| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

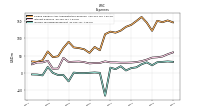

| Earnings Per Share Basic | 0.46 | 0.47 | 0.44 | 1.02 | 0.41 | 0.60 | 0.33 | 0.23 | 0.33 | 0.27 | 0.09 | 0.02 | 0.20 | 0.07 | 0.10 | -0.03 | 0.07 | 0.01 | -0.10 | -0.09 | NA | NA | 0.00 | NA | NA | 0.01 | -0.01 | 0.01 | 0.03 | 0.01 | 0.01 | -0.00 | 0.00 | -0.00 | NA | |

| Earnings Per Share Diluted | 0.45 | 0.46 | 0.43 | 1.00 | 0.40 | 0.59 | 0.32 | 0.22 | 0.32 | 0.26 | 0.08 | 0.02 | 0.20 | 0.07 | 0.10 | -0.03 | 0.07 | 0.01 | -0.10 | -0.09 | NA | NA | 0.00 | NA | NA | 0.00 | -0.01 | 0.00 | 0.01 | 0.00 | 0.00 | -0.00 | 0.00 | -0.00 | NA | |

| Income Loss From Continuing Operations Per Basic Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | 0.00 | -0.00 | NA | NA | -0.00 | 0.00 | NA | NA | NA | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Per Diluted Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | 0.00 | -0.00 | NA | NA | -0.00 | 0.00 | NA | NA | NA | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA |

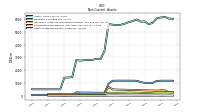

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 612.38 | 604.83 | 582.09 | 565.47 | 590.55 | 604.17 | 581.64 | 508.89 | 460.88 | 490.55 | 461.10 | 425.32 | 437.65 | 417.31 | 256.86 | 255.82 | 278.05 | 272.34 | 266.12 | 255.01 | 257.40 | 218.92 | 140.33 | 134.75 | 120.38 | 0.00 | 0.00 | 0.00 | 103.06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Gross Profit | 343.18 | 339.69 | 327.87 | 323.13 | 328.32 | 314.33 | 308.87 | 266.81 | 246.88 | 253.55 | 222.81 | 213.38 | 234.25 | 209.56 | 109.96 | 106.19 | 109.19 | 103.43 | 103.90 | 104.65 | 102.88 | 80.95 | 54.64 | 50.92 | 46.78 | 41.27 | 39.58 | 37.94 | 38.31 | 42.55 | 46.96 | 40.38 | NA | NA | NA | |

| Selling General And Administrative Expense | 146.41 | 151.98 | 146.81 | 150.89 | 121.89 | 145.44 | 162.16 | 150.21 | 139.15 | 133.42 | 122.39 | 116.48 | 119.36 | 112.08 | 65.27 | 74.97 | 57.74 | 68.16 | 71.62 | 73.48 | 90.03 | 71.90 | 47.73 | 45.21 | 61.84 | 36.10 | 31.65 | 32.76 | NA | NA | NA | NA | NA | NA | NA | |

| Operating Income Loss | 177.17 | 178.10 | 166.54 | 151.65 | 141.85 | 154.11 | 131.66 | 97.91 | 117.43 | 96.95 | 70.61 | 75.28 | 91.26 | 25.01 | 41.07 | 25.37 | 39.99 | 30.40 | 26.81 | 21.19 | -4.30 | 0.21 | 5.89 | 4.46 | -79.92 | -1.03 | -0.87 | -0.33 | -16.05 | -0.14 | -0.13 | -0.28 | -0.09 | -0.01 | -0.01 | |

| Interest Expense | 59.12 | 53.80 | 47.25 | 44.87 | 43.92 | 38.16 | 33.57 | 30.99 | 29.61 | 29.20 | 29.21 | 29.96 | 30.08 | 33.03 | 28.52 | 28.26 | 27.15 | 30.86 | 32.52 | 31.97 | 31.11 | 43.45 | 12.15 | 11.72 | 34.63 | 30.11 | 29.91 | 24.66 | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 49.56 | 49.18 | 46.55 | 39.57 | 42.23 | 28.25 | 37.78 | 22.20 | 37.36 | 14.38 | 29.00 | 23.05 | 37.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations | 86.33 | 91.52 | 87.73 | 76.27 | 99.02 | 85.73 | 73.38 | 39.05 | 62.41 | 57.11 | 20.37 | -6.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.38 | NA | NA | NA | -5.90 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 31.68 | 32.80 | 31.60 | 30.50 | 21.66 | 30.20 | 24.71 | 15.75 | 13.59 | 6.64 | 18.83 | 10.48 | 14.72 | -66.67 | -0.28 | 0.79 | -0.17 | -1.22 | -1.18 | 0.38 | -25.03 | -6.51 | -6.64 | -0.42 | 16.83 | -7.63 | -5.30 | -4.90 | NA | NA | NA | NA | NA | NA | NA | |

