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2447.94 | 2465.00 | 2475.46 | 2426.66 | 2395.65 | 2467.95 | 2547.32 | 2693.17 | 2723.98 | 2780.84 | 2785.52 | 2756.74 | 2732.97 | 2569.52 | 2586.06 | 2593.92 | 2101.27 | 2074.12 | 2023.14 | 1978.83 | 1927.27 | 1524.11 | 1403.03 | |

| Common Stock Value | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 141.83 | 113.95 | 113.95 | 113.76 | 113.76 | 113.76 | 97.20 | 91.79 | |

| Additional Paid In Capital Common Stock | 1633.39 | 1630.96 | 1636.06 | 1635.88 | 1634.28 | 1632.62 | 1636.70 | 1635.64 | 1634.09 | 1632.46 | 1636.10 | 1634.82 | 1634.17 | 1633.08 | 1638.12 | 1636.97 | 1169.60 | 1168.21 | 1167.76 | 1166.70 | 1165.01 | 789.04 | 686.17 | |

| Retained Earnings Accumulated Deficit | 1131.60 | 1118.13 | 1096.92 | 1077.67 | 1048.53 | 1018.21 | 998.32 | 977.76 | 946.75 | 925.98 | 879.79 | 831.69 | 802.89 | 782.99 | 800.06 | 824.69 | 809.33 | 788.90 | 761.00 | 737.58 | 709.48 | 692.82 | 673.17 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -297.91 | -264.63 | -234.40 | -262.42 | -266.64 | -176.06 | -111.31 | -5.12 | 4.46 | 12.59 | 9.80 | 31.36 | 38.30 | 40.52 | 41.14 | 1.20 | 9.92 | 4.11 | -18.10 | -37.87 | -59.87 | -53.35 | -47.08 | |

| Treasury Stock Value | 303.42 | 303.77 | 307.51 | 308.96 | 305.03 | 291.34 | 261.01 | 199.76 | 146.10 | 75.00 | 24.99 | 25.95 | 27.40 | 27.52 | 33.71 | 9.46 | 0.25 | 0.00 | 0.23 | 0.27 | NA | NA | 0.00 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.47 | 1.75 | 1.58 | 1.73 | 1.73 | 1.55 | 1.24 | 2.06 | 1.84 | 1.29 | 1.29 | 1.60 | 1.33 | 1.36 | 1.37 | 1.55 | 1.33 | 1.36 | 1.07 | 1.43 | 1.09 | 0.93 | 0.91 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 64.02 | 47.05 | 10.89 | 7.47 | 110.88 | 38.05 | 47.74 | 60.16 | 46.80 | 177.34 | 52.00 | 38.98 | -68.77 | 56.51 | 32.88 | 15.27 | 71.72 | 25.18 | 51.19 | 69.11 | 55.59 | 34.95 | 31.91 | |

| Net Cash Provided By Used In Investing Activities | -86.66 | -133.41 | -91.87 | -293.02 | 64.55 | -658.31 | -181.39 | 75.50 | 330.65 | 79.33 | -813.98 | 285.95 | 142.43 | -484.70 | 114.11 | 68.21 | -43.25 | 9.90 | 68.93 | 32.58 | 260.43 | 117.38 | -462.25 | |

| Net Cash Provided By Used In Financing Activities | -44.60 | 51.17 | 270.07 | 315.41 | -246.88 | -299.24 | 251.79 | -5.42 | -102.64 | -169.41 | 615.58 | -179.75 | -203.73 | 724.65 | 212.08 | -93.01 | 21.50 | -177.62 | 47.59 | -206.19 | -197.90 | -97.61 | 413.62 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 64.02 | 47.05 | 10.89 | 7.47 | 110.88 | 38.05 | 47.74 | 60.16 | 46.80 | 177.34 | 52.00 | 38.98 | -68.77 | 56.51 | 32.88 | 15.27 | 71.72 | 25.18 | 51.19 | 69.11 | 55.59 | 34.95 | 31.91 | |