| Income Taxes Paid Net | 10.19 | 7.71 | 9.40 | 5.65 | 7.49 | 6.99 | 8.00 | 2.61 | 3.73 | 1.74 | 3.79 | 0.59 | 2.96 | 1.30 | -0.03 | 0.00 | -1.70 | 0.19 | 1.10 | -0.75 | 0.28 | 1.34 | 0.22 | 0.78 | 1.79 | 0.04 | -0.73 | 0.30 | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 86.33 | 91.52 | 87.73 | 210.88 | 86.40 | 128.59 | 73.38 | 51.17 | 74.22 | 61.10 | 20.37 | 4.45 | 46.47 | 16.25 | 11.49 | -3.54 | 8.05 | 0.49 | -10.91 | -10.30 | -11.71 | -33.52 | 0.24 | -6.19 | -123.27 | 0.12 | -0.08 | 0.19 | -25.28 | 0.19 | 0.14 | -0.05 | -0.01 | -0.01 | -0.01 | |

| Comprehensive Income Net Of Tax | 77.63 | 91.55 | 106.47 | 218.15 | 109.29 | 90.86 | 48.92 | 49.42 | 78.86 | 52.15 | 25.61 | 11.66 | 75.54 | 34.78 | 19.63 | -30.74 | 15.74 | -2.51 | -10.54 | -8.55 | -25.50 | -31.46 | -2.09 | -5.97 | -125.41 | -5.23 | -2.79 | -7.50 | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 86.33 | 91.52 | 87.73 | 210.88 | 86.40 | 128.59 | 73.38 | 51.17 | 74.22 | 61.10 | 20.37 | 4.45 | 0.41 | -6.05 | -15.47 | 91.78 | NA | NA | NA | NA | -11.71 | -33.52 | 0.24 | -6.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 86.33 | 91.52 | 87.73 | 210.88 | 86.40 | 128.59 | 73.38 | 51.17 | 74.22 | 61.10 | 19.76 | 4.45 | 21.06 | -6.05 | -15.47 | -5.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

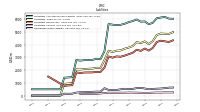

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

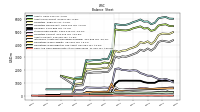

| Assets | 6137.91 | 6075.48 | 5718.50 | 5609.75 | 5827.65 | 5810.26 | 5978.81 | 5857.77 | 5773.60 | 5644.18 | 5559.71 | 5538.88 | 5572.20 | 5624.85 | 3501.54 | 2857.74 | 2897.65 | 2811.36 | 2796.28 | 2790.53 | 2752.49 | 2797.70 | 1457.03 | 1432.47 | 1410.74 | 500.87 | 502.71 | 501.92 | 501.60 | 501.36 | 501.08 | 501.05 | 501.10 | NA | NA | |

| Liabilities | 4876.66 | 4762.84 | 4279.95 | 4045.83 | 4262.35 | 4129.12 | 4204.86 | 3891.59 | 3776.84 | 3687.60 | 3554.30 | 3532.99 | 3430.93 | 3530.34 | 2796.45 | 2176.66 | 2188.69 | 2127.42 | 2111.81 | 2096.60 | 2050.29 | 2066.99 | 980.41 | 954.37 | 926.19 | 21.58 | 20.56 | 19.70 | 19.58 | 19.61 | 19.53 | 19.63 | 19.63 | NA | NA | |

| Liabilities And Stockholders Equity | 6137.91 | 6075.48 | 5718.50 | 5609.75 | 5827.65 | 5810.26 | 5978.81 | 5857.77 | 5773.60 | 5644.18 | 5559.71 | 5538.88 | 5572.20 | 5624.85 | 3501.54 | 2857.74 | 2897.65 | 2811.36 | 2796.28 | 2790.53 | 2752.49 | 2797.70 | 1457.03 | 1432.47 | 1410.74 | 500.87 | 502.71 | 501.92 | 501.60 | 501.36 | 501.08 | 501.05 | 501.10 | NA | NA | |

| Stockholders Equity | 1261.25 | 1312.64 | 1438.55 | 1563.92 | 1565.30 | 1681.14 | 1773.95 | 1966.18 | 1996.76 | 1956.58 | 2005.41 | 2005.89 | 2141.28 | 2094.51 | 705.09 | 619.32 | 644.37 | 621.50 | 622.00 | 630.64 | 638.22 | 664.33 | 428.46 | 429.79 | 435.62 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | NA |

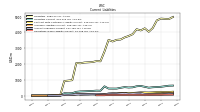

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

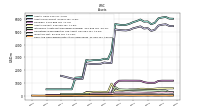

| Assets Current | 569.10 | 569.21 | 545.46 | 524.88 | 521.04 | 540.27 | 540.29 | 495.60 | 483.04 | 477.51 | 439.55 | 404.06 | 419.49 | 414.13 | 940.68 | 289.91 | 292.59 | 304.23 | 299.02 | 302.75 | 256.35 | 250.66 | 136.16 | 121.09 | 127.78 | 0.04 | 0.04 | 0.05 | 0.26 | 0.44 | NA | NA | 1.01 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 10.96 | 5.79 | 7.66 | 15.92 | 7.39 | 15.44 | 11.71 | 11.32 | 12.70 | 11.32 | 15.40 | 26.93 | 24.94 | 20.00 | 9.06 | NA | 3.04 | NA | NA | NA | 8.96 | 9.77 | 8.18 | 2.86 | 9.19 | 0.01 | 0.02 | 0.01 | 0.19 | 0.35 | 0.50 | 0.73 | 1.01 | 1.75 | 0.00 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 10.96 | 5.79 | 7.66 | 15.92 | 17.77 | 15.44 | 11.71 | 11.32 | 12.70 | 11.32 | 15.40 | 26.93 | 24.94 | 20.00 | 664.15 | 4.64 | 3.04 | 3.95 | 5.49 | 12.78 | 8.96 | 9.77 | 8.18 | 2.86 | 9.19 | NA | NA | NA | 6.16 | NA | NA | NA | NA | NA | NA | |

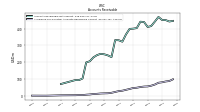

| Accounts Receivable Net Current | 451.13 | 469.34 | 441.64 | 415.34 | 409.77 | 439.31 | 440.99 | 403.15 | 399.89 | 398.35 | 365.16 | 322.43 | 330.94 | 332.02 | 231.01 | 241.14 | 247.60 | 250.49 | 242.73 | 229.56 | 206.50 | 199.46 | 104.01 | 94.38 | 94.82 | NA | NA | NA | 71.43 | NA | NA | NA | NA | NA | NA | |

| Inventory Net | 47.41 | 44.73 | 44.36 | 42.01 | 41.03 | 44.87 | 41.82 | 39.88 | 32.74 | 30.94 | 32.29 | 24.13 | 21.66 | 22.95 | 14.80 | 15.01 | 15.39 | 15.96 | 15.21 | 17.41 | 16.22 | 21.35 | 9.83 | 10.34 | 10.08 | 10.08 | NA | NA | 8.94 | NA | NA | NA | NA | NA | NA | |