| Net Income Loss | 36.84 | 44.88 | 42.34 | 52.21 | 53.03 | 42.75 | 44.12 | 54.15 | 44.41 | 70.59 | 73.11 | 52.85 | 41.30 | 4.49 | 23.40 | 36.38 | 37.35 | 44.81 | 40.34 | 43.93 | 32.49 | 33.17 | 33.53 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -86.66 | -133.41 | -91.87 | -293.02 | 64.55 | -658.31 | -181.39 | 75.50 | 330.65 | 79.33 | -813.98 | 285.95 | 142.43 | -484.70 | 114.11 | 68.21 | -43.25 | 9.90 | 68.93 | 32.58 | 260.43 | 117.38 | -462.25 | |

| Payments To Acquire Property Plant And Equipment | 2.67 | 4.68 | 12.23 | 2.71 | 2.47 | 2.25 | 0.56 | 2.68 | 1.25 | 2.24 | 2.36 | 1.59 | 1.10 | 1.94 | 2.92 | 3.86 | 2.28 | 3.88 | 2.18 | 2.27 | 1.55 | 0.52 | 0.33 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -44.60 | 51.17 | 270.07 | 315.41 | -246.88 | -299.24 | 251.79 | -5.42 | -102.64 | -169.41 | 615.58 | -179.75 | -203.73 | 724.65 | 212.08 | -93.01 | 21.50 | -177.62 | 47.59 | -206.19 | -197.90 | -97.61 | 413.62 | |

| Payments Of Dividends Common Stock | 20.58 | 20.56 | 20.56 | 20.03 | 20.16 | 20.57 | 20.57 | 21.17 | 21.80 | 22.09 | 21.42 | 21.40 | 21.40 | 21.43 | 21.02 | 16.91 | 16.91 | 16.92 | 15.82 | 15.83 | 13.53 | 12.78 | 11.45 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| , Commercial And Industrial | 100.00 | 100.00 | 100.00 | 0.00 | 0.00 | 0.00 | 100.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

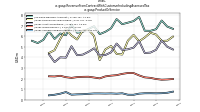

| Deposits | 6.73 | 6.23 | 6.17 | 6.76 | 6.94 | 6.49 | 6.09 | 6.59 | 6.05 | 4.88 | 4.89 | 5.67 | 5.33 | 4.32 | 6.62 | 7.17 | 7.06 | 6.20 | 6.55 | 7.39 | 6.31 | 5.15 | 4.82 | |

| Fiduciary And Trust | 6.71 | 6.92 | 7.49 | 6.67 | 6.52 | 6.53 | 7.83 | 7.44 | 7.29 | 7.15 | 7.63 | 6.75 | 6.43 | 6.20 | 6.95 | 6.70 | 6.42 | 6.34 | 7.12 | 6.10 | 6.26 | 5.75 | 6.50 | |

| Commercial Banking Fees | 0.76 | 0.65 | 0.61 | 0.60 | 0.61 | 0.60 | 0.57 | 0.46 | 0.46 | 0.60 | 0.56 | 0.59 | 0.58 | 0.59 | 0.58 | 0.55 | 0.51 | 0.50 | 0.47 | 0.72 | 0.56 | 0.46 | 0.41 | |

| Personal Service Charges | 5.97 | 5.58 | 5.56 | 6.17 | 6.34 | 5.88 | 5.52 | 6.13 | 5.59 | 4.28 | 4.33 | 5.08 | 4.76 | 3.74 | 6.03 | 6.62 | 6.54 | 5.70 | 6.08 | 6.67 | 5.75 | 4.68 | 4.42 | |

| Trust Account Fees | 4.75 | 5.01 | 5.61 | 4.72 | 4.46 | 4.42 | 5.54 | 4.92 | 4.77 | 4.71 | 5.31 | 4.48 | 4.22 | 4.19 | 4.86 | 4.53 | 4.26 | 4.21 | 5.06 | 3.98 | 4.01 | 3.56 | 4.29 | |

| Wes Mark Fees | 1.95 | 1.91 | 1.89 | 1.95 | 2.06 | 2.11 | 2.29 | 2.52 | 2.52 | 2.44 | 2.32 | 2.27 | 2.20 | 2.01 | 2.10 | 2.17 | 2.16 | 2.13 | 2.06 | 2.13 | 2.26 | 2.19 | 2.21 |