| Inventory Finished Goods | 4.33 | 2.61 | 3.39 | 3.18 | 2.42 | 6.15 | 6.41 | 7.29 | 5.88 | 6.47 | 7.80 | 2.47 | 2.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 57.49 | 48.39 | 42.87 | 42.68 | 31.64 | 39.69 | 44.24 | 40.28 | 36.76 | 35.94 | 26.69 | 28.15 | 29.95 | 26.39 | 21.39 | 20.58 | 14.62 | 24.68 | 22.68 | 22.04 | 21.83 | 20.07 | 14.14 | 13.52 | 13.70 | NA | NA | NA | 39.90 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Noncurrent | 5568.82 | 5506.27 | 5173.05 | 5084.87 | 5306.61 | 5270.00 | 5438.52 | 5362.18 | 5290.56 | 5166.67 | 5120.17 | 5134.82 | 5152.71 | 5210.72 | 2560.86 | 2567.82 | 2605.06 | 2507.13 | 2497.26 | 2487.77 | 2496.14 | 2547.04 | 1320.87 | 1311.38 | 1282.96 | NA | NA | NA | 1561.94 | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 8.00 | 5.90 | 6.00 | 5.90 | 6.40 | 5.60 | 5.90 | 5.90 | NA | NA | 6.80 | NA | NA | NA | 13.80 | 0.30 | -0.20 | 0.40 | 0.30 | 0.30 | 0.80 | 0.20 | 0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill | 1176.63 | 1158.08 | 1012.13 | 1011.51 | 1011.43 | 1064.58 | 1171.72 | 1177.29 | 1178.81 | 1178.29 | 1180.74 | 1179.42 | 1171.22 | 942.79 | 233.83 | 232.80 | 235.18 | 234.60 | 245.83 | 242.98 | 247.02 | 267.76 | 33.57 | 32.97 | 28.61 | NA | NA | NA | 56.81 | NA | NA | NA | 61.78 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 419.71 | 401.31 | 407.25 | 413.19 | 419.12 | 431.29 | 446.58 | 453.79 | 460.68 | 467.29 | 474.33 | 481.20 | 495.95 | 686.30 | 126.12 | 126.38 | 126.62 | 128.10 | 128.46 | 131.25 | 131.80 | 132.52 | 125.86 | 126.06 | 126.26 | NA | NA | NA | 125.00 | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 130.71 | 112.31 | 118.25 | 124.19 | 130.12 | 142.29 | 157.58 | 164.78 | 171.68 | 178.29 | 185.33 | 192.20 | 206.95 | 260.30 | NA | NA | 1.62 | 3.10 | 3.46 | NA | 6.80 | 7.52 | NA | NA | 1.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 4.63 | 15.54 | 7.23 | 6.58 | 6.68 | 8.91 | 4.77 | 10.49 | 10.85 | 11.14 | 11.79 | 15.57 | 16.08 | 12.02 | 3.43 | 3.64 | 4.44 | 4.64 | 4.36 | 5.46 | 4.28 | 4.20 | 4.04 | 3.42 | 4.28 | NA | NA | NA | 1.95 | NA | NA | NA | NA | NA | NA |

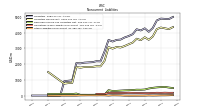

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

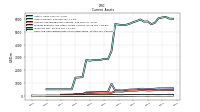

| Liabilities Current | 562.02 | 546.93 | 533.52 | 505.56 | 561.94 | 614.51 | 596.85 | 529.27 | 517.64 | 541.84 | 499.68 | 448.61 | 448.67 | 451.20 | 590.92 | 313.28 | 320.41 | 301.04 | 287.89 | 276.14 | 269.02 | 243.61 | 158.04 | 147.68 | 155.73 | 2.08 | 1.06 | NA | 0.08 | NA | NA | NA | 0.13 | NA | NA | |

| Accounts Payable Current | 86.12 | 92.32 | 91.78 | 92.06 | 108.07 | 160.26 | 155.90 | 135.35 | 118.27 | 145.32 | 132.03 | 111.41 | 106.93 | 114.25 | 87.85 | 102.57 | 109.93 | 101.53 | 96.03 | 96.18 | 90.35 | 78.64 | 58.37 | 46.89 | 57.05 | 1.70 | 0.83 | NA | 0.08 | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 129.62 | 123.24 | 120.30 | 120.84 | 110.82 | 123.30 | 115.12 | 102.94 | 100.19 | 163.34 | 149.67 | 133.04 | 141.67 | 125.31 | 101.21 | 82.85 | 82.36 | 96.39 | 90.61 | 88.68 | 84.70 | 79.72 | 45.61 | 41.51 | 48.91 | NA | NA | NA | 0.00 | NA | NA | 0.03 | 0.11 | NA | NA | |

| Contract With Customer Liability Current | 224.52 | 227.26 | 209.73 | 199.27 | 203.79 | 212.00 | 189.33 | 172.91 | 159.64 | 163.98 | 151.82 | 139.57 | 135.49 | 132.35 | 89.26 | 85.94 | 82.98 | NA | NA | NA | 71.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Noncurrent | 4314.65 | 4215.91 | 3746.44 | 3540.26 | 3700.41 | 3514.61 | 3608.01 | 3362.32 | 3259.19 | 3145.76 | 3054.62 | 3084.37 | 2982.26 | 3079.14 | 2205.53 | 1863.38 | 1868.28 | 1826.38 | 1823.91 | 1820.46 | 1781.27 | 1823.37 | 822.37 | 806.70 | 770.46 | NA | NA | NA | 1503.66 | NA | NA | NA | NA | NA | NA | |

| Long Term Debt And Capital Lease Obligations | 3538.52 | 3460.07 | 3035.52 | 2876.45 | 3063.04 | 2935.80 | 3017.68 | 2790.84 | 2694.32 | 2598.30 | 2506.30 | 2454.02 | 2453.81 | 2498.21 | 1971.01 | 1625.77 | 1632.59 | 1710.16 | 1709.52 | 1709.27 | 1674.54 | 1651.58 | 684.64 | 662.20 | 624.87 | NA | NA | NA | 655.69 | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 554.27 | 535.43 | 506.43 | 464.80 | 401.45 | 385.85 | 390.09 | 367.48 | 354.88 | 346.69 | 332.49 | 315.24 | 307.54 | 359.59 | 69.04 | 67.02 | 70.69 | 67.58 | 66.59 | 68.30 | 67.38 | 146.09 | 111.92 | 119.21 | 120.86 | NA | NA | NA | 118.17 | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 34.02 | 27.05 | 23.17 | 29.10 | 18.54 | 18.18 | 16.39 | 16.06 | 15.74 | 17.73 | 30.96 | 34.50 | 37.15 | 22.47 | 36.03 | 38.60 | 34.23 | 37.37 | 37.58 | 33.89 | 31.62 | 19.03 | 19.11 | 19.25 | 19.36 | NA | NA | NA | 11.20 | NA | NA | NA | NA | NA | NA | |

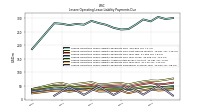

| Operating Lease Liability Noncurrent | 187.84 | 193.36 | 181.32 | 169.91 | 169.62 | 174.78 | 183.85 | 187.93 | 194.26 | 183.03 | 184.87 | 180.82 | 183.76 | 187.06 | 117.16 | 119.32 | 118.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

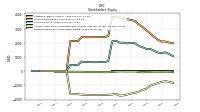

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1261.25 | 1312.64 | 1438.55 | 1563.92 | 1565.30 | 1681.14 | 1773.95 | 1966.18 | 1996.76 | 1956.58 | 2005.41 | 2005.89 | 2141.28 | 2094.51 | 705.09 | 619.32 | 644.37 | 621.50 | 622.00 | 630.64 | 638.22 | 664.33 | 428.46 | 429.79 | 435.62 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | NA | |

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Additional Paid In Capital | 2089.09 | 2218.11 | 2435.57 | 2667.42 | 2886.95 | 3112.08 | 3295.75 | 3536.91 | 3616.90 | 3655.59 | 3756.56 | 3782.65 | 3797.17 | 3825.94 | 2471.31 | 2402.20 | 2396.50 | 2394.09 | 2392.09 | 2390.18 | 2389.55 | 2390.19 | 2123.10 | 2122.05 | 2121.93 | 4.22 | 4.34 | 4.26 | 4.46 | 4.73 | 4.92 | 5.07 | 5.02 | NA | NA | |

| Retained Earnings Accumulated Deficit | -775.09 | -861.42 | -952.94 | -1040.67 | -1251.55 | -1337.95 | -1466.54 | -1539.92 | -1591.09 | -1665.31 | -1726.42 | -1746.79 | -1618.71 | -1665.17 | -1681.43 | -1692.92 | -1689.37 | -1703.70 | -1704.19 | -1693.28 | -1683.32 | -1673.75 | -1640.23 | -1640.47 | -1636.82 | 0.78 | 0.66 | 0.74 | 0.54 | 0.26 | 0.07 | -0.07 | -0.02 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -52.77 | -44.07 | -44.11 | -62.85 | -70.12 | -93.01 | -55.28 | -30.82 | -29.07 | -33.71 | -24.76 | -30.00 | -37.21 | -66.28 | -84.81 | -89.97 | -62.77 | -68.91 | -65.91 | -66.28 | -68.03 | -52.12 | -54.42 | -51.80 | -49.50 | NA | NA | NA | -56.93 | NA | NA | NA | NA | NA | NA |

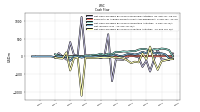

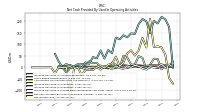

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 219.32 | 191.00 | 202.16 | 148.76 | 200.42 | 210.38 | 188.33 | 145.53 | 147.85 | 130.45 | 139.54 | 122.07 | 129.72 | 61.37 | 75.38 | 38.35 | 73.49 | 39.02 | 44.80 | 15.26 | 21.57 | -3.22 | 14.02 | 4.78 | -3.27 | -22.21 | -1.19 | 25.31 | 58.57 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -132.48 | -376.00 | -113.47 | 271.95 | -83.40 | 87.81 | -165.38 | -148.36 | -187.46 | -108.20 | -57.48 | -30.91 | -42.29 | -16.15 | -36.38 | -30.54 | -29.81 | -37.76 | -43.20 | -41.81 | -40.73 | -1098.80 | -29.23 | -48.44 | -393.16 | 111.91 | -59.62 | -51.78 | -29.41 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -81.85 | 183.18 | -97.17 | -423.09 | -115.64 | -292.92 | -22.39 | 1.59 | 41.05 | -26.02 | -93.69 | -89.22 | -83.35 | -690.30 | 620.27 | -5.58 | -44.69 | -2.72 | -8.94 | 30.29 | 18.63 | 1103.44 | 20.70 | 37.26 | 399.43 | -89.44 | -3.10 | 89.95 | -31.39 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 219.32 | 191.00 | 202.16 | 148.76 | 200.42 | 210.38 | 188.33 | 145.53 | 147.85 | 130.45 | 139.54 | 122.07 | 129.72 | 61.37 | 75.38 | 38.35 | 73.49 | 39.02 | 44.80 | 15.26 | 21.57 | -3.22 | 14.02 | 4.78 | -3.27 | -22.21 | -1.19 | 25.31 | 58.57 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 86.33 | 91.52 | 87.73 | 210.88 | 86.40 | 128.59 | 73.38 | 51.17 | 74.22 | 61.10 | 20.37 | 4.45 | 46.47 | 16.25 | 11.49 | -3.54 | 8.05 | 0.49 | -10.91 | -10.30 | -11.71 | -33.52 | 0.24 | -6.19 | -123.27 | 0.12 | -0.08 | 0.19 | -25.28 | 0.19 | 0.14 | -0.05 | -0.01 | -0.01 | -0.01 | |

| Increase Decrease In Accounts Receivable | -8.90 | 36.62 | 37.69 | 10.95 | -7.43 | 41.16 | 48.67 | 12.06 | 11.46 | 43.27 | 50.66 | -0.34 | 11.45 | 20.98 | -5.07 | -0.64 | -0.74 | 20.20 | 17.71 | 26.47 | 10.22 | 14.61 | 10.89 | 0.74 | 1.33 | 15.38 | 3.01 | 0.84 | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Inventories | 2.68 | -1.67 | 1.92 | 0.35 | -1.28 | 4.33 | 2.17 | 7.12 | 1.77 | -1.22 | 6.08 | 2.45 | -1.33 | -0.92 | -0.24 | -0.28 | -0.58 | 0.76 | -2.22 | 1.19 | 0.69 | 0.99 | -0.46 | 0.02 | 0.07 | -0.14 | -0.31 | -0.30 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 8.35 | 8.64 | 9.35 | 8.15 | 6.99 | 6.94 | 9.29 | 6.39 | 4.51 | 7.68 | 9.04 | 4.95 | 2.92 | 2.94 | 2.23 | 1.79 | 1.68 | 1.81 | 1.90 | 1.29 | 1.21 | 1.05 | 1.05 | 0.12 | 2.97 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA |

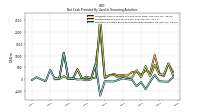

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -132.48 | -376.00 | -113.47 | 271.95 | -83.40 | 87.81 | -165.38 | -148.36 | -187.46 | -108.20 | -57.48 | -30.91 | -42.29 | -16.15 | -36.38 | -30.54 | -29.81 | -37.76 | -43.20 | -41.81 | -40.73 | -1098.80 | -29.23 | -48.44 | -393.16 | 111.91 | -59.62 | -51.78 | -29.41 | NA | NA | NA | NA | NA | NA | |

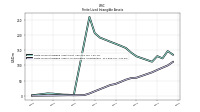

| Payments To Acquire Property Plant And Equipment | 5.49 | 5.56 | 4.45 | 6.74 | 13.41 | 10.00 | 9.77 | 10.48 | 9.66 | 3.39 | 10.14 | 7.31 | 7.38 | 5.89 | 1.67 | 1.52 | 1.74 | 2.70 | 2.27 | 1.63 | 1.53 | 1.48 | 0.62 | 1.00 | 1.51 | 0.92 | 1.31 | 0.70 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -81.85 | 183.18 | -97.17 | -423.09 | -115.64 | -292.92 | -22.39 | 1.59 | 41.05 | -26.02 | -93.69 | -89.22 | -83.35 | -690.30 | 620.27 | -5.58 | -44.69 | -2.72 | -8.94 | 30.29 | 18.63 | 1103.44 | 20.70 | 37.26 | 399.43 | -89.44 | -3.10 | 89.95 | -31.39 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 612.38 | 604.83 | 582.09 | 565.47 | 590.55 | 604.17 | 581.64 | 508.89 | 460.88 | 490.55 | 461.10 | 425.32 | 437.65 | 417.31 | 256.86 | 255.82 | 278.05 | 272.34 | 266.12 | 255.01 | 257.40 | 218.92 | 140.33 | 134.75 | 120.38 | 0.00 | 0.00 | 0.00 | 103.06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Operating, Total Leasing And Product And Service Revenues Costs, Modular Solutions | 387.51 | 387.81 | 370.68 | 349.67 | 405.94 | 362.07 | 335.25 | 288.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Total Leasing And Product And Service Revenues Costs, Storage Solutions | 224.86 | 217.03 | 211.41 | 215.80 | 184.61 | 215.94 | 187.64 | 162.62 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Leasing And Services | 580.09 | 582.37 | 562.07 | 546.58 | 483.61 | 580.37 | 554.02 | 493.52 | 489.69 | 463.10 | 434.86 | 399.17 | 409.62 | 384.78 | 241.78 | 239.42 | 245.75 | 253.18 | 243.99 | 228.50 | 228.18 | 188.44 | 132.66 | 123.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Modular Delivery And Installation | 102.20 | 115.60 | 112.75 | 106.63 | 88.12 | 132.84 | 125.40 | 100.33 | 99.80 | 99.70 | 91.68 | 83.50 | 86.75 | 84.69 | 51.64 | 51.07 | 51.41 | 61.88 | 56.48 | 50.28 | 50.12 | 46.78 | 31.41 | 26.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Modular Leasing | 477.89 | 466.77 | 449.32 | 439.95 | 395.48 | 447.54 | 428.62 | 393.19 | 389.89 | 363.40 | 343.18 | 315.66 | 322.87 | 300.08 | 190.14 | 188.35 | 187.16 | 191.29 | 187.51 | 178.22 | 178.06 | 141.66 | 101.25 | 97.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Modular Space Leasing | 248.78 | 243.95 | 236.62 | 224.47 | 202.65 | 226.26 | 212.86 | 199.08 | 196.23 | 188.51 | 181.38 | 169.95 | 169.47 | 163.63 | 132.38 | 131.40 | 131.72 | 131.56 | 129.47 | 123.55 | 124.59 | 98.79 | 69.62 | 67.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| New Units | 18.31 | 10.15 | 9.00 | 10.66 | 14.11 | 9.90 | 11.09 | 6.60 | 15.06 | 15.86 | 11.01 | 10.96 | 14.36 | 19.36 | 9.76 | 9.61 | 21.02 | 11.54 | 11.62 | 14.90 | 20.02 | 20.92 | 5.24 | 7.43 | 11.88 | 9.61 | 9.40 | 5.49 | NA | NA | NA | NA | NA | NA | NA | |

| Other Leasing Related Products And Services | 21.01 | 24.80 | 21.54 | 24.04 | 19.94 | 21.55 | 19.01 | 15.97 | 16.42 | 16.15 | 14.97 | 12.91 | 13.82 | 13.06 | 9.63 | 10.10 | 8.14 | 12.76 | 12.35 | 11.04 | 10.57 | 9.00 | 6.24 | 5.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Portable Storage Leasing | 107.85 | 98.16 | 93.46 | 97.31 | 91.23 | 103.50 | 88.55 | 77.99 | 79.66 | 66.18 | 58.85 | 54.61 | 60.71 | 52.94 | 5.72 | 5.85 | 5.98 | 6.03 | 6.02 | 6.24 | 6.51 | 5.40 | 4.83 | 4.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rental Units | 13.97 | 12.31 | 11.01 | 8.23 | 12.57 | 13.90 | 16.52 | 8.77 | 13.18 | 11.60 | 15.23 | 15.20 | 13.67 | 13.18 | 5.32 | 6.79 | 10.60 | 7.63 | 10.51 | 11.60 | 9.20 | 9.57 | 2.44 | 3.81 | 4.67 | 6.61 | 4.78 | 5.84 | NA | NA | NA | NA | NA | NA | NA | |

| Total Leasing And Product And Service Revenues Costs | 612.38 | 604.83 | 582.09 | 565.47 | 510.28 | 604.17 | 581.64 | 508.89 | 599.26 | 461.05 | 461.10 | 425.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Value Added Product And Services | 100.25 | 99.87 | 97.70 | 94.13 | 81.66 | 96.22 | 87.50 | 80.93 | 78.08 | 73.52 | 70.88 | 62.43 | 63.18 | 56.33 | 42.42 | 41.00 | 41.32 | 40.94 | 39.67 | 37.39 | 36.39 | 28.47 | 20.56 | 19.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Value Added Services | 5.80 | 6.40 | 6.10 | 5.60 | 2.20 | 8.80 | 6.80 | 7.50 | 7.30 | 7.20 | 7.80 | 6.20 | 4.90 | 5.60 | 4.30 | 4.00 | 4.00 | 4.00 | 2.60 | 3.80 | 2.90 | 3.00 | 4.10 | 2.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Total Leasing And Product And Service Revenues Costs, Discontinued Operations Disposed Of By Sale, United Kingdom Storage Solutions | 0.00 | 0.00 | 0.00 | 8.69 | 24.94 | 26.16 | 26.67 | 27.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| 31.42 | 30.92 | 30.84 | 26.94 | 32.55 | 34.81 | 32.90 | 25.27 | 31.41 | 31.54 | 29.54 | 23.58 | 22.55 | 24.10 | 16.28 | 16.71 | 21.53 | 19.31 | 21.46 | 18.22 | 18.95 | 14.35 | 8.68 | 8.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 7.12 | 6.69 | 5.92 | 5.35 | 4.92 | 4.45 | 4.70 | 4.21 | 3.86 | 3.67 | 3.85 | 3.46 | 4.16 | 3.28 | 2.97 | 3.79 | 4.22 | 3.92 | 4.22 | 4.02 | 3.98 | 4.80 | 3.67 | 3.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| US | 573.83 | 567.22 | 545.33 | 533.17 | 553.09 | 538.74 | 517.37 | 451.97 | 455.17 | 427.25 | 399.28 | 371.27 | 386.24 | 368.29 | 237.61 | 235.33 | 244.44 | 249.11 | 240.45 | 232.77 | 234.48 | 199.77 | 127.98 | 123.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Modular Delivery And Installation, Modular Solutions | 66.32 | 77.13 | 75.17 | 64.82 | 71.29 | 82.23 | 71.99 | 54.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Modular Delivery And Installation, Storage Solutions | 35.88 | 38.47 | 37.59 | 41.81 | 34.46 | 44.79 | 38.85 | 31.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, New Units, Modular Solutions | 17.02 | 8.66 | 7.17 | 8.92 | 12.88 | 7.89 | 8.45 | 4.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, New Units, Storage Solutions | 1.29 | 1.49 | 1.83 | 1.74 | 2.14 | 1.72 | 1.48 | 0.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Rental Units, Modular Solutions | 10.55 | 8.32 | 7.24 | 6.66 | 12.53 | 11.71 | 13.29 | 6.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Rental Units, Storage Solutions | 3.42 | 3.99 | 3.77 | 1.57 | 1.35 | 1.83 | 2.44 | 2.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Modular Delivery And Installation | 102.20 | 115.60 | 112.75 | 106.63 | 105.76 | 127.02 | 110.84 | 85.54 | 46.25 | 99.70 | 91.68 | 83.50 | 63.33 | 84.69 | 51.64 | 51.07 | 51.41 | 61.88 | 56.48 | 50.28 | 50.12 | 46.78 | 31.41 | 26.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| New Units | 18.31 | 10.15 | 9.00 | 10.66 | 14.11 | 9.90 | 11.09 | 6.60 | 15.06 | 15.86 | 11.01 | 10.96 | 14.36 | 19.36 | 9.76 | 9.61 | 21.40 | 11.34 | 11.51 | 14.84 | 20.02 | 20.92 | 5.24 | 7.43 | 11.88 | 9.61 | 9.40 | 5.49 | NA | NA | NA | NA | NA | NA | NA | |

| Rental Units | 13.97 | 12.31 | 11.01 | 8.23 | 12.57 | 13.90 | 16.52 | 8.77 | 13.18 | 11.60 | 15.23 | 15.20 | 13.67 | 13.18 | 5.32 | 6.79 | 10.89 | 7.47 | 10.42 | 11.55 | 9.20 | 9.57 | 2.44 | 3.81 | 4.67 | 6.61 | 4.78 | 5.84 | NA | NA | NA | NA | NA | NA | NA | |

| Modular Deliver And Installation, Discontinued Operations Disposed Of By Sale, United Kingdom Storage Solutions | 0.00 | 0.00 | 0.00 | 1.80 | 5.25 | 5.82 | 5.34 | 6.47 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| New Units, Discontinued Operations Disposed Of By Sale, United Kingdom Storage Solutions | 0.00 | 0.00 | 0.00 | 0.05 | 0.20 | 0.29 | 0.49 | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rental Units, Discontinued Operations Disposed Of By Sale, United Kingdom Storage Solutions | 0.00 | 0.00 | 0.00 | 0.45 | 0.14 | 0.36 | 0.68 | 0.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |